Electric vehicle (EV) manufacturers will face tariffs of up to 38.1% after the EU labelled them a threat to its own electric car industry.

It has provisionally concluded that Chinese manufacturers BYD, Geely and SAIC will be subject to tariffs of 17.4%, 20%, and 38.1%, respectively.

Other manufacturers who cooperated but were not sampled, which includes most, will be subject to a 21% surcharge, and the remaining who did not cooperate will face tariffs of 38.1%.

For now, Tesla will be subject to the 21% level though may have their own individual rate calculated at a later date.

Will Roberts, head of automotive research at Rho Motion, said: “European drivers are crying out for affordable EVs and with the news today of sales plateauing in Europe, lower-priced cars will be critical to achieving the transition as planned.

“Having said that, Chinese manufacturers should be able to absorb some of these lower tariff levels into their padded profit margins.

“The true test from today’s announcement will be whether Beijing will retaliate in kind, or come to an amicable solution.”

Europe’s manufacturers still rely on the Chinese market, so declining profits from the East would only slow their ability to transition effectively.

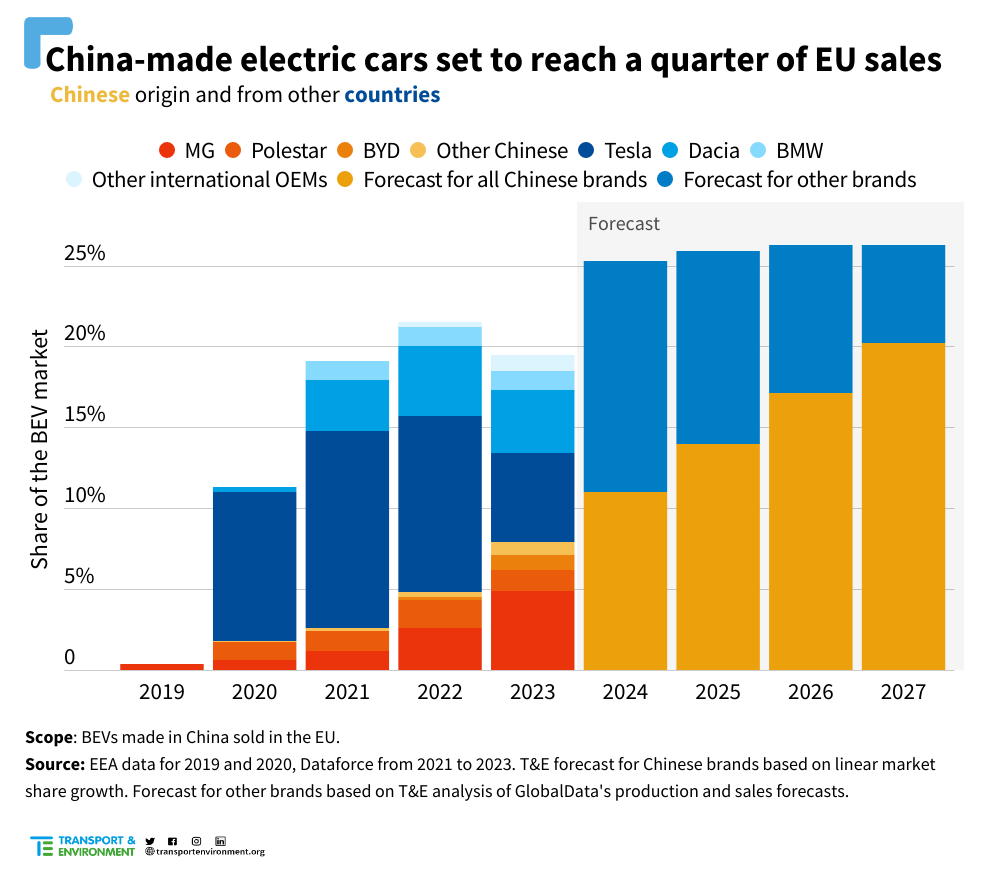

Rho Motion’s data shows that in 2023 just shy of half a million EVs were sold in the EU which were imported from China making up nearly one-third of the total EVs bought.

This has sparked the decision to impose tariffs on automakers importing from China – as the EU Commission argues that Chinese EV makers benefit from domestic subsidies that undercut European rivals.

Of the vehicles imported last year, 79% were from Western brands, predominantly Tesla, which accounted for over half of all the Battery Electric Vehicles (BEVs) imported but with significant volumes also from manufacturers such as Volvo (Geely-owned) and Dacia.

A further 15% of imports can be attributed to MG which, while a fully Chinese-owned company (SAIC), has brand heritage in the European market.

Excluding those mentioned, the remainder made up just over 6% of EV imports into the EU last year.

Recent analysis from Rho Motion concluded that many of these Chinese-only brands such as BYD, MG and Great Wall Motors with scaled production in China have brought down production costs significantly.

These low production costs allow additional profits of between 25% and 45% to be achieved over and above that already achieved in China, when operating logistics at scale in Europe.

This means the lower tariff levels will bring these manufacturers’ profits more in line with those achieved by European brands in the longer term, while likely not eliminating the profit margins completely.

However, the higher levels of nearly 40% will be harder to overcome, particularly hitting MG whose low-priced models have been extremely popular among European consumers.

Recent tariffs imposed in the US of 100% on Chinese electric vehicles opened the door for a much higher tariff level from the EU, however, imposing measures above 40% or even 50% would have been a more drastic measure likely to incur pushback or retaliatory measures from Beijing who see Europe as a key trading partner.

Sigrid de Vries, director general of the European Automobile Manufacturers’ Association (ACEA), said: “Free and fair trade means guaranteeing a level playing field for all competitors, but it is just one important part of the global competitiveness puzzle.

“What the European automotive sector needs above all else to be globally competitive is a robust industrial strategy for electromobility.”

“This means ensuring access to critical materials and affordable energy, a coherent regulatory framework, sufficient charging and hydrogen refilling infrastructure, market incentives, and so much more.”

The investigation will continue for several months until the European Commission decides whether to propose definitive anti-subsidy measures. Member states will then vote on such a proposal.

Reacting to the announcement, Julia Poliscanova, senior director for vehicles and emobility supply chains at Transport and Environment (T&E), said: "The EU Green Deal came with the promise of growth and jobs, and that’s not possible if our EVs are all imported.

“The tariffs are welcome but Europe needs a strong industrial policy to speed up electrification and localise manufacturing.”

She concluded: “Just introducing tariffs while scrapping the 2035 deadline for polluting cars would slow down the transition and be self defeating.”

Login to comment

Comments

No comments have been made yet.