Fleets are facing an increase in monthly rental rates for battery electric vehicles (BEVs) as leasing companies try to recover from a collapse in residual values.

Such is the decline in used BEV values, one leasing company even said it would be forced to walk away due to the financial risks involved if more stringent zero-emission vehicle (ZEV) targets were imposed.

The price of a lease is designed to account for the depreciation of a company car over the typical three-year lease period, based on estimated resale prices, or residual values (RVs).

But if second-hand prices end up being lower than anticipated when the lease ends, leasing firms take a financial hit when they get the vehicle back.

“The fleet and leasing sector is underpinning the transition to EV, but how long is that sustainable for?” Philip Nothard, Cox Automotive

Used EV prices have fallen for 21 consecutive months, with the cumulative decrease in residual prices for EVs since September 2022 some 51%, compared to 11% for petrol.

Philp Nothard, insight and strategy director at Cox Automotive, said: “That’s somebody’s cash – that’s somebody’s capital that has taken those hits.

Fleets are facing an increase in monthly rental rates for battery electric vehicles (BEVs) as leasing companies try to recover from a collapse in residual values.

Such is the decline in used BEV values, one leasing company even said it would be forced to walk away due to the financial risks involved if more stringent zero-emission vehicle (ZEV) targets were imposed.

The price of a lease is designed to account for the depreciation of a company car over the typical three-year lease period, based on estimated resale prices, or residual values (RVs).

But if second-hand prices end up being lower than anticipated when the lease ends, leasing firms take a financial hit when they get the vehicle back.

“The fleet and leasing sector is underpinning the transition to EV, but how long is that sustainable for?” Philip Nothard, Cox Automotive

Used EV prices have fallen for 21 consecutive months, with the cumulative decrease in residual prices for EVs since September 2022 some 51%, compared to 11% for petrol.

Philp Nothard, insight and strategy director at Cox Automotive, said: “That’s somebody’s cash – that’s somebody’s capital that has taken those hits.

“It’s not been supported by UK Government. It’s either the OEM, the leasing company or the consumer that has taken those losses.”

Leasing companies, he explains, are not only having to consider how they can try and continue to monetise vehicles through a second or third lease, they are also thinking when is the right time to dispose of them.

“Do they take an £8,000 loss today or keep hold of them and drop them into the market in 12 months’ time? But that £8,000 loss today could turn into £20,000 in a year’s time,” added Nothard.

“The fleet and leasing sector is underpinning the transition to EV, but how long is that sustainable for?

“They need a very strong and viable remarketing secondary usage. That isn’t there right now and, with the onset of new entrants and price wars, that makes it even more challenging.”

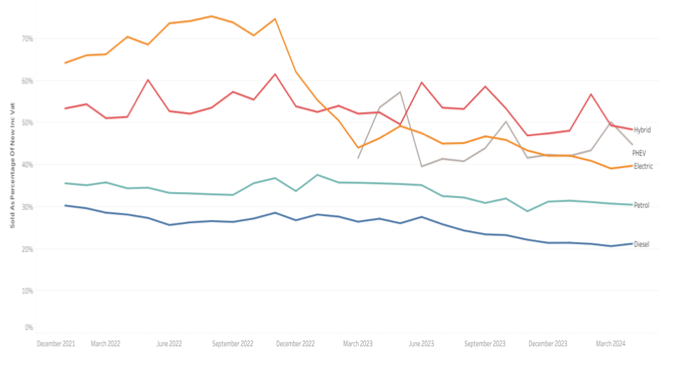

Fuel type - Sold price as a percentage of new car price

Source: Cox Automotive

While fleet operators that lease their vehicles have been protected by the substantial losses seen by leasing companies, they have started to see an increase in monthly rentals.

Nick Hardy, sales and marketing director at Ogilvie Fleet, told Fleet News: “The dramatic falls in used EV values in recent months has meant lease rates have risen as a result. Significantly in many cases.”

Analysis suggests that lease rates on a fully electric car, with a list price in the region of £40,000, have more than doubled in the past three years, from around £250 a month to more than £500, while an internal combustion engine (ICE) car has remained relatively stable.

“Like other leaders in the market... (Arval) has been forced already to increase prices because of lower residual values,” Bart Beckers, Arval

Setting RVs on used EVs ‘challenging’

BEV forecasts from three years ago were too high on average by 18.5%, according to pricing experts Cap HPI.

“Two years ago, used values for many BEVs were buoyant,” said Dylan Setterfield, head of forecast strategy at Cap HPI.

“But we were warning that they were unsustainable, and we applied significant negative adjustments to our forecasts (often between 15% and 20%), which many OEMs disputed as ‘unrealistic’.”

Nothard highlighted the challenge of setting RVs for electric vehicles (EVs). He explained: “A combustion engine evolves, it’s just another combustion engine, just slightly better, with better tech. But it’s slightly different with an EV.”

Battery technology and powertrains for zero-emission vehicles are evolving at break-neck speed, with previous iterations dating much faster than they would have done previously with ICE models.

Hardy explained: “In the past, when lease cos were setting these EV RVs, there was a broad belief that the used car market for EVs would be strong.

“We got that wrong as it stands right now, and the reality is therefore hitting home with the leasing industry having to change their future expectations significantly.

“The net result is far greater lease costs for EVs.”

Ogilvie Fleet is trying to offset increases in new EV lease rates (compared to three to four years ago) by extending contracts as it works with clients to reset their expectations and policies.

Hardy said: “As always, we’ll get through it, but there’s a lot of hard work to be done over the next two to three years on all of this.”

But describing it as a “mess”, he added that incentives for used vehicles need to be sorted as soon as possible to bolster used electric car values.

Used EV losses hit leasing profits

Industry trade body, the British Vehicle Rental and Leasing Association (BVLRA), says that the UK’s vehicle leasing and rental industry is facing an “existential threat” due to the collapse in used BEV values.

Thomas McLennan, head of policy and public affairs at the BVRLA, said: “Pricing a vehicle on what it may be worth in three- or four-years’ time, as leasing companies do, is a deeply challenging proposition.

“We are certainly seeing that the market has not yet found its feet, which is proving hard to foresee how to make it work in the long term. Volatility is the issue. Prices are moving a lot more than many expected.”

As part of last year’s FN50 research of the UK’s largest contract hire and leasing companies, Fleet News reported that, collectively, they made pre-tax profits of more than £2 billion thanks to record-breaking used car prices driven by the semiconductor shortage.

However, EV portfolios have been starting to bite as vehicles are defleeted in greater numbers.

In February, vehicle leasing giant Ayvens reported a 22.2% drop in pre-tax profits year-on-year, down from £1.42bn to £1.1bn.

Figures suggested a £341 million year-on-year decline in used car sales, with Ayvens blaming falls in RVs.

The RV risk on EVs, coupled with targets from governments both here and abroad, could force its withdrawal from the market, it says.

“If we were pushed very, very hard, that everything has to be electric too soon... my shareholders will say ‘we do not want to take the risk’ and we would be out of the market,” Tim Albertsen, CEO of Ayvens told Reuters. “Let’s be honest, without us, who will take the risk?”

Ayvens, which is majority owned by French bank Societe Generale, has a global fleet of 3.4 million cars, of which about 10% are EVs.

Albertsen said the company was now leasing EVs for longer than combustion-engine cars to reduce resale risks.

It has also started to lease EVs out once or twice more “at a more affordable rate” and keep them in its portfolio longer, possibly up to eight years, he said.

Bart Beckers, deputy CEO at Arval, the leasing company owned by French bank BNP Paribas, said that losses from low EV resale values were currently limited in number, given EVs are only a small portion of its overall portfolio.

“But the amounts are not insignificant,” he said. “Like other leaders in the market... (Arval) has been forced already to increase prices because of lower residual values.”

Zenith’s annual financial results, for the year ending March 31, 2024, published last month (July), showed turnover was £788.4m, up 16.1% year-on-year, from £679m the previous year. However, adjusted gross profit was £134.4m, down 8.5% year-on-year, from £147m.

The figures also revealed that its average termination profit per vehicle was down 40% year-on-year as a result of weak used vehicle prices both for BEV and ICE vehicles.

Mitigating used EV residual value decline

Tim Buchan, Zenith’s CEO, said it had been an “exceptionally challenging year” for the automotive sector, with much uncertainty about the ban on ICE vehicles, including the five-year delay to the 2030 deadline.

“I’m proud of the way we are responding to the challenges, finding ways to mitigate the risks and impact on our business,” he continued.

“Extending leases within our existing battery electric vehicle fleet, launching new products to new markets and ensuring our fleet has a healthy balance of BEVs and ICE vehicles, all help to meet the needs of our customers while driving the success of our own business.”

To mitigate losses, Zenith is targeting lease extensions where losses may be anticipated on the sale of individual vehicles, enabling additional lease rentals to be received during a period of lower depreciation.

Called Project Volt, it is targeting 3,000 lease contracts which are due to end during the next financial year (FY25).

For company car drivers used to selecting a new vehicle every two or three years, however, there was a note of caution from Ben Nelmes, CEO of New Automotive.

“Cars are still a status symbol in the UK and you getting a new car every two years is not always about the utility in the vehicle, it is often that you just want to be in the latest thing and have the latest technology,” he said.

“I think that that dynamic will still be out there for a lot of people.”

Another way in which the leasing sector is also adapting to a volatile market for second-hand EVs is through used car leasing, according to the BVRLA.

In its latest Road to Zero report, the BVRLA revealed that demand was up 7.7% in the last quarter as more drivers were drawn to accessing a used EV via lease, where they are not personally taking the risk on the residual value.

However, the discounts available for new EVs and the losses that leasing companies are suffering on end-of-contract battery powered cars, mean the second-life lease risks being a very similar price to a new vehicle, says the BVRLA.

Add in transport, inspection and refurbishment costs, and second-life leases for older (rather than early terminated) EVs are difficult to deliver at competitive rentals.

Nor do they offer any financial reprieve for leasing companies, it said, with depreciation losses recorded on balance sheets even if the vehicle is re-leased to a new customer.

Electric vehicle discounts

The monthly rental rise for fleets, however, comes against a backdrop of high levels of discounts from carmakers as the zero emission vehicle (ZEV) mandate takes effect and sellers look to stimulate demand, according to the BVRLA’s Road to Zero report.

The ZEV mandate, which came into force this year, requires more than a fifth (22%) of cars and 10% of vans sold by manufacturers to be fully electric.

The targets for manufacturers increase each year, requiring 80% of new cars and 70% of new vans sold in Great Britain to be zero emission by 2030, increasing to 100% by 2035.

“We are seeing considerable discounts on new BEVs from some manufacturers and there are several models which have seen significant reductions in current and future values as a result,” said Setterfield.

“However, it is not just the highly public money-off list price offers, there are also cases of enhanced finance deals which can also make the new car cheaper than used, and we are also seeing values suffer in this situation.”

According to Auto Trader, the average BEV retail discount rose from 5% last year to 10.7% by the end of May 2024.

Auto Trader director of automotive finance Rachael Jones, speaking with Fleet News editor Stephen Briers on the Q2 Market Insight recording, predicts the pressure will start to build on manufacturers towards the final quarter of the year, which could result in some “extreme discounting” as well as a spike in short cycle registrations, such as rental and captive schemes.

Some manufacturers have also suggested they could supress supplies of petrol and diesel cars to control the balance, although Auto Trader has not seen any evidence of this yet.

“I think it's likely that brands are going to wait until September [plate change] and then decide how to play those final few months. It's one to watch,” she said.

Zev mandate ‘fanning the flames’

Cox Automotive is also warning that the new car market in Q4 will be an extremely challenging period for the sector, potentially surpassing the pressure experienced during the economic crash of 2008 and the pandemic in 2020.

“Several prominent manufacturers have made it clear that non-compliance with the ZEV mandate is not an option and that they have no intention of paying penalties,” explained Nothard.

“But with EV sales falling well short of where they need to be, this leaves them with just a handful of options if they are to meet this pledge.

“They will either prioritise pushing EV stock into the market through aggressive fleet and retail price strategies or restrict the availability of ICE (internal combustion engine) and PHEV (plug-in hybrid electric vehicle) derivatives to force EV sales. Some may do both.”

Despite the average purchase cost of new ZEVs falling, with a median recommended retail price of £49,165, the purchase cost of zero-emission vehicles remained 31% higher than their ICE counterparts as of April 2024, according to the BVRLA.

“BEVs will be returning to market in greater numbers than ever before, with nothing done for used buyers,” Simon Harris, UK Vehicle Data

With incentives for EVs heavily focused on the corporate sector, but with no incentives or education for used car buyers to understand how they could benefit from the switch, Simon Harris, head of valuations at UK Vehicle Data, said some new cars have struggled to leave showrooms, especially among those car manufacturers which lack a strong profile in the corporate sector.

“For example, a few months ago, there were several Honda e:NY1s advertised for sale at dealers with discounts of £12,000 or more, followed a few weeks later by a formal list price cut by the manufacturer,” he said.

However, while this tactic might be deployed to sell excess volume, Harris explained it can only have a negative effect on the used values of similar models and the RV forecast.

“If there are too many units on the market now, forcing transaction prices down, it’s likely to be reflected in instantly depressing the relative values of cars on the market aged up to 12 months, and begins a chain of reduced values along the lifecycle,” he added.

“Likewise, the SMMT and others have been urging the Government to reduce VAT on the sale of electric cars.

“While it might persuade a few more retail customers to choose electric, it will most likely send a further ripple of falls in used values along the line - putting further pressure on cars leasing companies already have on their books.”

Harris believes that the ZEV Mandate is “fanning the flames of an already substantial bonfire”.

He told Fleet News: “BEVs will be returning to market in greater numbers than ever before, with nothing done for used buyers, other than a distressed market dragging down prices to more affordable levels.

“For fleets that lease, they are perhaps less exposed to some of the horrors in the RV story than if they were a private customer.

“The funder takes the hit on RV, the driver is paying lower BIK tax than with an ICE car, and the employer is also benefitting from lower Class 1A NIC payments for employees' private use of a company car.

“For fleets that purchase outright, there's still the generous writing down allowance for EVs, offsetting the cost against the business's tax bill. It also ticks boxes for corporate sustainability.”

Package of incentives for used EVs

He argues that a more joined up approach would be a package of incentives for used car buyers that makes it easier for them to transition.

“Zero VAT on electricity supplied by a domestic car charger, help with charger installation costs for first time EV buyers and robust used EV lease packages so buyers feel less exposed to the risk,” he said.

“If dealers can be confident they will have used buyers for EVs, it will make them more relaxed in bidding for them during the first remarketing phase, and help stabilise prices.”

Hardy is hoping for incentives in the used market, something which the Labour party identified in its Plan for Automotive, published prior to the General Election.

He said: “There is literally no reason for a used car buyer to pay any more than a petrol/diesel equivalent car in the used car market and, facing the unknown/uncertainty of an EV that they’ve never experienced before, there’s every chance that they won’t even pay the same as a petrol/diesel equivalent.”

Gaynor McNicholas, customer relationship director at Zenith, told the July Fleet News at 10 webinar that Zenith's key priority, and for other leasing companies, is support for the used vehicle market for EVs, including assurances on the degradation of the battery.

She also believes some sort of financial incentive for buyers of used EVs would help "support the new vehicle price", which will help used vehicle values.

“It’s what tools are at the consumers disposal as well,” said New Automotive's Nelmes. He believes that the availability of a total cost of ownership (TCO) tools to help consumers when selecting second-hand vehicles could help increase the appeal of EVs.

“There has to be some concerted effort from Government or industry, preferably both, to actually start providing that.”

Out of the 13 European countries which Indicata tracks each month, only Denmark has embraced both new and used BEVs.

“Many countries such as Spain and Sweden are suffering from a much lower demand than the UK for BEVs and large stockpiles of cars are yet to find buyers,” explained Dean Merritt, head of sales at Indicata.

“Such is the demand for used BEVs in Denmark that they are importing used cars from the likes of France, where second-hand demand is also weak, to satisfy demand.”

Indicata believes that Denmark could be the very first all-electric car market in Europe. Norway has reported strong new BEV sales on the back of a series of generous grants and allowances, but buyers still haven’t embraced used BEVs at the same level as Denmark.

“The UK has no such fairy godmother,” said Meritt. “The pinch point remains in weak retail demand which is restricting dealers to stock either zero or just a small number of used BEVs on their forecourts.

“This hasn’t been helped by wholesale stocking costs more than doubling in the past nine months.

“Some dealer groups are restricting dealers to stocking just a handful of cheaper BEVs on their forecourts or simply buying cars at auction to satisfy orders.

“Their attitude is why tie up your cash in used BEVs which may hang around for a long period when you can buy used ICE cars which sell in 30-45 days.”

Tesla impact on used EV values

In looking at how used BEV values have fallen so dramatically over the past two years, CAP HPI’s Setterfield told Fleet News that volumes of used Tesla Model 3 increased significantly, with the vast majority going straight to auction during the summer of 2022.

“Although BEVs did not increase in value in percentage terms by as much as ICE models through 2021, many leasing companies had net book values for these assets way below the market value, and some were happy to accept bids below market price,” he said.

“They were concerned about volume and were still making gain on sale.”

From the middle of September 2022, BEV values started to fall, including Teslas. “By November, we started to see some ‘distress selling’, with deals being done on batches of vehicles significantly (20% or so) below market price – the dealers who bought these cars typically put them on sale at large margins, and retail prices remained high,” added Setterfield.

“By the beginning of January 2023, Tesla Model 3 values had reduced by a cumulative total of 30% and Model Y RWD by 29%.

“This coincided with a lot of negative press coverage of BEVs in the mass media at the end of 2022, which happened during the record spike in electricity prices caused by the invasion of Ukraine.

“All of this combined to damage consumer demand for BEVs. There was also an overall increase in the volume of used BEVs hitting the market, causing a supply/demand imbalance.”

Tesla also provided an additional shock by reducing list prices by thousands of pounds without warning in January, last year.

However, Setterfield says that this was not the principal cause of the falls in BEV values across the used market.

Both Model 3 and Model Y used values decreased by more before this change than after.

Model 3 used values were virtually unaffected by the list price change as nearly new used values had decreased so far that they were still well below the new list price.

He added: “It was different with Model Y – nearly new values were above the new list price at the time of the change and further used value reductions followed as a direct result.”

The true impact of the list price change was to provide problems for Tesla’s competitors, according to Setterfield. “Monthly rentals became uncompetitive overnight, and they were faced with difficult choices if they wanted to close the gap,” he said.

Login to continue reading.

This article is premium content. To view, please register for free or sign in to read it.

Login to comment

Comments

No comments have been made yet.