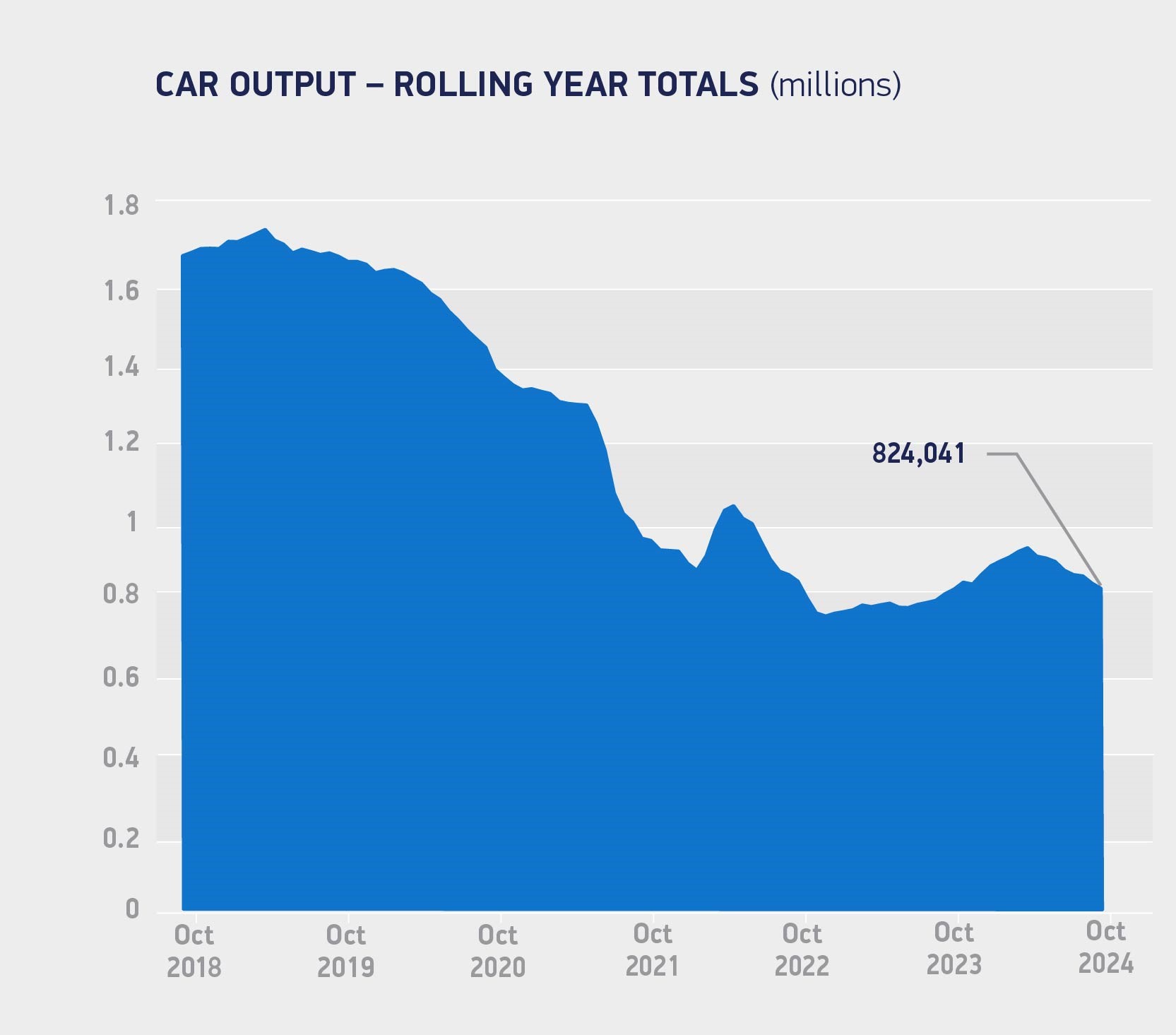

UK car and light van production expectations have been downgraded for this year and next.

New analysis suggests factories will produce 911,000 vehicles this year, and 839,000 in 2025, around a third less than the near 1.4 million cars and light vans made in 2019, pre-Covid.

If planned UK zero emission model launches stay on track and consumer demand for electric vehicles (EVs) improves, the Society of Motor Manufacturers and Traders (SMMT) believes that there is potential to get above one million units in 2028.

If not, the SMMT predicts that output will remain below one million units until 2030, and drop to fewer than 750,000, in a worst-case scenario, should plants close and there are reduced model lineups.

This, it says, would have a devastating effect on the sector, jobs and economic growth.

The analysis follows a series of announcements by manufacturers and suppliers, in the UK and Europe, reflecting challenging market conditions and a slowdown in the transition to electrification.

In the UK, Ford announced it was cutting 800 jobs over the next three years, with 4,000 roles being lost across Europe, due to weak demand for EVs.

Stellantis has also announced plans to consolidate its electric van production in the UK at its Ellesmere Port plant, closing its factory in Luton and putting 1,100 jobs at risk.

The owner of four van brands, Vauxhall, Citroen, Peugeot and Fiat, blamed the UK’s zero emission vehicle (ZEV) mandate.

It requires more than a fifth (22%) of cars and 10% of vans sold by manufacturers in the UK to be fully electric vehicles (EVs) this year.

The Government says it will launch a 'fast track' consultation on EV sales targets in the ZEV mandate after mounting pressure from the auto industry.

Mike Hawes, SMMT chief executive, said: “These are deeply concerning times for the automotive industry, with massive investments in plants and new zero emission products under intense pressure.

“Slowdowns in the global market – especially for EVs – are impacting production output, with the situation in the UK particularly acute given we have arguably the toughest targets and most accelerated timeline but without the consumer incentives necessary to drive demand.

“The cost of stimulating that demand and complying with those targets is huge and, as we are seeing, unsustainable.

“Urgent action is therefore needed, and we will work with Government on its rapid review of the regulation and the development of an ambitious and comprehensive Industrial Strategy to assure our competitiveness.”

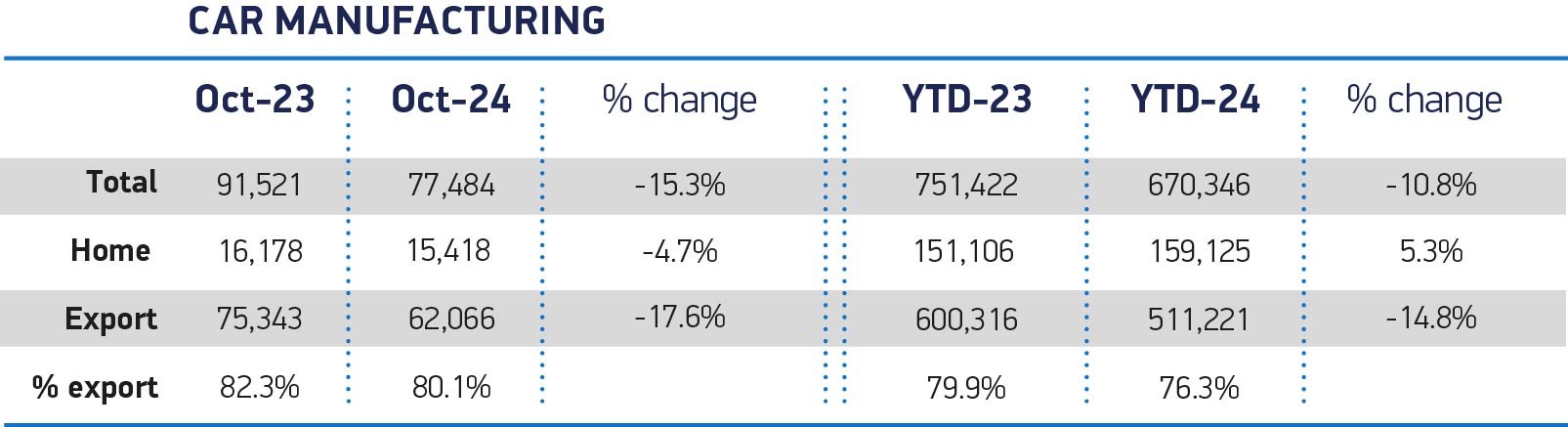

UK car manufacturing output fell 15.3% in October, the eighth consecutive month of decline, according to the latest figures SMMT.

Some 77,484 units left UK factories, 14,037 fewer than in the same month last year, with plants continuing their retooling to enable production of the next generation of zero emission vehicles.

The new data also shows that 24,719 battery electric, plug-in hybrid and hybrid electric cars were made, representing almost a third (31.9%) of output, despite a volume decline of 32.6%.

Since January, UK car makers have now turned out a combined 239,773 electrified vehicles, with 71.8% of them exported to global markets.

Overall, volumes for both domestic and export markets declined in October, down 4.7% and 17.6% respectively, with eight-in-10 cars shipped abroad and more than half of these (32,170 units) heading into the EU, although total volumes fell by 34.6%.

Exports to the next largest market, the US, meanwhile, surged 96.2% to 14,584 units, thanks to increasing shipments of the UK’s luxury and premium models.

In the year to date, UK car production has now slipped 10.8% to 670,346 units, due primarily to falling exports.

While production for the UK is up 5.3% to 159,125 units, exports are down 14.8% to 511,221 units, equivalent to 89,095 fewer cars being shipped overseas in the first ten months.

Login to comment

Comments

No comments have been made yet.