Author: Andy Picton, chief commercial vehicle editor, Glass’s (pictured)

Author: Andy Picton, chief commercial vehicle editor, Glass’s (pictured)

December is recognised as a quieter registration month, but with delayed pipeline orders now being delivered, the month proved stronger than expected. Registration data from the SMMT indicates the LCV market declined just 1% in December.

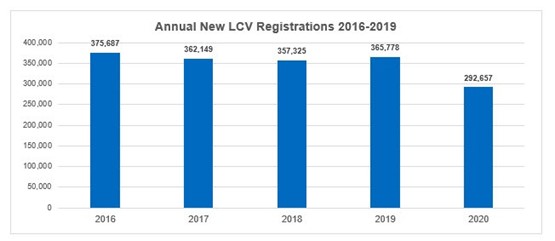

The 27,283 vehicles registered brought the total year-end volume for 2020 up to 292,657 units compared to 365,778 units in 2019, a deficit of 20%.

However, this result did allow LCV registrations for 2020 to exceed the quarter four SMMT forecast of 288,000 units.

In what has been an extraordinary and testing year for the commercial vehicle sector, with the backdrop of countrywide lockdowns, social distancing measures, redundancies, Brexit and the year-long concern of looming no-deal vehicle tariffs has all affected LCV demand during 2020.

The December segment breakdown reveals a 7.3% registration increase in vans between 2.5-3.5 tonnes sector was the only bright light.

Registrations for vans under 2.0 tonnes and vans between 2.0-2.5 tonnes declined by 17.7% and 2.6% respectively.

Unsettling times for the Pickup sector continue, with December registrations declining a further 29.9%.

Pickup registrations for the full year were 35,691 units, down 32.7% on the 53,055 total in 2019.

Top five LCV registrations

Throughout 2020 the pandemic affected the whole UK economy and will continue to do so into 2021.

Although a Brexit deal with Europe is now agreed, clarity over UK-EU trading relations coupled to the rollout of vaccinations is paramount to driving recovery and offering hope to both the van industry and the economy as a whole.

December used light commercial vehicle (LCV) overview

The first half of December remained busy with auction houses confirming high levels of online sale activity with healthy conversion rates.

In the run-up towards Christmas, the number of sales reduced but performance remained strong.

Prices held steady in the majority of sectors with high bids continuing for retail-ready stock in the busy home delivery run-up to Christmas.

Some dealers took this as an opportunity to stock up on additional vehicles ahead of a possible shortage of quality stock, driven by adverse effects on the supply chain due to further lockdowns and the implications of a Brexit ‘no deal’.

Although sales at auction in December decreased compared to December 2019, conversion rates over the period increased by 3.9%.

At the same time, Euro 5 stock made up over 60% of sales, highlighting the shortage of quality later year stock in the marketplace.

As we move through another period of lockdown, the outlook suggests further stock shortages through the first quarter of 2021.

Demand for home delivery shows little sign of abating and as a result, prices in most sectors look set to remain high.

December in detail

Glass’s auction data shows the overall number of LCV sales in December declined by 33.3% versus November 2020 and by 4.6% over the past twelve months.

First-time conversions decreased 1.8% on the previous month, with the 4x4 sector again most heavily affected.

December also saw average sales prices increase by 5.2% versus November and were 11% higher than the same point last year - the third highest in the last twelve months.

The average age of sold stock decreased from 73.5 months in November to 72 months in December and was 2.1 months younger than the same point last year.

In line with sales of younger vehicles, average mileages also decreased from 78,205 miles in November to 78,005 miles in December.

However, December’s average mileage is 560 miles higher than at the same point last year.

Glass’s continues to monitor the LCV market closely and has an open dialogue with auction houses, manufacturers, leasing and rental companies, independent traders and dealers as well as the main industry bodies.

This information, combined with the wealth of knowledge in our CV team ensures Glass’s valuations remain relevant in the market place.

Login to comment

Comments

No comments have been made yet.