The global shortage in semiconductors is becoming a “serious issue” for the vehicle rental industry, with new cars and vans in short supply.

New car registrations fell by 22% in August as a result of the chip shortage, the lowest performance for the month since 2013, according to the Society of Motor Manufacturers and Traders (SMMT).

End-user fleets are facing long lead times for new vehicles and have seen some safety specifications removed such as lane departure warning and rear parking sensors.

“We’re seeing cancellations of orders from many manufacturers,” Ron Santiago, Europcar

Ron Santiago, managing director of Europcar Mobility Group UK, says that thanks, in part, to preparations made for Brexit, vehicle supply was largely unaffected at the beginning of the year.

“Manufacturers brought vehicles into the UK, because they didn’t know what was going to happen (when it left the EU),” he said.

That additional stock may have initially helped soften the blow of the semiconductor shortage, but Europcar, like other vehicle rental and leasing companies, is now facing longer lead times for replacement vehicles.

“We’re seeing cancellations of orders from many manufacturers,” said Santiago. “That’s difficult, because at the same time we’re trying to sell vehicles to maximise the residual values in the market.

“We’re having to sell less than what we would have liked, because we’re not getting the new supply.”

He says that the business has managed that lack of new vehicle availability by extending some existing contracts but expects supply to the industry to remain constrained into next year.

“That means it’s very difficult to predict how much fleet growth we can achieve in 2022, because our fleet size is nowhere near where it was in 2019.

“As things open up, international travel starts to come again, we need to increase our fleet size, but it’s hard to predict how many vehicles we’re going to get.”

When will vehicle availability improve?

Many companies had cut orders for semiconductors, believing the pandemic would negatively impact demand, which led suppliers to reduce capacity.

However, the opposite was true – global demand for semiconductors grew by 15% last year – and, with global manufacturing based on a handful of factories, a fire at a semiconductor plant in Japan and power outages in Texas due to storms exacerbated the problem.

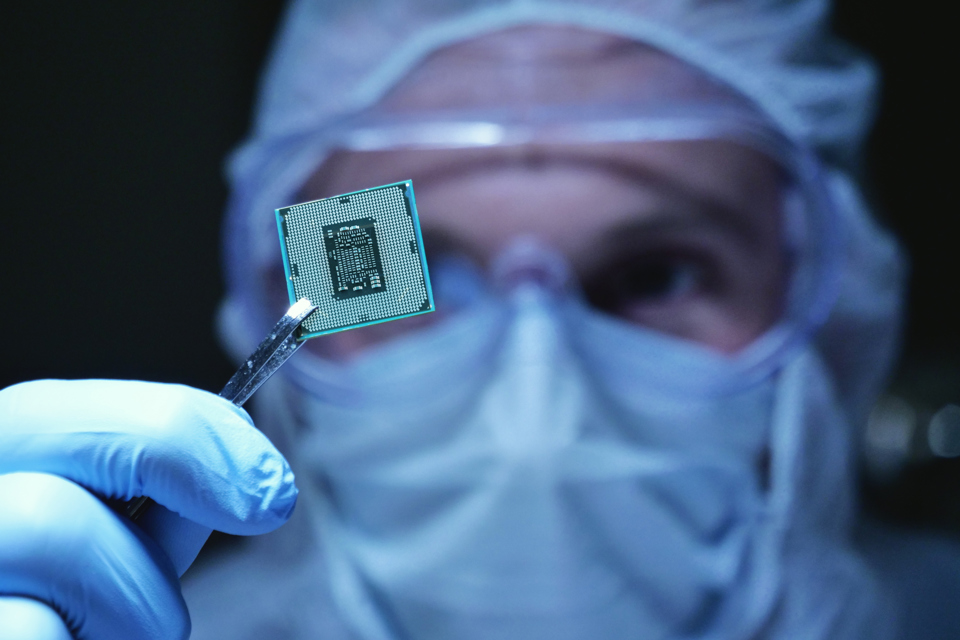

It is an issue for the auto industry as there can be between 50-to-1,000 semiconductors in a vehicle dependent on its complexity.

The computer chips feature in everything from infotainment systems and brake sensors to parking cameras and power steering.

“The manufacturers aren’t sure how long it’s going to take for the shortage in semiconductors to resolve itself,” said Santiago. “It’s a serious issue and it’s affecting everyone.”

Speaking at the IAA Munich auto show earlier this month (September 7-12), Daimler CEO Ola Kallenius said soaring demand for semi conductors means the auto industry could struggle to source enough of them throughout next year and into 2023, though the shortage should be less severe by then.

The carmaker has cut its annual sales forecast for its car division, projecting deliveries will be roughly in line with 2020, rather than up significantly.

Fleets are being urged to sit tight and continue to place orders for new vehicles, while also being warned that existing models may have to remain on the road for in excess of an extra 12 months.

Europcar UK fleet size

In the UK, Europcar currently operates more than 30,000 cars and 10,000 vans. Its car fleet was 25% higher in 2019, while its van fleet has grown over the past two years.

Cars will be replaced anywhere between four to six months to 36 months. However, Santiago says that the replacement cycle has increased due to longer lead times.

Europcar takes the residual value risk on around 50% of its fleet, with the remaining 50% sourced through a manufacturer buy-back deal.

Santiago expects to grow that risk fleet share to increase over time, enabling the business to take advantage of rising residual values (RVs).

Used car values have been increasing since April, according to Cap HPI, and had jumped by 16.6% by the end of July.

However, he says it is “much harder” to take the RV risk on electric vehicles (EVs), which he expects to make up 20% of the fleet next year, including hybrid and fully electric cars.

Santiago, who has a car rental career spanning 30-plus years, three continents and nine countries, joined the UK business in November 2020, following 12 years as managing director of Europcar Mobility Group Australia and New Zealand.

Read the September edition of Fleet News for more from the Europcar boss and how he expects to have the fleet fully connected by the end of the year.

Login to comment

Comments

No comments have been made yet.