The Chancellor is being urged to reconsider plans to tax double cab pick-ups as cars for benefit in kind (BIK) and capital allowances purposes after April 2025.

The automotive trade body, the Society of Motor Manufacturers and Traders (SMMT), says that the tax change will add further cost pressures to businesses that rely on these vehicles, such as construction, farming, utilities and the self-employed.

Given the impact this would have on the market and these sectors in particular, the SMMT is urging the Government to instead uphold HMRC’s decision of February this year, to avoid damaging growth prospects.

The previous Government initially announced it was also going to treat double cab pick-ups as company cars, before performing a spectacular U-turn days later.

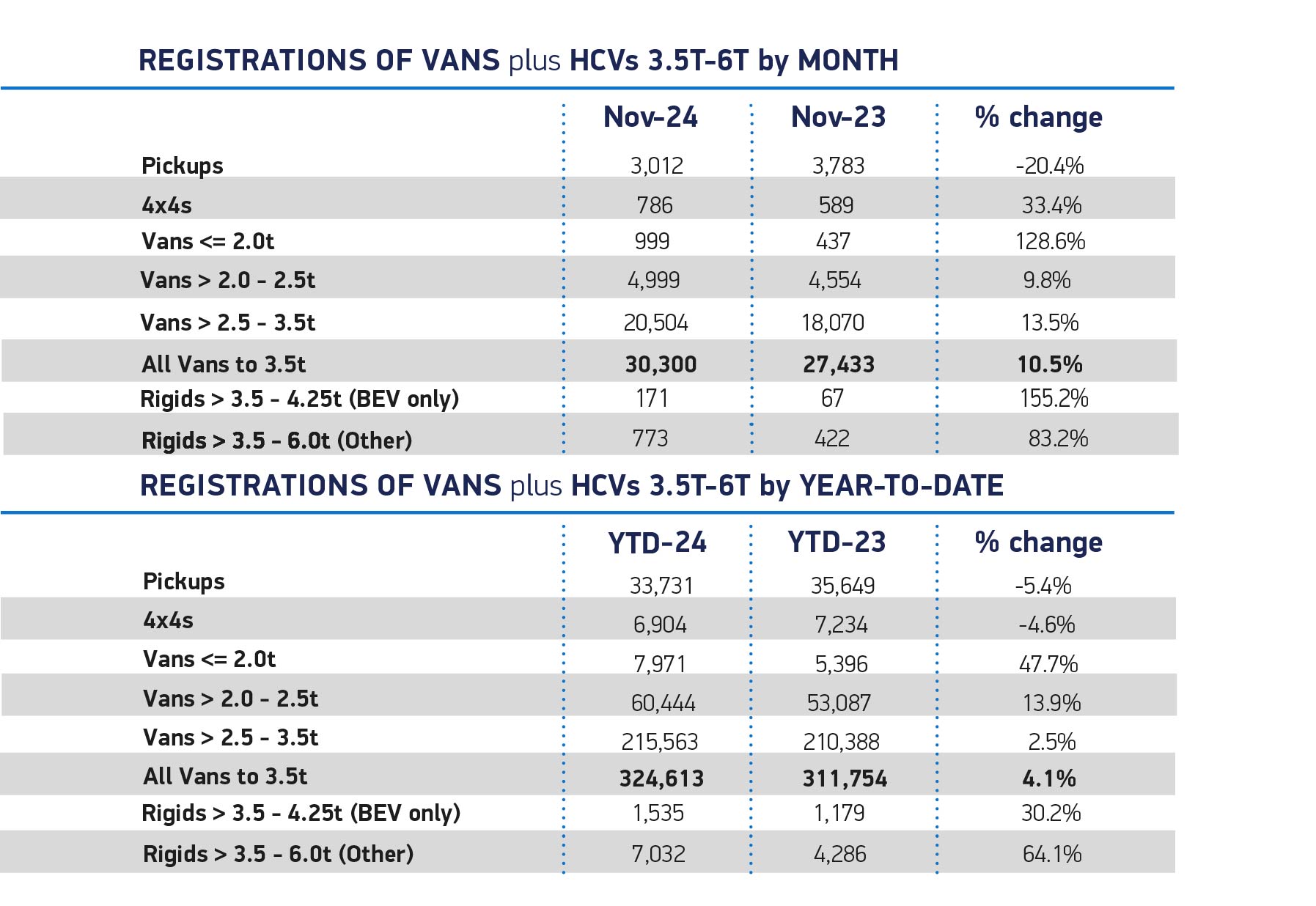

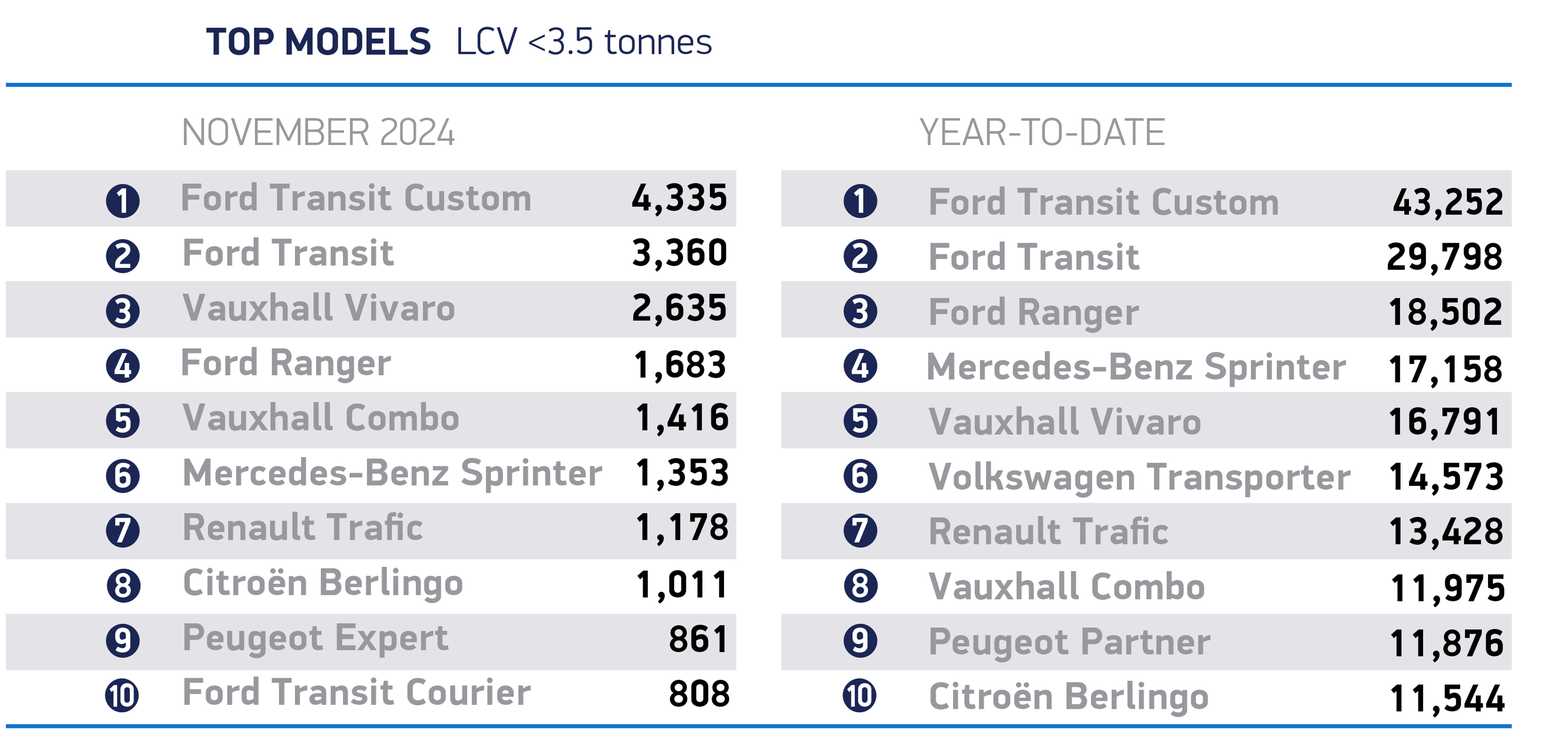

New data, for November light commercial vehicle (LCV) registrations in November, show that pick-up registrations fell by 20.4% to 3,012 units.

The SMMT says that, while uptake has been in decline across the year, last month’s Budget has put that segment in further danger.

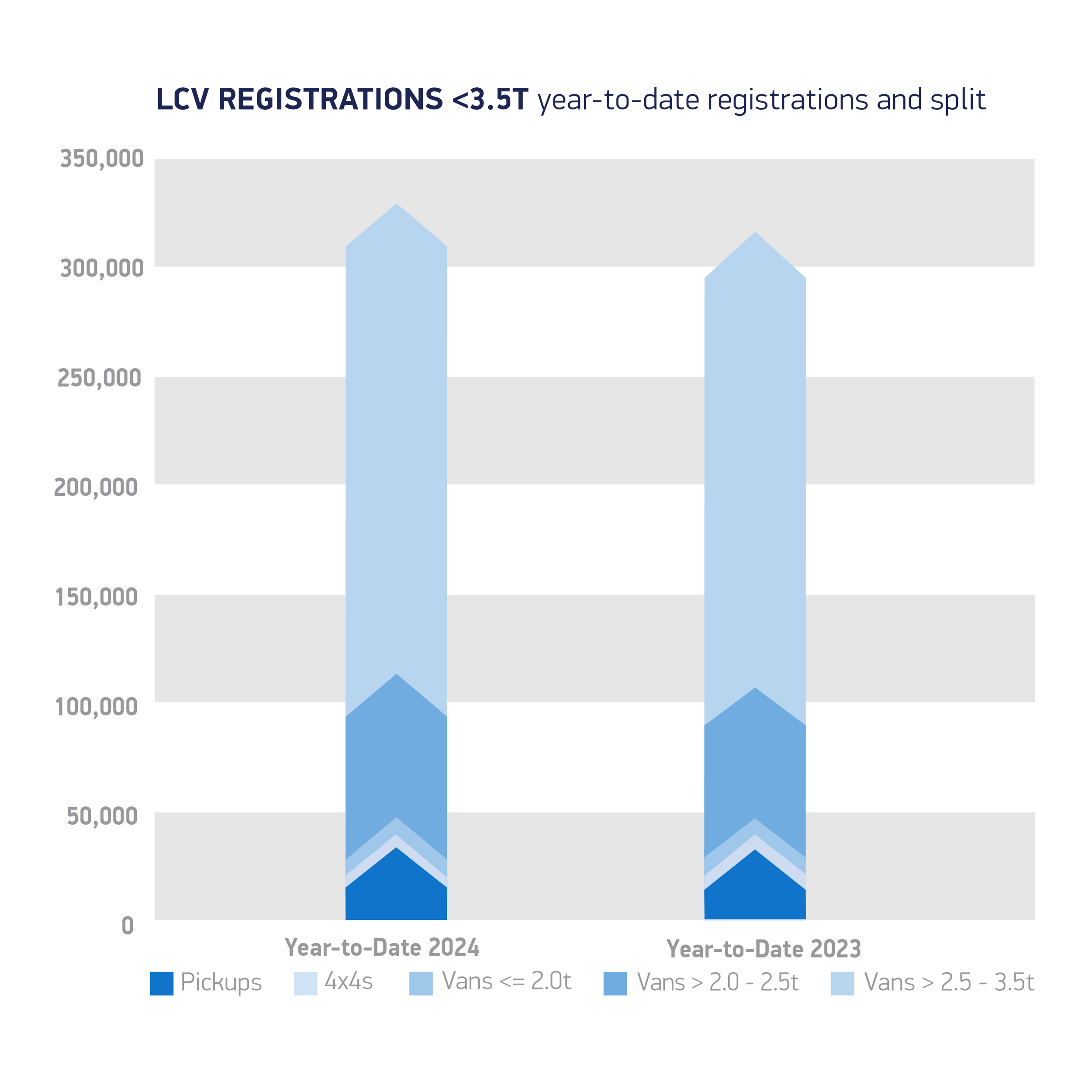

Looking at all vehicle types, the new LCV market recorded its fourth consecutive month of growth as registrations rose by 10.5% in November.

With 30,300 new vans, pick-ups and 4x4s registered, it was the second biggest November in history for the market.

Growth was recorded across all van weight classes, with small van volumes up 128.6% to 999 units, medium vans rising by 9.8% to 4,999 units, while large vans saw volumes increase by 13.5% with 20,504 reaching the road.

Registrations of 4x4s also saw a boost, up by 33.4% to 786 units.

Electric van market share down on 2023

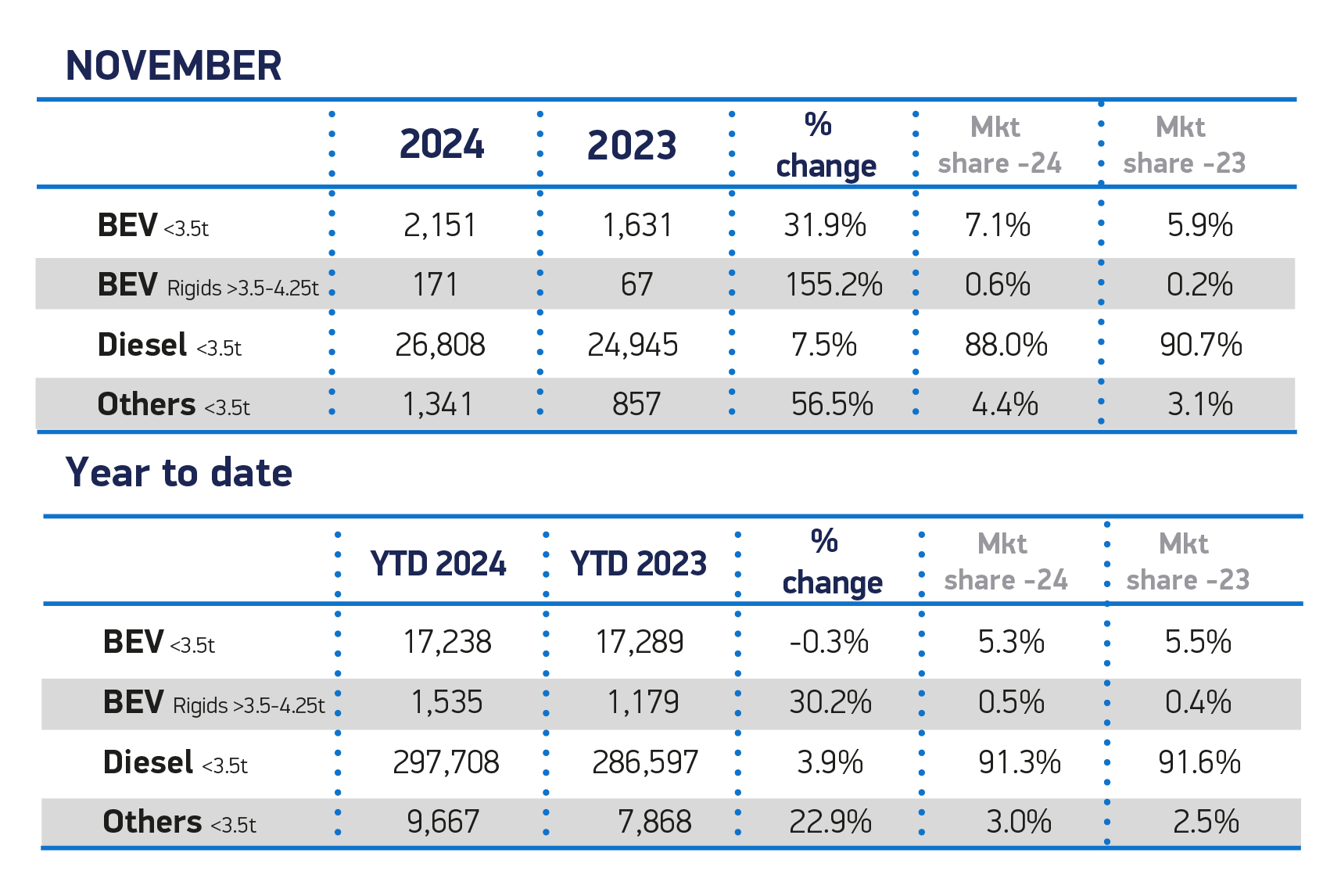

Electric van uptake grew for the second consecutive month after four months of decline, rising by more than a third (36.7%) to 2,322 units, in part supported by the plug-in van grant, which will now continue for the next financial year.

Market share also rose, from 6.1% to 7.7%. However, Government has mandated that 10% of each brand’s new van registrations must be zero emission this year and year-to-date market share has reversed compared with 2023, down from 5.9% to 5.8%.

With no obvious plan for a national network of van-specific charge points, the SMMT says that companies and traders continue to lack the confidence to switch in greater volumes.

The latest market outlook expects volume growth of more than 85% in 2025 – but this would still leave the BEV share of the market at just 10.6% next year against a mandated target of 16%.

As the year draws to a close, concerns over the impact of the zero emission vehicle (ZEV) mandate on buyer choice, volume delivery and UK industrial competitiveness are mounting.

The Government’s decision to review the regulation has, therefore, been welcomed by industry which remains committed to delivering decarbonisation against the current market realities.

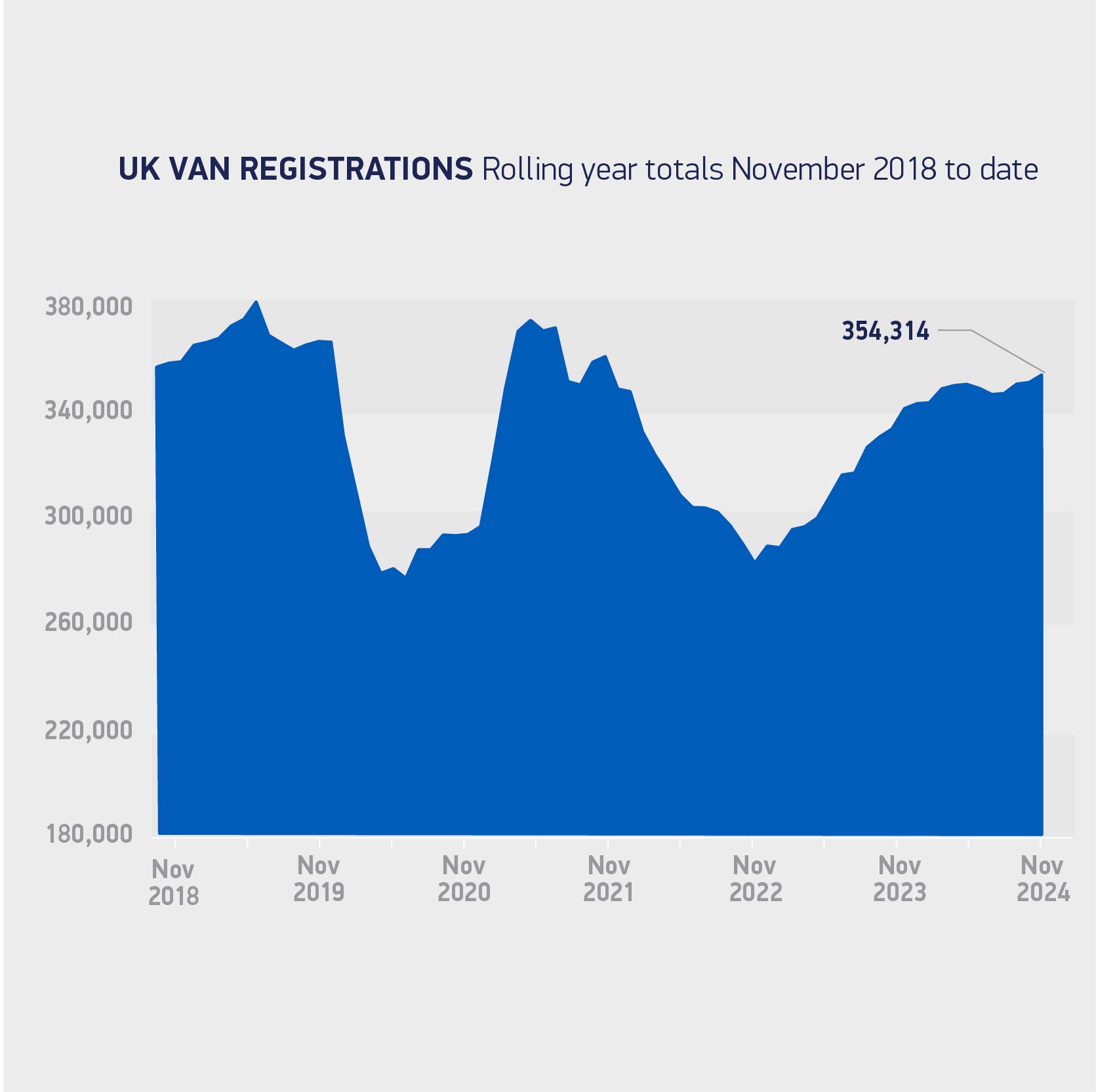

SMMT chief executive, Mike Hawes, said: “The UK light commercial vehicle market continues to build back after a challenging start to the year, delivering the best performance since 2021 and the unleashing of pent-up demand.

“Britain’s appetite for zero emission vans continues to lag behind government ambition, however, and market share this year is heading in the wrong direction.

“With warnings over UK competitiveness now translating into tangible impacts, a fast-tracked review of market regulation is essential to ensure manufacturers can deliver the choice, growth and decarbonisation the nation needs.”

Login to comment

Comments

No comments have been made yet.