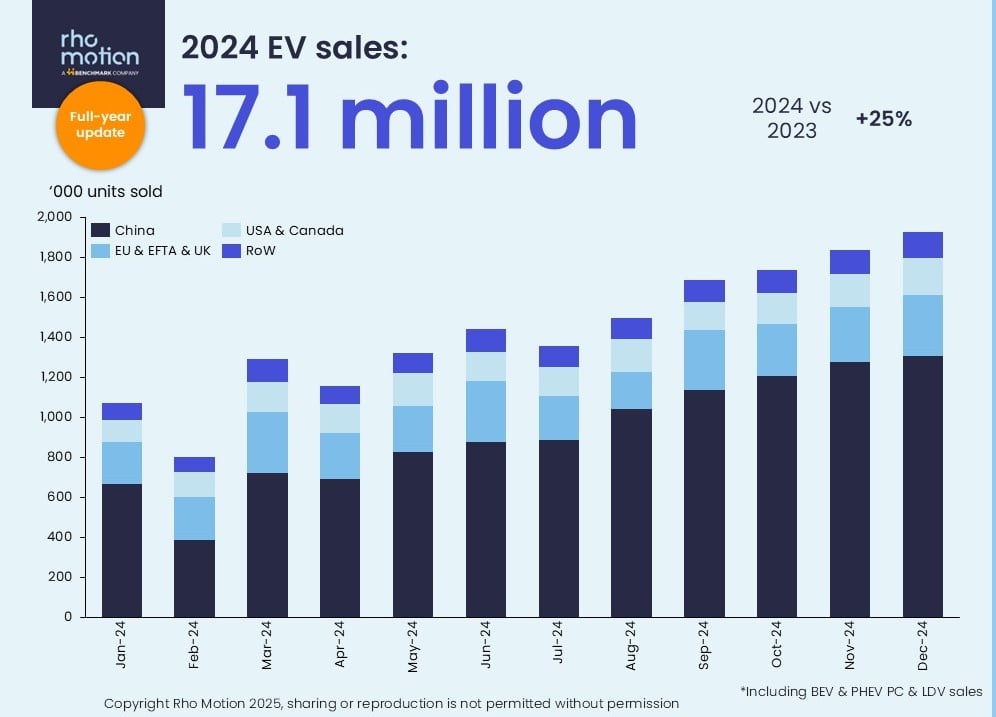

Global electric vehicle (EV) sales grew by 25% in 2024 to 17.1 million units, while the European market ended the year down 3% compared to 2023, according to new sales data.

The US and Canadian market grew by 9% to 1.8 million units in 2024, helped by the vehicle tax credits that incoming President Trump has announced he plans to cut.

In China, the new figures from Rho Motion show that EV sales grew by 40% year-on-year to 11 million units.

China also achieved another monthly record for electrified vehicle sales in December 2024 with more than 1.3 million units sold, accounting for the lion’s share of the more than 1.9 million EVs registered globally in the month.

Rho Motion data manager, Charles Lester, said: “After the record-breaking year in 2023 for EV sales we entered 2024 with some optimism about the market despite headwinds.

“While overall the global market has boomed, growing by a quarter over the year, the regional disparities have also grown.

“Europe’s market (which includes the UK) has shrunk 3% and China’s grown by 40%.”

Lester explained: “What is clear is that Government carrots and sticks are working.

“In North America, the 9% growth can mostly be attributed to consumer subsidies and over in the UK, the ZEV mandate has highly incentivised manufacturers to push their low emission cars.

“Meanwhile the removal of subsidies in Germany had a devastating impact on the whole European market, if the US follows suit, we may see the same there.”

The EU, EFTA and UK market finished 2024 down by 3% after selling more than 300,000 EVs in December 2024.

Despite being down overall in 2024, the European market increased by 12% month-on-month and by 1% year-on-year.

The UK market had the most battery electric vehicle (BEV) sales with more than 400,000 units sold, surpassing Germany’s year-to-date sales towards the end of the year.

The UK market was up by almost 20%, bolstered by the ZEV mandate, while the German EV market was down in 2024 versus 2023 following the removal of subsides at the end of 2023, ultimately having a negative impact on sales.

Norway continues to have the highest penetration rate in the world and reached more than 90% passenger car and light-duty EV sales monthly penetration towards the end of 2024.

Huge part of China’s growth through PHEVs

The Chinese market grew by 2% month-on-month in December and by 40% overall, last year.

A huge part of that year-on-year growth came from plug-in hybrid electric vehicles (PHEVs), with 81% growth, compared to BEV growth of 19%.

The rise in demand for range-extender electric vehicles (REEVs) has played a significant role in the growth of PHEVs in China, a technology that has yet to come to Western markets in mass.

The Chinese market benefited from its car trade-in scheme, which it doubled in July 2024, and has been extended for 2025.

BYD’s sales kept growing throughout the year, with the major manufacturer easily selling the most EVs in China in 2024 as just over one-third of new EVs sold are BYD models.

BYD has more than 40 models in China across four EV brands. BYD is also planning to start production at its facility in Hungary in 2025, as it looks to gain market share in the European EV market, following the blow of EU BEV tariffs.

US & Canada market ends on high

The US and Canada market ended the year on a high with record EV sales in December 2024 of over 185,000 units sold.

The North American market has consistently grown by 10% throughout the year and finishes with a total of 1.8 million units sold in 2024.

The EV market in the US will be tested in 2025, with the threat of the EPA emission standards or EV tax credit potentially being reversed, both of which are essential drivers of EV adoption in the US.

Despite this risk to EV adoption in the US, there are still many facilities being built across the supply chain for EVs and EV batteries, with some being funded from the US Department of Energy (DoE), most recently being Rivian’s $6.6 billion conditional loan from the DoE’s Advanced Technology Vehicle Manufacturing (ATVM) programme.

Login to comment

Comments

No comments have been made yet.