Healthy used car demand drove a very stable market in May, according to BCA.

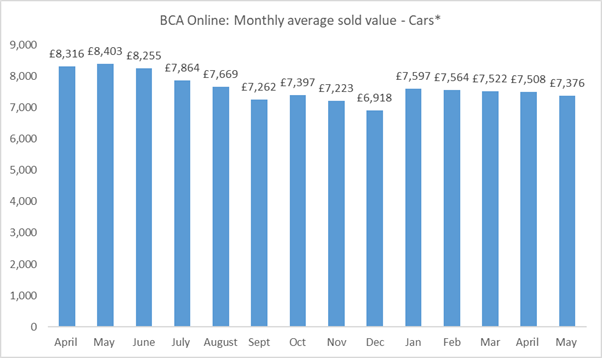

With supply matching demand there was just a small reduction of £132 to £7,376 in the overall average value of a vehicle sold at BCA compared to April.

The average value has now fallen just over £200 from the £7,597 seen in January.

Monthly sold volumes, meanwhile, rose to the second highest point this calendar year and performance against price guide expectations rose by 1.1 percentage points compared to April.

Sale conversion rates remained healthy, supported by a total active buyer number that remains significantly ahead of the same period last year.

With more than 5,000 different buyers purchasing each week, a number of new sales events were introduced across the seven-day selling programme, with a further expansion to the weekend’s itinerary.

Feedback from BCA’s buyers suggests that used retail activity remains healthy, and the impact of the new car registration decline during the pandemic period continues, ensuring that the best presented vehicles have been strongly contested.

Overall, the used car market has performed strongly in the post-Easter period and is expected to remain positive, even over the coming summer holiday period, says BCA.

Stuart Pearson, BCA’s chief operating officer, explained: “After a little pricing volatility at the start of the month, the mood of both our buyers and sellers has been generally positive, mainly driven by a very stable market with minimal overall movement.

“We’ve seen volume lift, but demand has more than matched it and clean, well-presented stock always attracts a flurry of competitive bidding.

“Whilst EVs continue to receive too much negative press, many have now found a price point that makes them very attractive and we’re seeing good levels of demand for many models.

“Overall, pricing stability tends to radiate confidence, and we’ve seen the June market lift even further in the early days of the month.”

He added: “Considering the flurry of often contradictory economic messages and the impending General Election, as well as being firmly in the traditionally quieter period of the year for used car sales, our buyer customers tell us that retail activity remains relatively buoyant.

“Every indication suggests that these trends will continue over the coming months with many dealers having the desire to carry even more used stock, if they are able to source it.”

Healthy competition to buy higher value used vehicles at Aston Barclay

Premium brands are dominating Aston Barclay’s June used car desirability Index with the Porsche Taycan, Range Rover Velar and Audi Q7 the three most sought-after cars at auction.

The only three models on the list not a premium SUV were the Porsche Taycan, MG5 and Tesla Model Y in first, sixth and tenth place.

Aston Barclay says that this reinforces that dealers are also starting to compete with one another for zero emission stock at both ends of the price scale.

JLR secured three out of the top 10 places on the index with the Velar, Range Rover and F-Pace, and BMW two places with its X5 and X4.

Nick Thompson, Aston Barclay’s chief customer officer, said: “Higher value premium SUVs have been in demand for the past four years, but the big difference now is that dealers are buying the majority of these vehicles to order.

“Stocking costs have gone up over the past 6-9 months in the form of higher interest rates and this has changed dealer behaviour as to what they park on their forecourt.

“Many dealers will be stocking two to three £10-15,000 used cars rather than one £50k car, with auctions giving them the flexibility to source this stock quickly when they need it.

“With used EVs dealers continue to stock the lower value vehicles, they are turning to auction when they want something different.

“Auctions are playing a big part in helping dealers manage their used car stocking in the most efficient manner in the current economic client.”

Aston Barclay’s monthly desirability index takes into consideration three key metrics: web views prior to sale, number of physical and online sale bids, and sale price achieved as a percentage of CAP average.

|

Make |

Model Description |

Desirability Score |

|

Porsche |

Taycan |

7.3 |

|

Range Rover |

Velar |

6.2 |

|

Audi |

Q7 |

5.2 |

|

Land Rover |

Range Rover |

5.2 |

|

BMW |

X5 |

5.0 |

|

MG |

5 EV |

4.7 |

|

Jaguar |

F-Pace |

4.6 |

|

Mercedes-Benz |

GLC |

4.6 |

|

BMW |

X4 |

4.6 |

|

Tesla |

Model Y |

4.4 |

Login to comment

Comments

No comments have been made yet.