The price of public rapid electric vehicle (EV) charging remains high despite a fall in wholesale energy prices, according to the RAC.

In contrast to the low prices enjoyed by drivers who are able to recharge their vehicles at home, the price of using the very fastest chargers, which are relied on by drivers making journeys beyond the range of their vehicles, is virtually unchanged since the start of the year.

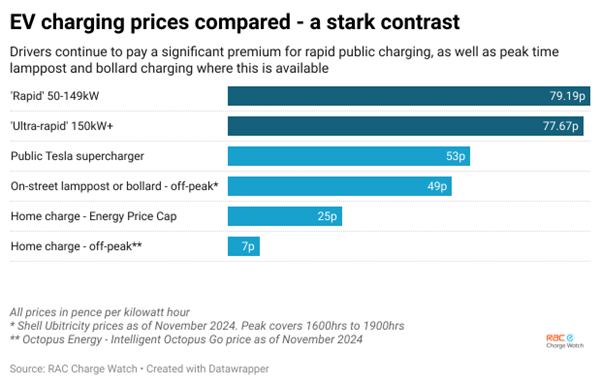

The average cost of a rapid pay-as-you-go charge, using chargers with power outputs between 50 and 149 kilowatts, currently stands at just under 80p per kilowatt hour (79.19p/kWh), virtually unchanged on the start of the year (79.55p) but up 4% since a year ago and up 28% on two years ago.

Drivers today therefore pay £41.18 to charge a family-sized electric car from 10% to 80%, adding a range of around 170 miles.

Using the country’s fastest ultra-rapid chargers – those with a power output of 150 kilowatts or above that can charge many EVs in minutes – costs a similar 77.67p/kWh, making a 10-80% charge cost £40.39.

Off-peak home charging can cost just a seventh of the price of doing so at an on-street lamppost or bollard charger where these exist (7p, compared to between 49p/kWh), and less than a tenth of the price of using a much more common rapid or ultra-rapid charger (7p, compared to 80p and 78p/kWh).

RAC spokesperson Rod Dennis said: “Drivers of electric vehicles might be frustrated that the cost to use rapid or ultra-rapid chargers remains stubbornly high, despite wholesale energy prices dropping.

“But they might also be surprised to learn that the actual cost of electricity they are using when they charge up makes up a relatively small part of the total price they have to pay due to the high charges levied on the networks for grid upgrades and connections.

“Charging networks are spending enormous sums of money now to install the charging infrastructure that an increasing number of drivers will be using in the years to come, as more of us switch to EVs.

“Figures show that almost twice as many of the fastest chargers have so far been installed this year compared to last, and nearly four times as many compared to 2022.”

The low cost of home charging means that even drivers who are on a standard domestic electricity tariff pay no more than £15.88 to fully charge an electric vehicle from 0% to 100%.

This is down from a high of around £22 during late 2022 and 2023 and may leave drivers wondering why public charging prices have not come down, when the cost to charge at home has done as a result of falling wholesale energy costs: as of the end of August 2024, the wholesale electricity price was just under 9p/kWh, down from a high of 51p in August 2022.

The reason, the RAC says, is three-fold. Firstly, the charging networks which build and operate rapid and ultra-rapid chargers have faced huge increases in some of the charges they pay for the supply of their electricity, including those covering the capacity they will need in the future.

Secondly, it is the same charging networks that are doing the vast majority of the ‘heavy lifting’ when it comes to the vital task of installing and running the country’s EV charging infrastructure, meaning the prices they charge drivers need to be higher to help fund this.

The networks are, effectively, building charging stations now to meet drivers’ needs in the future, given that EVs represent less than 4% of the total number of cars on the UK’s roads.

Finally, unlike that which exists for domestic energy customers, there is no price cap applied to electricity bought by businesses including the charging networks.

“Public EV charging prices reflect the realities of building a reliable, future-proof network - not profiteering,” Adrian Fielden-Gray, BeEV

Ofgem’s domestic price cap was crucial in keeping down domestic energy bills after wholesale prices spiked following the Russian invasion of Ukraine.

Dennis continued: “Of course, not all drivers depend on these fastest, high-powered chargers, but they are a crucial element of the charging mix.

“They are especially important for drivers who don’t have their own off-street parking space and so can’t benefit from the cheap rates to charge an EV at home.

“Our figures highlight the huge gulf in prices between those paid by EV drivers to use public chargers, and those that homeowners with EVs pay at home.

“On the one hand, anyone who has an off-street parking space and a home charger installed can charge up for just a seventh of the price of using a lamppost or bollard charger off peak where these exist, and less than a tenth of the price of using a high-powered public charger.

“For these reasons, it’s vital that public charging costs for drivers come down.”

He added: “Reducing the rate of VAT charged on electricity sold at EV chargers from the present 20% to match the 5% charged to domestic customers would be a huge help, but this wasn’t included in last month’s Budget.

“The best prospect of lower prices may come from Ofgem reviewing and, in turn, reducing the additional charges the charging networks have to pay. If these costs come down, drivers could at last expect cheaper public charging costs in the future.”

ChargeUK chief executive officer Vicky Read said: “We believe reforms are needed to help charge point operators offer public charging that is as affordable as possible.

“The sector has committed to spend £6 billion ahead of demand and profitability to deliver the charging infrastructure that the UK needs.

“With a public charger being installed every 25 minutes and the network expanding by 42% a year, we are on track to do this. Our members are also committed to making charging affordable as possible, because we know this is a key consideration in the decision to switch to EVs.

“But operators are faced with significant costs outside their control. VAT charged at 20% for public charging (versus just 5% at home), standing charges for rapid charging that have risen more than 10-fold in the past 18 months, wholesale electricity prices that remain among the highest in the EU28, and the fact that operators in the UK do not benefit from carbon credit schemes, unlike many of our European counterparts.

“We call on the Government and Ofgem to act now to ensure that affordability is not a hurdle in the transition to EVs.”

Financial risk to support EV adoption

Adrian Fielden-Gray, co-founder of BeEV, explained that electricity accounts for only a fraction of the total cost of charging. “CPOs often enter fixed contracts so we’re not paying 50p/kWh one month and then 9p/kWh the next,” he said.

“We enter fixed price contracts, which is a good thing for customers as gives price certainty rather than passing on volatility.

“Additionally, the cost of the kit is very high. If a home user spends £1,000 on installing a home charger, that’s an upfront cost which they don’t equate to an extra, say, 20p/kWh on their normal tariff but that is what happens when fronting the upfront cost in public charging.”

He added: “CPOs are taking substantial financial risks to support EV adoption, committing £6 billion to develop a charging network driver want at a time when EVs account for just 3% of vehicles on the road.

“Public EV charging prices reflect the realities of building a reliable, future-proof network - not profiteering.”

LCP Delta research indicates that 84% of fully electric car drivers in the UK have private, off-street parking, which is significantly higher than the overall population.

John Murray, head of electric vehicles at LCP Delta, said: “To enable the mass adoption of EVs, we need affordable, accessible charging infrastructure that works for all.

“When public charging tariffs exceed 50p/kWh, typically the running cost of an EV is higher than the equivalent cost of refuelling a petrol car.

“Public charging prices remain too high, and they must fall for EVs to represent a realistic option for drivers that cannot park at home.

“To ensure we have a public charging infrastructure that is equitable and fit for the future, we support ChargeUK’s calls to lower the VAT rate on public charging from 20% to 5%.

“The public chargepoint operators are continuing to do a great job in rolling out public charging infrastructure across the length and breadth of the UK. However, high upfront capital expenditure coupled with high energy procurement costs and other costs outside their control results in most players not turning a profit today. Comprehensive grid connection and planning reforms are essential to meet national EV charging targets.”

Kerbside charging costs rise, but hike not as steep as 2023

The AA says that charging at peak times on slow chargers, typically lampposts within residential areas, have risen by 11p/kWh in October.

While the hike is less steep than one last year (13p/kWh in 2023), the cost of charging at peak times on a public slow charger is now 69p/kWh compared to 67p/kWh 12 months ago, according to the AA’s EV Recharge Report.

The timing of the increase runs alongside the increasing cost of domestic energy, however those with the ability to charge at home on a standard tariff will still enjoy motoring at less than 6 pence a mile. Typically, lamppost charging prices fall in the summer, mirroring the costs of home electricity.

Elsewhere, charging at ultra-rapid stations increased by up to 3p/kWh in a month, but fast charging costs fell by 2p, meaning it would cost around £23 to add 80% battery to an EV.

In contrast, the price of fuel fell in October to 134.50 pence per litre, giving a refill cost of £43, or 11.76 pence per mile. However, fuel prices are now rising, with petrol up 1p a litre so far in November and looking set to become more expensive as drivers head into winter.

Jack Cousens, head of roads policy for the AA, said: “EV owners without their own parking spot won’t be pleased that residential charging costs have risen. However, as these increases are at peak times, typically as people return home from work, if they are prepared to plug-in before bedtime, they can charge overnight at a competitive rate.

“While price rises are always disappointing, the difference between EV and petrol costs is that charging companies offer far more stability and uniformity compared to forecourts.

“We expect there to be little price fluctuation at chargers across the winter, whereas petrol drivers fear that their costs could increase daily.”

Login to comment

Comments

No comments have been made yet.