More than three quarters of new electric vehicles (EVs) were sold to fleet customers in September, as the corporate channel continues to be the primary driver of zero emission vehicle sales.

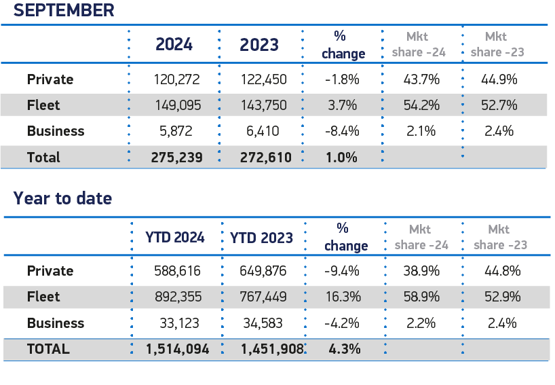

New car registrations were up by 1.0% overall, in September, according to the Society of Motor Manufacturers and Traders. A total of 275,239 new cars were registered.

The performance was the best since 2020, but still 19.8% lower than pre-Covid September 2019.

Fleet and business sales accounted for 56.3% of all new car sales in September and 75.9% of EV registrations.

Mike Hawes, SMMT chief executive, said: "September’s record EV performance is good news, but look under the bonnet and there are serious concerns as the market is not growing quickly enough to meet mandated targets.

"Despite manufacturers spending billions on both product and market support – support that the industry cannot sustain indefinitely – market weakness is putting environmental ambitions at risk and jeopardising future investment.

"While we appreciate the pressures on the public purse, the Chancellor must use the forthcoming Budget to introduce bold measures on consumer support and infrastructure to get the transition back on track, and with it the economic growth and environmental benefits we all crave."

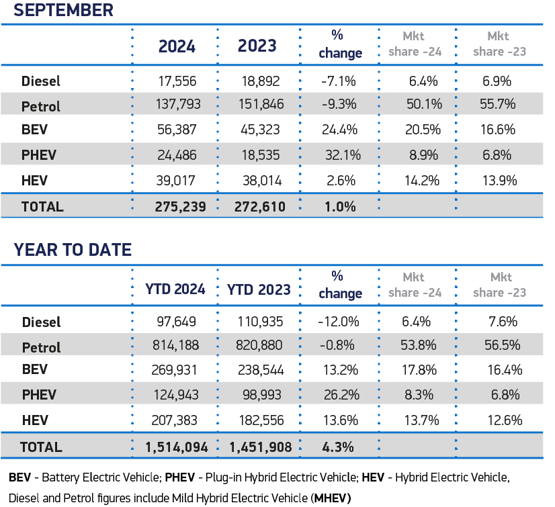

Demand for the latest EVs hit a new record volume for any month in September, up 24.4% to 56,387 units, achieving a 20.5% share of the overall market, up from 16.6% a year ago.

This was not enough, however, to shift market share significantly, which edged up from 17.2% in the first eight months, to 17.8% from January- September. It is expected to reach 18.5% by the end of the year.

Private EV demand rose by 3.6% after unprecedented manufacturer discounting, but this was equivalent to just 410 additional registrations. Consumer demand for diesel grew at a faster rate, increasing 17.1% in September – a volume uplift of 1,367 units. Year-to-date private EV demand remains down by 6.3%.

Gerry Keaney, BVRLA chief executive said: “September’s figures show that BEV registrations have gained some much-needed momentum, on the back of heavy discounting from manufacturers and sustained investment from business fleets.

“This growth is welcome but will remain unstable and unsustainable unless the Government comes up with a long-term strategy for supporting the BEV market towards its ambitious ZEV Mandate and Phase Out targets.

“Collapsing used BEV values – down 60% over two years and forecast to continue falling – have already led to an anticipated loss of 220,000 new EV sales. That ground now needs to be made up. Falling used values are eroding the confidence of fleet buyers and making the most popular way of financing a new electric car more expensive.

“We need used EV-targeted grants, tax incentives and a confidence-building communication campaign to boost retail demand and stabilise prices.”

In an effort to offset the underlying paucity of demand, SMMT calculates that manufacturers are on course to spend at least £2 billion on discounting EVs this year. Given the many billions already invested to develop and bring these models to market, the SMMT says this situation is untenable and threatens manufacturer and retailer viability.

For this reason, SMMT and 12 major vehicle manufacturers representing more than 75% of the market, have written to the Chancellor calling for measures to support consumers and help speed up the pace of the EV transition. These include:

- Temporarily halving VAT on new EV purchases to put more than two million new ZEVs (rather than petrol or diesel) on the road by 2028

- Scrapping the VED ‘expensive car’ tax supplement for ZEVs, due next year, to avoid penalising buyers

- Equalising VAT on public charging to match the 5% home charging rate, and mandating infrastructure targets to support those who cannot charge at home

- Maintaining and extending the business incentives that are working, including Benefit in Kind which supports company cars and those on salary sacrifice schemes, and the important Plug-in Van Grant

Jon Lawes, managing director at Novuna Vehicle Solutions, added: “Despite an uptick in EV uptake last month following the number plate change driven by fleets, sustained momentum to attract the personal leasing sector relies on making the switch more accessible, starting with this month’s Budget as the first real test of the new government’s commitment to the transition.

“Building a stronger second-hand marketplace by boosting demand for used EVs is one of the key areas which must be addressed to achieve the EV transition at scale. It’s vital policymakers take bold action to reinforce business and consumer confidence in the long-term feasibility of the EV ecosystem.”

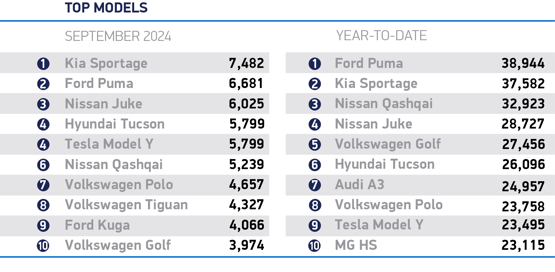

September 2024 best-sellers

The Kia Sportage accelerated to the top of the sales chart in September, with 7,482 examples registered. The Sportage is the second best-selling model year-to-date, however. The Ford Puma is the volume champion so far in 2024.

Nissan is the only car maker to have two cars in the top 5, with the Juke and Qashqai both selling significant volumes this year.

Login to comment

Comments

No comments have been made yet.