Used battery electric vehicle (BEVs) sales have increased, growing by 81.8% to 30,645 units in quarter two, representing 1.7% of the market – a new record – up from 1% last year, according to new figures published by the Society of Motor Manufacturers and Traders (SMMT).

Double-digit growth also continued for plug-in hybrids (PHEVs) and hybrids (HEVs), up 11.4% to 18,437 units and 29.5% to 53,634 units, respectively.

The rising proportion of electrified vehicles meant that market share for conventionally powered cars fell to 94.3% from 95.7% last year, even though volumes of petrol and diesel cars saw growth of 2.5% and 2.8% respectively.

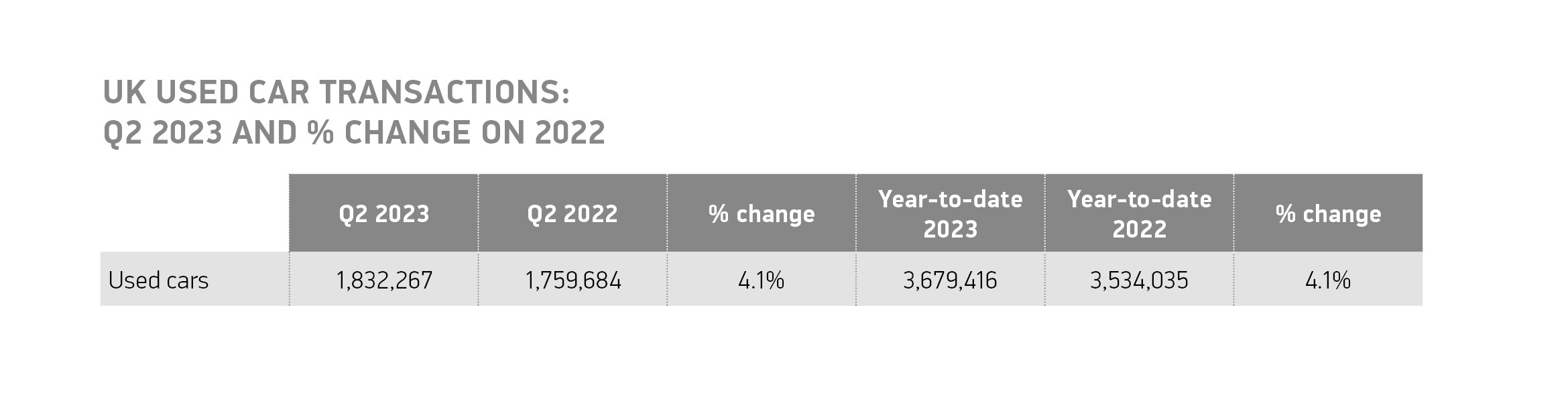

Overall, the UK’s used car market rose by 4.1% during Q2, with 1,832,267 units changing hands.

The increase equates to an additional 72,583 transactions compared with the same period in 2022, reflecting improving availability.

The easing of supply chain disruptions has driven sales growth in every month so far this year, although the Q2 market remains 9.9% below 2019 levels.

Mike Hawes, SMMT’s chief executive, said: “It’s great to see a recharged new car sector supporting demand for used cars and, in particular, helping more people to get behind the wheel of an electric vehicle.

“Meeting the undoubted appetite for pre-owned EVs will depend on sustaining a buoyant new car market and on the provision of accessible, reliable charging infrastructure powered by affordable, green energy.

“This, in turn, will allow more people to drive zero at a price point suited to them, helping accelerate delivery of our environmental goals.”

Superminis remained the best-selling used vehicle type, making up 31.5% of transactions and growing by 4.4% to 576,980 units.

This was followed by lower medium, accounting for 26.5% of the market, while dual purpose cars rounded off the top three with a 15.1% share.

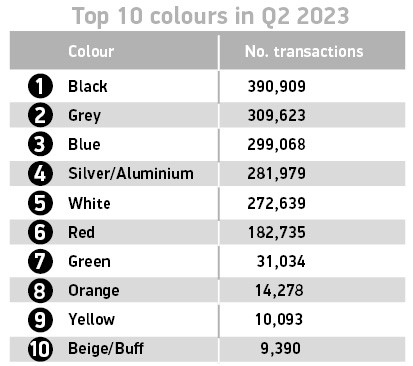

Black retained its position as the most popular colour choice for the 10th quarter in a row, representing more than one in five (21.3%) transactions.

It was followed by grey and blue in second and third places with respective 16.9% and 16.3% market shares.

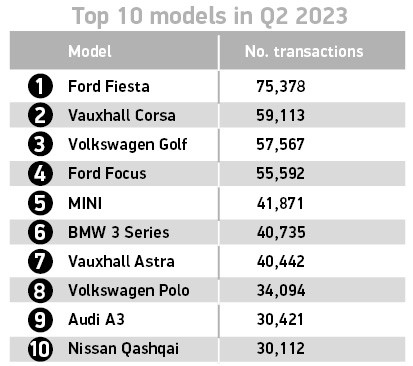

The Ford Fiesta was the best-selling used car, with 75,378 units sold in the quarter, the Vauxhall Corsa (59,113 units) and Volkswagen Gold (57,567 units), were the next most popular.

Chris Knight, UK automotive partner for KPMG, said: “Used car demand remains strong, with prices normalising after spiking during the pandemic years of lower supply into the market.

“This is good news for buyers, especially for electric cars which have seen significant price drops in recent months as a result of supply coming back into the market, and price wars on new models pushing second-hand values down further.

“Early EV adopters who bought at the peak of the market will bear the cost of this price normalisation.

“Greater affordability continues to drive EV uptake, but the ability of households without off street parking to charge near their home remains a major barrier to higher levels of adoption.

“Installing more public charge points is key to greater EV transition - as is the speed and cost of using them.”

Cox Automotive is predicting that used car transactions for the year will exceed 7.1 million units, a 4% year-on-year increase.

However, that will still be 3% below the average pre-pandemic yearly figure, with Cox forecasting 1,866,540 transactions in Q3, softening to 1,607,517 in Q4.

With various challenges persisting, a more substantial recovery is not expected until early or mid-2024, it says.

Increase in warranties sold for 10 to 20-year-old cars

The SMMT used car sales figures for Q2 have been published as research from the RAC Dealer Network shows that the number of warranties sold for 10 to 20-year-old cars has risen by 67% since the pandemic.

In 2020, 6% of all policies sold through its 1,200 used car retailers were for vehicles in this age range but during the first six months of this year, it had risen to 10%.

Similarly, the number of claims in this category have risen from 15% to 21% of the overall total made.

There has also been a marked 34% increase in warranties sold for 5 to 10-year-old cars over the same time period, rising from 34% to 46%.

Claims have comparably increased from 61% to 65%.

Conversely, there has been a fall in activity in the 3 to 5-year-old age range, with a decrease in warranty sales from 35% to 33% of the overall total, and a reduction in claims made from 23% to 14%.

Lee Coomber, RAC client director at Assurant, which partners with the RAC in the warranty and aftersales sector, said: “These figures show how post-pandemic vehicle shortages and the subsequent ageing of the car parc are having an increasing impact on warranty claims, with a marked shift towards the upper end of the age ranges in which we offer cover.

“As has been widely reported, dealers are finding themselves in a situation where they are selling more aged vehicles, a development that looks set to continue for some time to come.

“What has been less widely covered is the role that warranty providers such as the RAC and Assurant have played in helping them through this shift, providing the cover that car buyers desire even though claims on older vehicles are obviously higher and more costly.

“Warranties have, we believe, become much more important as consumers find themselves buying cars that tend to be older and more expensive in the post-pandemic market. Our claims figures illustrate the way in which we are supporting this trend.”

The RAC Dealer Network consists of more than 1,200 used car retailers across the UK offering a range of RAC-branded products - including warranties, service plans and more - created in conjunction with Assurant.

Login to comment

Comments

No comments have been made yet.