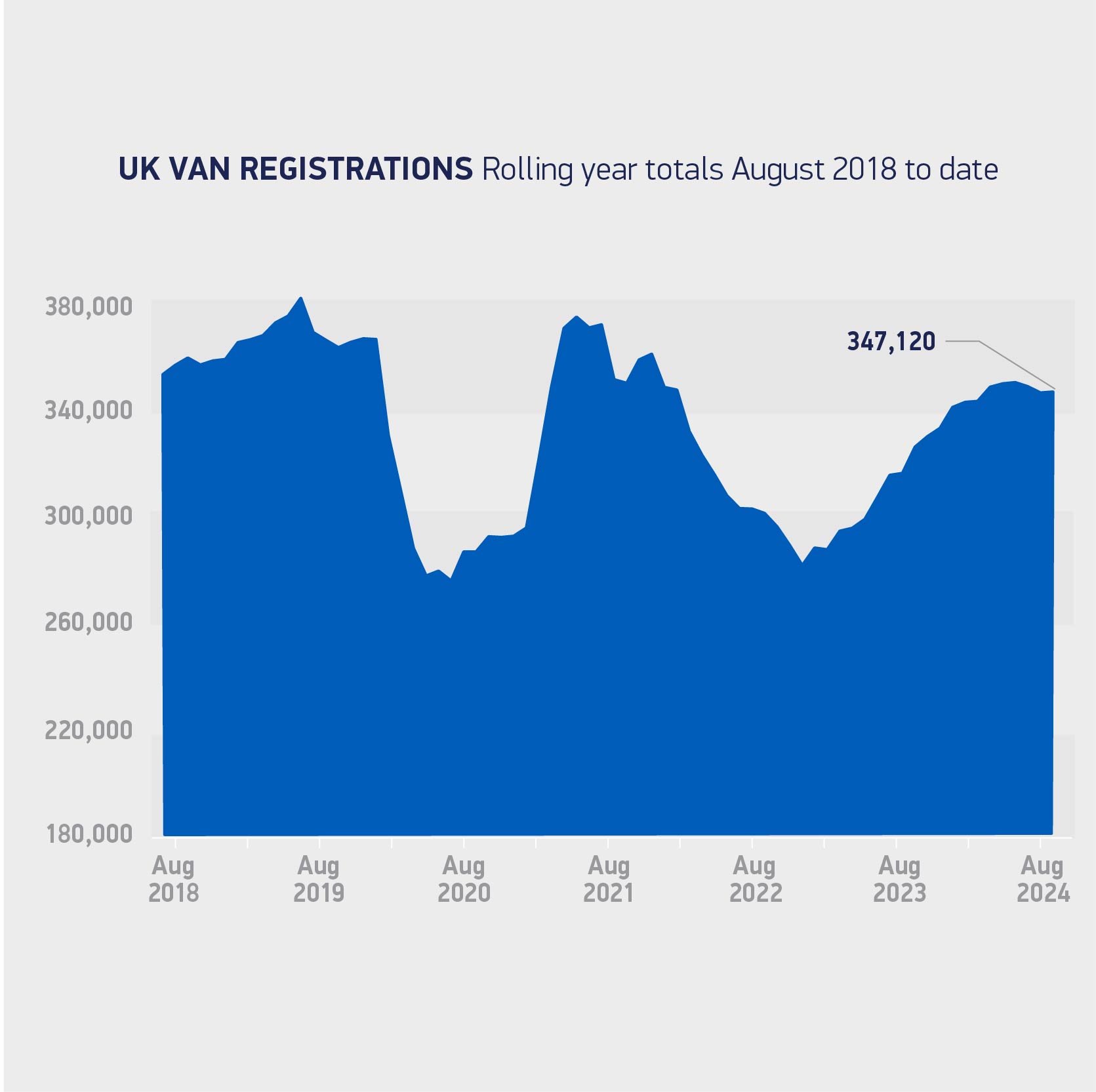

Registrations of new light commercial vehicles (LCVs) declined by 20.5% in January, according to new figures from the Society of Motor Manufacturers and Traders (SMMT).

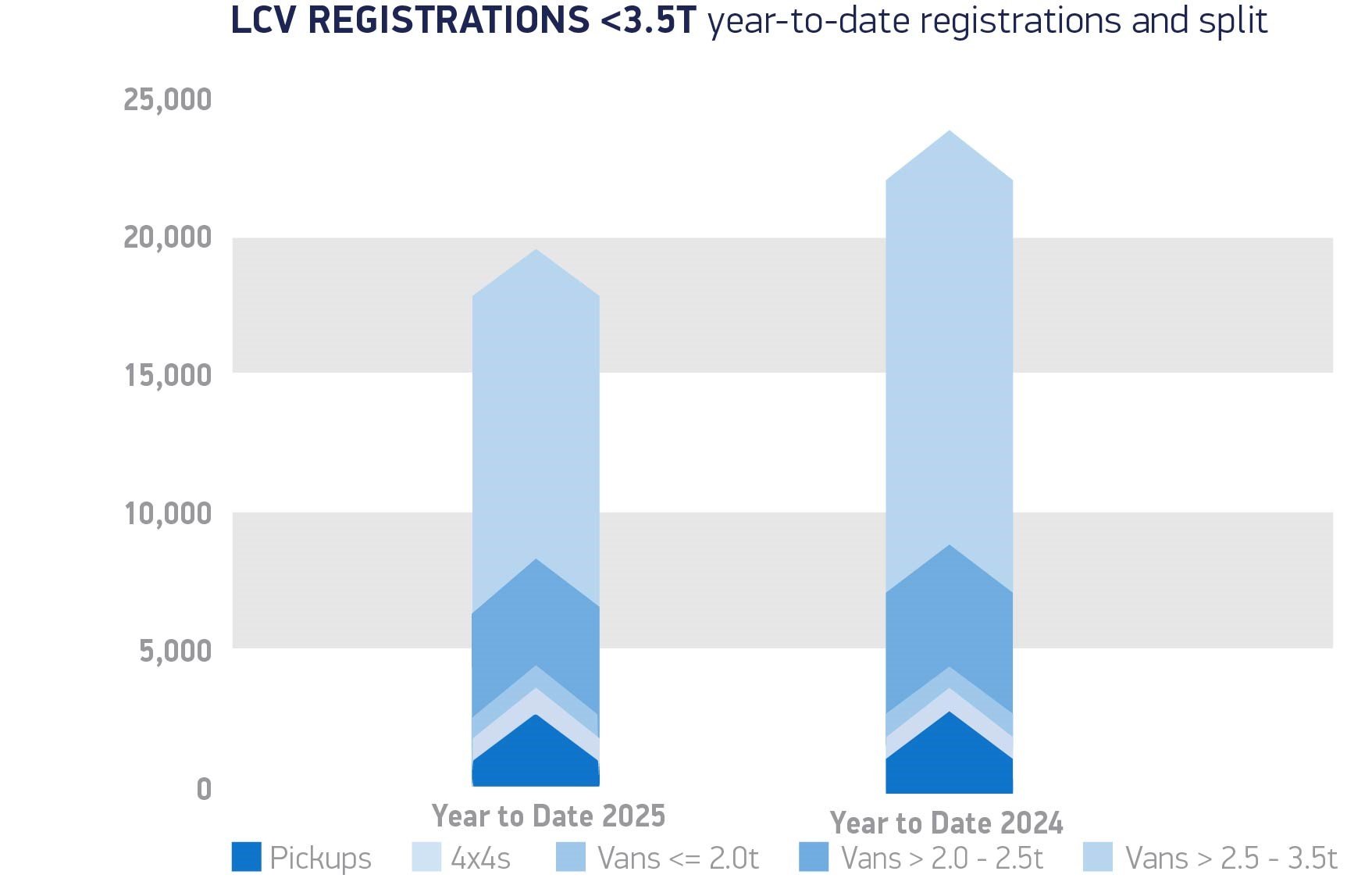

There were 19,050 new vans, pick-ups and 4x4s registered, with falling demand hitting all but one segment.

Small van registrations recording the only increase, up 89.8% to 668 units but accounted for a fraction (3.5%) of the market.

Registrations of the largest vans were down 22.3% to 11,537 units – representing 60.6% of the overall market – while those of medium vans fell by 30.4% to 3,507 units.

In the smaller volume segments, meanwhile, 4x4s and pick-ups fell by 27.2% and 6.5%, respectively.

It was the second consecutive month of decline following robust growth in 2024, and is set against a tough economic backdrop and weakened business confidence to invest, says the SMMT.

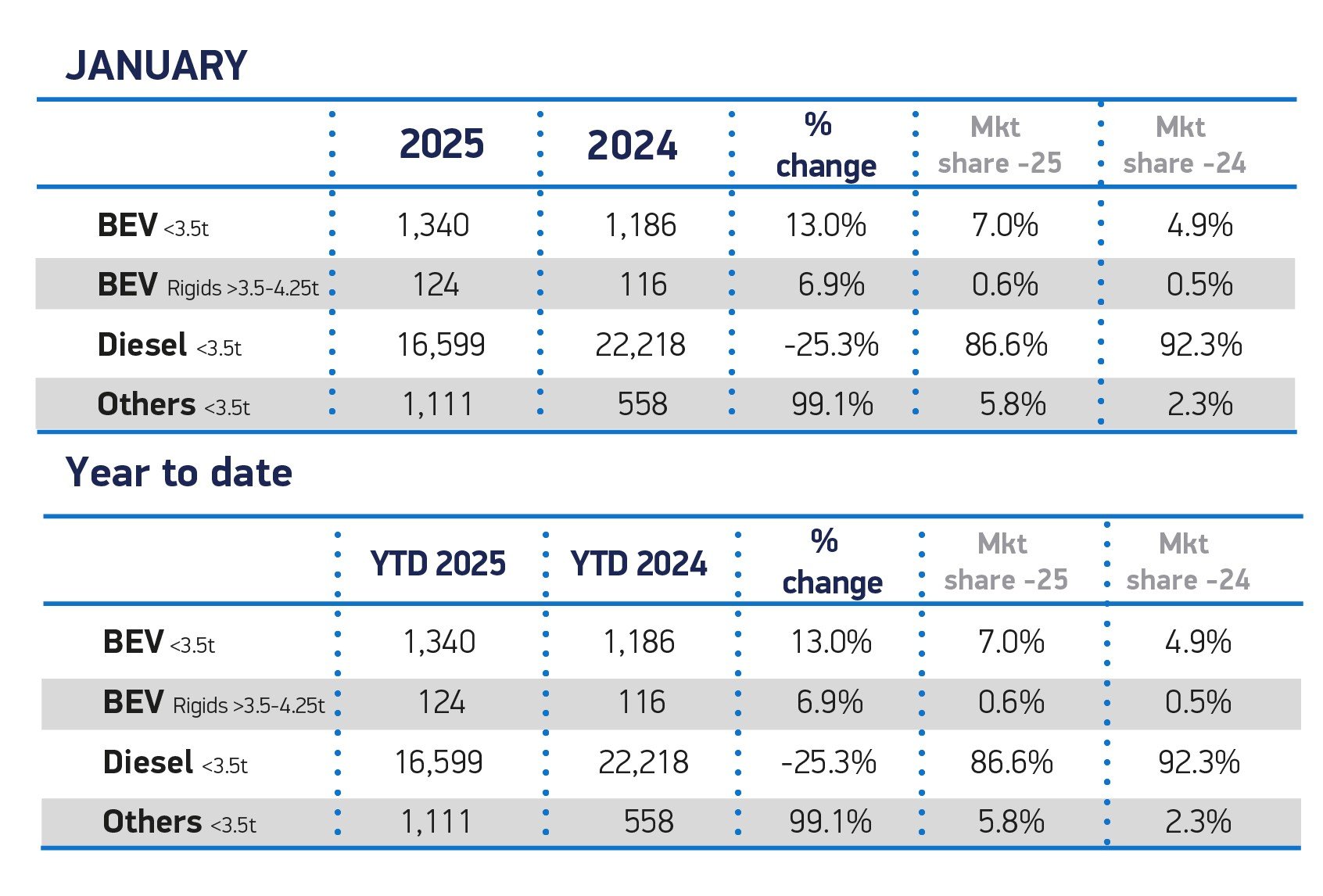

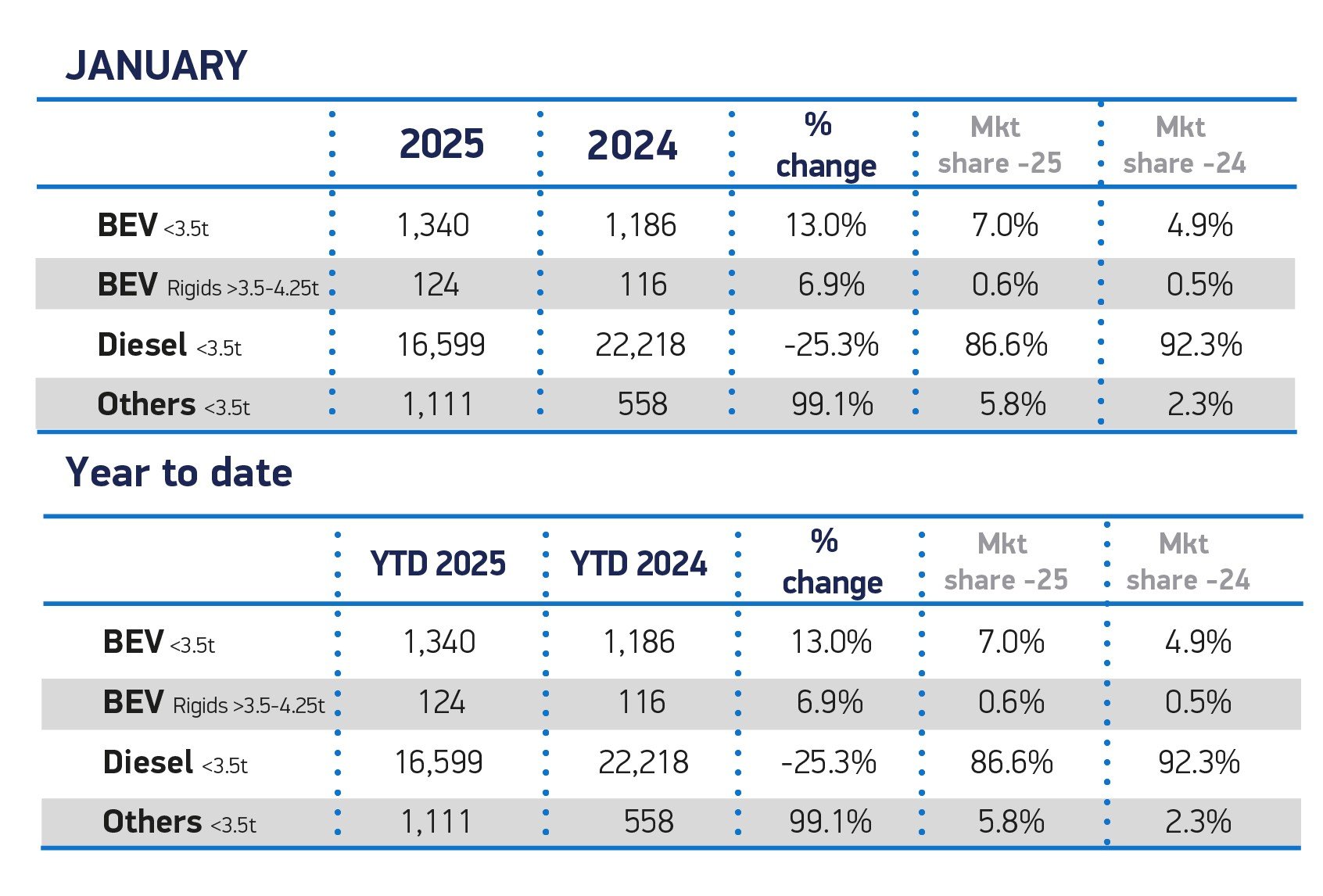

Battery electric van (up to 4.25 tonnes) uptake rose for the fourth consecutive month, supported by the continuation of the plug-in van grant, up 12.4% to 1,464 units – an overall market share of 7.6%.

Further growth is anticipated across the year, with the latest outlook published today suggesting battery electric van volumes (to 3.5-tonne only) will reach 33,000 in 2025 to command a 10.6% share of registrations – substantially below the 16% mandated.

At the same time, the overall market is expected to contract by 1.2% to 348,000 units.

Manufacturers have invested massively in EV innovation, says the SMMT, with more than half (33) of all van models on the UK market available as zero emission, providing operators with an impressive array of choice.

Unless Government backs its EV regulation with an ambitious fiscal and infrastructure strategy, however – one that includes mandating faster charge point rollout that meets the specific charging needs of vans compared with cars – operators will lack confidence to run their fleets on zero emissions, the SMMT warns.

With the new year now underway, Government’s review of the Zero Emission Vehicle Mandate must ultimately deliver measures and flexibilities to support the industry and the van buyer, it added.

Mike Hawes, SMMT chief executive, said: “The van market has enjoyed a bullish performance over the past two years but, amid a tough economic environment, businesses are under pressure.

“It means action is needed to drive fleet renewal and back the industry which has invested massively to produce new EV models.

“The mandate review must, therefore, deliver workable regulation that reflects market realities, and ensure infrastructure rollout that makes fleet decarbonisation a commercially viable, compelling proposition.”

Sue Robinson, chief executive of the National Franchised Dealers Association (NFDA), added: “While the 7.6% market share for BEV commercials is encouraging, it remains well below the 16% ZEV target for light commercial vehicles this year - especially concerning with fines for each non-compliant van set to double from £9,000 to £18,000.

“Another important area to monitor is the upcoming benefit-in-kind tax changes for double cab pick-ups in April, https://www.fleetnews.co.uk/news/double-cab-pick-ups-to-be-treated-as-company-cars which already seem to be influencing the market.

“The Government needs to recognise the importance of expanding the availability of faster, size-appropriate charging points for commercial vehicles.

“This is essential to provide light commercial operators with a practical incentive to transition to zero-emission vehicles without placing them at a financial disadvantage.”

Login to comment

Comments

No comments have been made yet.