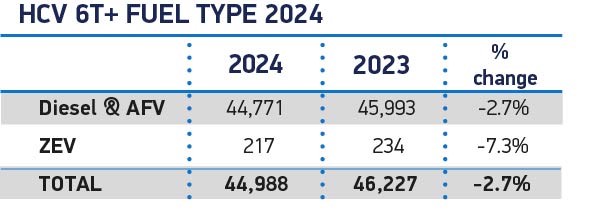

Registrations for the UK’s new heavy goods vehicle (HGV) market fell by 2.7% in 2024, according to new figures by the Society of Motor Manufacturers and Traders (SMMT).

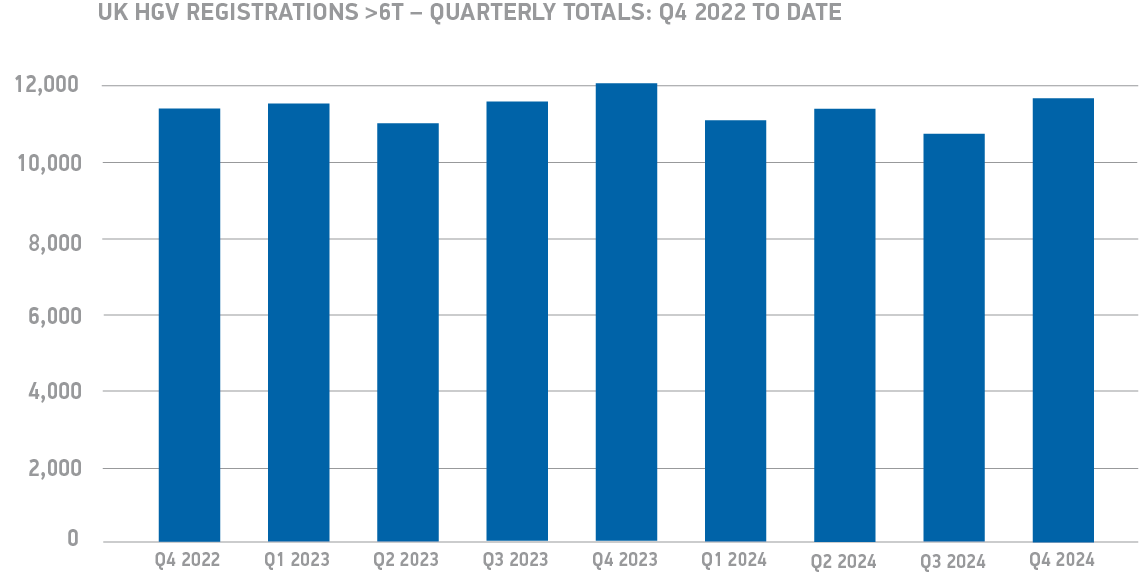

It was the first fall in three years, but followed a strong 2023, which was the busiest year of truck fleet renewal since 2019.

Indeed, the 44,988 new registrations last year, means it was the second-best annual performance across that five-year period.

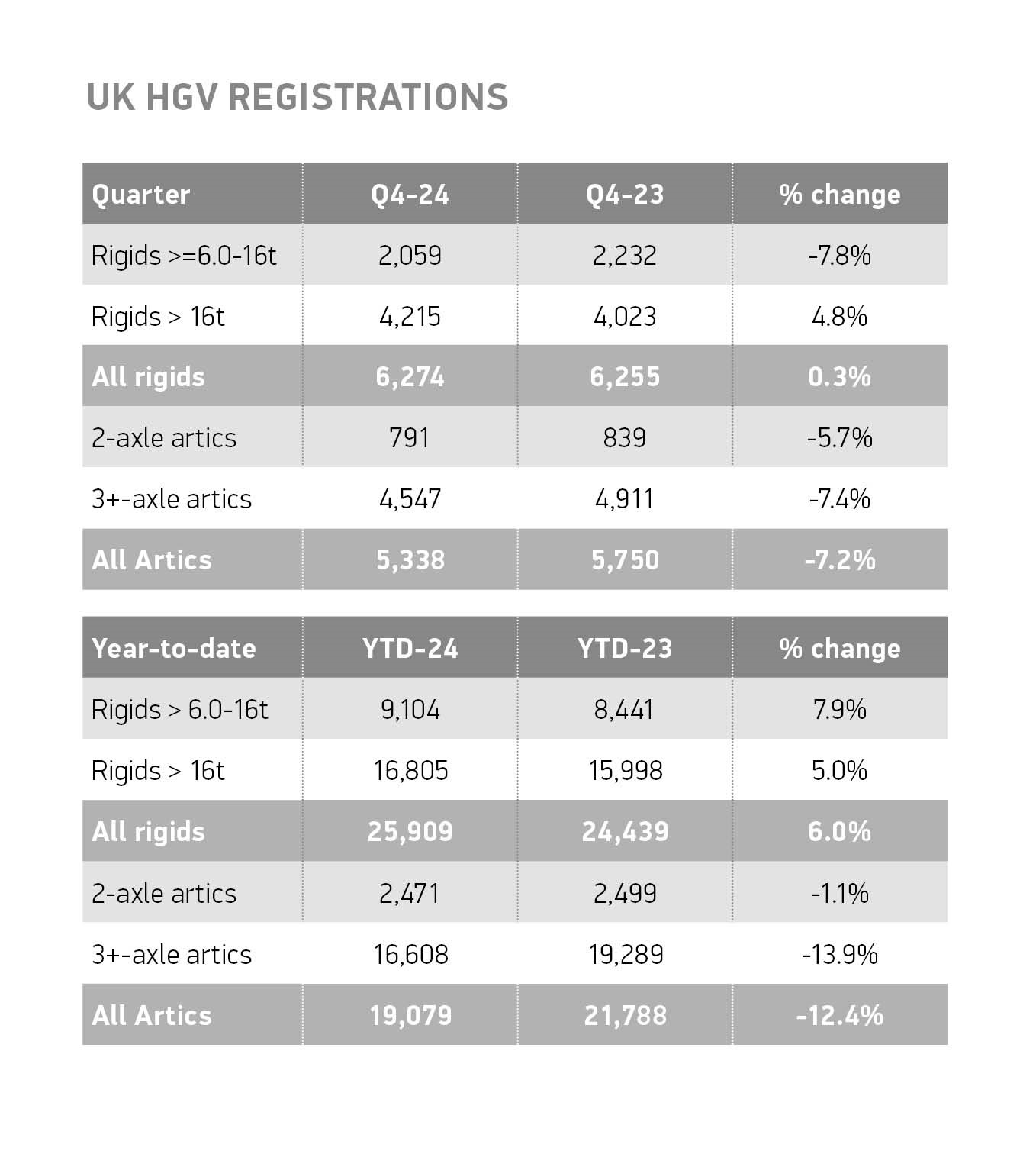

The annual decline was driven by falling demand for articulated trucks, down 12.4% to 19,079 units, which offset a rise in deliveries of new rigid trucks, up 6.0% to 25,909 units.

Demand grew for box (13.4%), curtain-sided (7.1%), tipper (0.9%) and flat (4.1%) truck bodies, but tractors remained the most popular body despite a 13.4% fall in registrations to 18,570 units.

While the cyclical nature of HGV fleet renewal can cause annual fluctuations, it is concerning that fleet demand for zero emission trucks fell by 7.3% to just 217 units, with a 0.5% market share – the same as in 2023, says SMMT.

The UK has signalled it will end the sale of all new, non-zero emission HGVs weighing up to 26 tonnes in 2035 – almost three quarters of the market last year.

Manufacturers have invested significantly to deliver a wide choice of zero-emission vehicle (ZEV) models, says the SMMT, but the higher cost of production means higher acquisition costs for operators – in addition to expensive depot infrastructure upgrades – posing significant barriers to uptake.

The UK has the world’s most ambitious end of sale targets for new, non-zero emission HGVs and substantial support is needed to meet them.

Given the plug-in truck grant – available to fleet operators since 2016 – is set to end in six weeks’ time, the SMMT says that an updated replacement that offers compelling incentives for all new zero emission HGV models, along with support for depot upgrades, is critical.

Such support will be available to a limited number of fleets taking part in the Zero Emission HGV and Infrastructure Demonstrator programme this year.

However, with results not expected until 2030 at the earliest, further measures are needed to grow uptake further, says the SMMT.

The provision of en-route infrastructure is also limited, with fewer than five HGV-dedicated charge points on UK roads.

Mike Hawes, SMMT chief executive, said: “A slight decline in truck fleet renewal reflects a sector that is normalising after strong post-covid growth.

“With most of the market nearly one full investment cycle away from the 2035 end of sale, however, urgent action is needed to address stagnant zero emission uptake.

“Manufacturers are delivering the products – now operators must be convinced to invest.

“Meaningful fiscal support and infrastructure rollout is essential, therefore, so that fleet transition is a compelling commercial proposition.”

Mark Main, EY UK transport lead, says that interest in the decarbonisation of the HGV market from investors and OEMs is increasing.

However, he added: “It’s imperative that eHGV charging infrastructure is improved, built out and accelerated significantly in the coming years.

“A review of vehicle pricing and incentives could also provide crucial support to eHGV adoption over the next decade.

“On that topic, several organisations have begun to show tangible interest in supporting the development of charging infrastructure and eHGV charging networks, so there are undoubtedly reasons for optimism. Furthermore, we are seeing eHGV affordability improving, albeit steadily.

“Indeed, it is now looking increasingly viable that price parity between eHGVs and diesel HGVs could become a reality much sooner than previously thought, potentially as early as 2028. And, with organisations acutely aware of the need to decarbonise their fleets, further green shoots for the eHGV transition could be in prospect.

“Maintaining a cleaner and greener fleet may well offer a competitive advantage during future bidding processes for competitive tenders, given the knock-on effect for customers’ scope 3 emissions.

“Notwithstanding the valid reasons for positivity, the ongoing marked headwinds facing the eHGV market cannot be downplayed.

“Total cost of ownership (TCO) and upfront vehicle purchase prices remain high, which continues to be a factor deterring some companies from decarbonising their fleets. And, with several eHGV manufacturers recently facing well-documented financial difficulty, it’s clear to see why the road ahead remains challenging.”

Login to comment

Comments

No comments have been made yet.