A deep dive into Whole Life Cost (WLC) calculations, with a view to selecting the most cost-effective new company cars, can leave the heads of managers of Small and Medium-sized businesses’ (SMBs) reeling.

There is a great deal to consider if you do not have ready access to an automated WLC calculation engine. Larger firms which are tied into solus and dual brand contracts to purchase specific OEMs’ vehicles, will be able to access the selected manufacturers’ own WLC calculators.

However, that is not practical when you want to explore the whole market. Whole of market WLC calculators do come bundled with some enterprise fleet management software suites, but annual licenses for this type of software tends to be beyond the pockets of most SMBs.

This explains why, according to PricewaterhouseCoopers (PwC), only 32% of companies offering company cars use WLC to determine the value of the cars they select to add to their fleets.

SMB managers tend to use ‘Lease Cost’ price, Recommended Retail Price (RRP) or ‘Purchase Cost’ (RRP minus discounts), to help make affordability decisions - even though none of these numbers give you any real idea of what it’s going to cost to run the selected vehicle through its typical three-year lifetime as a company car.

Good WLC calculators factor in many more parameters. These may include financing cost; maintenance costs (including tyre replacement); roadside recovery packages; and fuel usage.

They may build in all the tax implications of vehicle selections including VAT recovery, Corporation Tax Relief, Vehicle Excise Duties (VED), Class 1A National Insurance, Benefit In Kind (BIK), even lease rental restrictions (for cars with CO2 110g/km+ emissions).

Some will allow firms to calculate fuel costs based on average fuel rates (AVRs) priced over the last quarter, thereby smoothing out sudden hikes in fuel prices at point of purchase.

Others prefer to work with their own ‘pence per mile’ rate, perhaps assuming 60% of usage will be for business contract mileage and the rest for personal usage.

For company cars being bought outright by the firm, it is important to build in the cost of capital (i.e. not having that money as working capital available to the business and potentially servicing an overdraft to pay for it).

For those leasing, administration and management fees of the selected leasing company needs to be factored in.

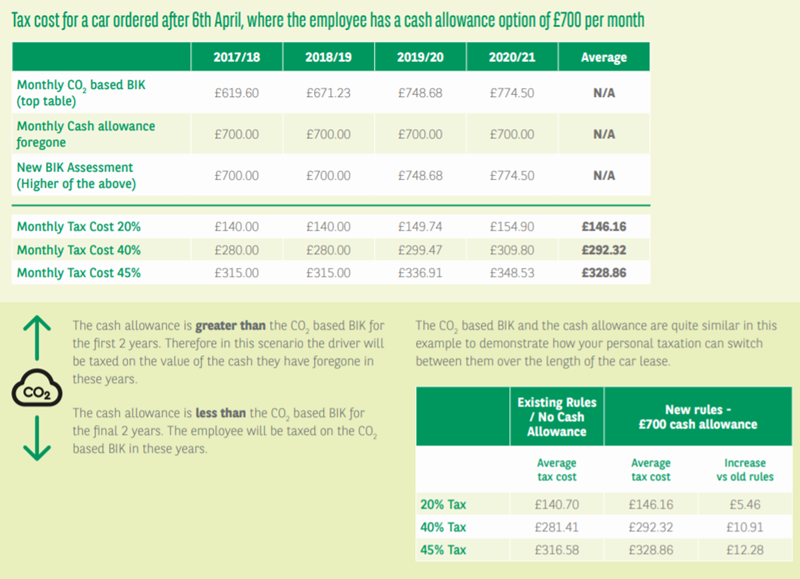

Their excess mileage and damage charges also need to be added to the calculator. Since 6th April 2017, the Government changed the tax on company cars to stimulate greener motoring.

This is progressively increasing the tax burden for Combustion Engine-based company car drivers. Take a look at how this is affecting the monthly tax bill for a 2015 BMW 3 Series Diesel Saloon below:

Source: Arval ‘Changes in Benefit In Kind Calculations for Company Cars’

It’s very complicated stuff, even for a tax accountant. Pretty quickly, SMB fleet managers may decide to hold up their hands and put WLC in the ‘too difficult’ pile.

However, for those with more than half a dozen vehicles in their fleet, this would be a mistake.

One estimate by Deloitte Consulting puts savings per vehicle across a typical three-year life of a company car at up to £1,200, if managers can make fleet vehicle selections based on accurate WLC estimates.

That could amount to more than a £5,000 saving each year for fleets of just 13 vehicles.

WLC calculators can be used for many reasons:

- For forward budgeting to predict future costs

- To compare funding methods for new cars

- To determine driver grades/allowances

- For real-time vehicle ordering

- To compare manufacturers when negotiating solus, dual badge or simply drawing up a list of preferred manufacturers

- To define cash allowances (for staff that choose to cash in their company car allowance)

- To select your short list of vehicles being offered under a company car scheme

However, it’s now possible to use the ‘big data’ approach to deliver highly accurate and yet cost-effective WLC calculations to smaller fleet owners and the staff managing them.

Cap HPI is able to assemble very accurate WLC figures on most vehicles available to buy in the UK because they collect and crunch multiple data feeds on every vehicle sold in the UK.

They’ve factored in everything from tyre replacements costs to average fuel consumption on each of them.

If you add to that the tax implications for each vehicle - based on its original price, the car allowance offered, NI contributions, VED, VAT, BIK rates and implications for corporation tax payments, then you quickly build to a highly accurate WLC figure for each vehicle you are considering buying or leasing to add to the corporate fleet.

And in the future, it will be possible to achieve even greater WLC calculation accuracy as ‘Connected Car’ data on real-time mileage, driving behaviour and service history will be collectable from vehicles’ Engine Control Units, distributed via OEMs’ own Connected Car data platforms, such as the BMW CarData platform which is already live. WLC calculators will soon be able to cater for every manufacturer out there and deliver the true, real-time costs of running your prospective, as well as actual, fleet. WLC is about to get a whole lot more affordable, accessible, dynamic and accurate.

Drive Software Solutions launched its own cloud-based fleet management software suite called ODO in January 2018.

By Simon West-Oliver, director of sales and marketing, Drive Software Solutions

Login to comment

Comments

No comments have been made yet.