The number of employees paying company car tax has fallen 10% year-on-year, according to new data published by HMRC.

The latest benefit-in-kind (BIK) statistics, published by HMRC today (Thursday, September 29), reveal another dramatic decline in company car drivers.

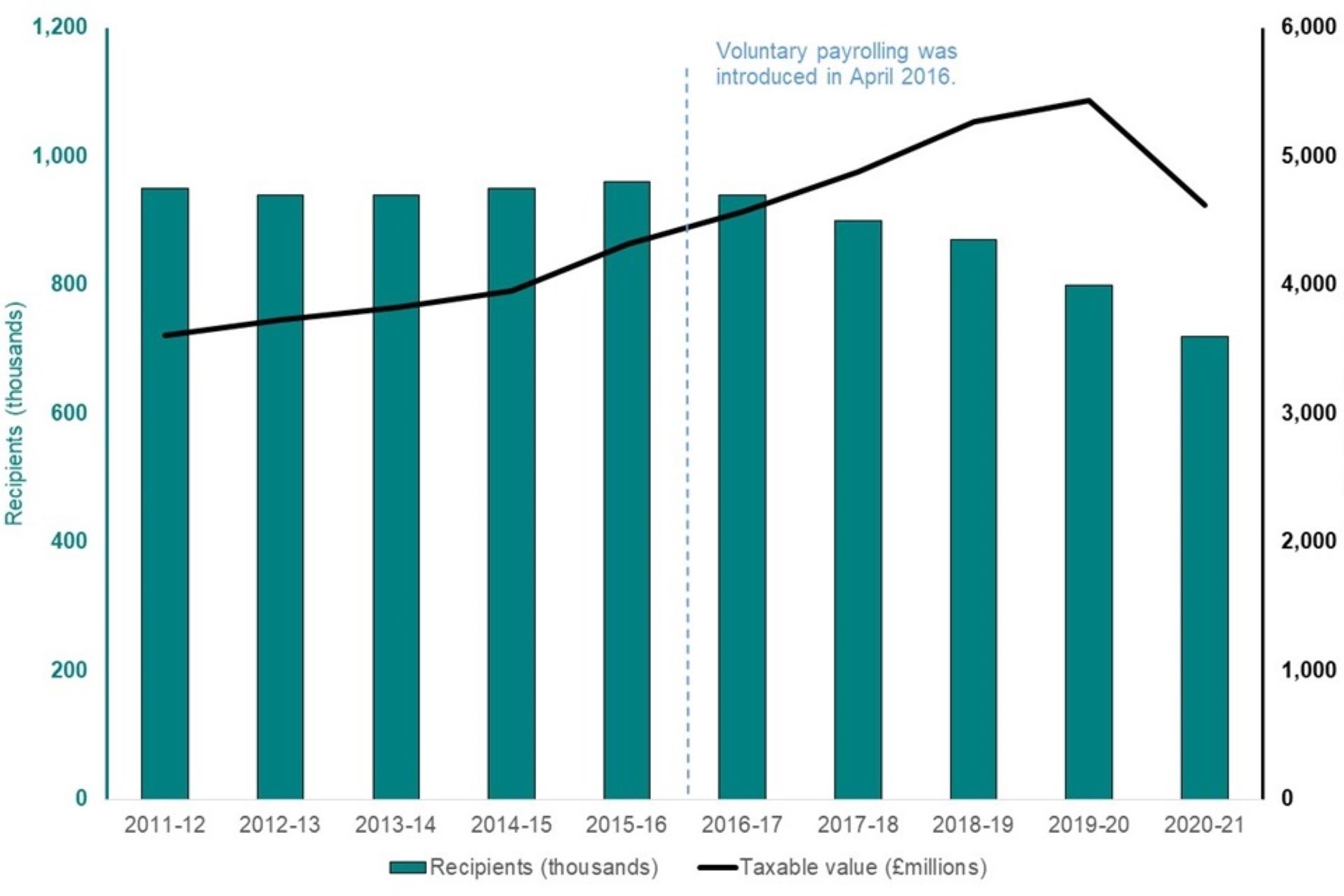

There were 720,000 company car drivers in 2020/21 – 80,000 fewer than the 800,000 reported the previous year – despite a zero percentage BIK rate for electric vehicles being introduced the same year.

However, fully electric cars accounted for 7% of car benefit recipients and, with leasing companies reporting record orders for electric vehicles (EVs), that is expected to increase further next year.

It will also be hoped that the low BIK tax rates, introduced for electric company cars from April 2020, will start to put the brakes on the decline seen over recent years.

The HMRC data shows that the number of employees now paying BIK on a company car has fallen by a quarter (25%) since 2015/16, when 960,000 people enjoyed the benefit.

From 2011/12 to 2015/16 the reported number of recipients of company car benefit remained relatively stable at just under one million.

In more recent years, however, it has steadily declined to the current level.

HMRC says that reporting issues brought about by voluntary payrolling, introduced in 2016, may mean there is a "substantial number of individuals" in these years who received company car benefit that (while taxed at payroll) was not properly reported to HMRC. The appropriate tax was collected but car benefit not recorded.

Average reported CO2 emission for company cars

In terms of emissions, only around 2% of company cars had reported CO2 emissions in excess of 165g/km in 2020/21, according to the HMRC.

By contrast in 2002/03, 58% of company cars had reported emissions in excess of 165g/km.

The average reported CO2 emission of company cars including electric cars was 99g/km compared to 111g/km in the previous tax year.

For cars with internal combustion engines, the average was 107g/km, while the proportion of company cars using diesel fuel reduced to 49%.

Diesel cars accounted for around 80% of company cars up to 2017, with a steady decline through to 60% by 2019/20.

Meanwhile, the number of reported recipients of company cars with CO2 emissions of 75g/km or less was 137,000 (up from around 78,000 in the previous tax year).

Tax take from company cars

The total taxable value of company car benefit was £4.62 billion in 2020/21, down from £5.43bn in the preceding year.

Total Income Tax and NIC liabilities arising from company car benefit were around £1.42bn and £0.64bn respectively.

The drop in the number of company car drivers in 2020/21, says HMRC, is expected to have been exacerbated by the Covid-19 pandemic, and associated reduction in economic activity.

Meanwhile, the long-term downward trend in both the number of recipients and the total taxable value of car fuel from 240,000 recipients (taxable value £770 million) in 2011/12, to 60,000 recipients (taxable value £320m) in 2020/21, continues.

This trend, says HMRC, is likely to reflect rising fuel prices during most of this period, causing employers and employees to look more carefully at whether the fuel benefit formula results in a tax charge commensurate with the perceived value of the benefit.

Although average fuel costs were around 10% lower in 2020/21, there were significant travel restrictions at various times due to the Covid pandemic which may have driven some taxpayers to relinquish car fuel from their employer, it says.

The rise in electric vehicles means fewer company cars used car fuel in 2020/21 compared to earlier years.

Read the October edition of Fleet News, published next month, for more analysis and insight on the latest company car statistics.

Login to comment

Comments

No comments have been made yet.