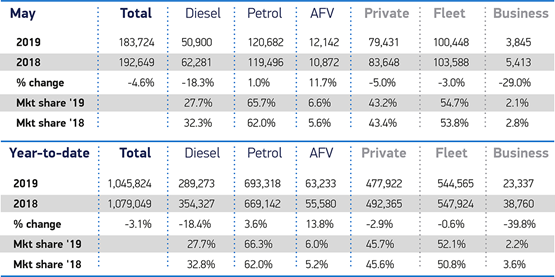

Fleet and business registrations fell by 4.4% in May, with 104,293 units registered, according to the Society of Motor Manufacturers and Traders (SMMT).

Year-to-date, fleet and business registrations are now 3.2% lower (567,902 units) than they were in the first five months of 2018 (586,684 units).

Overall, the UK new car market declined by 4.6%, with 183,724 units registered.

SMMT says that the fall reflects continued uncertainty over diesel and clean air zones as well as the removal of incentives for plug-in hybrid vehicles.

The underlying economic and political instability also continues to affect consumer and business confidence, it said.

Furthermore, plug-in hybrids (PHEVs) experienced another substantial decline, down by 40.6% in May and 25.1% year-to-date. This compares with a 36.2% increase in the first five months of 2018 and is further evidence of the removal of the purchase incentive for PHEVs.

In contrast, Battery electric cars recorded a significant rise of 81.1% year-on-yera yet this segment still only represents 1.1% of the overall market in May.

Modest growth in registrations of petrol (1%) and alternative fuel vehicles (AFVs) (11.7%) was not enough to offset the significant decline in demand for diesels, which fell for the 26th consecutive month.

Ongoing anti-diesel sentiment and the forthcoming introduction of low emission zones continues to affect buyer confidence. However, thanks to significant industry investment in new technology, the latest diesels are safer and cleaner than ever before, said the SMMT.

Mike Hawes, SMMT chief executive, said: “Confusing policy messages and changes to incentives continue to affect consumer and business confidence, causing drivers to keep hold of their older, more polluting vehicles for longer.”

Most vehicle segments experienced a fall in demand, however, executive and dual purpose vehicles bucked the trend, with registrations growing 9.1% and 16%.

While demand for superminis and small family cars fell, these vehicles remain the most popular taking a combined 56.3% of the market.

Karen Johnson, head of retail and wholesale at Barclays Corporate Banking, said: “It’s absolutely right that government and industry should focus on making the UK’s streets as clean as possible and there are some very positive steps being taken to achieve real change, but another dip of nearly a fifth in diesel sales shows that the message around the availability of cleaner diesel models isn’t getting through yet.

"It’s only through effective policy decisions and clear communication of future plans, alongside well-targeted incentives for all fuel types, that we’ll be able to encourage private and fleet buyers to invest in cleaner models.

"Dealerships I speak to are telling me there’s still plenty of interest from buyers and lots of good financing offers available – we just need to make sure the right support is there to help them close sales and get car registrations back into positive territory.”

Login to comment

Comments

No comments have been made yet.