Strong demand for used petrol and diesel cars continued in 2019, with sales of the latter down just 0.6% to 3,297,953 and a 41.7% market share, according to new data from the Society of Motor Manufacturers and Traders (SMMT).

Petrol sales fell by an even more marginal 0.3% to 4,494,611 transactions, contrasting with zero emission, battery electric vehicle demand, which surged 21.8% to 14,112, but equivalent to just 0.2% of the market.

Overall, the UK’s used car market finished 2019 almost on par with the previous year, recovering to just a 0.1% drop, with 7,935,105 transactions in the year, down 9,935 on 2018.

Combined, alternatively fuelled vehicles (hybrid, plug-in hybrid and battery electric) were up, increasing 23.4% with 135,516 changing hands and accounting for 1.7% of all sales.

Meanwhile, transactions of the latest, cleanest Euro 6 models, available since 2015, were up 32.5% as more of them reached the used market, helping to address air quality concerns.

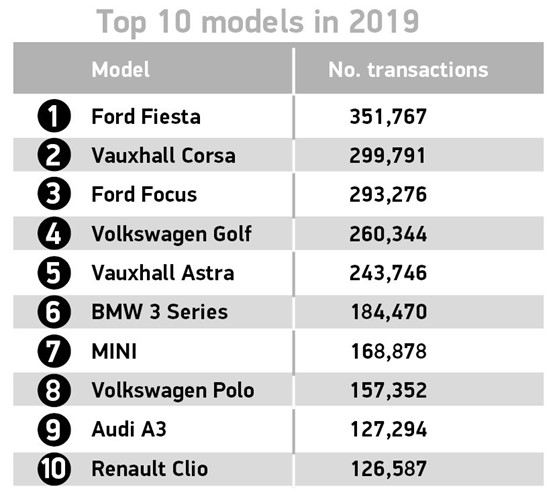

Reflecting trends in the new car market, superminis remained the most popular used buy, maintaining their 2018 performance and taking a 32.8% market share.

The lower medium and upper medium segments were the next most popular, taking 27.0% and 11.8% of sales respectively, but down -0.8% and -5.8%.

The fourth largest, dual purpose, was the only one to post growth in the full year, up 11.1%, to take 12.1% market share.

Mike Hawes, SMMT chief executive, said: “It is encouraging to see used car sales return to growth in the latter part of 2019 after a prolonged period of decline, and we need to see a similar rebound in new car sales if we are to meet environmental targets.

“A buoyant used car market is necessary to maintain strong residual values and, clearly, it is now outperforming the new car market. This does, however, suggest that weak consumer confidence and ongoing uncertainty over possible future restrictions on different vehicle technologies are causing some car buyers to hold off buying new models.

"This is delaying the fleet renewal we need now if we are to deliver immediate and continuous improvement in air quality and climate change.”

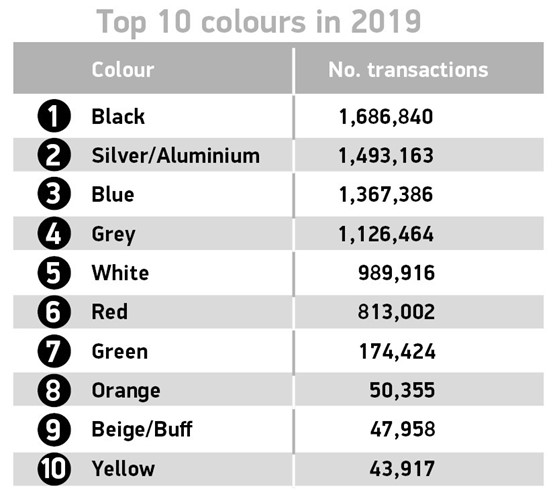

Black was the most popular option for used cars in 2019, up 1.4% to 1.6 million sales, followed by silver and blue. Grey could only manage fourth place with 1.1 million sales, but with it being the top colour in the new car market in 2019 its popularity is expected to rise in the future. Pink was the fastest growing colour in 2019, up 14.2%, albeit with only 5,098 sales.

The latest industry data indicates that used car prices remained firm in 2019, with the average up 0.6% to £12,800. 2019 finished with two quarters of growth following a nine-quarter downward streak. November and December showed their strongest performances since 2016. Despite three straight years of decline in the used market, 2019 is still the fourth highest year on record.

“It is pleasing to see the end of 2019 showing a growing used car market, after the first half of the year was slower,” said Louise Wallis, head of the National Association of Motor Auctions (NAMA).

“Demand remains strong from dealers looking for forecourt stock, in order to satisfy the consumer demand for used cars.

“We expect that the used car market for the rest of February and March will remain strong, with supply being likely to be boosted by March part exchange vehicles coming into the market.”

john4870 - 14/02/2020 11:34

There's not much chance of AFV's (hybrids etc) rising until Jo Public understands them properly. Not helped by inept sales staff who are equally ignorant - even in main dealers. Personal experience!