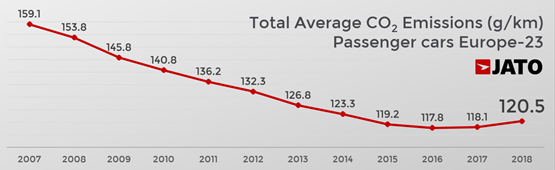

The average CO2 emissions across all cars sold in Europe reached a four-year high of 120.5g/km in 2018, according to Jato Dynamics.

Its analysis found that CO2 emissions had been steadily reducing year-on-year, reaching a low of 117.8 in 2016.

A fall in demand for diesel cars from 2017 has led to a reverse in the trend. Average CO2 emissions across Europe increased to 118.1 in 2017 and 120.5 last year.

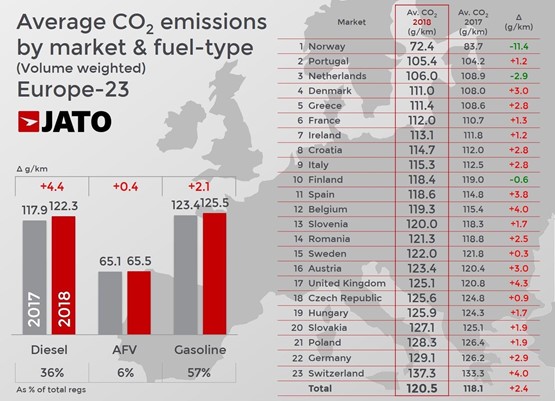

In the UK, average CO2 emissions in 2018 were 125.1, a 4.3g/km increase on 2017.

This is largely driven by the switch to petrol and the growing popularity of larger SUVs, which are less efficient than traditional family hatchbacks.

“The positive effect of diesel cars on emissions has faded away as their demand has dropped dramatically during the last year. If this trend continues and the adoption of alternative fuelled vehicles doesn’t accelerate, the industry will need to take more drastic measures in order to meet the short- term targets,” said Felipe Munoz, JATO’s global analyst.

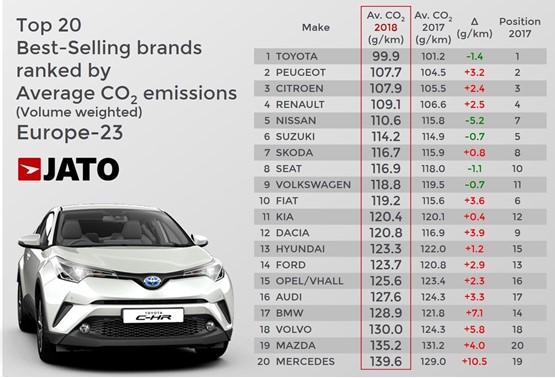

The best performing brand in 2018 was Toyota. It was the only car maker to achieve average emissions of less than 100g/km.

With a result of 99.9g/km, it represents a 1.4g/km improvement over 2017,

Only four other car makers improved their performances in 2018 vs 2017: Nissan (110.6), Suzuki (114.2), Seat (116.9) and Volkswagen (118.8).

The correlation between the decline in demand for diesel cars and the increase in CO2 emissions was most evident when analysing the data by country. Only three countries saw improvements in CO2 emissions: Norway, Netherlands and Finland. In Norway, the growing popularity of electric and hybrid cars (57% market share) was large enough to absorb the drop posted by diesel cars (-28%). In the Netherlands, the improvement was due to an increase in demand for AFVs (+74%) which counted for 11% of the total market. However, this market is still strongly dependent on gasoline cars, which make up 76% of the market. The worst performance was seen in the UK, which has carried out one of the most aggressive campaigns against diesel.

Robert Chisholm, Applewood Vehicle Finance Ltd - 05/03/2019 11:45

It would be interesting to understand the infrastructure that the likes of Norway have in place in order to achieve such a high penetration of AFV sales. There is no way a market such as the UK's will get anywhere near this level of AFV penetration without significant investment.