The UK new light commercial vehicle (LCV) market increased by 5.4% in April, according to the latest figures from the Society of Motor Manufacturers and Traders (SMMT).

Demand for fully electric vans fell, however, leading to full-year expectations being downgraded by the SMMT, which will be shy of Government’s battery electric vehicle (BEV) target for 2024.

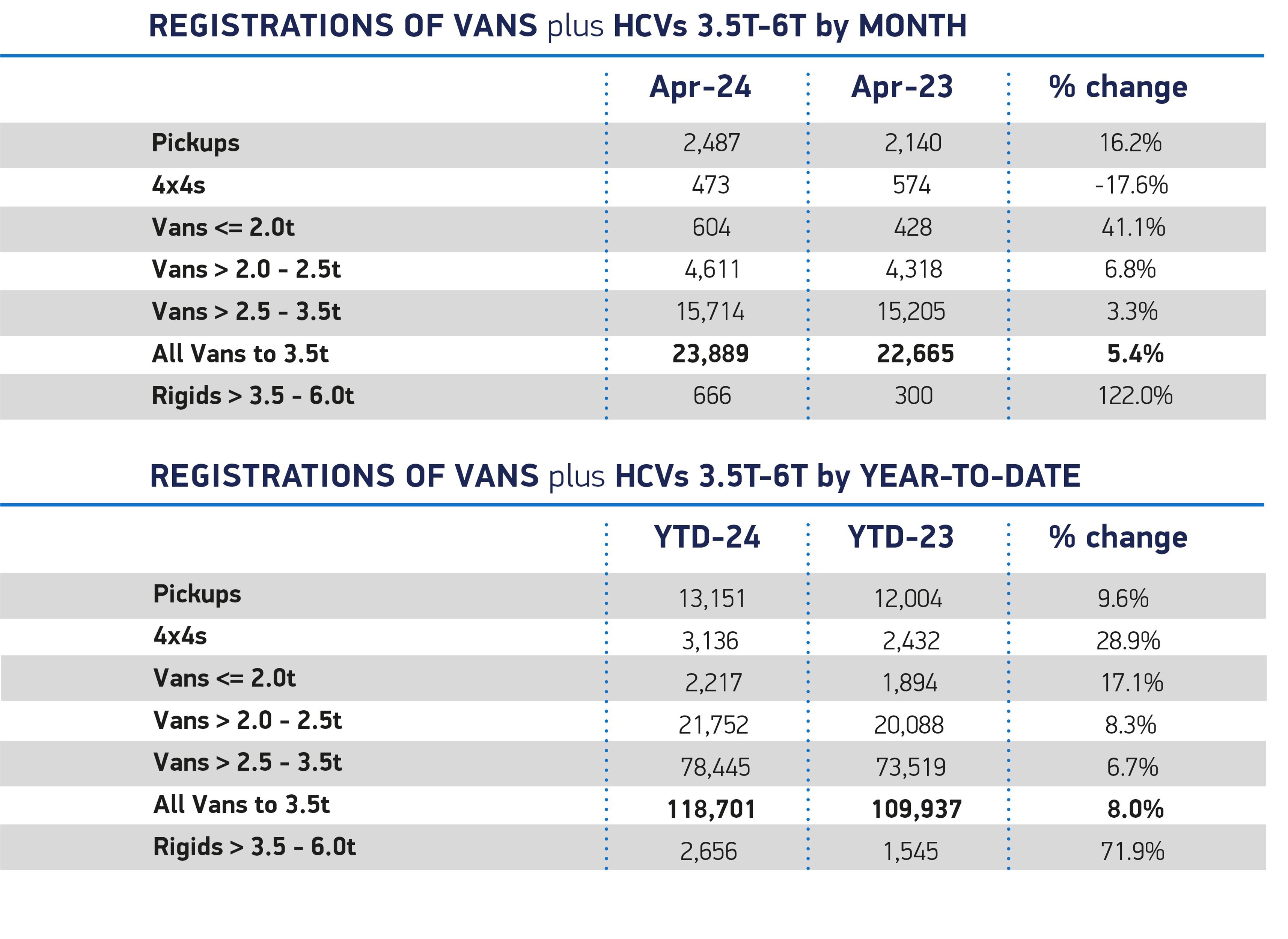

There were 23,889 new vans, 4x4s and pickups registered in April, the highest total for the month since 2021.

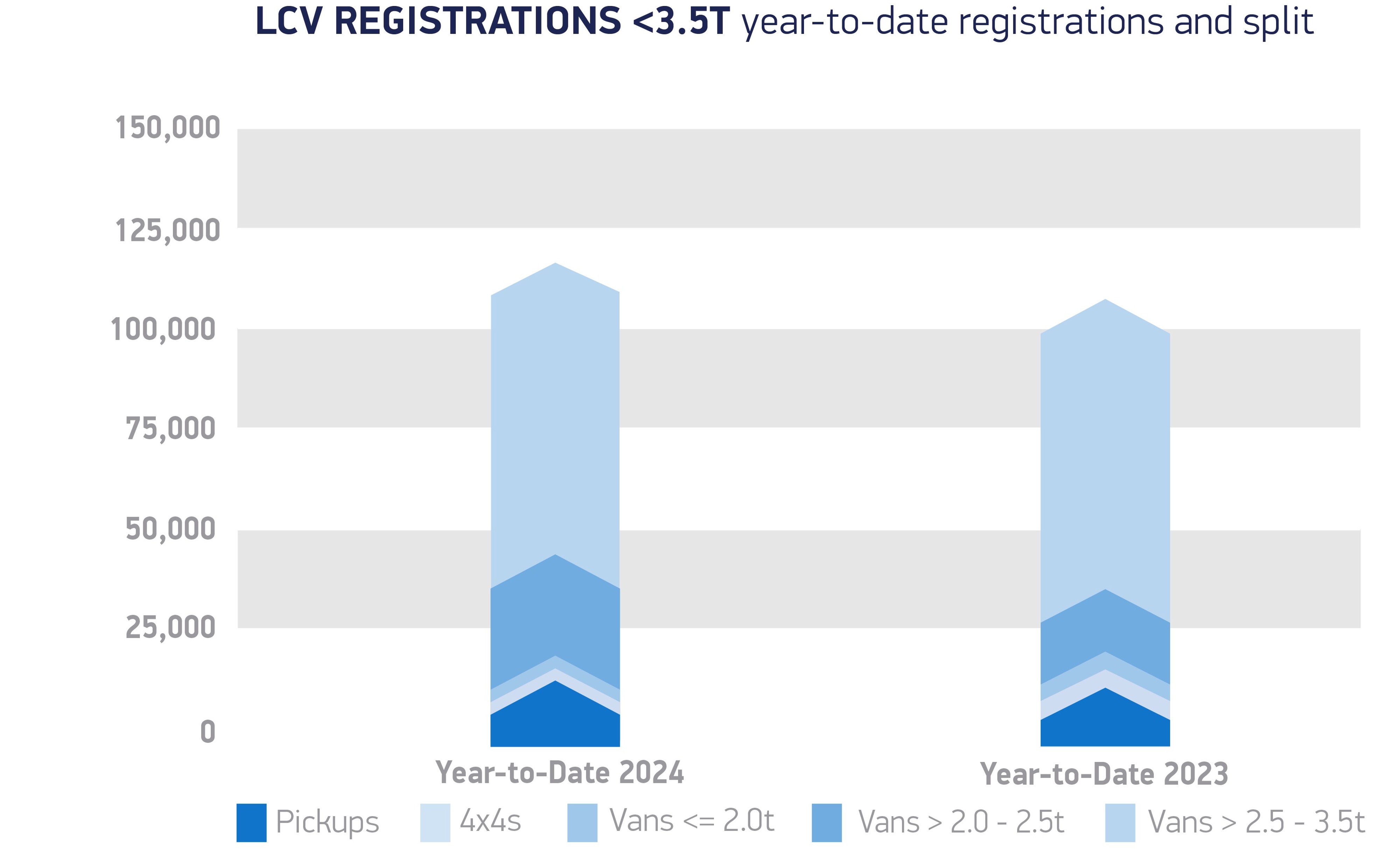

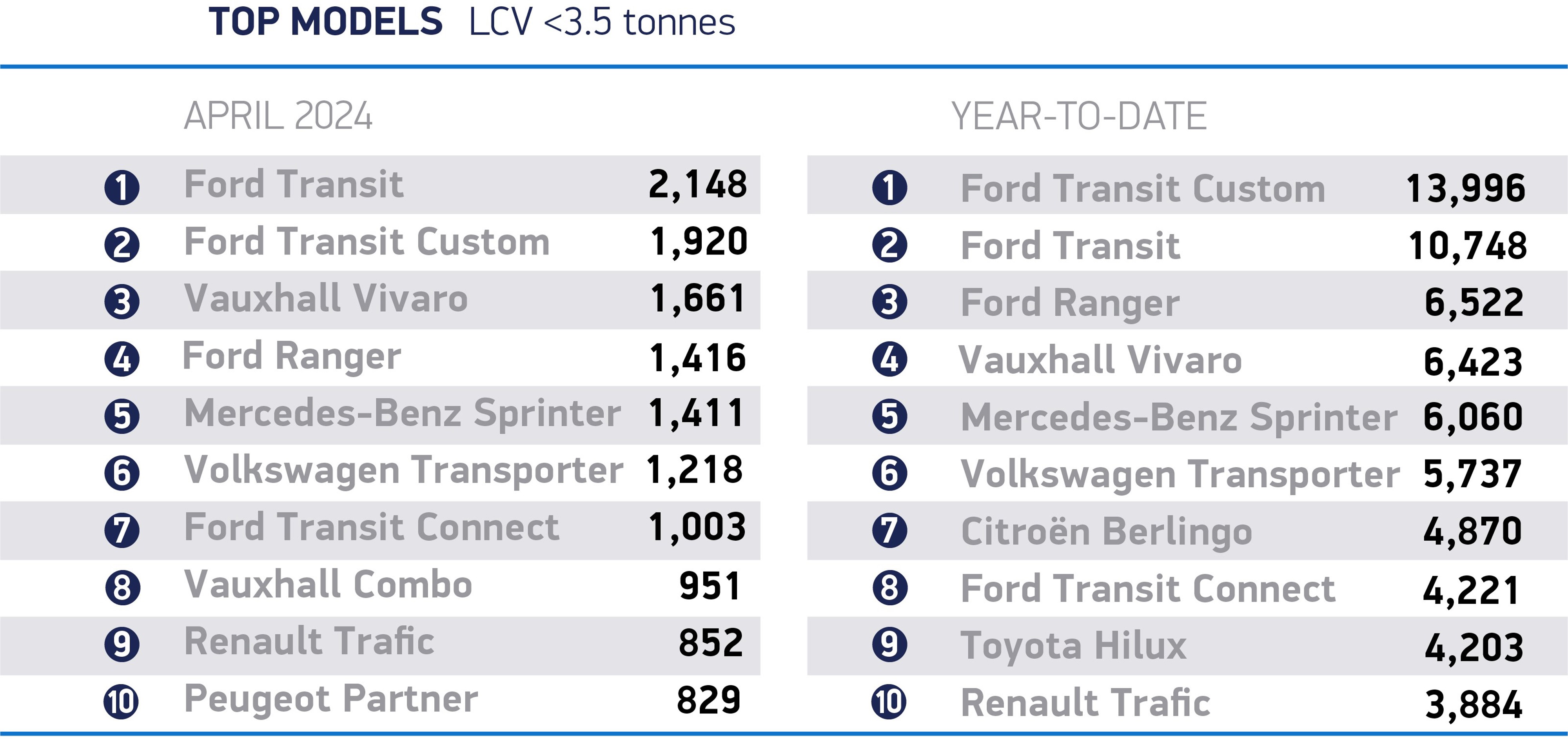

Growth across the market was underpinned by the long-term popularity of the largest LCV models weighing more than 2.5 tonnes to 3.5 tonnes, up 3.3% to 15,714 units – accounting for almost two thirds (65.8%) of registrations.

Deliveries of medium-sized vans grew by 6.8% to 4,611 units, while the biggest percentage increase was for the smallest vans, up 41.1% – albeit still representing just 2.5% of the market.

Pick-up volumes also rose, by 16.2% to 2,487 units, while deliveries of new 4x4s fell by 17.6% to 473 units, compared with a particularly strong April last year.

Deliveries of zero emission LCVs declined last month, with new battery electric van (BEV) uptake falling to 861 units, down 42.4% compared with last year’s uplift in demand.

It means BEVs accounted for just 3.6% of all new LCV registrations compared with 6.6% in April last year.

Matthew Davock, director of Manheim Commercial Vehicles at Cox Automotive, said: “While the new LCV figures mark the 16th consecutive month of growth, the news is overshadowed somewhat by the significant drop in BEV registrations.

"At this point, the number should be much stronger than the 23,889 LCV registrations recorded.

“I think there are two factors behind this performance. On one hand, we're seeing many fleet, rental, and SME van operators review their needs as their utilisation rates fluctuate. On the other, we're still experiencing a lack of buyer confidence in electrification.

"Much has been made about government policy needing to support the EV car market, but these numbers show that action in the LCV sector is vital too if operators are to adopt EV LCVs in greater volumes."

The month traditionally has low registration volumes following new plate March and is therefore subject to volatility, however, such a decline in BEV uptake – just as Government targets demand rapid growth – puts green goals at risk.

Industry’s latest market outlook expects the UK’s new van market to grow by 3.3% to 353,000 units this year, while BEV market share has been revised to 8.3%, down from 9.4% in the January outlook.

BEV volumes are still expected to rise by 44.1% in 2024 to 29,000 units, but uptake is set to remain below the ambitious sales targets set for manufacturers in the Vehicle Emissions Trading Scheme (VETS).

Manufacturers continue to invest to deliver more zero emission models with competitive ranges and payloads, quiet operation and high comfort levels – but they alone cannot drive Britain’s green goals, says the SMMT.

While some flexibilities in the early years of the VETS will help, the lack of suitable public charging infrastructure for vans remains a significant barrier to switching to zero emission fleet operations.

Decarbonising the sector therefore depends on a nationally planned, locally delivered charge point strategy that meets the specific needs of vans – particularly the largest models for which existing infrastructure is not normally suitable, explains the SMMT.

Identifying the best places to locate such charge points, while speeding up grid connections in every part of the country, is essential to give operators confidence to invest.

Given the current need to create the right conditions for more fleets to switch, it also says that the plug-in van grant must also remain in place, else the UK risks slowing down road decarbonisation.

Mike Hawes, SMMT chief executive, said: “Britain’s new van market continues to grow with the very latest, more fuel-efficient models driving down CO2 – a core mission for the sector.

“Manufacturers are investing billions to bring electric vehicles to market, however, uptake is slowing and urgent action is needed.

“If Government is serious about delivery of its ambitious targets, it must deploy an equally bold strategy for delivering van-suitable public charge points across the UK, now the single most important step to get a greener Britain moving.”

Sue Robinson, chief executive of the National Franchised Dealers Association (NFDA), added: “Van buyers need confidence from the Government to make the switch to new EV commercials through measures such as improving charging infrastructure.

“With the ZEV mandate stipulating that 10% of vans sold by manufacturers this year are required to be zero-emissions or face penalties, it is crucial that incentives are introduced by the Government to drive up demand and meet these targets.”

Login to comment

Comments

No comments have been made yet.