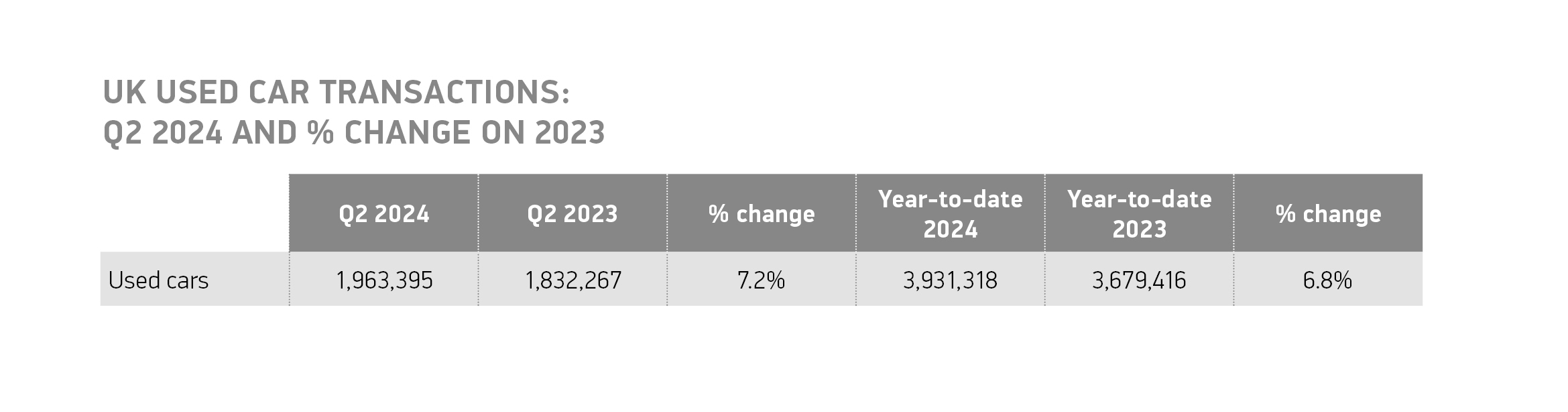

Almost four million used car transactions have been made in the past six months, according to new data from the Society of Motor Manufacturers and Traders (SMMT).

Transactions have risen in every month of the year, up 6.8% in the first half of the year to 3,931,318 units – the best growth since 2016 and the best first half year since 2019.

Year-to-date, the SMMT reports that the used car market is now just 3% shy of pre-pandemic levels.

The UK’s used car market grew for the sixth consecutive quarter, rising 7.2% in Q2, with an additional 131,128 sales compared with the same period in 2023.

Sustained growth in the new car market, says the SMMT, is fuelling choice and availability in the used sector.

SMMT’s chief executive, Mike Hawes, said, “It’s encouraging to see the used car market continue its recovery, with choice and affordability rejuvenated by the new car sector’s sustained run of growth.”

With an increasing number of battery electric vehicles (BEVs) being defleeted, it is no surprise to see market share increase.

In the last quarter, 46,773 used, fully electric cars were sold, a rise of 52.6% equating to a record-breaking market share of 2.4%, up from 1.7% on the same period last year. Sales of plug-in hybrids (PHEVs) and hybrids (HEVs) also grew, up 25.2% to 21,580 units and 43.6% to 78,782 units, respectively.

Hawes said: “The increased supply of electric vehicles to second and third owners is helping more motorists make the switch – underlining the importance of energising the new EV market to support a fair transition for all.

“Maintaining momentum requires reliable, affordable and green EV charging up and down the country and incentives to get all of Britain on board the net zero transition.”

Petrol and diesel-powered cars still accounted for 92.4% of all vehicles, down from 94.3% last year. Petrol remained the most popular fuel type, up 9.2%, while diesel fell by 1.2%.

Philip Nothard, insight director at Cox Automotive, said the latest data set for the used market was “encouraging”.

“Despite subdued retail demand, margin pressures and ongoing constraints in prime three-year-old retail stock, the market has shown remarkable resilience, marking its sixth consecutive quarter of growth,” he continued.

“The surge in BEV sales is particularly promising, reflecting a significant shift in buyer preferences.”

However, Nothard warned: “As we look ahead to the year's second half, it's important not to get too giddy.

“Supply will remain a battleground, and the composition of the car parc is shifting faster than consumer preferences.

“While used values may have settled compared to the volatility seen last Q4, this year's Q4 will likely see renewed turbulence as the rush to meet ZEV mandate targets intensifies in the new car market.”

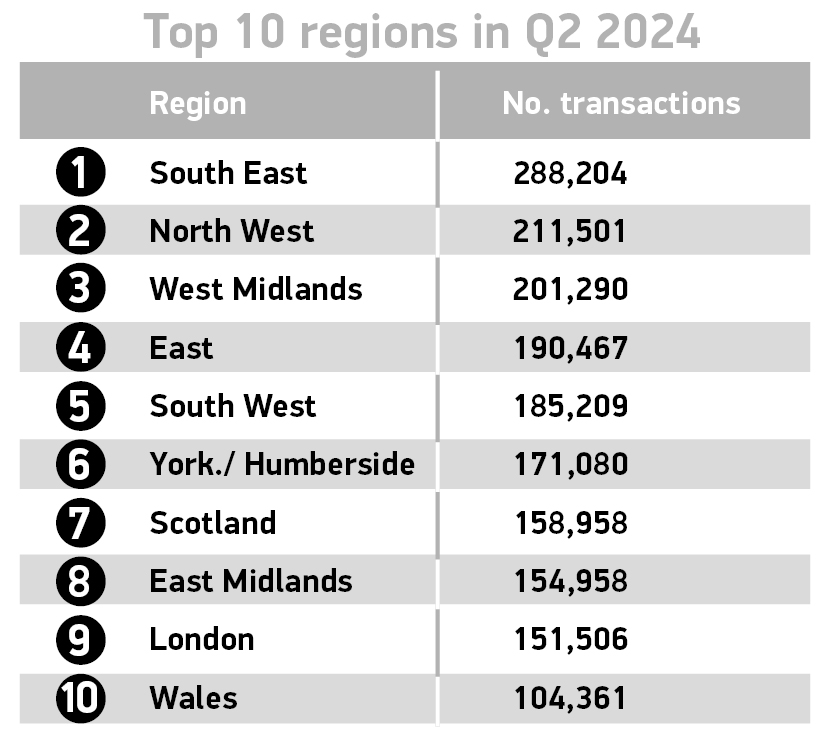

The south-east saw the greatest number of used car transactions, with more than 280,000 vehicles being sold, while there were just over 100,000 used car transactions in Wales.

Superminis sustained their position as the best-selling used vehicle type, with volumes increasing by 8.6% to make up 31.9% of transactions, followed by lower medium (27.1% share) and dual purpose (15.8% share).

The top three accounted for three quarters of all used vehicles, with only the executive (down by 4.2%) and luxury saloon segments (down by 5.4%) recording volume falls.

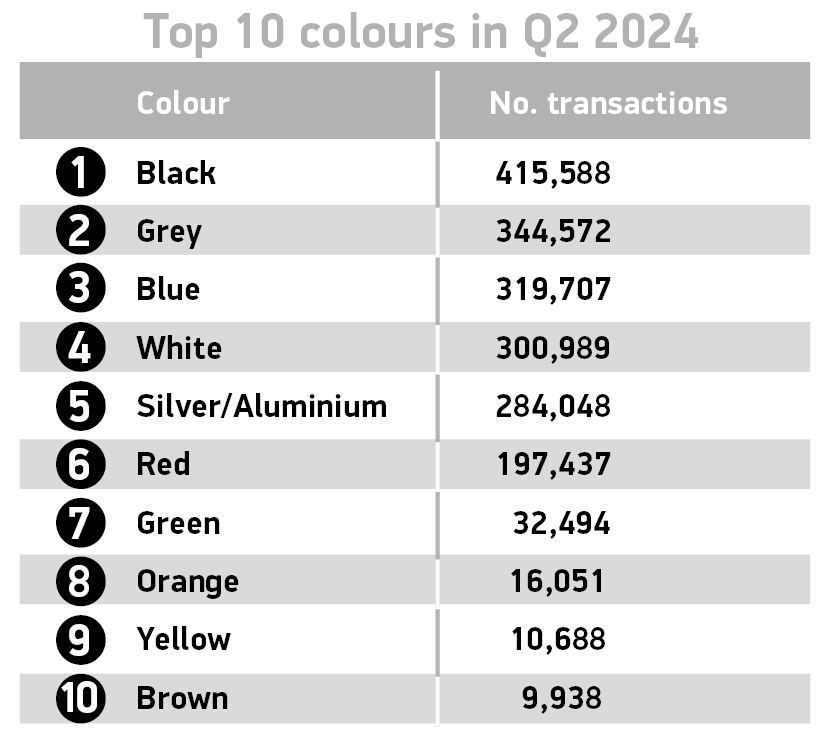

Black remained for the most popular used car colour, recording 6.3% growth and accounting for more than one in five (21.2%) transactions.

Unchanged from last year, grey and blue took second and third places with 17.5% and 16.3% market shares respectively.

White moved into fourth place to push silver back to fifth, while cream/ivory remained at the bottom end of the spectrum, at just 1,194 units.

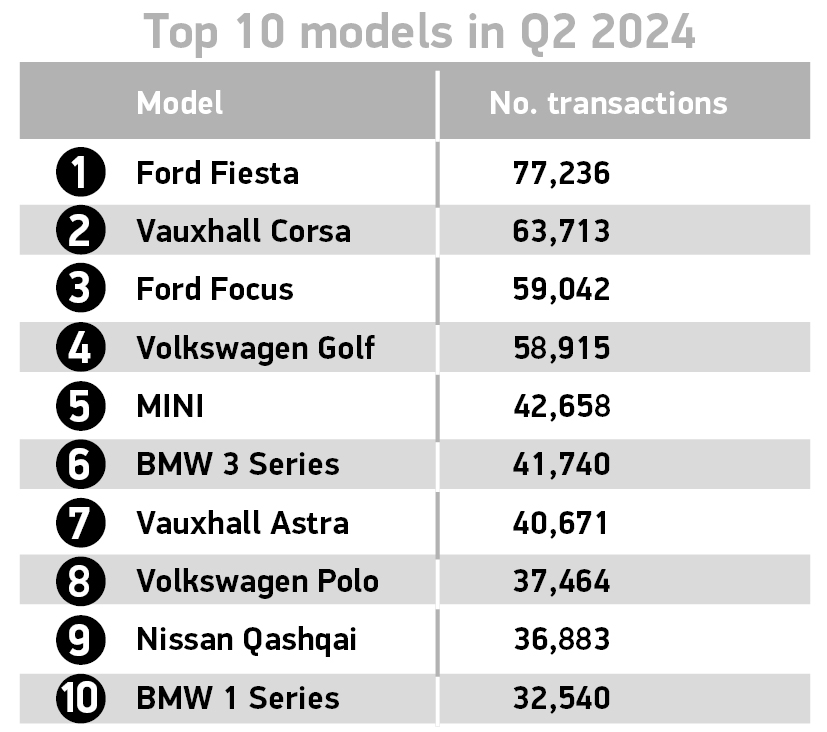

The Ford Fiesta was the most popular used car during Q2, just ahead of the Vauxhall Corsa and Ford Focus, which were the second and third most popular used cars, respectively.

Login to comment

Comments

No comments have been made yet.