New car registrations fell by 2% year-on-year in January, across 28 European markets.

Data from Jato Dynamics shows 993,098 new cars were sold in the continent during the first month of the year.

Internal combustion engine cars (ICEs) and plug-in hybrids experienced the biggest drop in volumes, with registrations decreasing by 10% and 6% respectively. In contrast, more than 166,000 units of battery electric vehicles (BEVs) were registered – a year-on-year increase of 38%, representing 17% of all sales.

Felipe Munoz, global analyst at JATO Dynamics, said: “The market saw significant year-on-year growth in December 2024, largely due to the implementation of incentives and last-minute deals towards the end of the year. The removal of these has contributed to the decline in the number of passenger car registrations.”

Despite BEVs reporting strong results in January on the whole, Tesla registered only 9,913 units – a year-on-year decline of 45%. This can largely be attributed to the upcoming model changeover of the Model Y.

Munoz added: “The solid performance of BEVs is particularly impressive given the significant dip in sales that Tesla experienced in January. It’s not unusual for sales to drop just before a new generation or an updated model is introduced to the market, as the brand reduces the production of the existing model in anticipation of the new release. This is likely to be what Tesla is experiencing before it rolls out the refreshed version of the Model Y, after which it can expect to see sales pick up again.”

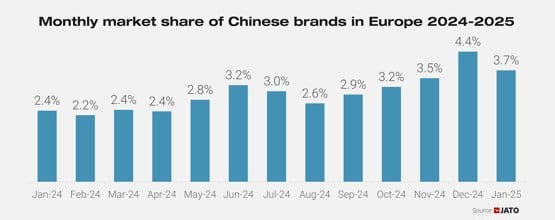

Chinese car brands continued to gain traction, with 37,134 vehicles registered in January, an increase of 52% from January 2024. The market share of Chinese brands grew from 2.4% to 3.7% over the same period.

The segment that drove the most growth for Chinese brands was hybrid models (HEVs). The imposition of tariffs on Chinese BEVs by the European Commission has sparked some Chinese car manufacturers to focus their efforts on other powertrains, including hybrids, to overcome these. As a result, almost 7,500 HEVs registered in Europe in January were from Chinese brands, accounting for 6.1% of the total HEV market. Plug-in hybrid models (PHEVs) made by Chinese brands also experienced year-on-year growth, with 4,035 units registered in January, compared to 1,276 during the same month in 2024.

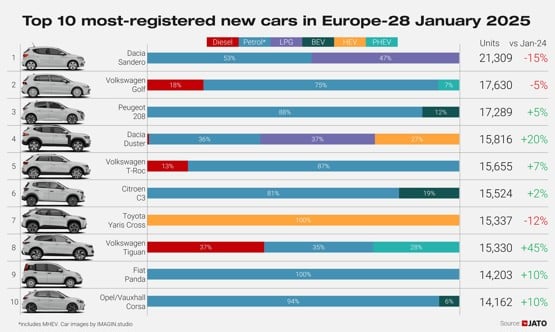

Volkswagen Group and Renault Group held the biggest market share gain in January. Volkswagen Group secured a 26.7% share of the market, registering almost 265,000 units – a year-on-year increase of 5%. Renault also performed well, registering 98,800 units – up by 7%. By contrast, Stellantis registered 154,100 units in January, resulting in a 16% decline in volume.

Volkswagen’s volumes rose by 17%, and its strong monthly performance can be largely attributed to the success of its SUV models and the Volkswagen ID.7. The group’s Cupra brand outpaced its sister brand Seat with registrations increasing by 48% driven by popularity of the Terramar, Tavascan, Leon and Born. Alongside this, Renault’s volume increased by 20% due to its solid SUV line-up, which grew by 48%. 4,000 units of the Renault 5 were registered alone.

The Dacia Sandero remains Europe's best-selling model, with more than 15,000 units registered in January 2025. The VW ID 4 was the best-selling BEV, in January, while the Volvo XC60 emerged as the most popular PHEV.

Login to comment

Comments

No comments have been made yet.