A former special advisor at the Department for Transport (DfT) has suggested the Government will unveil road pricing proposals in the Autumn Statement today (Thursday, November 17).

Meera Vadher, a director at Flint Global, has tweeted that she expects the Chancellor, Jeremy Hunt, to publish plans on a new form of taxation which will replace fuel duty and vehicle excise duty (VED).

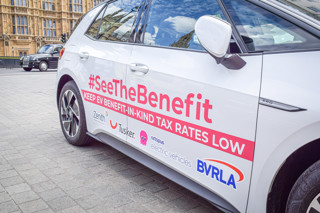

Making electric vehicles (EVs) subject to VED for the first time could also be introduced in the short term, while road taxes are overhauled.

RAC head of roads policy Nicholas Lyes said: “The fact the Chancellor is giving serious thought to how drivers pay for road use in the future is potentially a landmark moment in how drivers are taxed.

“As more electric vehicles come on to our roads, revenue from fuel duty and vehicle excise duty will decline, so it’s inevitable a new system will have to be developed.”

RAC research suggests drivers broadly support the principle of ‘the more you drive, the more tax you should pay’, with more than a third (36%) saying a ‘pay per mile’ system would be fairer than the current regime – although three-quarters (75%) are concerned the Government might use such a system as a way of increasing the amount they are taxed.

“Whatever any new taxation system looks like the most important thing is that it’s simple, transparent and fair to drivers of both conventional and electric vehicles,” continued Lyes.

“It’s also essential that a new system replaces rather than runs alongside existing taxation regime.

“Ministers should additionally consider ringfencing a sizeable proportion of revenues raised from a new scheme for reinvestment into our road and transport network.”

Fuel duty and VED combined raise about £35 billion for Government coffers but, according to the Office for Budget Responsibility (OBR) the growing share of electric cars will cut motoring tax revenues by £2.1bn by 2026-27.

Login to comment

Comments

No comments have been made yet.