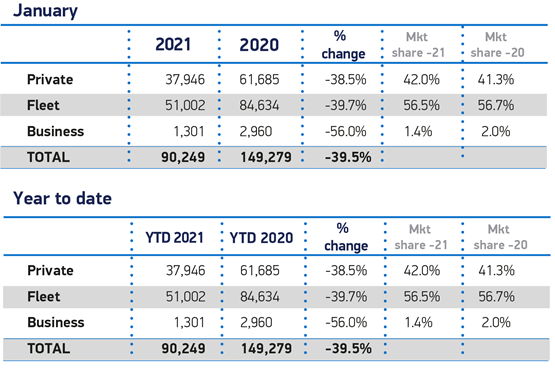

Fleet and business new company car sales fell by 40% in January, with 35,291 fewer registrations compared to the same month last year.

There were 52,303 new cars registered to fleet and business compared to 87,594 units in January 2020, according to the new figures published by the Society of Motor Manufacturers and Traders (SMMT).

Overall, the UK new car market fell by the same percentage, with 90,249 cars registered as showrooms across the country remained shut, leading to the worst start to the year since 1970.

Mike Hawes, the SMMT’s chief executive, said: “Following a £20.4 billion loss of revenue last year, the auto industry faces a difficult start to 2021.

“The necessary lockdown will challenge society, the economy and our industry’s ability to move quickly towards our ambitious environmental goals.

“Lifting the shutters will secure jobs, stimulate the essential demand that supports our manufacturing, and will enable us to forge ahead on the Road to Zero. Every day that showrooms can safely open will matter, especially with the critical month of March looming.”

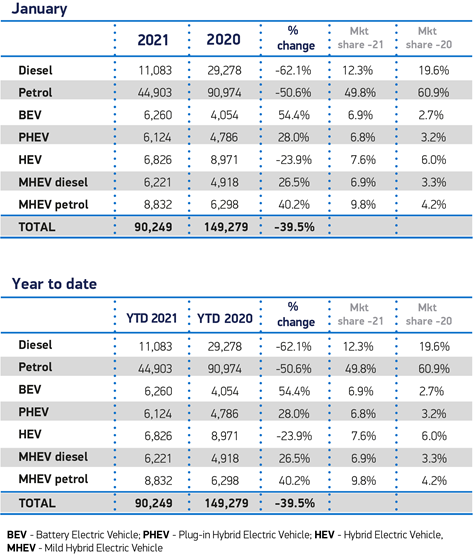

Demand remained depressed for both private buyers (-38%) and large fleets (-40%). Declines were also recorded in both petrol and diesel cars registrations, which fell by 62% and 51% respectively.

On a positive, however, battery electric vehicle (BEV) uptake grew by 2,206 units (54%) to take 7% of the market, as the number of available models almost doubled from 22 in January 2019 to 40 this year.

Combined, BEVs and plug-in hybrid vehicles (PHEVs) accounted for 14% of registrations.

Jon Lawes, managing director of Hitachi Capital Vehicle Solutions, said: “Despite the industry low in car registrations continuing into the new year, there remains a quiet, cautious optimism from many in the sector for the remainder of 2021.”

Lawes believes that the Government’s “promising” vaccination roll-out, as well as new trade agreements in the pipeline for the UK, could lay the foundations for a strong recovery as the year continues.

“With lockdown restrictions set to ease in the second quarter of 2021, we can expect to see a release of pent up demand for new vehicles,” he continued.

“As we start to return to ‘normal’, those consumers, businesses and organisations that delayed buying or leasing vehicles due to the financial uncertainties of the past 12 months, and closed dealerships, may now have the confidence to push ahead.”

Another positive for the new year, according to Lawes, is a continued increase in EV uptake in the face of a decline across petrol and diesel variants.

“With the 2030 ICE ban on the horizon, 2021 looks to be the year of the green revolution in the UK, as charging infrastructure accelerates to support growing demand and increasing numbers of manufacturers are set to bring more EVs to the mass market over the coming months,2 he said.

“The industry must continue to encourage new buyers to future-proof their purchase by going green, by showcasing the number of mainstream and affordable EVs on offer.”

Nevertheless, with lockdown restrictions in place until March – the most important month of the year for the sector, accounting for one in five new car registrations on average – the industry will face a challenging year as showroom closures depress consumer demand, which has a knock-on effect on manufacturing output, says the SMMT.

The effect of the current lockdown can be seen in SMMT’s latest market outlook. Having expected more than two million new cars to be registered in 2021, this forecast has now been downgraded to below 1.9 million given the more severe negative impact on first quarter performance and March in particular.

The forecast does represent an increase of almost 16% compared to 2020’s ‘lost year’ but it would still be a very subdued market in historical terms, given the 10-year average new car market to 2019 was 2.3 million.

More positively, however, BEVs and PHEVs are estimated to grow their combined market share from just over one in 10 new cars, to more than one in seven.

Such growth in ultra-low emission vehicles would continue the trend seen in 2020. Latest SMMT analysis shows that 2020 recorded the largest ever fall in average car CO2 emissions, spurred on by increased uptake of BEV, PHEV and hybrid electric vehicles (HEVs) which accounted for almost one in six new car registrations.

In fact, more than half of all BEVs registered in the past two decades were registered in 2020 alone. Combined with ongoing improvements to petrol and diesel engines, average vehicle CO2 dropped to 112.8g/km – a reduction of 12% compared to 2019 and -8% compared to 2000.

While all classes of car have reduced emissions by at least a third since 2000, one of the biggest reductions was achieved in dual purpose cars (49%), aided by increased availability of BEV and other low emission models. Around 30% of dual purpose vehicles are now zero emission-capable, demonstrating their vital role in helping to reduce overall CO2 emissions.

Andrew Burn, head of Automotive at KPMG, says that some consumers are continuing to prefer used vehicles as they are less exposed to lead times, which in some instances will be increasing as a result of the semi-conductor issues that are dogging the sector currently.

“What is interesting, however, is the continued move away from diesel cars and a growing preference for smaller petrol, hybrid and electric vehicles,” he said.

“Looking ahead, I suspect that we will see lower numbers coming from the sector for the rest of quarter one.

“Many will be keeping a watchful eye on the plate change in March, which is typically a key month for the industry.

“Arguably, this is going to be one of the most critical tests for the sector, given this is the first time during the pandemic that we have seen a lockdown running for so long into a plate change month. In March 2020 there would have been orders in the system ahead of the lockdown, so it is most likely that this base level of orders will not be there to the same level this quarter.”

Login to comment

Comments

No comments have been made yet.