This article, published in 2022, was originally made exclusively available to members of the Fleet200 Strategy Network, a group of the most influential fleets operating in the UK, founded by Fleet News.

Network benefits and joining details for UK fleet decision-makers at the bottom of this article. Plus FSN articles and insight.

The headline registration figures from the Society of Motor Manufacturers and Traders tell the holistic story: year-to-date, full electric accounts for 14% of total car sales (up from 7.5% in 2021), while diesel is at 5.8% (down by five percentage points).

Dig beneath the surface of the UK’s largest fleet operators and the speed of change from those at the vanguard of the electric revolution is clearly illuminated.

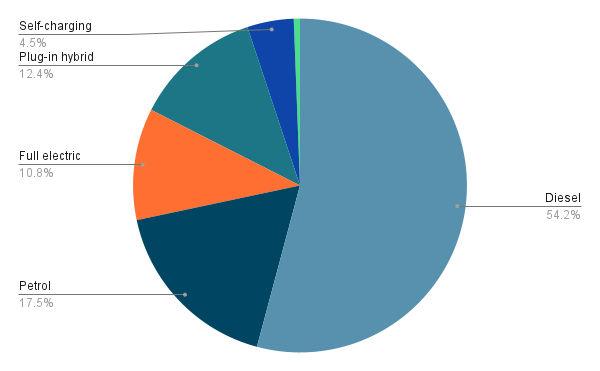

A Fleet200 Strategy Network (FSN) survey carried out by Fleet News (in 2022) among FSN members and other fleet professionals reveals how respondents have already reduced the diesel mix of their car fleets to 54% - as recently as 2018, Fleet200 figures show this was sitting in excess of 80%.

Full electric accounts for almost 11% (up from 1.9% four years ago) and plug-in hybrid 12.4%.

This article, published in 2022, was originally made exclusively available to members of the Fleet200 Strategy Network, a group of the most influential fleets operating in the UK, founded by Fleet News.

Network benefits and joining details for UK fleet decision-makers at the bottom of this article. Plus FSN articles and insight.

- Rapid move away from diesel to electric power

- Average CO2 emissions of new car orders less than half that of entire car fleet

- Lack of choice hampers van transition to EV

- Questions over EVs' lifetime benefits to the environment

- Up to 18 months to implement workplace charging infrastructure

- Company policy on home charger installation revealed

The headline registration figures from the Society of Motor Manufacturers and Traders tell the holistic story: year-to-date, full electric accounts for 14% of total car sales (up from 7.5% in 2021), while diesel is at 5.8% (down by five percentage points).

Dig beneath the surface of the UK’s largest fleet operators and the speed of change from those at the vanguard of the electric revolution is clearly illuminated.

A Fleet200 Strategy Network (FSN) survey carried out by Fleet News (in 2022) among FSN members and other fleet professionals reveals how respondents have already reduced the diesel mix of their car fleets to 54% - as recently as 2018, Fleet200 figures show this was sitting in excess of 80%.

Full electric accounts for almost 11% (up from 1.9% four years ago) and plug-in hybrid 12.4%.

With many organisations in the private and public sectors operating replacement cycles of three-to-four years, this speed of change already looks impressive.

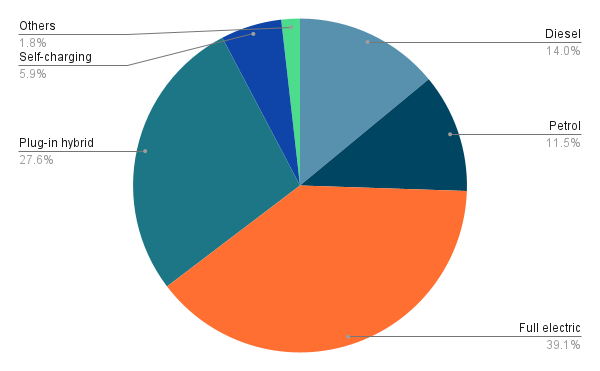

But it’s the forwards orders book that tells the real story.

Here, 39% of cars are full battery electric vehicles (BEVs) and more than 26% are plug-in hybrid (PHEVs).

Just 14% are diesel, with the proportion slightly higher among those operating the smaller fleets.

Not only are UK businesses and their drivers hurrying away from diesel, turned off by the negative dieselgate emissions stories, they are flooding towards BEV more than PHEV – attracted by the 2% benefit-in-kind taxation.

As one knowledgeable fleet manager said recently, “when the cost becomes that low, any concerns about charging and range anxiety go away”.

Consequently, average CO2 emissions of new car orders are just 42g/km, while across the entire car fleet, they average 90g/km.

The figures produced in this Fleet200 Strategy Network report are based on a benchmarking survey carried out with almost 200 fleet decision-makers in May via both email links and telesales interviews.

Of the respondents, 35% operate up to 100 vehicles, 29% have 101-500 vehicles and 36% have more than 500 vehicles on their fleet.

In total, companies are running almost 53,000 cars, 45,000 vans and more than 13,600 trucks, plus almost 300 motorcycles. Total combined fleet size is around 111,500 vehicles.

NOTE: Industry responses were removed from the survey results for the purposes of this report.

Fuel proportions – car

• Diesel – 54.1%

• Petrol – 17.5%

• Full electric – 10.8%

• Plug-in hybrid – 12.4%

• Self-charging hybrid – 4.5%

• Others – 0.6%

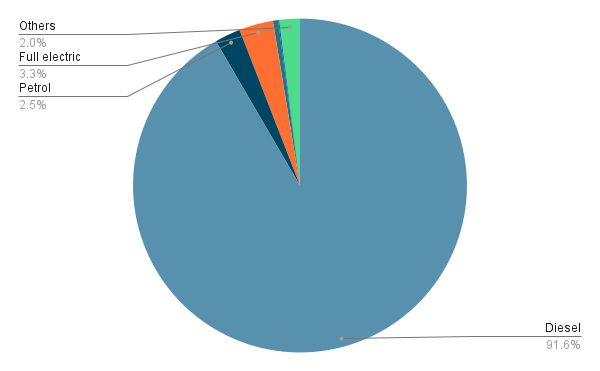

Fuel proportions – van

• Diesel – 91.6%

• Petrol – 2.5%

• Full electric – 3.3%

• Plug-in hybrid – 0.5%

• Self-charging Hybrid – 0.1%

• Others – 2%

The pace of change: cars v vans

It is clear from the survey responses that the electrification of cars is happening at a far more rapid pace than vans, which comes as no surprise as manufacturers prioritised their development and launch.

While there is a growing list of electric vans now on the market, 3.5-tonne large vans are lagging behind, while pick-ups appear to still be a couple of years away – notwithstanding the new Maxus two-wheel drive option which will be launched later this year.

And issues still abound about electric vans’ ability to tow.

Nevertheless, in the LCV sector, priorities are squarely focused on a straight transition from diesel to full electric (BEV), leapfrogging the plug-in hybrid stepping-stone commonly used in the car market (although even here, 2% benefit-in-kind is persuading many drivers to go straight to BEV – see forward orders table).

Forward orders – cars

• Diesel – 14%

• Petrol – 11.5%

• Full electric – 39.1%

• Plug-in hybrid – 27.6%

• Self-charging Hybrid – 5.9%

• Others – 1.8%

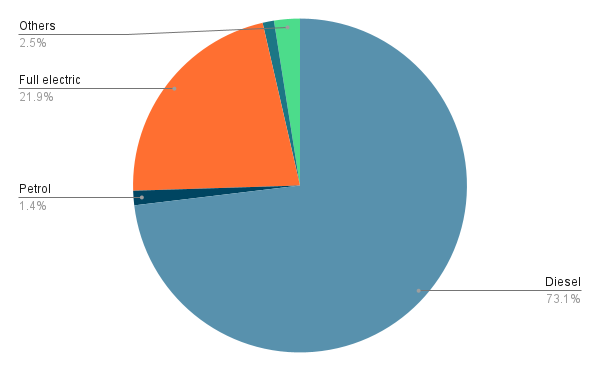

Forward orders – vans

• Diesel – 73.1%

• Petrol – 1.4%

• Full electric – 21.9%

• Plug-in hybrid – 1.1%

• Self-charging Hybrid – 0%

• Others – 2.5%

BEV-only car policies

Confirmation, if it was needed, of the direction of travel in fleet.

The transition to full electric is undeniably underway, and gathering speed, certainly among the larger, more professional public and private sector organisations.

“I do not believe over a vehicle’s lifetime electric is the least polluting and best for the planet."

For cars, electric is by far the most popular powertrain being ordered, followed by plug-in hybrid (PHEVs) with diesel trailing way behind.

However, PHEVs pose an interesting conundrum: often ordered by drivers travelling higher mileage who want the security of being able to fill up (usually with petrol) quickly and conveniently, in reality, they tend to offer little more range than the newest full electric cars (because of smaller fuel tanks) and can, when running on petrol only, emit higher levels of CO2 emissions than the traditional diesel (though fewer particulates which impact on air quality).

It’s another reason why some of the bigger fleets have opted to introduced BEV-only car policies – with many offering real-world range of 250 miles, and rapid charging times of 80% fill in less than 20 minutes, they really do meet almost every need.

However, not everyone is an advocate or believer in electric.

One survey respondent said their biggest challenge was deciding when to go electric: “I do not believe over a vehicle’s lifetime electric is the least polluting and best for the planet.

"We will continue to use existing vehicles as long as they remain reliable and only replace when essential and with electric vehicles when they have a full lifetime pollutant level below that of petrol cars.”

Companies intending to hold out until the 2030 ban on the sale of new petrol and diesel cars and vans are highly likely run into significant issues unless they have started their planning several years earlier.

Going EV is not simply about the vehicles; it’s about implementing the workplace charging infrastructure – especially for depot-based vehicles - and that can take on average 12-18 months from start to finish due to the lengthy negotiations with the distribution network operators (DNOs) on electric supply. Start planning now is the advice from those already on the journey.

For vans, the trend to BEV is palpable when viewing forward orders. For all fleets, it is now a straight choice between diesel and full electric, with the latter dominating the order books for urban, last mile and home delivery operators, as evidenced by EV pioneers such as Mitie, British Gas and Royal Mail.

Average CO2 emissions

• Current car fleet: 90.6g/km

• Forward car orders: 42g/km

• Current van fleet: 127.3g/km

• Forward van orders: 108.5g/km

Home chargers

As the sector transitions to electric, so the CO2 emissions (as well as particulates) fall.

Car forward orders on average are emitting less than half the CO2 of the existing fleet. Van emissions are falling more gradually, in line with the slower uptake of BEVs by fleets.

Nevertheless, when the average emissions of all cars registered in 2021 are taken into consideration (circa 185g/km, although half of registrations are in the 111-150g/km band), it’s clear that fleets are leading the way.

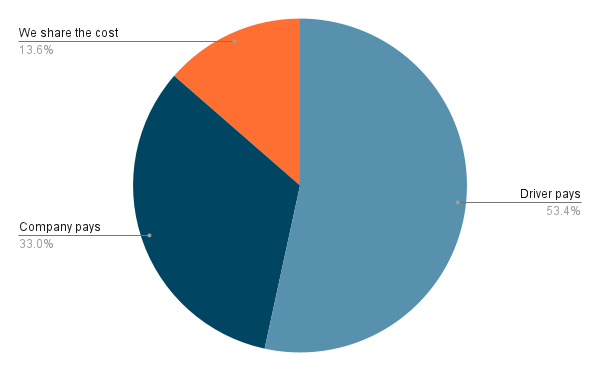

What is your company policy on paying for home chargers for CARS?

• Driver pays: 55%

• Company pays: 34%

• We share the cost: 14%

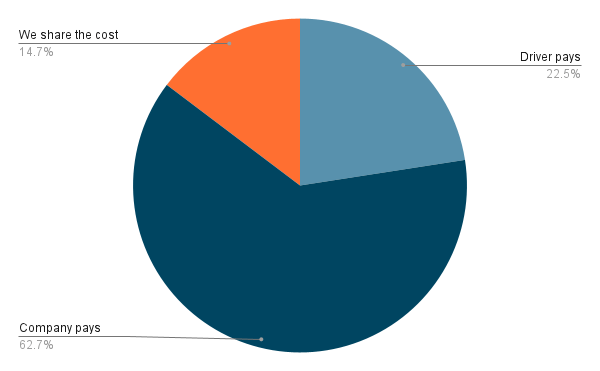

What is your company policy on paying for home chargers for VANS?

• Driver pays: 23%

• Company pays: 64%

• We share the cost: 15%

It’s a decidedly mixed picture when it comes to who pays for home chargers, especially for cars, where the prevailing view is the drivers must fund the cost of installing a home charger.

Many fleets have installation as a mandatory requirement before an employee is allowed to order an EV.

The thought process, according to National Grid fleet manager Lorna McAtear, is to have a level playing field for all employees, allayed to the fact that vehicles can be charged in the workplace to perform their daily tasks.

Companies with a transient workforce also do not want to risk investing in a home charger only for that employee to leave the business; although some have written financial compensation into employee contracts to address those situations.

It is a different proposition for vans, which are a work vehicle and therefore subject to greater support from the business where they require home charging.

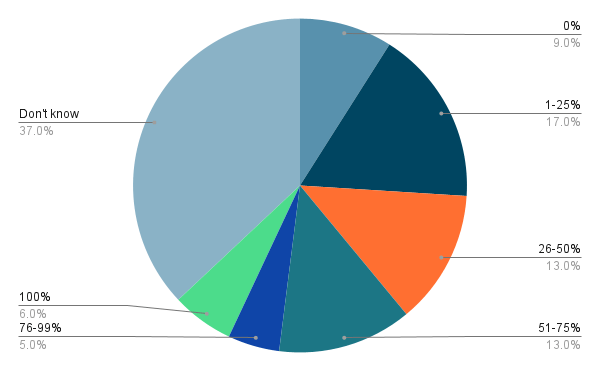

Roughly what proportion of your company vehicle drivers are able to have a charge point installed at home?

0% 9%

1-25% 17%

26-50% 13%

51-75% 13%

76-99% 5%

100% 6%

Don't know 37%

Fleets need to know the answer to this question, especially if they are running return-to-home vans – but more than a third don’t.

Obstacles to adoption

Can drivers charge vehicles at home?

Estimates carried out by Field Dynamics for the Association of Fleet professionals suggests that around 40% of households do not have sufficient space to park a van off-road. In our survey, around 40% of fleets say at least half their employees do not have the facility to charge at home.

A lack of home charging opportunities raises many, as yet unanswered, questions.

Public charging attracts 20% VAT; domestic energy is taxed at 5%.

Public charging can often exceed 40p per kWh; at home it can be as low as 10-14p per kWh.

How can the Government balance this inequity?

Certainly, the 5p per mile Advisory Electric Rate (AER) for business mileage reimbursement doesn’t come close.

Often it is the lower income families that do not have access to off-street parking, and they are the ones being potentially frozen out of the EV opportunities.

There are some solutions being touted, such as residential charging stations – although available land space could be an issue – plus streetlamp chargers or pop-up chargers, but none will be as cheap as home charging on low-rate tariffs.

“Who are these fleets which are continuing to cost themselves money, failing to deliver huge tax benefits to their employees, avoiding addressing the 40% of UK carbon emissions associated with transport and missing out on the reputational benefit of taking meaningful sustainability action?

“All I can assume is that there are lots of fleets and businesses which just don't get it.”

Then there are home chargers with cantilever arms stretching over the pavement to the car, but flat dwellers are still left out in the cold.

Some companies restrict EV choices to those staff who can install home chargers, while others have open policies on the understanding that it is the employee’s responsibility. Workplace charging can, for some, be sufficient.

What are the biggest challenges your business faces in the switch to EV?

Cost of vehicles 46%

Not sufficient range for job/mileage requirements 66%

Cost of installing workplace charging infrastructure 28%

Unable to install workplace chargers 17%

Many drivers do not have off-road parking suitable for home chargers 43%

Lack of public charging infrastructure 58%

Lack of support by directors/board 8%

What is the single biggest challenge your business faces in the switch to EV?

Cost of vehicles 16%

Not sufficient range for job/mileage requirements 43%

Cost of installing workplace charging infrastructure 8%

Unable to install workplace chargers 3%

Many drivers do not have off-road parking suitable for home chargers 13%

Lack of public charging infrastructure 16%

Lack of support by directors/board 1%

The big four issues, according to fleets, are cost of vehicles, lack of sufficient range, lack of off-road parking for a home charger and lack of public charging infrastructure, but when asked to pinpoint their single biggest concern, range is the overwhelming response.

Some of the response become quite emotive with deeply held views that are at odds with the findings of fleets that are well on their way to zero emissions motoring.

Take this example with blasts the “pointless and relentless push towards electric vehicles when they clearly are not the answer”.

The fleet manager goes on to list his concerns as “poor range, poor infrastructure, expensive, end of life issues, charging at home/work issues and complete lack of compatibility with real life work and private driving situations” and goes on to call on the Government to “focus on hydrogen and cleaner petrol plus alternative biofuels”.

A contrasting view is offered by the likes of British Gas, Mitie and National Grid, which have seen significant total of ownership savings thanks to greatly reduced maintenance and repair bills, plus better reliability so less time off road and fuel savings which are growing as the pump price of diesel surges.

Simon King, former Mitie director of sustainability, social value and fleet, doesn’t mince his words when viewing the latest SMMT figures, which show that even if every EV sold so far in 2022 had gone to a fleet (which clearly they haven’t), then less than a third of new company cars were pure electric.

“I am genuinely baffled,” he said in a LinkedIn post.

“Who are these fleets which are continuing to cost themselves money, failing to deliver huge tax benefits to their employees, avoiding addressing the 40% of UK carbon emissions associated with transport and missing out on the reputational benefit of taking meaningful sustainability action?

“All I can assume is that there are lots of fleets and businesses which just don't get it.”

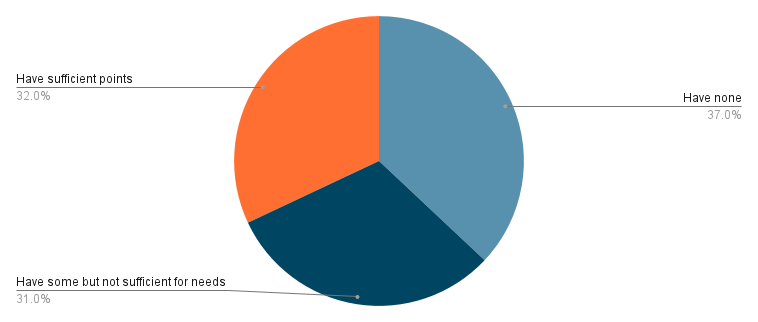

Which of the following best describes your workplace electric charging network?

Have none: 37%

Have some but not sufficient for needs: 31%

Have sufficient points: 32%

On paper an even spread of results across fleets, but there are huge variations when compared by fleet size. The vast majority of companies with up to 100 vehicles (62%) have no chargers; however, just 20% of companies with more than 500 vehicles have none.

Most of these big businesses have some chargers but recognise that they need more to cope with their expanding electric vehicle fleets.

Future proofing your workplace is difficult when it comes to EV chargers, as some of the early adopters have found out.

Charger reliability has been a recurring problem, while wiring becomes dated and not capable of accommodating more powerful units.

The proportion of fleets who believe they have sufficient points is surprising, and fairly equal across fleet size (29% for the smaller rising to 36% for the biggest), but perhaps relates to the fact that they either have mainly return to home vehicles or a high proportion of staff who work from home resulting in lower demand for office chargers.

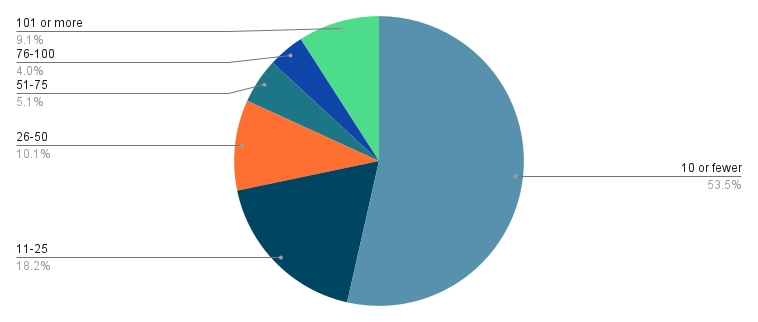

Workplace charging point numbers

How many workplace charge point connectors does your business currently have?

10 or fewer 53%

11-25 18%

26-50 10%

51-75 5%

76-100 4%

101+ 9%

Obviously, the smaller the company, the fewer the chargers. Nine out of 10 organisations with up to 100 vehicles have 10 or fewer charger points; the remainder have 11-25. Of the mid-size companies running 101-500 vehicles, half have fewer than 10 charge points, with another 28% having 11-25.

However, even among big business, running more than 500 vehicles, the biggest proportion – 38% - have fewer than 10 chargers.

One in five does have more than 100 units installed.

Previous Fleet News' surveys have revealed than the most common charger output is 7kW – the same as a home charger.

These are fine for relatively slow charging during the day, typically taking around eight hours for an empty-to-full charge on an average 60kW battery (or adding up to 30 miles per hour).

The next most popular are 22kW chargers which can fully charge in around 3.5 hours (up to 80 miles per hour). However, a note of caution: not all cars will charge on AC at the full rate.

The Hyundai Ioniq 5, for example, will charge at a maximum of 11kWh on an AC charger regardless of the power output.

Meanwhile, a 50kW charger can add up to 100 miles of range in a little over half an hour and is perfect for rapid top ups required by highly utilised fleets (or for those drivers who have forgotten to plug in overnight).

Are you planning to increase the number of electric charge points at work?

Yes 61%

No 39%

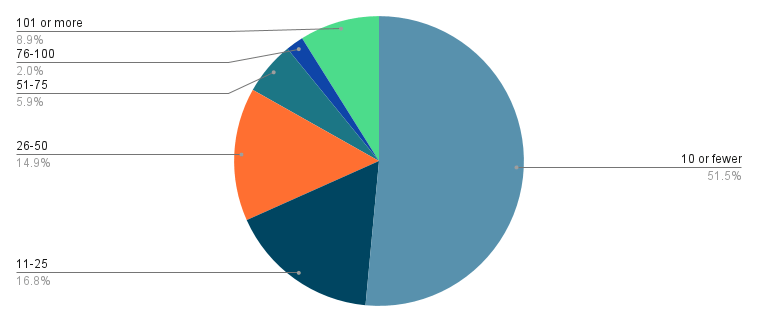

If yes, how many more electric charging points are you planning to install?

10 or fewer 52%

11-25 17%

26-50 15%

51-75 6%

76-100 2%

101+ 9%

Just over six out of 10 fleets intend to install more charger points, with more than half looking to add up to 10 new units.

The bigger the company, the more chargers it intends to install.

So, while no fleets with up to 100 vehicles is looking to install any more than 25 chargers, 21% of companies running 501-plus vehicles intend to add more than 100 chargers to their workplace(s).

In total, 55% of the biggest companies expect to add at least 50 new chargers to the offices or depots.

All will need to consult closely with their DNO ad local grid capacity is unlikely to be able to cope with such a huge increase on demand.

However, solar panels and battery storage systems are increasingly being deployed by fleets to help overcome supply issues.

That’s the approach taken by Dundee City Council with its major site on Princes Street in the city which deploys solar panels and second life battery storage to help power the six 50kW rapid and three 22kW fast charging units.

On-site photovoltaic cells provide 36kW of power with the battery storage solution having 90kWh capacity.

The solar system allows the EV hub to reduce demand from the national grid at peak times and take advantage of off-peak charging tariffs.

In London, deliver firm UPS has also deployed an energy storage system which coverts and inverts power based on tariff, network loading and vehicle specific requirements.

By integrating active network management and battery storage system technologies, UPS’s depot’s electricity demand will not exceed the network limit.

This prevented the need for significant investment in network electrical infrastructure and safeguarded UPS against the impact associated with having uncharged vehicles.

> Download the EV survey (pdf)

> Interested in comparing electric vehicle data? Check out our EV tool.

> Interested in ensuring the efficient use of EVs. Check out our dedicated editorial sections: Insight & policy | EV news | Charging & infrastructure | Costs & incentives | Benefit-in-kind | EV case studies | EV road tests

Login to continue reading.

This article is premium content. To view, please register for free or sign in to read it.

Login to comment

Comments

No comments have been made yet.