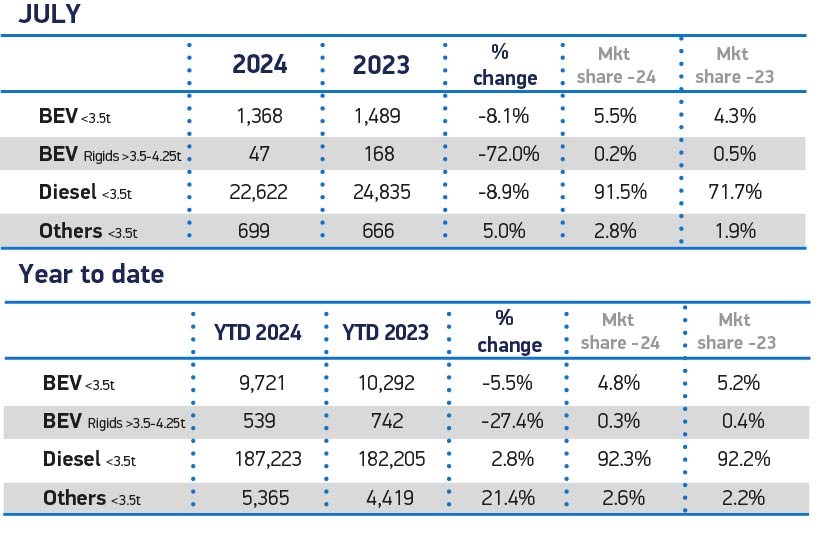

New, fully electric van registrations fell to just 1,415 units in July – a 14.6% decline – according to new figures published by the Society of Motor Manufacturers and Traders (SMMT).

That’s despite manufacturers launching ever more BEV models, with 28 electric vans now available to UK buyers – up from 25 last year.

Since January, battery electric vehicles (BEVs) have accounted for 5.1% of all new vans – a share that includes those weighing up to and equal to 3.5 tonnes (4.8%) and those weighing above 3.5 to 4.25 tonnes (0.3%) – meaning zero emission uptake is down 7% across the year.

Given manufacturers are mandated by Government to ensure BEVs comprise at least 10% of new van sales in 2024, the SMMT says that demand needs to increase significantly in the remainder of the year, especially with the number plate change month of September coming soon.

Mandated targets for van-suitable charging infrastructure are needed fast, while it argues that the plug-in van grant must be maintained beyond April 2025 if more businesses are going to decarbonise.

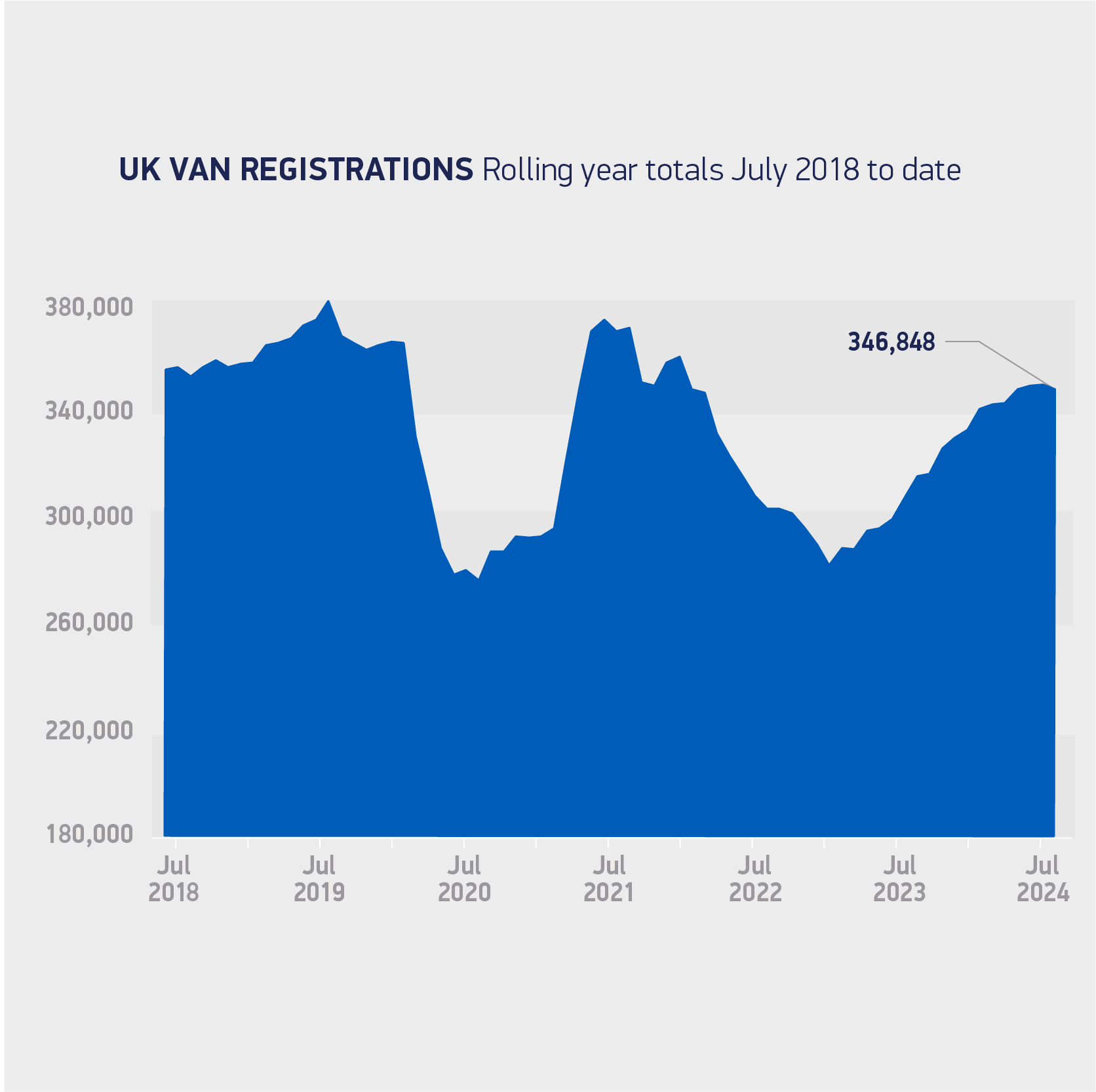

The latest outlook for the year remains robust, with 351,000 units expected this year, a 2.8% increase on 2023. However, the BEV share of LCV registrations under 3.5t has been revised downwards to 6.6%.

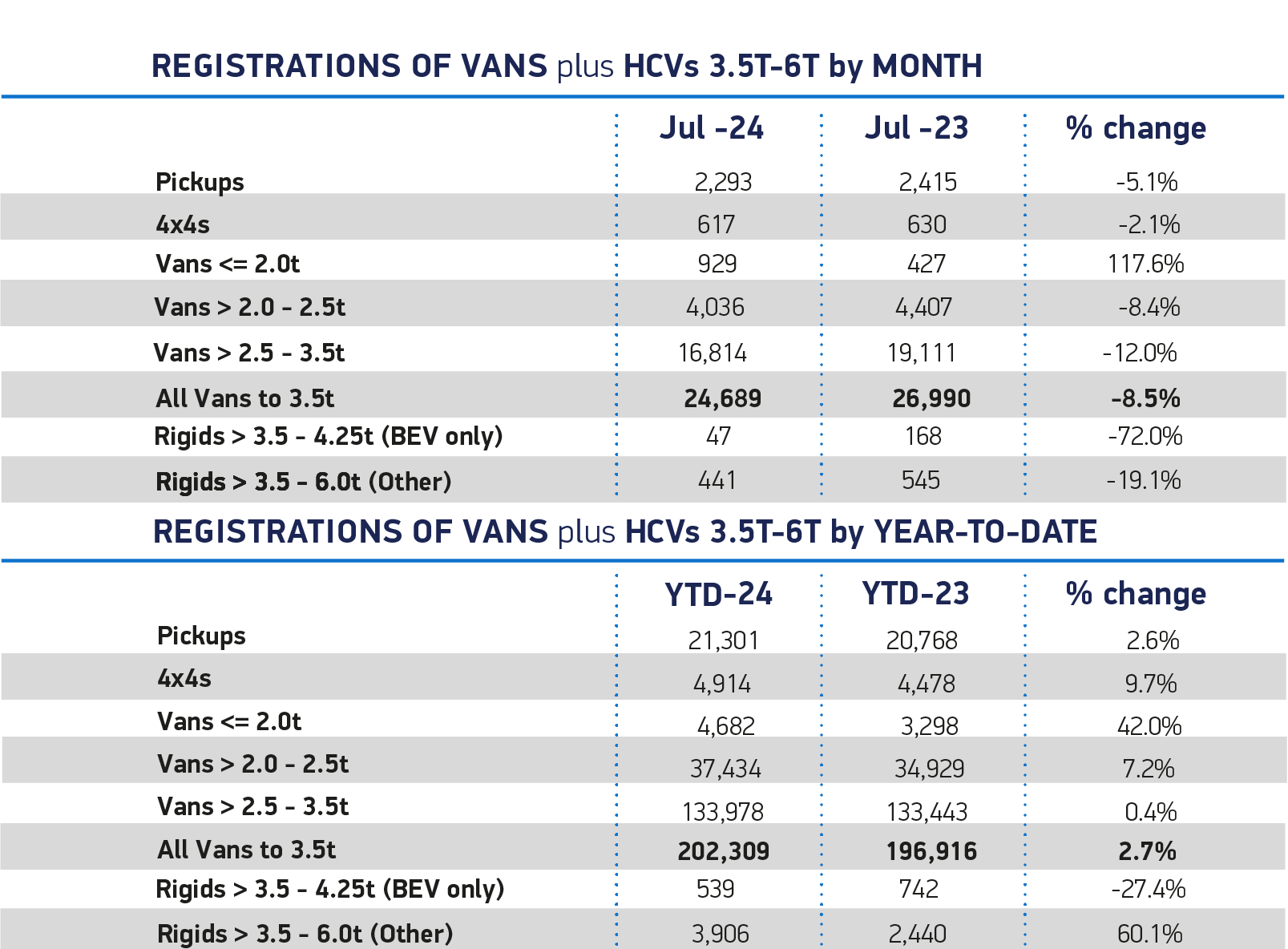

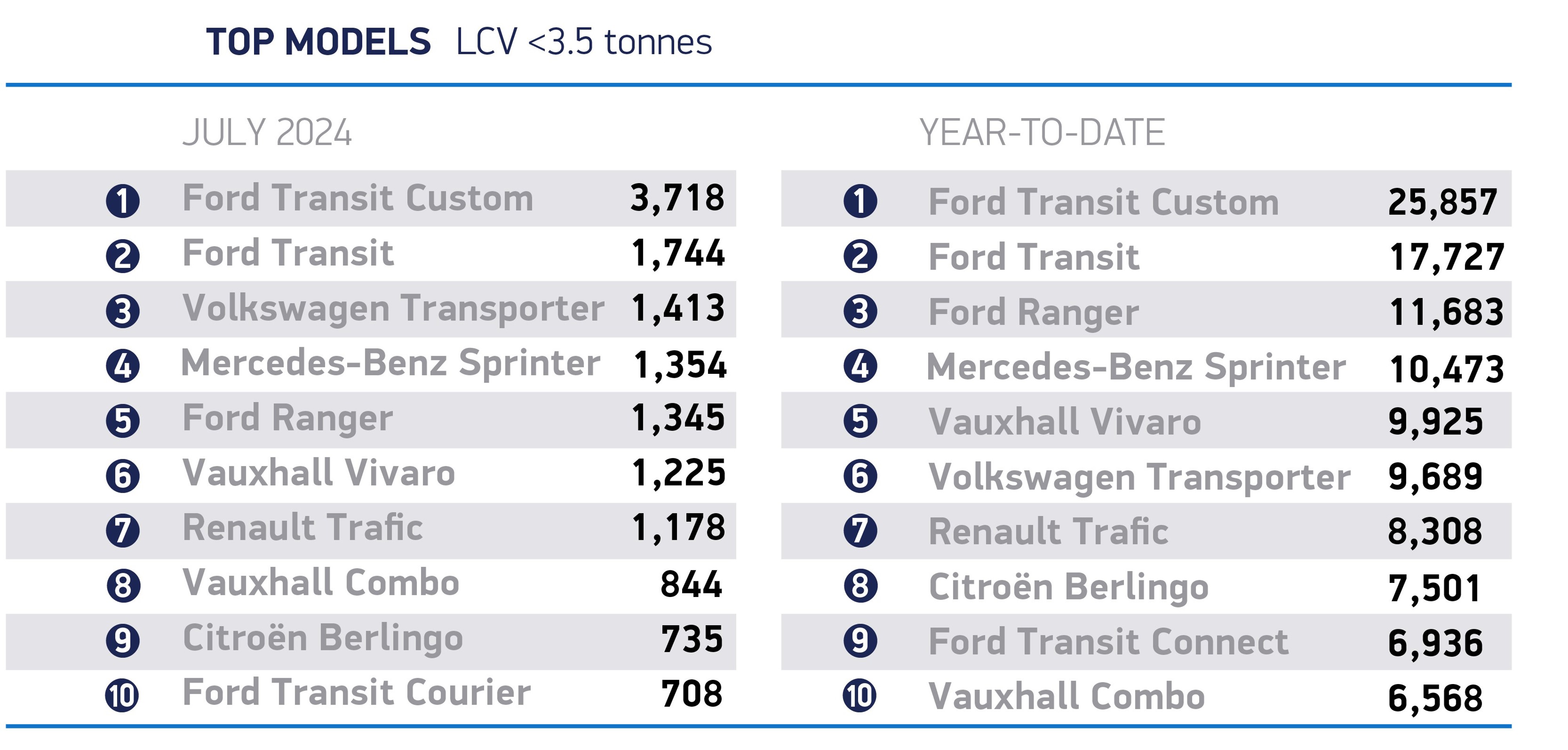

Overall, the UK’s light commercial vehicle (LCV) market dropped 8.5% in July with 24,689 vans, 4x4s, pickups and taxis joining the road, with registrations up 2.7% year-to-date to become the best first seven months since 2019.

The dip in demand in July affected most segments, with uptake of the largest vans down 12% to 16,814 units – still representing more than two thirds (68.1%) of the overall market – while 8.4% fewer new medium-sized vans were registered.

Deliveries of pickups and 4x4s also fell, by 5.1% and 2.1% respectively.

There was a spike in demand for the smallest vans in July, however, with registrations more than doubling (117.6%) to 929 units.

While smaller volumes can accentuate fluctuations, the new small van market has been robust across 2024 with demand up 42% in the year-to-date, supported by new model launches.

Mike Hawes, SMMT chief executive, said: “Britain’s new van market remains robust following a record-equalling growth run and, despite a dip in June and July, demand will resume with manufacturers offering impressive product line-ups.

“Declining uptake of the very greenest models remains a major concern, however, given the UK’s zero emission ambitions. Industry has invested – and continues to commit – billions into this transition but manufacturers cannot deliver this alone.

“Given the paucity of van-specific charging infrastructure, we need an equally ambitious mandate for charge point rollout, one that supports operators right across the country.”

For best practice advice on the challenges and benefits of electric vans, click here.

Matthew Davock, director of Manheim Commercial Vehicles at Cox Automotive, says that July's fall was expected and reflects the realities of the new LCV market currently.

“Registrations have tapered off from the highs we were seeing, but these resulted from post-pandemic fleet appetite for new stock and manufacturers’ focus on supplying them,” he explained.

“The dynamic has now shifted, and the market is settling.”

He continued: “The ZEV mandate will influence the rest of this year as the pressure to shift EV volume intensifies. Whether demand aligns with the targets set remains to be seen.

“The gulf between legislative push and buyer preferences continues to grow, but the deadlines for adoption are getting closer.

“We urge the new Government to listen to the sector, understand the consequences of this conflict, and support the van sector with incentives and infrastructure investment.”

Overall, Davock remains positive. “Activity in the new market has fuelled a strong and vibrant used van market in the first half of 2024,” he added.

“We’ve seen record volumes pass through our Manheim Auction Services and Manheim Vehicle Services locations and wholesale prices reflect the continued demand from used buyers.”

Login to comment

Comments

No comments have been made yet.