The used car market halved in quarter two, but year-to-date decline and recent used car sales show the sector is recovering.

The were just over 1 million used car transactions during April, May and June, 48.9% down on the 2 million-plus used cars sold during the same quarter in 2019.

The new data released today (Tuesday, August 11), by the Society of Motor Manufacturers and Traders (SMMT), shows that the decline followed a bumper January and February.

The new data released today (Tuesday, August 11), by the Society of Motor Manufacturers and Traders (SMMT), shows that the decline followed a bumper January and February.

The pace of decline eased as the quarter progressed, from a peak year-on-year loss of 74.2% in April to 17.5% in June.

In fact, due to that strong start to 2020 and the increasing demand seen as lockdown has been eased, in the first six months of 2020, used car transactions were only down by 28.7% overall, with 2.89 million units changing hands.

The second quarter represented more than 85% of the 1.16 million lost sales so far this year.

SMMT says that it is unclear how long it will take for the market to recover given economic uncertainties and a need for greater activity in the new market to drive fresh stock.

SMMMT chief executive, Mike Hawes, explained: “As the UK starts to get back on the move again and dealerships continue to re-open, we expect to see more activity return to the market, particularly as many people see cars as a safe and reliable way to travel during the pandemic.”

However, he said: “If we’re to re-energise sales and the fleet renewal needed to drive environmental gains, support will be needed for the broader economy in order to bolster business and consumer confidence.”

USED EV DEMAND

Demand for used battery electric vehicles (BEVs) grew by 44.8% in the first quarter of 2020, but declined in the second quarter, falling by 29.7% to 2,288 units, although their market share remained stable at 0.2%.

Meanwhile, sales of plug-in hybrid electric vehicles (PHEVs) dropped by 56.3%, with just 3,249 changing hands.

Petrol and diesel used car sales fell by 49.2% and 48.5% respectively, although combined they still accounted for 98.3% of sales in the quarter, equivalent to 1,021,963 units.

USED SUPERMINIS

Despite a 52.4% drop, used superminis remained the most popular purchase, with 316,570 being sold in Q2, representing 30.5% of the market.

All segments saw a decline with luxury saloons faring best with a slightly more modest 30.4% decrease.

Black remained the most popular colour choice with 227,660 units sold, closely followed by silver/aluminium, blue, grey and white.

POST-LOCKDOWN MARKET IMPROVING

Close Brothers Motor Finance said the latest SMMT used car sales data did not reflect the reality of today’s car market post-lockdown.

New research, it conducted last month, revealed that 73% of car dealers expect used demand to overtake new in 2021, a significant increase from pre-pandemic.

Seán Kemple, managing director at Close Brothers Motor Finance, explained: “Q2’s figures for used car sales are interesting, but they paint a picture worlds away from today’s market.

“It will come as no surprise that sales plummeted to near-zero in the months of total lockdown; in fact, it’s a positive sign in the grand scheme of public health. But since dealerships starting opening their doors in June, there’s been a huge release in pent up demand; we saw this in July’s new car sales lifting to 11% above 2019.

“Looking to Q3 and beyond, the used car market is likely to see an even stronger surge in demand. New car sales may be stalled by slower socially-distanced production, leading to a shortfall of stock for dealers in the coming months.

“Faced with limited availability, long waiting times, and a potentially tighter budget, buyers are more likely to turn to used and second-hand cars instead. And with people still reticent to take public transport, private car ownership is becoming ever more appealing.”

USED VALUES STABILISE IN JULY

The latest used car data from BCA shows that values stabilised in July, with the rising supply of stock well matched by increasing demand.

Insight from BCA Valuations shows that values were marginally down, month-on-month, while sold volumes increased by nearly a third.

Used car values at BCA averaged £8,517 over the month, down by £48 (0.6%) compared to June, with sold volumes rising by more than 30%.

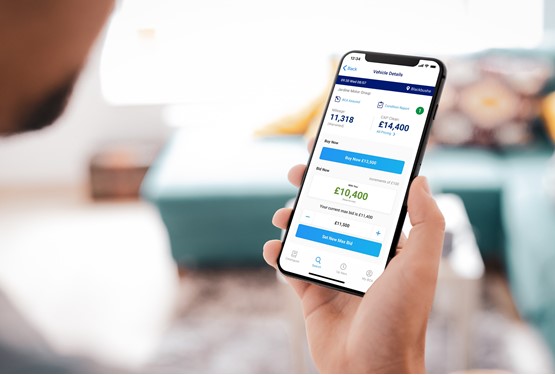

Conversion rates remain strong and the online sector-focussed channels – proving vital during the coronavirus crisis – are frequently seeing up to 1,500 buyers joining individual events, it said.

BCA offered record numbers of vehicles online in July, with daily sales entries typically exceeding 5,500 and often rising above 6,000. On Wednesday, July 29, BCA offered nearly 6,300 vehicles, the highest volume of vehicles ever offered by BCA in online sales on one day.

BCA chief operating officer for UK Remarketing, Stuart Pearson, said: “Daily entries are regularly exceeding 5,500 vehicles and demand across most sectors is ahead of what we would typically see at this time of year.

“Our focus has been on creating online events that are targeted to make it easy for customers to find the stock they need, provide maximum choice, along with the ability to scale quickly to meet the demands of the market.”

Login to comment

Comments

No comments have been made yet.