Car manufacturers are expected to achieve their zero-emission vehicle (ZEV) mandate targets this year, although very few are likely to sell the required number of electric cars.

The ZEV mandate scheme requires carmakers to sell a certain percentage of electric cars each year. Fines of £15,000 will apply to each car sold outside of the target.

A headline target of 22% applies in 2024, rising progressively to 80% in 2030.

By the end of July, registrations of electric cars were up by 10% to 195,000. But this only gives them a market share of 16.8%, according to data from the Society of Motor Manufacturers and Traders (SMMT).

Analysis of new car registrations data by New AutoMotive concludes that manufacturers will achieve compliance, in 2024, despite a prediction that overall electric car sales will only reach 18%.

Ben Nelmes, CEO of New AutoMotive, said: "The UK is starting to see a return to growing EV sales after a lost year, as car companies move closer to meeting their EV sales targets.

"While some parts of the automotive industry may struggle to adjust to the UK's stretching ZEV mandate targets, those same targets are supporting investment and growth in new electric vehicle production and battery manufacturing. Ministers should therefore resist calls to change or dilute the ZEV mandate."

A handful of carmakers are comfortably ahead of the targets this year. They include BYD, Polestar and Tesla, which only make electric vehicles.

Others are significantly wide of the mark. Ford, Mazda and Suzuki are among the brands that have electric car sales below 5% year-to-date.

The targets aren’t as clear cut as they may seem, however. There are multiple ways for car makers to avoid fines without selling the targeted proportion of electric cars.

A credit-based system exists whereby manufacturers can bank credits if they overperform on their targets. These can be used to bolster performance in future years, when the targets become stricter, or can be sold to other brands that are underperforming.

Large groups, like Stellantis and Volkswagen can also pool their registrations to mitigate the poor performance of one brand with the stronger performance of another.

A further layer of complexity comes in the form of emissions credits, awarded for sales of low emission cars, such as plug-in hybrids. In this case, each manufacturer has an individual target based on their 2021 average fleet emissions.

If manufacturers reduce their average CO2 emissions and exceed their CO2 target, then they can ‘convert’ that into credits against their ZEV targets; subject to an exchange rate, a cap (65% of the 22% target in 2024), and only for the first three years.

A spokesperson from the Department for Transport (DfT), told Fleet News: “The way this works is that the manufacturer gets a target based on their emissions performance in 2021 and, in order to convert, the manufacturer would have to beat that target in the given calendar year.”

They added: "We certainly expect manufacturers to take advantage of this flexibility."

It means that each carmaker is working to different target and the proportion of new electric cars sold by the end of the year is likely to be significantly lower than the 22% mandate target.

Details about how each manufacturer chooses to utilise these options will not be publicly disclosed until March 2026.

Channel mix unbalanced

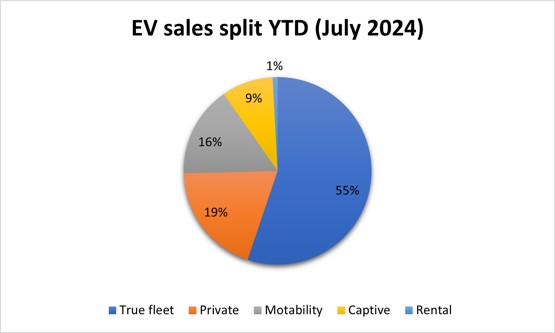

The majority of electric cars sold so far this year have been to fleet customers. The true fleet channel accounts for 55% of the 195,000 electric cars registered in 2024. The rest of the cars aren’t going to private buyers, however. Retail sales account for only 19% of electric cars sold; down from 23% in 2023.

If we look at the proportion of total private registrations, electric cars equate to just 9%. In the fleet sector, more than a third of all sales are zero emission models.

This is the result of favourable company car taxation, making electric cars far more attractive to fleet customers than anyone else.

Attempts to entice private buyers by slashing prices has failed to stimulate the market – 86% have bought petrol or diesel-powered cars this year.

Lexus and Vauxhall are among the most recent brands to announce price cuts for their electric models. On top of this, data from Auto Trader shows the average discount currently applied to EVs is 10.6%.

Rental companies have bought almost no electric vehicles this year, either. This has meant manufacturers have been pushing heavily-disounted excess stock into the Motability channel while also increasing the volume of ‘tactical’ pre-registered vehicles.

Mike Hawes, SMMT chief executive, said: “Two years of new car market growth against a backdrop of a turbulent economy is testament to the sector’s resilience and the attractiveness of the deals on offer.

“Weakening private retail demand, however, particularly for EVs and despite generous manufacturer discounts, is the over-riding concern.

“More people than ever are buying and driving EVs but we still need the pace of change to quicken, else the UK’s climate change ambitions are threatened and manufacturers’ ability to hit regulated EV targets are at risk.

“Achieving market transition at the pace demanded requires greater support for consumers and, with the all-important new numberplate month of September beckoning, action on incentives and infrastructure is needed now.”

Ford is one manufacturer that openly supported the introduction of the ZEV mandate, back in 2023. With only one electric car on sale currently, it faces one the largest struggles to meet this year’s target.

Two more electric models have been revealed – the Explorer and the Capri – alongside a promised electric Puma, but volume sales of these won’t begin until 2025.

In May, the brand revealed that it may restrict the sales of non-electric cars to re-balance its electric mix and said it’s unlikely to achieve a fully electric line-up by 2030.

Stellantis has also voiced concerns. It’s key volume brands – Citroen, Peugeot and Vauxhall - are all underperforming on the 22% target.

Earlier this year, Stellantis chief executive Carlos Tavares branded Britain's EV policy as "terrible", warning that it could ultimately lead to carmakers facing bankruptcy.

Tavares said the UK's quota system had been set at levels “double the natural demand of the market”, forcing carmakers to sell vehicles at a loss in order to avoid heavy fines, jeopardising financial stability.

Tavares then warned: "To survive, companies have to stay in the black. I will not sell cars at a loss", adding that the net zero measures could mean it ceases offering some models and even scale back its presence in Britain.”

Login to comment

Comments

No comments have been made yet.