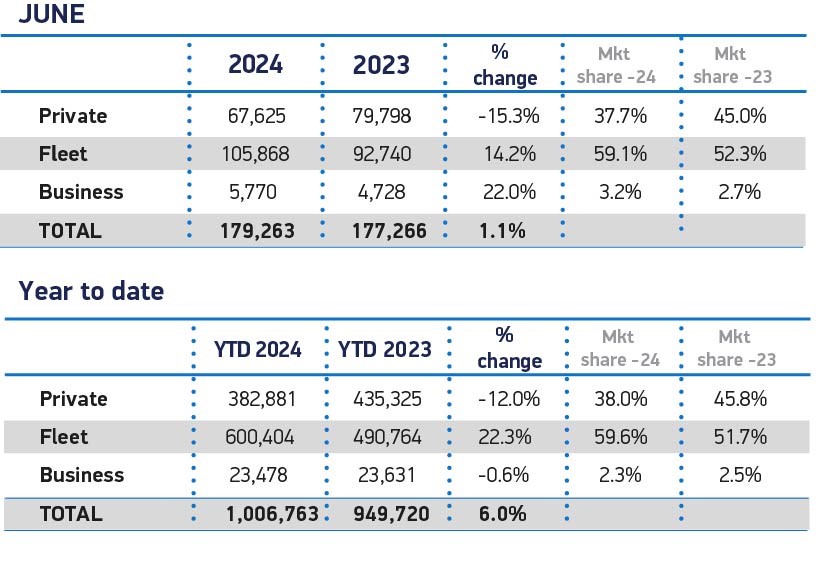

The fleet sector is continuing to drive the new car market with fleet and business registrations up by more than a fifth (21%) year-on-year.

In the first half of the year, company cars accounted for 62% of the new car market, with 623,882 cars registered to fleet and business.

That’s almost 110,000 more cars than were registered to fleets in the first six months of 2023, when market share was 54%, according to new figures from the Society of Motor Manufacturers and Traders (SMMT).

A strong fleet market continues to compare starkly, however, with the retail new car market which continues to struggle - private registrations are down 12% year-to-date.

Looking at June, private registrations were down by more than 15%, while fleet and business registrations combined showed a 14.5% uplift, compared to June 2023.

There were 111,638 new cars registered to fleet and business in the month, compared to 67,625 registered privately.

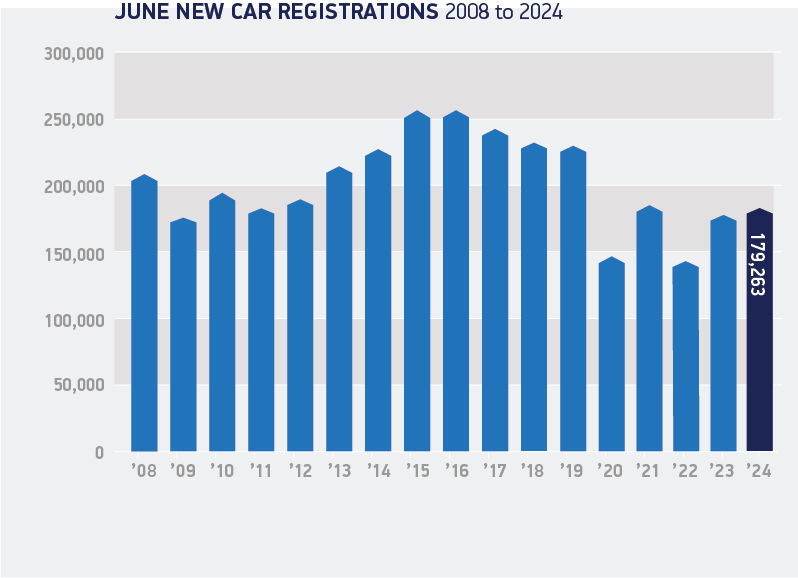

Taken together, the 179,263 units equated to a modest 1.1% increase on June 2023’s performance.

However, the growing popularity of company cars helped the UK new car market hit the half-year million motors mark for the first time in five years.

So far in 2024, 1,006,763 new cars have been registered, up 6% on the previous year but still down a fifth (20.7%) on the pre-pandemic figures of 2019.

Mike Hawes, chief executive of the SMMT, said: “The year’s midpoint sees the new car market in its best state since 2021 – but this belies the bigger challenge ahead.

“The private consumer market continues to shrink against a difficult economic backdrop, but with the right policies in place, the next Government can re-energise the market and deliver a faster, fairer zero emission transition.”

Electric vehicles grab market share

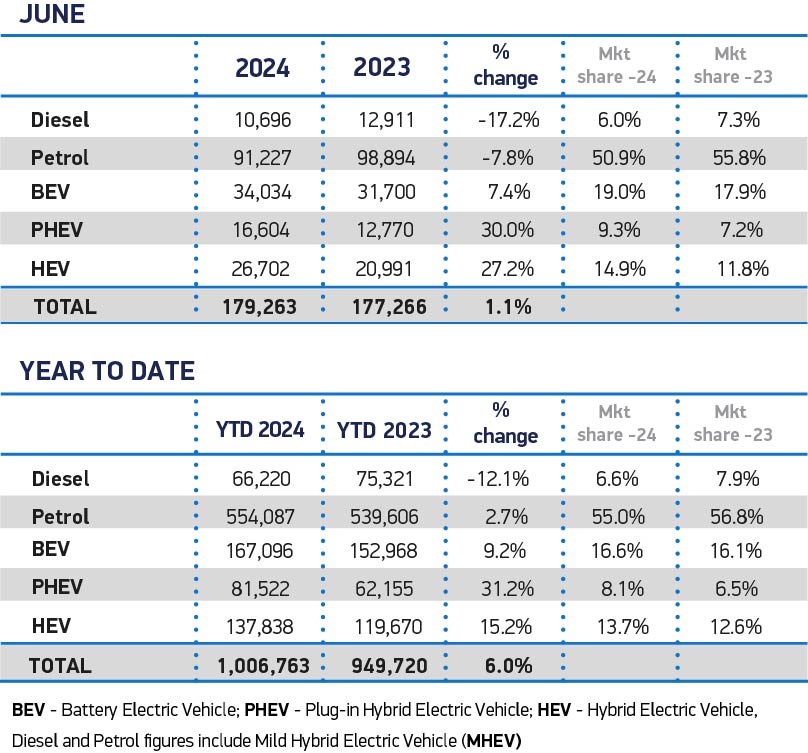

Electrified vehicle uptake continued to grow in June, with plug-in hybrid (PHEV) volumes up 30% to reach a 9.3% market share, while hybrid electric vehicles (HEV) rose 27.2% to achieve 14.9% of the market.

Both powertrains also outpaced battery electric vehicle growth (BEV), which rose 7.4% but took its highest monthly share this year, accounting for 19% of all new vehicle registrations.

The UK’s zero emission transition – and the ability of manufacturers to meet the requirements of the Vehicle Emissions Trading Scheme – currently relies on the fleet sector as private consumer uptake continues to soften.

Private BEV uptake has fallen 10.8% year-to-date, with fewer than one in five new BEVs going to private buyers.

Overall, BEVs now comprise 16.6% of the new car market so far this year, slightly above the 16.1% achieved in the same period last year, with uptake behind the levels mandated by Government.

With the UK heading to the polls today (Thursday, July 4), the automotive industry calls on the next Government to provide greater support to the consumer on the journey to zero emission mobility.

Re-instating fiscal incentives for the private consumer by way of a halving of VAT on BEVs for three years would re-energise the market, putting an additional 300,000 private BEVs – rather than petrol or diesel cars – on the road over the next three years, on top of current outlooks, says the SMMT.

Jamie Hamilton, automotive partner and head of electric vehicles at Deloitte, says efforts to incentivise private consumers to make the switch to electric needs “ramping up”, especially as the market share for EVs is still below the required 22% as set out in the zero-emission vehicle mandate.

“Whilst the rollout of superfast charging infrastructure is happening, there is a need for more accessible public charging,” he added.

A Deloitte survey shows that consumers are more than twice as likely to be interested in switching to an electric vehicle if their home has access to off-street parking and charging facilities.

Kim Royds, mobility director at Centrica, says that the imbalance of public and domestic charging networks remains a “stubborn barrier” to wider adoption of plug-in vehicles.

“If the UK is to work towards fully electrified roads, we must ensure all drivers – with or without driveway access - can enjoy the financial and practical benefits of charging either at home or in public,” she added.

Ian Plummer, commercial director at Auto Trader, argues that, with average new car prices rising almost 40% over the past five years, “cost is the culprit”.

“Manufacturers are responding with discounts but they're failing to keep pace, which is forcing many buyers to opt for a used alternative,” he said.

“Whoever forms the next Government needs to address electric car affordability and provide long term stability for the market, securing the future of the salary sacrifice and benefit-in-kind schemes is essential as these drive the majority of new electric car uptake and it will be very difficult to scale without these.”

Richard Peberdy, UK head of automotive for KPMG, says that the industry has its eyes firmly on the outcome of the election and what that means for automotive policy and attracting continued and further investment over the coming years.

“Increasing new electric vehicle sales is imperative to UK car makers, who are now mandated to ensure that annually increasing percentages of the cars that they manufacture are electric,” he added.

“Increasingly players in the industry are talking about how this is best achieved, including the likes of increased incentives for consumer purchases of new EVs.

“Incentivising businesses to make new EV purchases has been a key contributor to growing UK EV sales in recent years.”

Jon Lawes, managing director at Novuna Vehicle Solutions, also believes consumers considering the EV switch are contending with affordability hurdles and a dearth of charging infrastructure.

“Whoever forms the next Government urgently needs to adopt a bold strategy to mobilise policy incentives and deploy infrastructure investment,” he said.

Philip Nothard, insight director at Cox Automotive, added: “The low proportion of private registrations shows the levels of caution still evident amongst consumers.

“The industry unanimously calls on the next Government to support the automotive sector and consumers with the transition to EV.

“The critical question now is whether we will see action. We’re otherwise unlikely to see a significant shift in the market performance this year.”

Login to comment

Comments

No comments have been made yet.