Values for used electric vehicles (EVs) at three years and 60,000 miles fell by 3.6% in May, or £785 on average, according to new data from Cap HPI.

In what has been a continuous decline for 21 consecutive months, the cumulative decrease in battery electric vehicle (BEV) values amounts to approximately 57%, compared to petrol, with a decline of around 12% over the same period.

In May, petrol engine cars reduced by 0.4% (£135), while diesel used cars fell by 1.1% (£210), along with plug-in hybrids, which also registered a decline of 1.1% (£285) and pure hybrids, which fell by 1% (£200).

Jeremy Yea, senior valuations editor at Cap HPI, said: “Our wholesale supply of BEV sold data continues to increase month-on-month at a phenomenal rate, which has been fascinating to observe.

“We have already received around 70% of last year’s total trade sold volumes in less than five months, and April also recorded the highest trade volume of used BEVs sold in a single month - a real positive for both vendors and buyers.”

Overall, the used car market performed ahead of seasonal expectations in May, and average values decreased by 0.9% (£210) at three years, 60,000 miles, according to Cap HPI.

It was the strongest May into June movement since the introduction of Cap Live in 2012, with average movements, excluding Covid years, showing a 1.6% decline.

Yea said: “There is strong demand for retail-friendly vehicles in good condition and in the most desired fuel types. However, buyers have become more discerning in their choices, prioritising desirable and fast-selling stock over potentially depreciating assets that could pose financial risks.

“The market continues to perform in line with seasonal expectations, or even slightly better for some and wholesale activity has remained largely stable throughout the month. Trade data supply volumes have remained consistent and healthy, with mid-month supply tracking around 6% above the same period in 2023, and 10% down compared to pre-COVID 2019.”

At the one-year age point, values declined by 0.8% (£325), while at five years old, values reduced by 1.3% (£160) and by 2.4% (£100) at 10 years.

Convertibles and coupe cabriolets continued on a seasonal rise, increasing by 0.9% (£80) and 2.5% (£400), respectively, at the three-year age point.

However, Supermini dropped by 0.1%, with Lower Medium (or C Sector) also only dropping by 0.8% (£100), meaning that these are the strongest mainstream sectors and highlight the demand for cheaper fast-churning stock.

Steady used car market

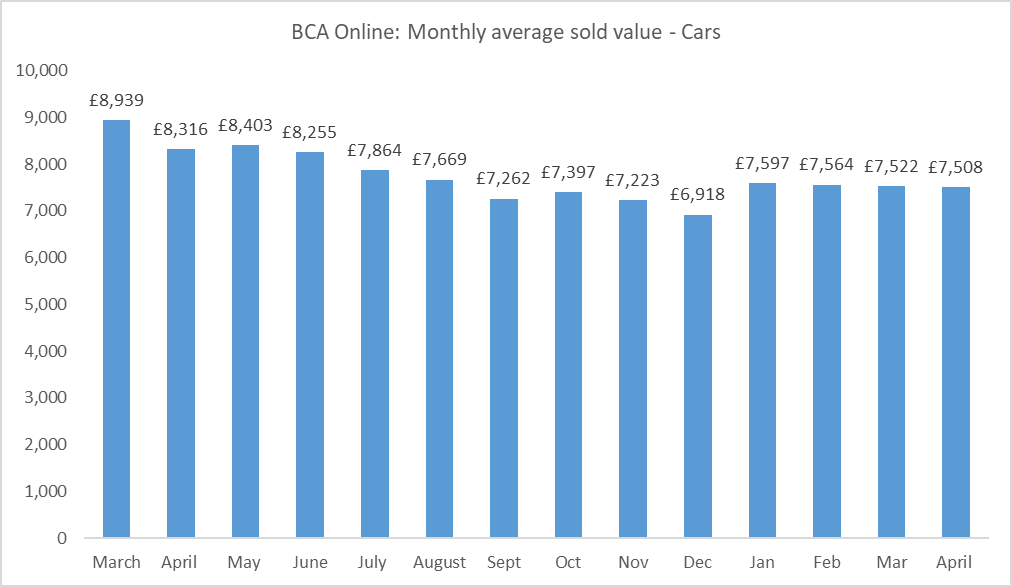

BCA continues to report on stable and steady used car demand, with used car values averaging £7,508 in April, down just £14 on March’s figure.

Data from BCA Valuations showed that sold volumes and conversion rates remained consistent for the fourth month running, while buyer numbers continued to rise steadily.

Wholesale activity remained positive in the post-Easter period, with very healthy levels of buyer engagement, confident bidding and stable conversion rates.

Anecdotal buyer feedback suggests that used retail demand remains generally good, but a number of retailers have told BCA that it can be challenging to secure the most desirable stock for their forecourts.

Many dealers still have the capacity to increase stock levels further and that means wholesale demand is likely to remain steady over the coming weeks, said BCA.

Condition remains paramount, however, and dealers continue to focus their attention on the best presented vehicles that can be retailed quickly, with many models outperforming price guide expectations.

The used sector remains short of desirable 2- to 4-year old product, says BCA, an ongoing legacy from the pandemic and demand remains particularly positive in this sector.

However, pressure remains on older, higher mileage vehicles with values moving more quickly and mechanical condition being the key factor impacting price.

Lower graded vehicles in poorer condition requiring repair and cosmetic refurbishment need to be valued realistically if they are to attract the buyers and the ongoing national shortage of vehicle repair capacity continues to impact this budget end of the market.

Stuart Pearson, BCA’s chief operating officer, said: “Whilst it is pleasing to be able to report on a fourth successive month of stability in the used car sector, as always the devil is in the detail and there are a lot of moving parts across the marketplace.

“The value gap between high demand, well-presented younger cars and poorer condition, typically older and higher mileage examples continues to widen, because buyers are factoring in the potential for delay in getting repairs and refurbishment carried out.”

Login to comment

Comments

No comments have been made yet.