This feature originally appeared in the October 2020 edition of Fleet News. Read the digital issue of the magazine.

New technologies and products often arrive accompanied by a massive fanfare and claims they will transform people’s lives, only to later disappear from sight without making any impact at all.

This hype is something that also surrounds the mobility sector, with technologies such as autonomous vehicles and mobility as a service (MaaS) often talked about as being able to revolutionise transport.

But what is the truth? Is this revolution really happening and, if so, when? And what technologies are nearer mainstream availability than others?

These are among the questions the annual Hype Cycle for Connected Vehicles and Smart Mobility report, produced by global technology consultancy Gartner, aims to answer.

This year’s study was prepared under the shadow of the Covid-19 pandemic, which has been a “major curveball”, says Pedro Pacheco, senior director analyst at Gartner.

“When you are in a period when no unforeseen factors come into play, it is obviously a lot easier to predict what’s going to happen in the future from a technology perspective,” he adds.

“Covid-19 made us think even harder than before and we had to look at how it would affect mobility as a whole. How is it going to affect the financial situation of carmakers and tech companies involved in mobility? How is it going to affect the technology they are developing?

“These are things we had to embed into the development of this hype cycle.”

Changing societal trends

The report says some technologies, such as those related to connectivity, were largely unchanged, although economic uncertainty and changing societal trends may accelerate or decelerate the movement of these innovations over the next several years.

However, some technologies such as MaaS have been affected in a “profound way” by the pandemic.

“The number of people working from home has become – and is expected to remain – much larger than in the past,” says Pacheco.

“This means the mobility needs will change, especially in cities, because if you have a considerable amount of people either staying at home or going into their workplaces more sporadically, maybe once a week or every now and then, then it becomes less about mass transportation and more about on-demand transportation.

“It’s not that MaaS per se will necessarily suffer greatly with a new normal because there will still be the need for a digital platform that enables each individual to go from A to B as effortlessly as possible with a seamless interconnection of means of transportation, it’s just that this formula will have to be adapted to a new reality.”

The adoption of MaaS has been growing with several cities, including Berlin, embracing it, although Covid-19 is heavily impacting passenger volume on public transport and taxi or ride-hailing because of a fear of infection.

“This can slow down the adoption of MaaS solutions in the near future,” says Gartner, which recommends MaaS developers strengthen their offerings in the field of shared mobility, including shared cars, e-scooters and bicycles.

It also recommends city planners adopt MaaS models to reduce road traffic and emissions, but warns that evidence suggests ride-hailing companies such as Uber and Lyft have reduced the use of public transport and increased the number of miles driven on city streets.

“Such situations undermine some of the advantages brought by MaaS, hence there needs to be a more holistic management of its overall efficiency,” says Gartner.

The report also says MaaS developers should consider new ways to monetise their products, such as through goods delivery and advertising.

It will be five to 10 years before there is mainstream adoption of the technology, says Gartner. It defines ‘mainstream’ as when around 20% of a target audience has adopted or is adopting it.

As part of its hype cycle, the consultancy places technologies into one of five zones (see full key), each defining where a product is in terms of development and commercialisation.

This begins with the Innovation Trigger, before progressing through the Peak of Inflated Expectations, the Trough of Disillusionment and the Slope of Enlightenment, before reaching the Plateau of Productivity where technology reaches the mainstream. MaaS falls into the Trough of Disillusionment, which includes “technology which does not live up to its overinflated expectations” so that it “rapidly becomes unfashionable”.

Also in the Trough of Disillusionment are autonomous vehicles, with Gartner predicting it will be more than 10 years before the technology becomes mainstream.

“In the recent past there were basically lots of promises that in many cases weren’t fulfilled, or at least within the initially set deadlines,” says Pacheco.

“But Covid-19 is adding another aspect of complexity. Car manufacturers and associated suppliers are having a difficult time from a financial standpoint which means they need to reprioritise their investments.

“Autonomous vehicles are definitely still on the radar for them, but the timelines seem to be extending. The tendency is to invest more on the low-hanging fruits and put money into areas where companies can recover it faster, such as vehicle connectivity or connected services. Also, in Europe, electrification is a priority because there is regulation pushing carmakers to go flat out in this area.”

Recent events which have pushed autonomous driving into the Trough of Disillusionment have included Continental delaying its investments in the technology, autonomous truck company Starsky Robotics and self-driving start-up Drive.ai failing, while Audi abandoned plans to introduce the Level 3 traffic jam pilot feature into its A8, which it had originally announced in 2017.

Increased investment

However, tech companies which have seen their revenues less affected by Covid-19 have increased investment in this area. “The likes of Apple and Amazon have bought companies in the autonomous driving sector,” says Pacheco. “Also Intel, which has plans to set up a robo taxi service by 2022. It is still committed to that timeline and basically those companies whose financial situations are more comfortable at the moment are perhaps in a better position to stick to their initial timelines.”

Autonomous vehicle pilots and trials have continued to be undertaken during the pandemic, though most are still supported by safety drivers.

Gartner says continuing advances in sensing, positioning, imaging, guidance, mapping and communications technologies, combined with AI algorithms and high-performance computing capabilities, are bringing the autonomous vehicle closer to reality, but it still faces major challenges.

These focus on reducing cost, though increasingly the key challenges are regulatory, legal and societal considerations, such as permits for operation, insurance and the effects of human interaction.

The hype cycle identifies connected car platforms as the mobility technology closest to mainstream adoption, saying this will happen in under two years.

“There are several OEMs currently working with large technology and telecommunication operators to deploy cloud-connected vehicle platforms, and most automakers have their own connected car platforms,” says the report.

These OEM-owned platforms are evolving and merging with services offered by large cloud operators, such as Microsoft Azure. Amazon Web Services, Alphabet and IBM. “The technology companies are supplying the underlying computer power, artificial intelligence, machine learning and cloud storage for connected vehicle data,” says the report. “The cloud platform is also a way to build a digital ecosystem around the connected car, which is an important evolution for the vehicle.”

The report says the technology has a potentially high business impact as the availability of cloud-connected vehicle platforms will allow OEMs to focus on creating vehicle and driving experiences.

They will also further enable the role of OEMs in integrating consumers, dealers, repair and service, and aftermarket services, as well as building up automotive data marketplaces for selling data to third parties. Gartner describes the technology as transformational (see Priority Matrix below) which it defines as enabling new ways of doing business across industries that will result in major shifts in industry dynamics.

Other transformational technologies

Other technologies the report describes as transformational are electric vehicles and vehicle-to-vehicle (V2V) communications.

V2V – the wireless transmission of data via dedicated short-range communications (DSRC) or cellular vehicle-to-everything (C-V2X) – is slipping into the Trough of Disillusionment partly because vehicle makers continue to lack direction from a regulatory standpoint, says Gartner.

“V2V communications can play a crucial role in improving traffic safety and flow by allowing vehicles in transit to send data about vehicle position, road conditions and traffic conditions to one another,” adds the report. “Drivers may receive a warning or the vehicle itself may take pre-emptive actions, such as braking in an automated way.”

The report says V2V will become mainstream in five to 10 years’ time, although its future technological evolution has yet to gain consensus as the DRSC and C-V2X systems are not compatible, creating confusion over “which technology will win”.

Ford Motor Company said it plans to deploy C-V2X in all new US vehicle models from 2022, while last year Volkswagen announced its Golf will have DCRC-based technology, making it the first mass market vehicle to be so equipped.

“The lack of consensus may lead to a hybrid approach in some markets to ensure maximum interoperability among vehicles and infrastructure, with DSRC or C-V2X being sold in parallel, depending on OEM decisions,” says Gartner.

“China will likely establish C-V2X as its technology for V2V, creating an important global shift that may well tip the scales in favour of C-V2X over the long term.”

HYPE CYCLE PHASES

Innovation Trigger

A breakthrough, public demonstration, product launch or other event generates significant interest.

Peak of Inflated Expectations

During this phase of over-enthusiasm and unrealistic projections, a flurry of well-publicised activity by technology leaders results in some successes, but more failures, as the technology is pushed to its limits.

Trough of Disillusionment

Because the technology does not live up to overinflated expectations, it rapidly becomes unfashionable. Media interest wanes, except for a few cautionary tales.

Slope of Enlightenment

Focused experimentation and solid hard work by an increasingly diverse range of organisations lead to a true understanding of the technology’s applicability, risks and benefits. Commercial off-the-shelf methodologies and tools ease the development process.

Plateau of productivity

Real-world benefits are demonstrated and accepted. Tools and methodologies are increasingly stable as they enter their second and third generations. More organisations feel comfortable with a reduced level of risk; the rapid growth phase of adoption begins. Approximately 20% of the target audience has adopted or is adopting the technology as it enters this phase.

Rating the impact

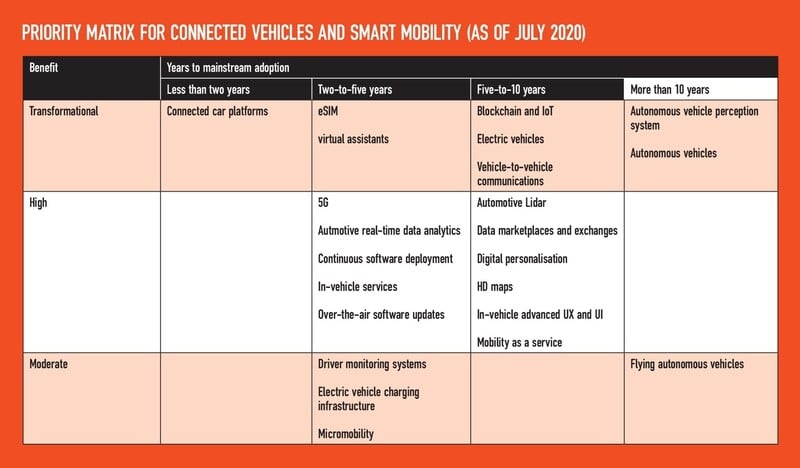

Gartner also produces a priority matrix for connected vehicles and smart mobility which rates the technologies on the impact they will have on the sector.

Its study says many of the most powerful changes expected in the auto industry will happen in the next two-to-five years.

“A significant number of technologies are in the Trough of Disillusionment, and their expected maturity isn’t far off,” says the report.

“Over the next five years or so, many technologies on this hype cycle will become productive parts of the automotive and smart mobility ecosystem, leading to new capabilities and increased value for both consumers and commercial owners.”

The matrix ranks the expected levels of benefit of the technologies as:

- Transformational. These enable new ways of doing business across industries that will result in major shifts in industry dynamics.

- High. These enable new ways of performing horizontal or vertical processes that will result in significantly increased revenue or cost savings for an enterprise.

- Moderate. These provide incremental improvements to established processes that will result in increased revenue or cost savings for an enterprise.

The transformational technologies with near-term maturity include connected car platforms, virtual assistants and embedded SIM (eSIM).

The majority of high-benefit technologies, including 5G, automotive real-time data and over-the-air software updates will also mature in usage over the next five years.

Longer term, electric vehicle technologies and autonomous vehicle technologies will dominate the transformation of the auto industry, says Gartner.

Login to comment

Comments

No comments have been made yet.