This feature originally appeared in the February 2022 edition of Fleet News. Read the article in the digital issue of the magazine.

The costs associated with electric vehicles (EVs) are on something of a roller coaster ride at the moment.

Despite the uptake of the technology being a key part of the Government’s transport decarbonisation strategy, in December it cut incentives by slashing the plug-in car grant and changing the eligibility criteria for the scheme.

Some carmakers responded by reducing the sale price of their battery electric vehicles (BEVs) so they still qualified, a move enabled, in part, by the cost of producing batteries – which account for around 40% of the cost of manufacturing a BEV – falling to a record low.

However, soaring natural gas prices have seen the price of electricity rise as the fossil fuel is used to generate 40% of the UK’s electricity, while many experts predict the cost of batteries will rise in 2022.

“We’ve got an ever-increasing reliance upon elements such as nickel, cobalt, lithium, manganese and copper for EV batteries,” says James Nicholson, partner in advanced manufacturing and mobility at EY.

“For a while now, a lot of those commodities have had suppressed prices and there’s a strong chance that, as demand goes up and these metals become quite scarce, we will see some of those material prices continue to lift.

“That’s going to put a pinch point on the cost of the materials that go into battery cells and that could lift the price to the carmaker and, eventually, the consumer.”

Figures from Bloomberg New Energy Finance show the inflation-adjusted price of battery packs for cars was $1,200 (£885) per kWh in 2010. This had fallen to $132 (£97) last year.

The impact this has on the cost of producing an EV is significant. Assuming a kWh price of $132, it would have cost $6,000 (£4,425) to produce a 50kWh battery last year. In 2010, this would have been $60,000 (£44,247).

However, prices of many of the elements used in EV battery production rose sharply in the second half of 2021: for example, battery-grade lithium carbonate rose to a record high of $41,060 (£30,280) per tonne, more than five times higher than last January, cobalt doubled to $70,208, (£51,775) while nickel jumped 15% to $20,045 (£14,782) a tonne.

Tough environment

“This creates a tough environment for automakers, particularly those in Europe, which have to increase EV sales in order to meet average fleet emissions standards,” says James Frith, head of energy storage research at Bloomberg New Energy Finance.

“These automakers may now have a choice between reducing their margins or passing costs on, at the risk of putting consumers off purchasing an EV.”

Factors behind the rise in costs include the investment needed in new mining and processing facilities to produce greater quantities of the materials, as well as soaring demand.

According to S&P Global Market Intelligence, lithium carbonate equivalent supply is forecast to increase from 497,000 tonnes last year to 636,000 tonnes in 2022. Demand, however, is expected to hit 641,000 tonnes.

“We’re entering a new era in terms of lithium pricing over the next few years because the demand will be so strong,” adds Gavin Montgomery, research director for battery raw materials at Wood McKenzie.

The need to reduce the cost of batteries is one of the driving forces behind research. One option to achieve this is to change the chemistry of the batteries to use cheaper, more common metals.

For example, cobalt can be replaced by nickel, which is cheaper and holds more energy.

However, cobalt’s advantage is that it doesn’t overheat or catch fire easily.

“The real breakthrough research will be to keep the cost down and retain the resilience of the supply chain at the same time,” says Pam Thomas, CEO of battery research programme The Faraday Institution, which oversees a consortium of more than 20 UK universities and 50 businesses.

“So it’s quite a conundrum. You may find that you have different batteries in different cars: high-performance cars like McLarens will use different batteries compared with city cars. We’ve got to get the right battery in the right application.”

When news breaks of new battery technology developments, the focus is, understandably, usually on the amount of charge a battery can hold as well as its charging time, as these are the issues which affect fleets and drivers now.

Last month, it was announced that a team from the University of Michigan has developed a biologically-inspired membrane that could quintuple the charge capacity of electric car batteries.

Self-healing batteries

Another recent announcement has come from Israeli battery technology company StoreDot, which revealed patented technology that will allow battery cells to regenerate while they are in use.

This self-healing system includes a suite of software algorithms which can identify cells or strings of cells that are underperforming or overheating, temporarily disabling them in order to proactively recondition them back to 100% without the driver experiencing any loss of performance.

StoreDot says this technology will play a major role in prolonging battery life and driving range, as well as improving safety by helping to prevent overheating.

The ‘self-healing’ technology sits alongside the company’s developments of extreme fast charging lithium-ion batteries. It expects to deliver units which provide a 50% reduction in charging time at the same cost as current batteries by 2024.

StoreDot is also working on lithium-ion batteries which can charge in five minutes, as well as its next-generation solid state batteries, with planned mass production in 2028.

However, increasing focus is being placed on lower-cost technologies using less rare metals.

One solution being considered by car manufacturers is to use low-cost lithium-iron phosphate (known as LFP) chemistry as the cathode material.

These batteries are significantly cheaper than the industry-standard lithium-ion, do not require any nickel or cobalt, and are more stable, which makes them safer.

However, the cells are less energy dense which means they offer lower range for the same weight as other cells. Cold conditions also affect them more.

In October, Tesla announced it would use LFP chemistry in its standard-range BEVs rather than nickel-cobalt-aluminium which it will continue to use in its longer-range cars.

In its Model 3, LFP will result in a small reduction in range, dropping to 305 miles. The move has been considered as a way for Tesla to increase profit margins on its cars without having to raise retail prices.

It is already making cars with LFP batteries in Shanghai and sells those in China, the Asia-Pacific region and Europe.

Ford and Volkswagen have also expressed interest in the technology for lower-priced models, according to Guidehouse Insights.

Other manufacturers will no doubt follow: Toyota is sourcing LFP technology from Chinese carmaker BYD Auto to use in a fully-electric small car due to be launched in China this year.

UK projects

Significant research and investment in battery technologies is also taking place in the UK: £10m of Faraday Battery Challenge funding is being used to build a better British battery industry.

The projects include a consortium led by LiNa Energy that will develop a new sodium nickel chloride battery system, leading to improved cell performance, and manufacturing optimised for scale-up, decarbonisation and recycling.

Another, led by Anaphite, aims to develop faster charging batteries by incorporating graphene into the battery cathode.

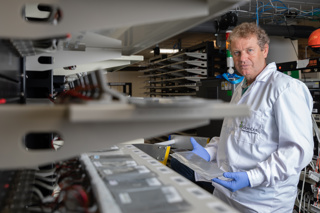

Funding from the Faraday Battery Challenge also helped in the opening of the UK Battery Industrialisation Centre (UKBIC) in Coventry last year.

The centre has been developed to support UK industry with the development of battery technologies for future electrification.

As well as cost and performance, the question of sustainability is also taking centre stage with new battery technologies.

There has been much talk that BEV batteries can be given a second life in functions such as grid storage when they are no longer suitable for use in vehicles, but there will also be a point where they degrade too much to be useful in this application as well.

“It’s clear that one should only be investigating and researching new technologies where the recycling at end-of-life can be achieved in a green way,” says Thomas.

“It’s not green recycling just to shred the batteries into black powder and then send that to be incinerated or buried in China, which is currently what the industry is doing.

“We have a finite supply of materials in the world and, therefore, we should be doing our utmost to recover these precious elements at a battery’s end of life.”

Complicated process

However, the process is a complicated one, says Thomas. “Batteries do not end life in the same state as they started it,” she adds.

“If all we had to do was dismantle a pristine battery, that might be something that would be a very surmountable problem.

“But these end-of-life batteries will actually have been abused in terms of maybe being driven beyond their recommended life or

treated in ways by the average motorist that are not exactly the optimum way of treating the battery according to the technical guides.

“Every battery is a new case in terms of recycling. A project for researchers is around how the whole lifecycle of a battery can be monitored.

"The data collected will tell the end-of-life recycler what that battery had gone through and will inform them how that particular unit can be safely taken apart and the elements recovered.”

Resource management company Veolia last month announced plans to build its first battery recycling facility in the UK, which, it says, will have the capacity to process 20% of the UK’s end-of-life EV batteries by 2025.

Veolia anticipates there will be an estimated 350,000 tonnes of end-of-life EV batteries in the country by 2040.

The plant, in Minworth, West Midlands (just north-east of Birmingham), will initially discharge and dismantle batteries before the mechanical and chemical separation recycling processes will be completed.

One positive for researchers looking into how EV batteries can be effectively recycled is that the need to find a solution is not as pressing as that to develop future battery technologies.

“We’ve got a little bit of time on our side,” says Nicholson.

“The reality is there are not enough batteries that have been into a car, been through their useful first life and come out again to support recycling plants on an economically viable basis.

“That’s useful because we need the technology to mature a little bit.”

Quintuple-charge batteries not without drawbacks

Scientists from the University of Michigan have developed a biologically-inspired membrane that could quintuple the charge capacity of electric car batteries, significantly increasing their range.

Lithium-sulphur battery technology is seen as a potential future chemistry for vehicle batteries as they are capable of holding up to five times as much charge as the industry standard lithium-ion cells.

However, the cathodes used in them is inherently instable as they undergo a 78% change in size each charge cycle, meaning they are impractical for use in consumer electronics.

The flaw also makes them degrade extremely quickly, meaning they would need to be replaced far more often that lithium-ion batteries.

But a solution is coming.

“There are a number of reports claiming several hundred cycles for lithium-sulphur batteries, but it is achieved at the expense of other parameters: capacity, charging rate,resilience and safety,” says Nicholas Kotov, a professor of chemical sciences and engineering at the university, who led the research.

“The challenge is to make a battery that increases the cycling rate from the former 10 cycles to hundreds of cycles and satisfies multiple other requirements, including cost.”

The scientists used recycled Kevlar – the same material found in bullet-proof vests – to create a network of nanofibres similar to a cell membrane.

This fixed many of the fundamental issues with the degradation and instability of lithiumsulphur batteries. Kotov describes the new design as “nearly perfect”, allowing the capacity and efficiency to approach the theoretical limits of lithium-sulphur batteries.

The anticipated lifespan of 1,000 cycles would mean the average car battery would need to be replaced roughly every 10 years.

Also, the materials used in production are far more abundant and less environmentally damaging than those used in lithium-ion batteries.

> Interested in comparing electric vehicle data? Check out our EV tool.

> Interested in ensuring the efficient use of EVs. Check out our dedicated editorial sections: Insight & policy | EV news | Charging & infrastructure | Costs & incentives | Benefit-in-kind | EV case studies | EV road tests

Login to comment

Comments

No comments have been made yet.