New heavy goods vehicle (HGV) registrations rebounded in quarter two (Q2) after recording a decline in Q1, new figures from the Society of Motor Manufacturers and Traders (SMMT) show.

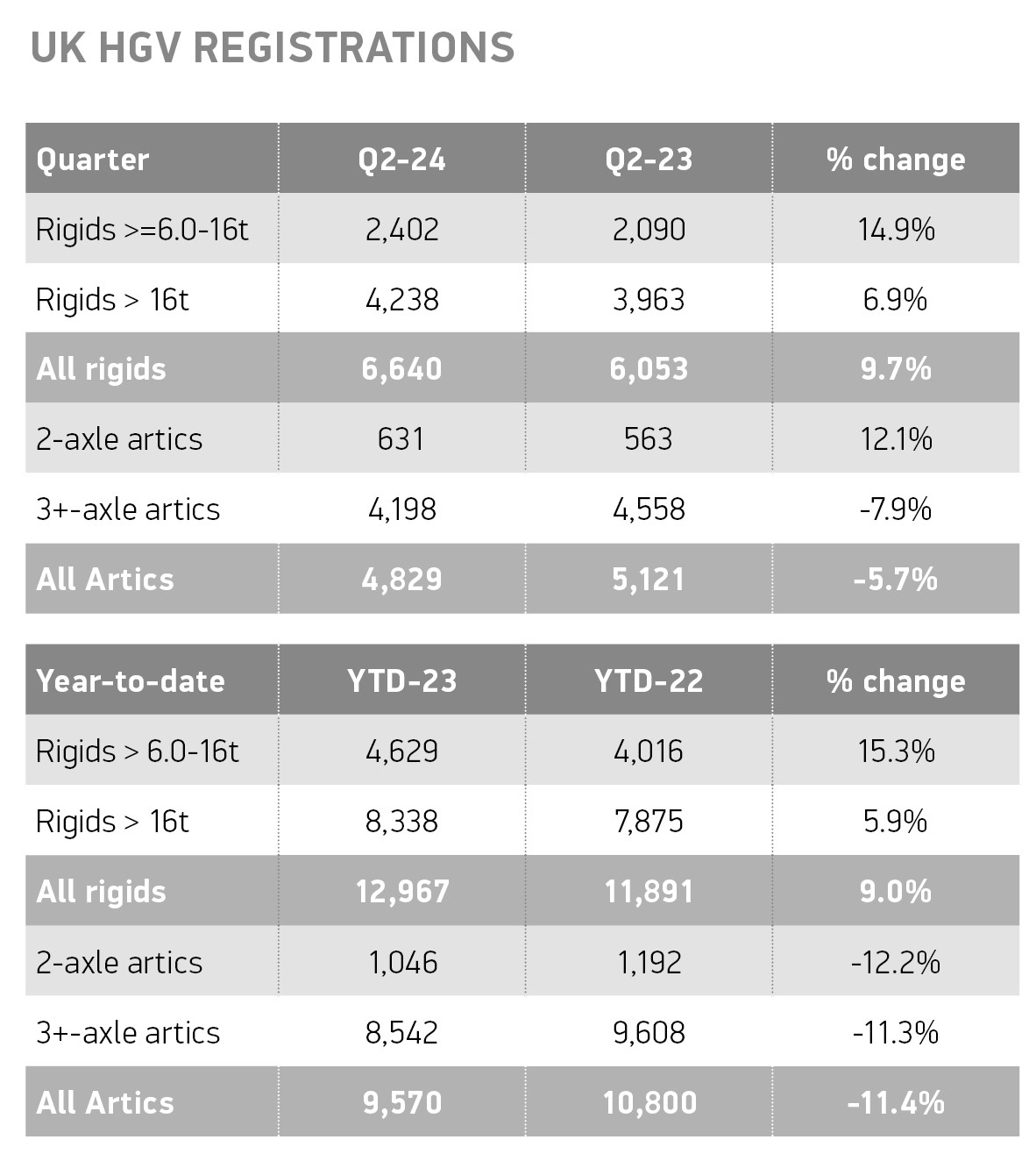

Registrations rose 2.6% in Q2, with 11,469 new HGVs entering service, thanks to a rise in rigid truck uptake as the market continues to normalise following the fulfilment of pent-up demand in 2023. Rigids rose 9.7% in Q2 to reach 6,640 units, taking a 57.9% market share, up from 54.2% in the same quarter last year.

Artic volumes, meanwhile, declined by 5.7% to 4,829 units.

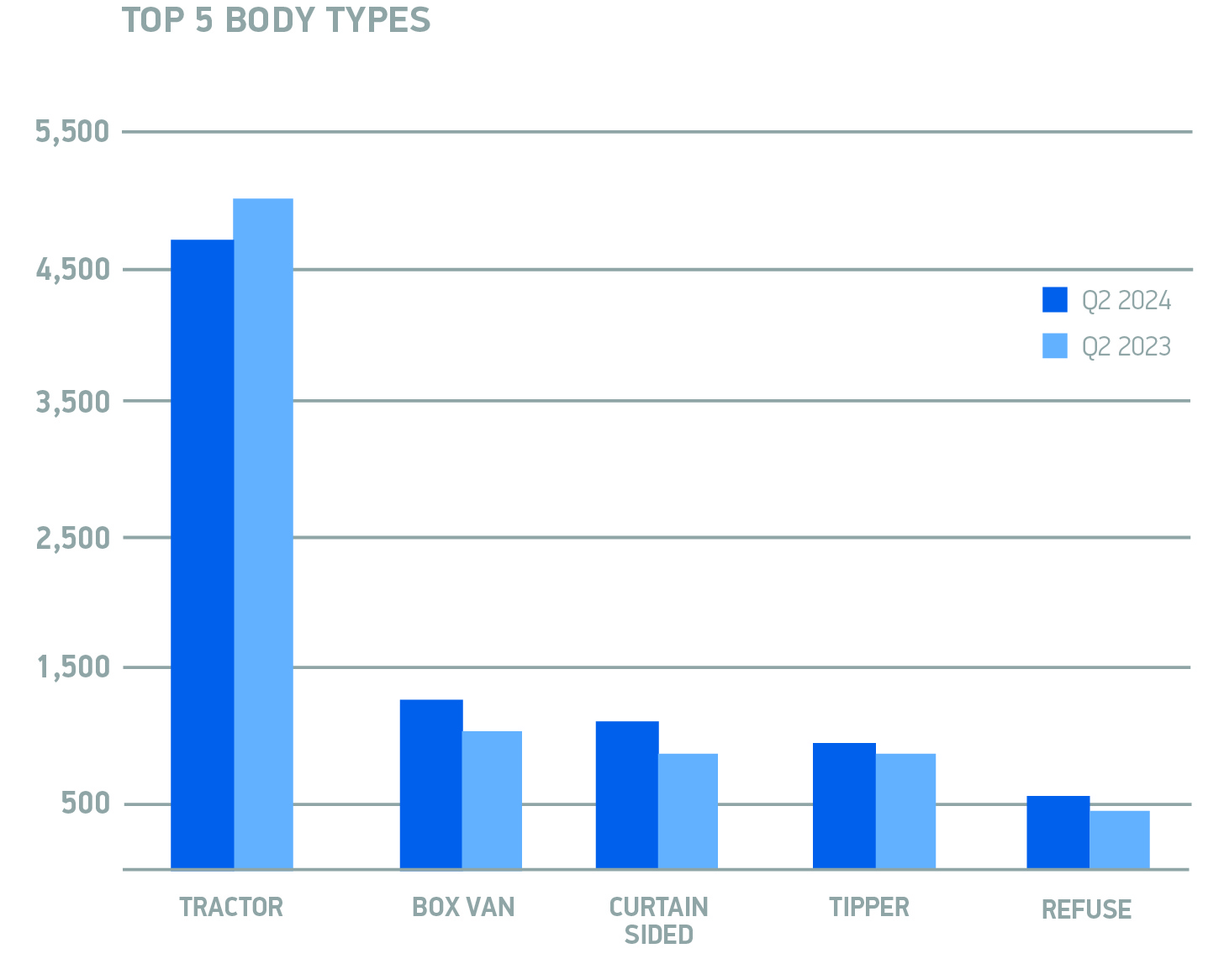

The weighting of the market towards rigids was reflected in the composition of the top body types, with businesses investing more in box vans (up 17.3%), curtainsiders (up 14.9%), tippers (up 11.4%) and refuse vehicles (up 14.1%), while tractor unit volumes fell 7.4%.

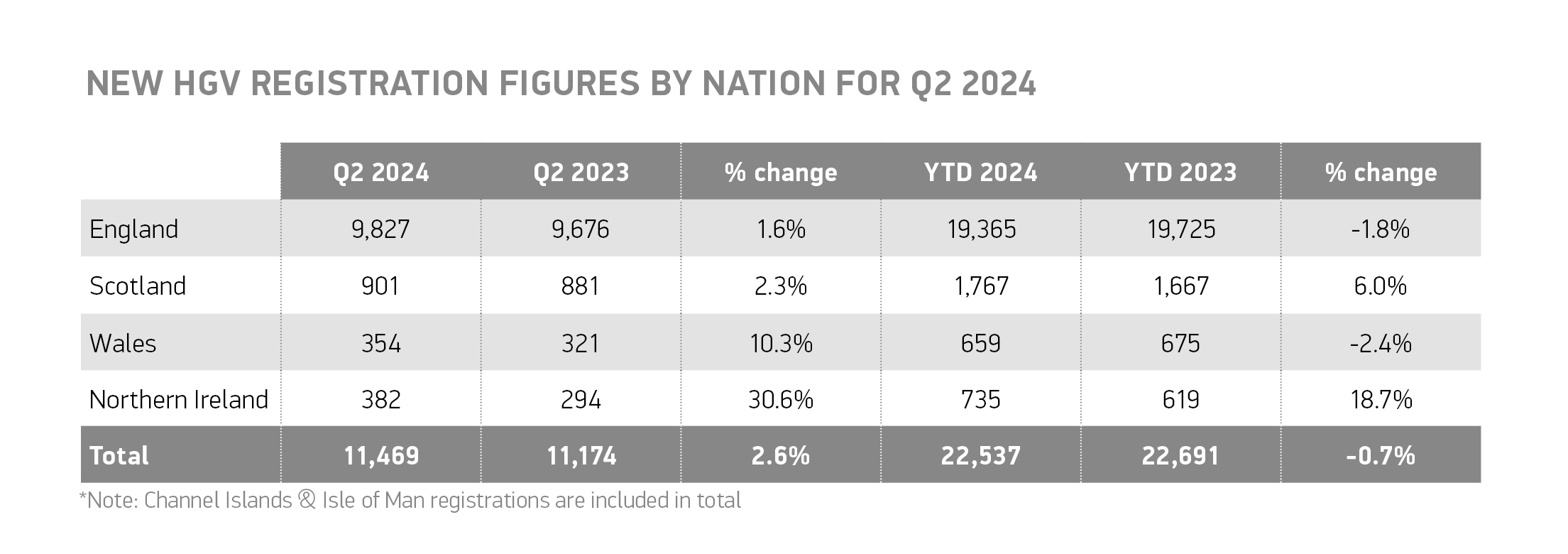

Nationally, England took the lion’s share of new HGV registrations, with volumes rising 1.6% to reach 9,827 units.

Northern Ireland recorded the largest growth, up by 30.6%, which saw it overtake Wales to become the UK’s third largest HGV market.

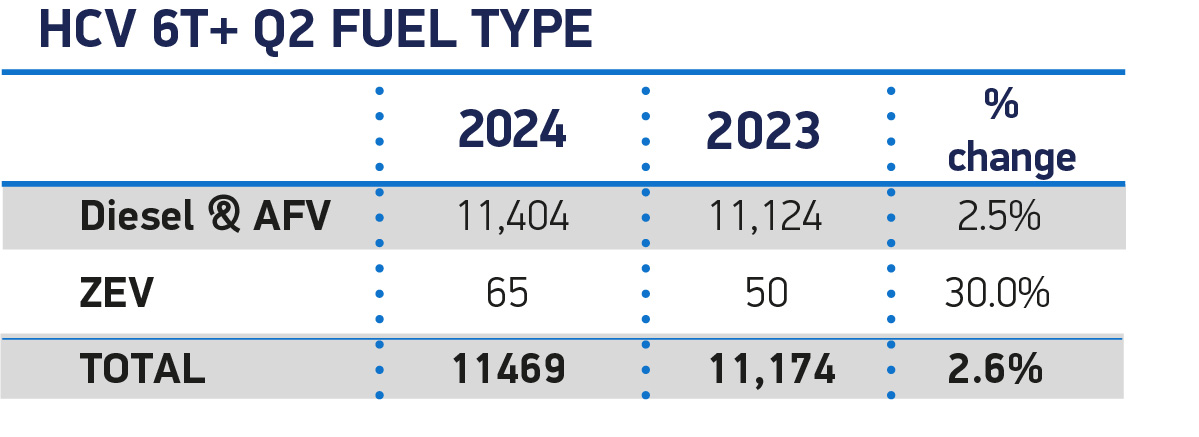

Zero emission vehicle (ZEV) uptake also continued to grow. Uptake rose by 30% to achieve a 0.6% share of market, up from 0.4% in Q2 last year.

However, market share remains low compared with the car and van sectors, demonstrating the ongoing challenge in convincing operators to switch from fossil fuels.

With just over a decade to go until the end of sale of non-ZEV HGVs weighing less than 26 tonnes, operators continue to face a grant system that is lengthy and covers fewer than half of all available models.

Progress on the rollout of HGV-specific charging facilities also remains lacklustre, says the SMMT.

Reforming the grant, plus investment in infrastructure within a national plan, would provide more confidence to operators and encourage greater uptake.

Mike Hawes, SMMT chief executive, said: “The truck market’s return to growth after a slower start to the year demonstrates its robustness and resilience – particularly as overall uptake continues to keep pace with last year and the pent-up demand that fuelled volumes.

“The UK’s place as Europe’s second largest zero emission truck market also demonstrates Britain’s potential to be a leader in the ZEV truck transition.

“Delivering that ambition, however, requires compelling incentives and infrastructure which will put operators on a confident path to 2035 and beyond.”

Login to comment

Comments

No comments have been made yet.