New electric vehicle (EV) registrations in Europe have declined year-on-year, according to new data from Jato Dynamics.

Data from 28 European counties shows overall new car sales increased by 0.9%, in 2024, while EV's posted a 1.2% decline.

Petrol cars remained the most popular across the continent, achieving a market share of 48%. Hybrids, which recorded an 11.4% market share, saw the largest uplift in registrations.

Despite the slight uptick in registrations, 2024 was the fifth year of muted registrations figures when compared to pre-pandemic levels. Europe’s car market has shrunk by almost 2.9 million units since the arrival of the pandemic in 2020.

“Overall, when you consider the range of challenges facing Europe’s automotive industry, the results for 2024 are not overly negative,” said Felipe Munoz, global analyst at Jato Dynamics.

“However, you would expect any other industry to have shown significant signs of recovery by now, and there is very little evidence that the automotive industry will return to the pre-pandemic reality. The higher cost of vehicles, the rise of working from home, inflationary pressure on wages and the emergence of new transportation solutions are among the reasons why Europeans have stopped buying brand new cars,” he continued.

According to JATO estimates, almost 21% of total new passenger vehicles registered in EU28 in 2024 came from plants in Germany. However, Germany lost market share in this respect to Czechia, the third largest country of origin for vehicles in Europe, behind Spain. France came in fourth position, despite volumes from French factories falling by 3%, while Romania rounded off the top five.

The most significant trend was China becoming the sixth-largest country of origin for new vehicles registered in Europe. Between 2023 and 2024, it outsold the United Kingdom, Turkey, Japan and South Korea.

Munoz said: “Last year, more of the cars registered in Europe came from China than Japan. China’s influence in Europe – both from Chinese OEMs and Chinese-made vehicles – is growing steadily. Their products are highly competitive, but it remains to be seen just how much the introduction of tariffs will impact its growth.

SAIC Motor, Geely, BYD, Chery, and BMW Group were the top best-selling companies of Chinese assembly origin cars in Europe last year.

SUVs remained the best-selling vehicle segment in Europe, despite growth of the category moderating over the past three years. 54% of total registrations in Europe in 2024 were SUVs - a record market share for the segment. In total, consumers in Europe bought 6.92 million SUVs, up 4% from 2023.

Compact SUVs (C-SUVs) were the most popular type within the category, accounting for 42% of total SUV registrations last year, followed by smaller models (B-SUVs), with 36% market share. However, the largest growth came from luxury SUVs, registrations of which were up 13% to 56,300 units.

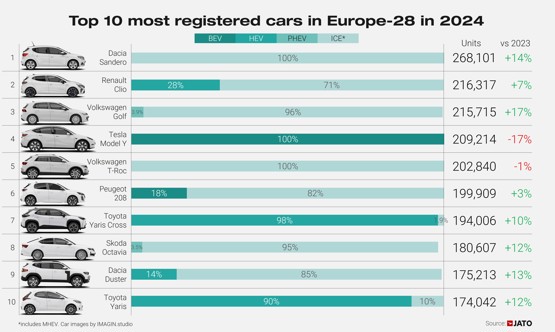

The Dacia Sandero (pictured) was Europe's best-selling car in 2024, with more than 268,000 examples registered. 2023's best-performing model, the Tesla Model Y, fell by 17% – the steepest drop among the top 36 models – as it dropped to fourth place in the model ranking. The Model Y remains the best-selling EV in Europe.

Login to comment

Comments

No comments have been made yet.