The transition from petrol and diesel vehicles to battery electric vehicles (BEVs) is causing significant strain on the supply chain, with unpredictable production schedules and financial challenges for suppliers.

That’s according to Lee Swinerd, director and head of automotive at financial advisory firm Interpath.

“The rush towards BEVs is creating a precarious situation for the ICE (internal combustion engine) supply chain,” he explained.

“While some softening was expected, production schedules are increasingly unpredictable, creating uncertainty for suppliers.

“This, combined with the post-Covid-19 production challenges, is affecting working capital and liquidity across the sector.”

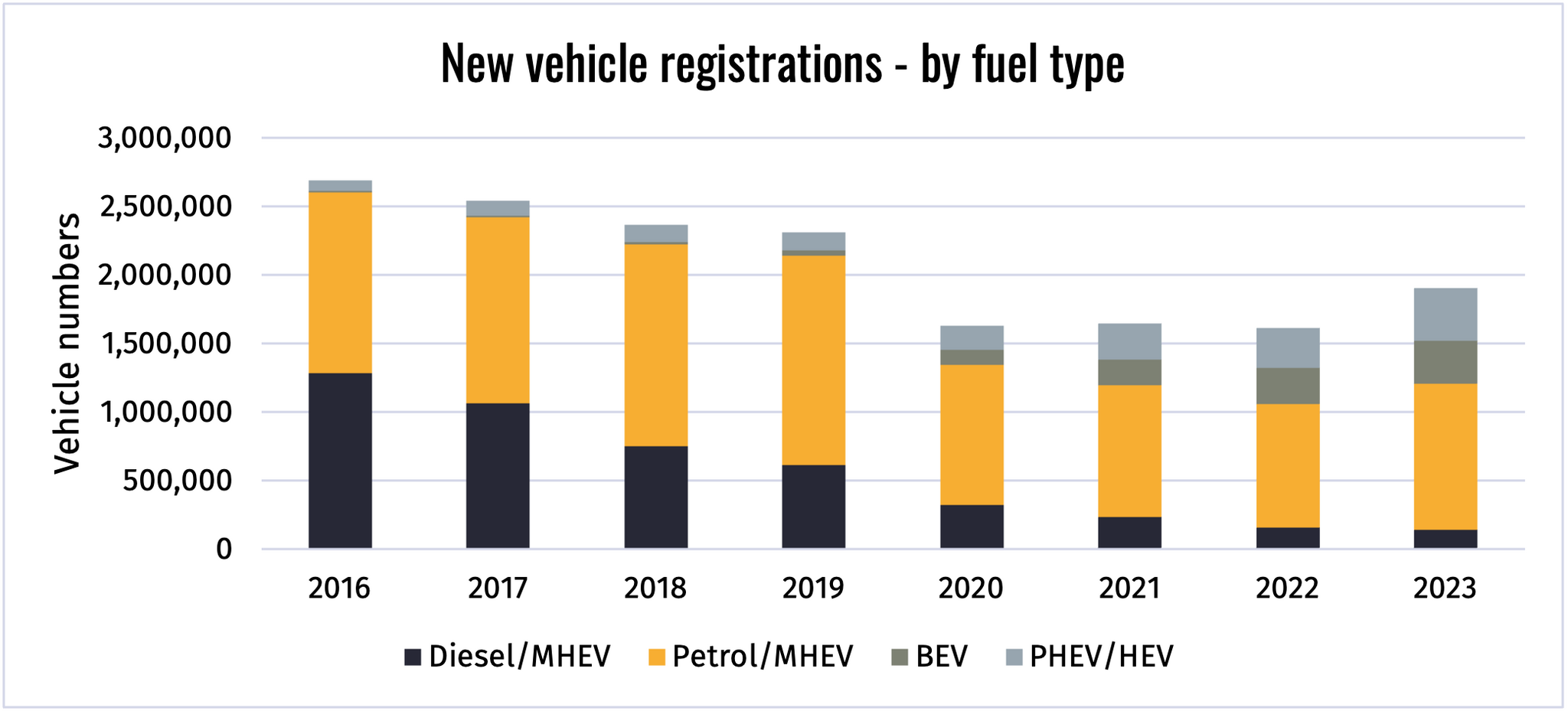

As BEV demand struggles to meet expectations, Cox Automotive's insight director, Philip Nothard, says it is important to ask questions about the short to medium-term future of ICE vehicles and the supply chain which supports them.

“Interpath raises some key points about how suppliers – and OEMs – will need to adjust their strategies to meet the fluctuating and unpredictable demand/supply dynamics for both ICE and BEVs,” he added.

Many suppliers, who have already adjusted strategies from diesel to petrol, are now seeing reduced levels of OEM investment and shrinking manufacturing capacity, says Swinerd in Cox Automotive's latest Insight Quarterly.

“The declining investment in ICE production is leading to ageing equipment and more frequent production downtimes, exacerbating the issue,” he added.

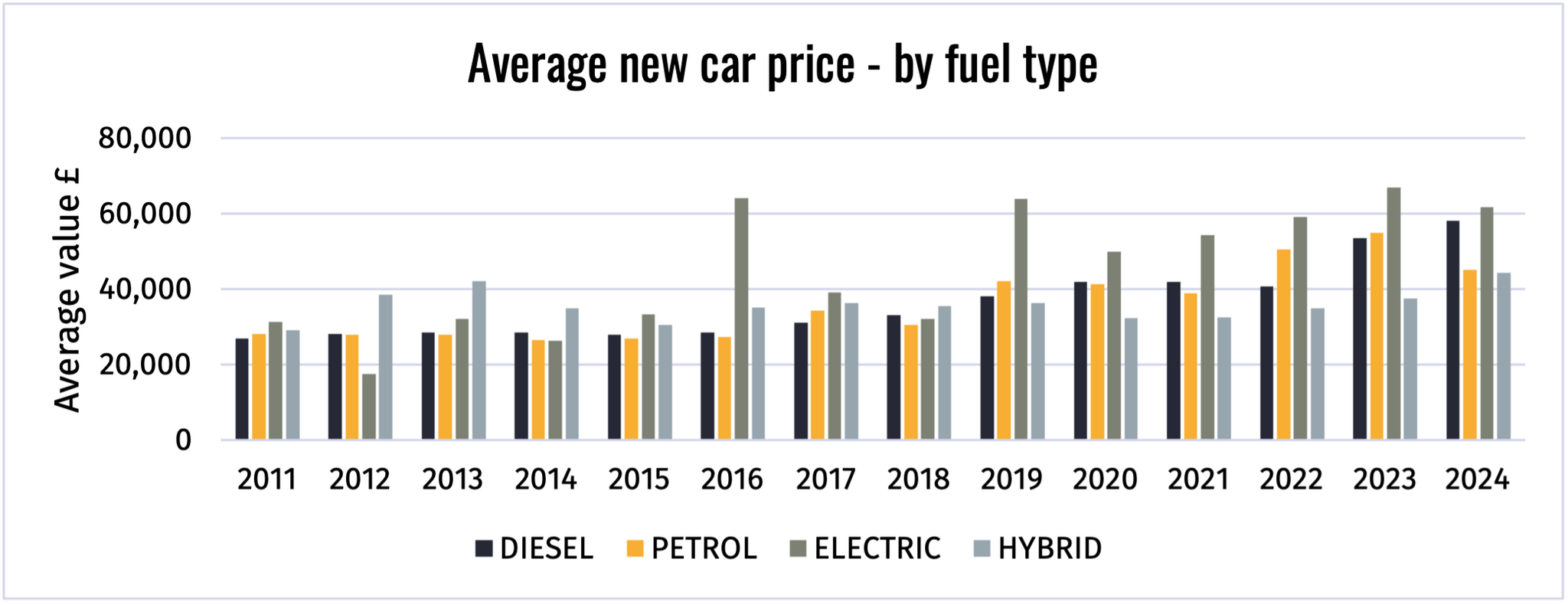

“These challenges may force OEMs to either absorb higher costs or pass them onto consumers, making ICE vehicles potentially more expensive.”

The ongoing volatility and uncertainty in the market suggests the need for strategic intervention from OEMs to stabilise their supply chains and manage the transition effectively.

This, according to Nothard, could lead to reduced consumer choice for ICE vehicles as the industry shifts its focus towards BEVs.

He said: “The lack of certainty around future ICE volumes, based on weaker than anticipated consumer uptake of BEVs, will continue to create stresses and strains throughout the ICE component supply chains.

“The question is how the industry will respond – as putting an additional £15,000 cost uplift on every new consumer vehicle to cover penalties if ICE targets are not met is just not a viable outcome.”

Login to comment

Comments

No comments have been made yet.