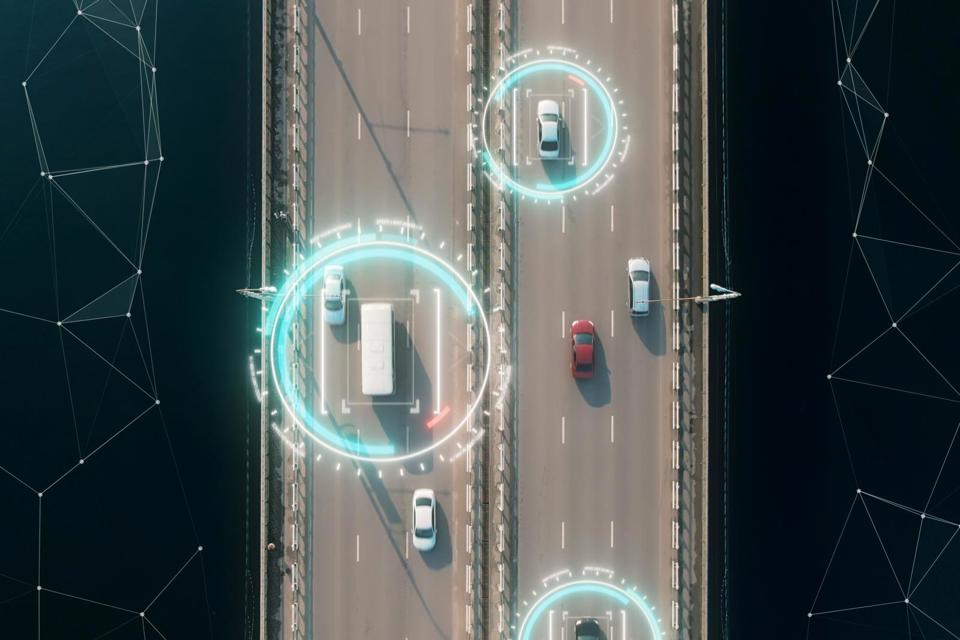

Data from connected vehicles offers “limitless” possibilities for developing new services and products for businesses, not just fleet decision-makers.

That’s according to the Stellantis-owned data company Mobilisights, which was launched at the start of 2023 to leverage exclusive access to factory-fitted telematics across the manufacturer’s 14 brands.

Sébastien Fraysse, chief commercial officer at Mobilisights told Fleet News that, while Stellantis and its individual brands will continue to develop new services, Mobilisights wants to become the ‘App Store’ for the connected vehicle market, with an array of enhanced solutions available according to customer need.

“One of the reasons of the success of the smartphone is the App Store... you have access to a constellation of applications,” he said. “This allows personalisation of the service and having something that fits everybody’s agenda.

“We are replicating this… Stellantis will continue to develop their first-party services, but we want to enrich considerably the type of the number of solutions that our customers, Stellantis customers, can access via our partners.”

Mobilisights announced it was partnering with GAC Technology, a fleet management software provider in France, in February.

The deal, which will give its customers access to connected vehicle data from Stellantis brands, illustrates the growing demand for smart fleet management integration, promoting more efficient and sustainable vehicle operations, according to Mobilisights.

Data from connected vehicles offers “limitless” possibilities for developing new services and products for businesses, not just fleet decision-makers.

That’s according to the Stellantis-owned data company Mobilisights, which was launched at the start of 2023 to leverage exclusive access to factory-fitted telematics across the manufacturer’s 14 brands.

Sébastien Fraysse, chief commercial officer at Mobilisights told Fleet News that, while Stellantis and its individual brands will continue to develop new services, Mobilisights wants to become the ‘App Store’ for the connected vehicle market, with an array of enhanced solutions available according to customer need.

“One of the reasons of the success of the smartphone is the App Store... you have access to a constellation of applications,” he said. “This allows personalisation of the service and having something that fits everybody’s agenda.

“We are replicating this… Stellantis will continue to develop their first-party services, but we want to enrich considerably the type of the number of solutions that our customers, Stellantis customers, can access via our partners.”

Giving access to third party suppliers

Mobilisights announced it was partnering with GAC Technology, a fleet management software provider in France, in February.

The deal, which will give its customers access to connected vehicle data from Stellantis brands, illustrates the growing demand for smart fleet management integration, promoting more efficient and sustainable vehicle operations, according to Mobilisights.

It followed a similar agreement with Samsara, which will allow its customers to connect Stellantis vehicles to its platform without the need for additional hardware installation, providing instant access to data, such as GPS location, mileage and fuel levels.

By entering a vehicle identification number (VIN), Samsara says that onboarding a new vehicle is quick, seamless, and entirely remote.

There were also partnership deals struck with Webfleet and Geotab last year, and an agreement to develop data services for vehicle rental company Sixt on the back of mega fleet deal with Stellantis.

Mobilisights has partnered with many of the leading telematics companies, with Fraysse (pictured below) explaining it wants to ensure that whichever provider Stellantis customers decide to use, they can easily access the data.

“We want to foster innovation and multiple use cases for multiple types of people, even sometimes within the same organisations,” Sebastien Fraysse, Mobilisights

He also highlights how vehicle data is increasingly becoming critical to other parts of the business, not just fleet.

“You have different stakeholders within the same organisation who can, could, should benefit from the data. That’s what we were exploring right now,” he said.

One such area where this is becoming evident is the need for larger companies to accurately report their emissions.

Fraysse told Fleet News: “We’re trying to bridge those two worlds and to show that the data, maybe not the same data, maybe not in the same format… but the data itself can be relevant and can bring a lot of value to different stakeholders within the same organisation.”

Factory-fitted telematics solutions in Stellantis vehicles have thousands of data points which can be switched on, with the appropriate consents.

“We don’t collect anything if there isn’t consent,” said Fraysse. “But at the same time, we’re trying to make sure that we don’t collect consent for nothing. “We want to make sure there is good use of it (the data).”

And, with more data that could be extracted from the vehicle than it is processing today, Fraysse says it is discussing with partners to better understand what that next use case will be.

Data being employed in different ways

One area where data derived from connected vehicles is particularly vital is electrification. “The bottom line is that there is no analysis without data and there is no proof point without data,” said Fraysse. “You need data to help them plan for this (electric) transition.”

However, he says that accessing data once electric vehicles (EVs) join the fleet is also critical, not only to end-user fleets in terms of charging patterns etc., but to leasing companies eager for information to predict and protect residual values (RVs), for example.

It could be a question of knowing how many times a vehicle is charged and the type of charge, whether rapid or not, explains Fraysse.

Other potential use cases could come from aggregated, anonymised data, which can be used to give traffic flow information, weather conditions through the triggering of windscreen wipers or where potholes are situated on the road network.

“To enable this use case, we can leverage the data from across all of the Stellantis brands and the different types of vehicles, like LCVs and cars,” said Fraysse.

It also enables fleets to compare the performance of their vehicles on a range of metrics to those being operated under similar usage patterns.

“It’s really limitless in terms of possibilities,” Fraysse concluded. “What matters to us is... the privacy and the security of the data... and that there is need of the data one way or another for everyone and absolutely everybody.

“This is why we're also taking this partnership approach with GAC (Technology) and others. We want to foster innovation and multiple use cases for multiple types of people, even sometimes within the same organisations.”

Read more insight and analysis from Fleet News, including what every fleet decision-maker needs to know about telematics.

Login to continue reading.

This article is premium content. To view, please register for free or sign in to read it.

Login to comment

Comments

No comments have been made yet.