Tax and fuel type are among the recurring themes as Gareth Roberts reviews the biggest industry news of the past decade.

1978 Fleet financing and winter of discontent

Fleet financing options came under the spotlight in the first edition of Fleet News in March 1978. An article claimed: “The British economy is showing signs of an upturn. Industry is showing an increased degree of confidence, although unemployment is expected to remain high.

“In light of this, companies must review transport. Many vehicles have been kept long after they should have been replaced. Now is the time for those over-age units to be replaced.”

The optimistic outlook was to be short-lived however, with widespread strikes by public sector trade unions demanding larger pay rises, following the ongoing pay caps of the Labour government led by James Callaghan, giving rise to the so-called ‘winter of discontent’ at the end of the year.

1979 Thatcher targets company car tax

Following Margaret Thatcher’s election success that May, changes to company car taxation were suggested in a consultation document in September.

Fleet News reported how proposals included increasing taxable scale figures, scrapping the £8,500 earnings figure under which tax was not payable and taxing petrol given for private use.

The Prime Minister raised VAT to 15%, scrapped 100% first-year allowances for lessors and the concept of a writing down allowance was properly effected, based on a notional cost new of £8,000. A comparable restriction (rental disallowance) applied to leasing charges.

Bill Hill, chairman of the Association of Car Fleet Operators (ACFO), would later outline the Chancellor’s plans to tax the provision of fuel by companies for private motoring in his regular column for Fleet News.

However, it wasn’t until 1983 that scale charges were introduced to formalise and simplify the process of taxing fuel for private use.

1983 Clunk click with every trip

The law requiring all drivers to wear their seatbelts came into force in January 1983.

Car manufacturers had been required to install seatbelts since 1965, but the law requiring drivers to wear them did not come in to force for another 18 years.

Fleet News reported how soon after the law came into effect, 90% of car drivers and front-seat passengers were observed to be wearing seat belts.

These high rates of seat belt wearing in front-seats of cars have been sustained since that time.

When seatbelt wearing became compulsory for all rear-seat occupants in 1991, there was an immediate increase from 10% to 40% in observed seat belt wearing rates.

1985 Vauxhall grows market share

UK new car sales figures were dominated by Ford, but by 1985 a rapidly rising force – Vauxhall – was making inroads into its market-leading position.

Just three years before, in 1982, Fleet News reported Ford’s market share had topped 30%; by the end of 1984 that had fallen to less than 28%, while at the same time Vauxhall’s market share, driven by the Cavalier, had grown from less than 12% to more than 16%.

Meanwhile, Nissan revealed its plans for the British fleet market when it announced its Washington plant would open next year and the fleet market was a primary target.

1986 ‘From today not all petrol is the same’

Shell launched two new brands, Helix motor oil in 1985 and Formula Shell in 1986.

In the UK, Formula Shell was launched with the strapline ‘From today not all petrol is the same’.

However, Fleet News exclusively reported drivers who were using Shell’s ‘new formula’ petrol were complaining about ‘pinking’, also known as ‘knocking’, where combustion occurs where the cylinder is not in the correct position.

Damage to cars from the new fuel was also reported in Denmark, Norway and Malaysia.

It took Shell, in collaboration with motor manufacturers, more than a year to establish the cause of the problem, while Fleet News continued highlighting the plight of fleets who had suffered damage as a result of using the new fuel.

Fleet News finally won its lengthy battle on behalf of all fleets in 1988, when the oil giant finally withdrew the Formula Shell brand from a number of markets, including the UK.

1991 Lamont’s ‘budget for business’

The ‘budget for business’ was met with dismay by the fleet industry when Chancellor Norman Lamont announced another hike in company car taxes in 1991. Fleet News reported how he proposed increasing car scales again by 20%.

He also proposed that company cars and fuel should now become liable for Class 1A National Insurance Contributions, assessed according to the scale charges used for taxation, and VAT was increased from 15% to 17.5% – largely to pay for the abolition of the ‘Poll Tax’.

The leaders of the big four manufacturers – Ford, Vauxhall, Rover and Peugeot – warned that the measures could cost more than £1 billion in lost car sales.

They were proved right, with the UK was gripped by recession, the new car market crashed. Sales fell by almost half a million to 1,592,326 in one year.

The following year, Lamont’s budget tried to make amends by scrapping the banding system for benefit-in-kind tax on company cars.

Tax payable was determined not by reference to the value of the car but by its engine size. Lamont was reported saying: “As the Monopolies and Mergers Commission has pointed out, this causes distortions. It also discriminates against diesel cars.

"The unfairness in the current system may have been acceptable when the tax charge was only a fraction of the true value to the user, but that is no longer the case.”

1997 Rover 100 withdrawn after crash tests results

Fleet News published the first Euro NCAP crash tests in February 1997, sparking a political storm.

Until the birth of Euro NCAP, consumers had to rely on claims from manufacturers for how much protection a car would offer in a crash.

At an independent crash test laboratory, seven ‘super-mini’ cars were subjected to three different, exacting tests – a frontal impact at 64km/h (40mph), a side impact at 50km/h (31mph) and pedestrian safety tests.

Each test was scientifically-formulated, minutely monitored, filmed and analysed – and designed to represent actual accidents as closely as possible.

The seven cars were fitted with sophisticated crash test dummies to reveal what would really happen to adult passengers or the driver in a collision, and were initially scored out of a potential maximum of four stars.

Only the Ford Fiesta and Volkswagen Polo managed to achieve three stars based on protection levels offered to adult occupants.

The Fiat Punto, Nissan Micra, Opel/Vauxhall Corsa and Renault Clio achieved only two stars, while the top-selling Rover 100 achieved just one star and was later withdrawn from sale.

Volvo’s S40 became the first four-star car for occupant protection just five months later.

2000 Pump protests hit fuel supplies

By 2000, tax accounted for 81.5% of the total cost of unleaded petrol, up from 72.8% in 1993. Fuel prices in the UK had risen from being among the cheapest in Europe to being the most expensive in the same time frame.

The worldwide price of oil had trebled from $10 to $30 a barrel, the highest level in 10 years. Fleet News reported how drivers in the UK were now paying an average of 80ppl (pence per litre) for unleaded and 80.8ppl for diesel. The Government abandoned the fuel tax escalator early in the year.

In 1999, lorry drivers had protested in London against rising fuel prices and announced their intentions for a nationwide campaign.

In opposition, the Conservative Party joined the fray, organising the ‘Boycott the Pumps’ campaign, with motorists urged not to visit petrol stations on August 1.

Support for the day was reported to be patchy, but on September 8, the Stanlow Refinery near Ellesmere Port in Cheshire was blockaded by Farmers for Action. Over the next few days, pickets were reported at Milford Haven and an oil terminal at Avonmouth causing some petrol stations to run out of supplies.

The protests spread and by September 12, 3,000 petrol stations were reported to be closed due to a lack of fuel.

The protests fizzled out in a couple of days, but the Institute of Directors estimated that the protests had cost UK businesses £1 billion.

2002 CO2-based company car tax introduced

The Government first announced its intention to reform the company car tax system in order to help protect the environment in 1999.

Details revealing the new CO2-based system were announced in Budget 2000, but the new rules came into force in April 2002.

The company car tax system had been designed to provide financial incentives for employers and company car drivers to choose cars that produce lower CO2 emissions, and encourage car manufacturers to develop and introduce greener cars.

Fleet News reported how the Treasury was predicting the new tax regime would encourage 200,000 more employees to take company cars.

2003 Congestion charge hits fleet operations in London

Mayor of London Ken Livingstone introduced the congestion charge at £5 a day in February 2003 with the aim of reducing traffic congestion in and around the charging zone.

Fleet News reported how the congestion charge operators, Capita RAS, was fined £1 million for its poor performance in dealing with both drivers and equipment just eight months later.

2005 Fleet reprieve to taxation of contract hire

Fleets were given a last minute reprieve from major changes to taxation of contract hire that threatened to swamp them with paperwork.

Under the proposed changes in the Corporation Tax Review, instead of leasing companies claiming tax allowances on vehicles and passing the benefit on to drivers in the form of lower leasing costs, customers would have made the claims instead.

Although this would have guaranteed the fleet operators would receive the benefit of tax allowances directly, Fleet News reported it would have been at the expense of handling vast amounts of detailed paperwork.

In addition, monthly rentals would have increased as soon as the cushion of tax allowances was removed.

The BVRLA warned the result would have been ‘mayhem’ had the changes gone through.

2011 Plug-in grant launched

The electric vehicle (EV) subsidy was launched by the coalition Government after being announced by the previous administration.

The plug-in car grant reduced the up-front cost of eligible vehicles by up to 25%, capped at £5,000.

However, the money ring-fenced by Treasury for the first 15 months of the scheme was £43 million, making subsidies available for 8,600 qualifying cars.

This was far below the £230m – enough to subsidise the purchase of some 46,000 cars – the previous Government had earmarked for the three-year subsidy.

Fleet News reported the concerns ACFO director Stewart White had about the short-term nature of the grants commitment.

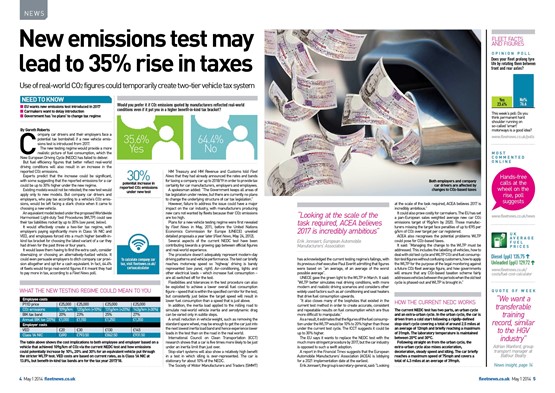

2014 Tax threat from new emissions test exposed

Fleet News was the first news outlet to suggest company car drivers and their employers faced a potential tax bombshell

if a new vehicle emissions test was introduced from 2017.

The Worldwide harmonized Light vehicle Test Procedure (WLTP) would provide a more realistic picture of fuel consumption, which the New European Driving Cycle (NEDC) had failed to deliver.

But figures that better reflect real-world driving conditions would also result in an increase in the reported CO2 emissions.

Experts predicted the increase could be significant, with some suggesting that the reported emissions for a car could be up to 30% higher under the new regime.

With company car tax and other vehicle taxes based on CO2 emissions, Fleet News urged the Government to address the threat it posed to fleet. Four years later and it is still waiting.

2015 Millions of vehicles affected by dieselgate scandal

After US regulators ordered Volkswagen to recall 500,000 diesel cars for being fitted with so-called defeat devices – software that disguises pollution levels during testing, more countries launched investigations into the German carmaker.

Fleet News would later report that nearly 1.2 million VW, Audi, Škoda and Seat models in the UK were affected by the emissions scandal – nearly 10% of those affected worldwide.

Volkswagen Group reported a €3.48 billion (£2.5bn) operating loss for the third quarter, and a €2.52bn (£1.8bn) pre-tax loss, thanks to the mounting cost of the scandal.

2016 Tax overhaul hits cash-takers

Fleet News exclusively revealed that cash-for-car schemes would be considered as part of the consultation on the future of salary sacrifice arrangements.

The UK tax authority had already come under fire for including cars obtained through salary sacrifice schemes in the consultation on potential tax changes.

However, now HMRC was casting its net much wider than first thought, with the changes targeting thousands more in receipt of a cash allowance.

2017 Plans revealed to improve air quality

Fleet News reported how a central pillar of Defra’s air quality plan was a ban on the sale of new conventional petrol diesel engines. It also put the burden on local authorities to tackle the causes of air pollution, with the plan saying they should consider a wide range of options so they can deliver reduced emissions in a way that best meets the needs of their communities and local businesses.

However, if these measures are not sufficient, local plans could include access restrictions on vehicles, such as charging zones or measures to prevent certain vehicles using particular roads at particular times.

Mike Hawes chief executive of industry group the Society of Motor Manufacturers and Traders (SMMT), told Fleet News the UK’s automotive sector could be undermined if Government doesn’t allow enough time for the industry to adjust.

2018 Record revenues for HMRC

Analysis of HMRC figures by Fleet News highlighted how the Government is raising record revenues from the company car market.

It showed that the amount of cash collected by the Treasury in company car tax has increased by more than 24% year-on-year – some £360 million. However, the number of employees receiving the benefit fell by 20,000 over the same period.

The amount of national insurance contributions (NICs) paid by employers on company cars also increased. Employers paid £630m in 2016/17, compared to £600m the previous year.

What else was happening in 1978?

In the news

- In a controversial speech, the then opposition leader Margaret Thatcher said that many Britons feared being “swamped by people with a different culture”.

- Anna Ford became the first female newsreader on ITN.

- The Conservative Party hired Saatchi & Saatchi to improve its image.

- The State Earnings-Related Pension Scheme (SERPS) was introduced.

- May Day became a bank holiday for the first time.

- Louise Brown, the world’s first IVF baby, was born.

- Georgi Markov, a Bulgarian dissident, was murdered in London with an umbrella that carried a poison pellet.

- Motability was founded and Chrysler sold its European operations, including former Rootes Group factories, to Peugeot.

At the cinema

- Oscar for best picture went to Woody Allen’s Annie Hall though the film that scooped most awards, with six, was the original Star Wars.

- Other major releases that year included the Christopher Reeve version of Superman and the much-lauded The Deer Hunter.

- In March Saturday Night Fever was released in the UK. The other John Travolta movie hit, Grease, was released later the same year. Singles from the soundtracks of these two dominated the music charts with six of the top 20 selling singles for the year.

On TV

- We saw the start of Top Gear on BBC2 and All Creatures Great and Small and Blake’s 7 on BBC1; on

- ITV the last episodes of The Sweeney and Rising Damp were screened. BBC viewers saw the first episode of Grange Hill, which would run for 30 years.

In fashion

- Platform shoes and flared trousers were all the rage for women, while men were sporting afro and mullet hairstyles.

In entertainment

- Night Fever by the Bee Gees was the second biggest-selling single of the year although younger Gibb brother, Andy, outsold them with Shadow Dancing. Among other iconic singles from the year was Wuthering Heights by Kate Bush.

- Perhaps unsurprisingly, the biggest albums of the year were from films Saturday Night Fever and Grease, topping the charts for a combined 31 weeks.

- The Sex Pistols played their last gig together.

- Who drummer Keith Moon died.

- Evita was staged for the first time in London and on BBC Radio 4 The Hitchhiker’s Guide to the Galaxy began airing.

In sport

- In football, hosts Argentina beat Holland 3-1 (after extra time) in the World Cup Final. Liverpool beat Brugge 1-0 with a Kenny (now Sir Kenny) Dalglish goal. Nottingham Forest were First Division champions and Ipswich Town won the FA Cup (after narrowly beating Bristol Rovers in a 5th round replay – editor’s first match as a spectator!).

- Boxing saw Leon Spinks take the world heavyweight crown off Muhammed Ali before losing it back to him later in the year, making Ali the first boxer to win the title for a third time.

- In golf, Jack Nicklaus won The Open and great friend and rival Gary Player won The Masters.

- Formula 1 champion was Mario Andretti (the last American to do so) with Lotus team-mate Ronnie Peterson second and Carlos Reutemann third. Peterson died during the championship after a crash at the Italian Grand Prix.

1978 costs

- Averages for the London area with today’s money equivalent in brackets.

- House price: £17,288 (£97,159); today £430,749

- Salary £3,269 (£18,372); today £34,473

- Car price £2,760 (£15,511); today £20,000

- Litre of fuel £0.17 (£0.95); today £1.23

Login to comment

Comments

No comments have been made yet.