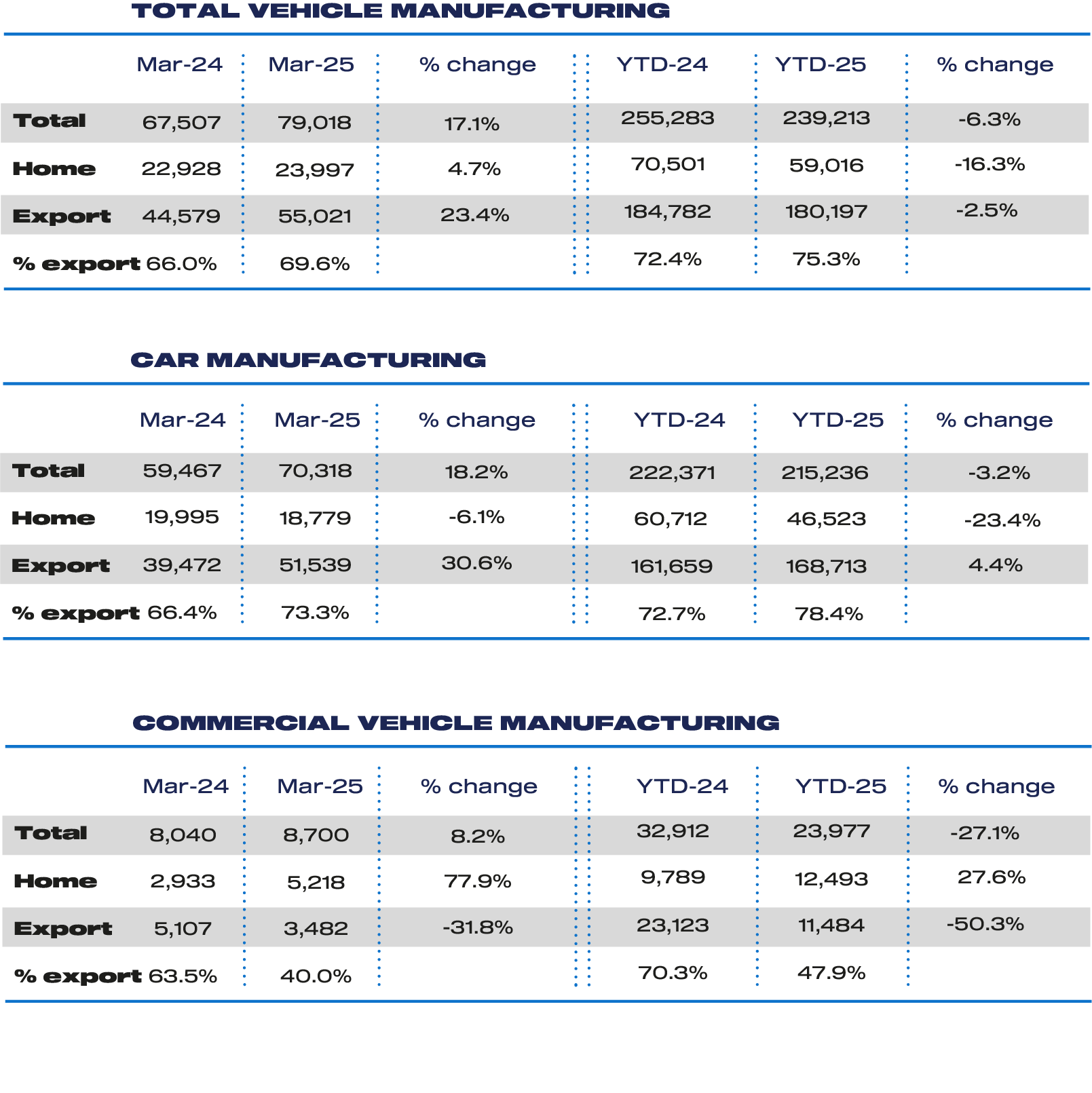

UK production of cars, vans, trucks, taxis, buses and coaches increased by 17.1% to almost 80,000 units last month, when compared to March 2024.

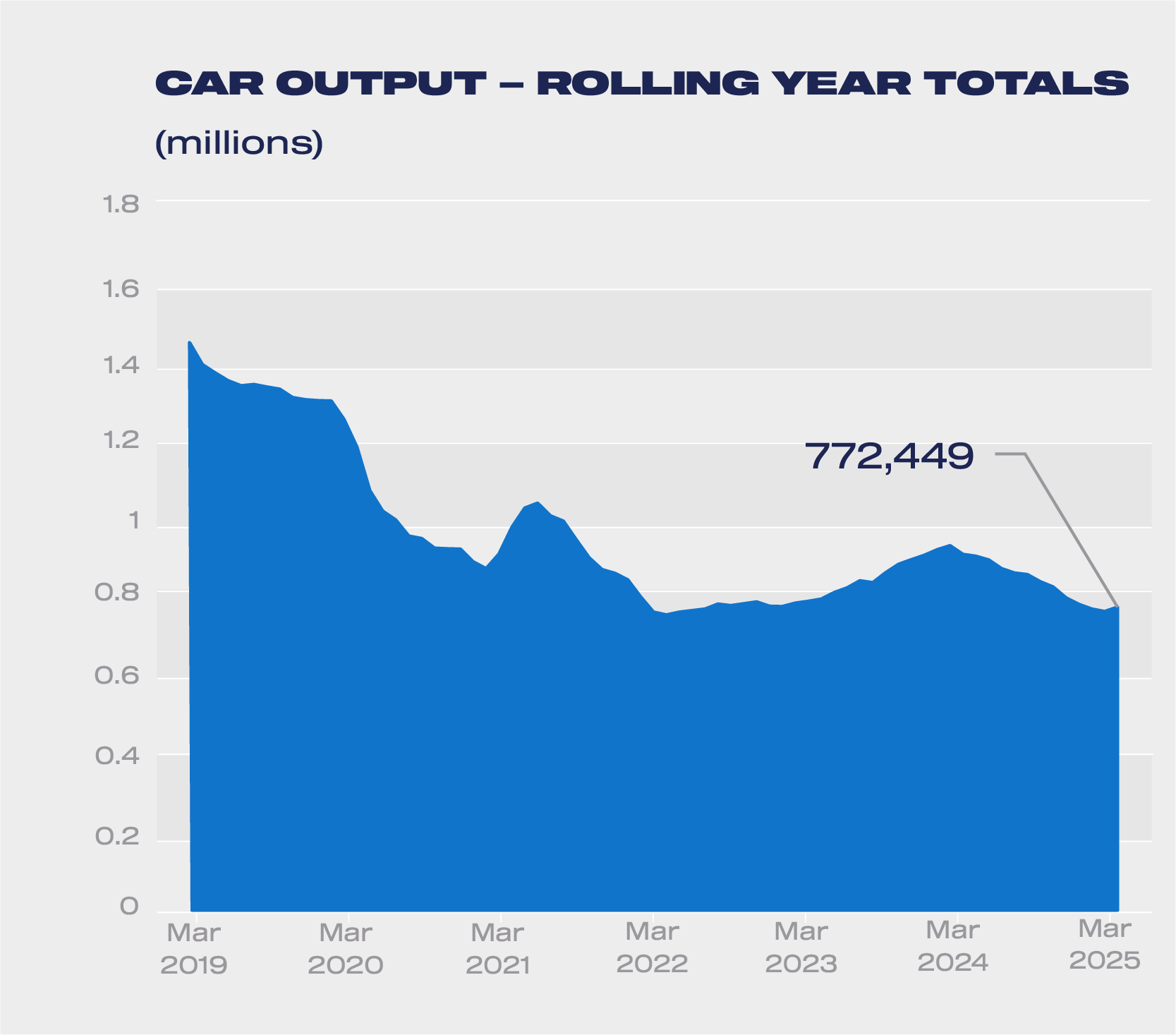

Car manufacturing grew for the first time in 12 months, driven by robust export demand that increased by 30.6%, with almost three quarters (73.3%) of output shipped overseas.

However, the new figures, published by the Society of Motor Manufacturers and Traders (SMMT), show that production for the UK market fell by 6.1%.

The EU continued to be the largest destination for UK car exports, accounting for 57.2% of all shipments.

Ahead of the introduction of new tariffs, the US remained the second largest export market, comprising 15% of exports, followed by China (8.5%), Turkey (2.7%) and Japan (2.6%).

Exports to all top five markets rose for the month, with the EU up by 28.9%, the US 36.1%, China 86%, Turkey 272.1% and Japan 91.8%.

Electrified vehicle production also rose, by 38.5% – more than twice the rate of total production – to 31,661 units, to account for almost half of all UK car output (45%).

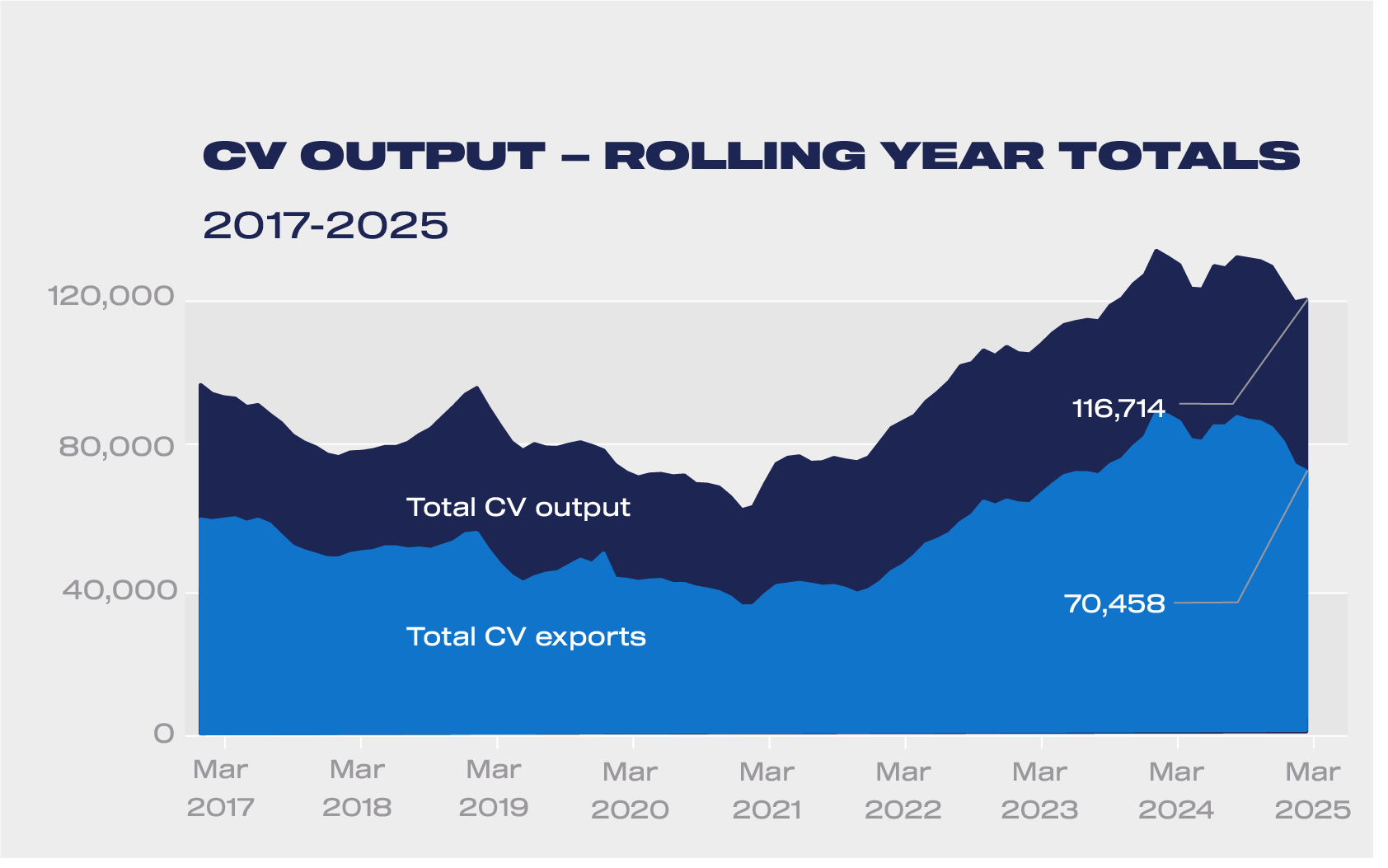

Commercial vehicle (CV) production also rose in March, up by 8.2% to 8,700 units, in comparison with a weak March last year, when volumes were constrained by both Easter timing, and a softening of output following 2023’s post-Covid pent-up demand.

As in previous months, CV growth was driven by domestic demand, which rose by 77.9% to 5,218 units.

Conversely, exports fell by almost a third (31.8%) to comprise just 40% of output.

The EU remains the sector’s largest market by far, accounting for 94.2% of exports in the month.

UK car production for Q1 2025 was down slightly, by 3.2%, but with exports up 4.4%.

CV output, meanwhile, was down a more significant 27.1%, and exports down by 50.3%.

The SMMT says that, given the figures reflect the level of demand ahead of the announcements of new US tariffs, manufacturers face considerable uncertainty heading into quarter two as US demand likely weakens with knock on effects on other markets and the supply chains.

Trade discussions must continue at pace to reach a deal that supports jobs, demand and growth on both sides of the Atlantic, it added.

It argues that increased protectionism and retaliatory tariffs being levied in key markets mean a rapid response from Government is needed, given the immediate challenges facing the industry’s exports.

Mike Hawes, SMMT chief executive, said: “A March uplift to manufacturing is overdue good news, although the performance was boosted by a comparatively weaker month last year, when holiday timings and product changeovers combined to reduce output.

“With the last quarter showing demand for British-built cars rising overseas, navigating the new era of trade uncertainty is now the major challenge.

“Government has rightly recognised automotive manufacturing’s critical role in Britain’s export economy and must now show urgency and creativity to deliver a deal that supports our competitiveness, spurs domestic demand for the latest cleanest vehicles, and helps factory lines flourish.”

The latest independent outlook – compiled ahead of rapidly changing trading conditions with the US - estimates that light vehicle production will fall 7.8% in 2025 to 818,200 units, before rising slightly by 1.2% in 2026 to 827,700 units.

With a favourable Government strategy, however, the SMMT says that this could rise to 834,900 units and set the industry on the path for further growth.

Login to comment

Comments

No comments have been made yet.