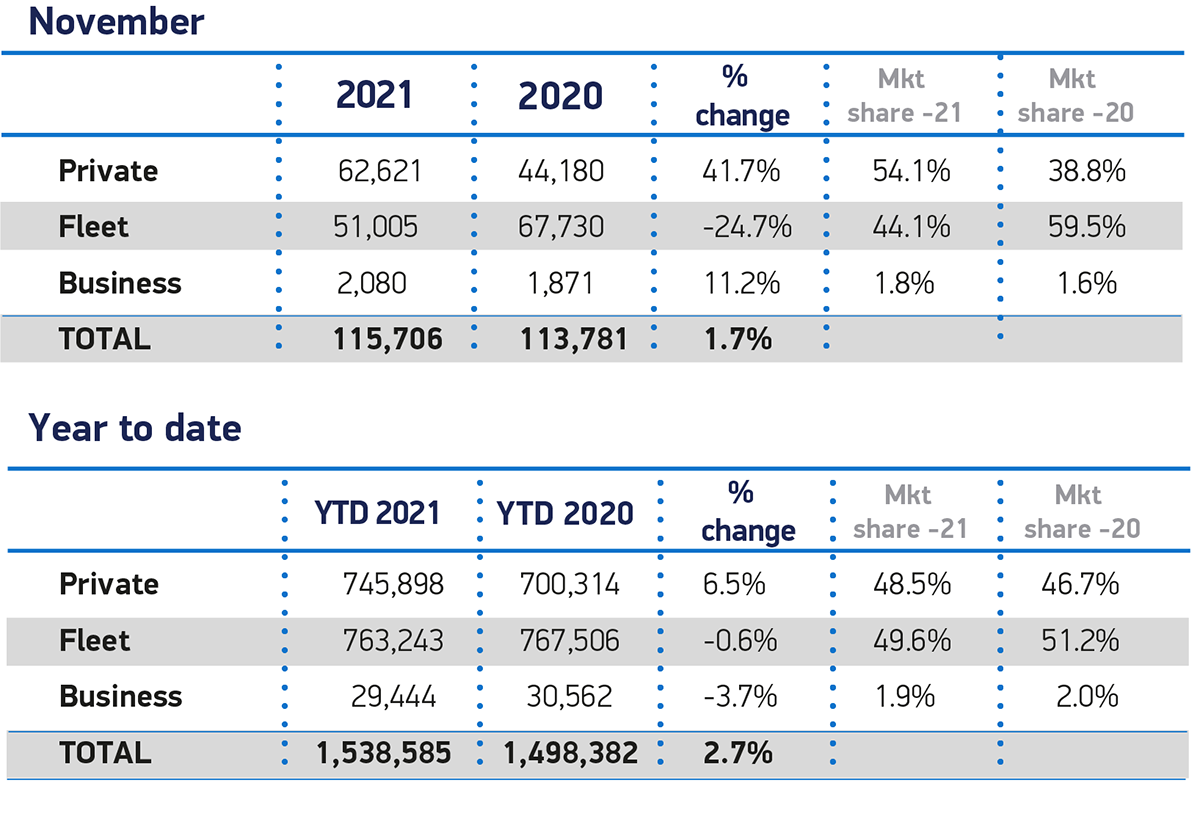

Supply constraints as a result of the semiconductor shortage are being blamed for fleet and business registrations being down by almost a quarter (23.7%) in November, compared to the same month last year.

New figures from the Society of Motor Manufacturers and Traders (SMMT) show that 53,085 company cars were registered to fleet and business last month, 16,516 units fewer than November 2020.

However, year-to-date registration figures for fleet and business cars are just 0.7% down, 792,687 units versus 798,068.

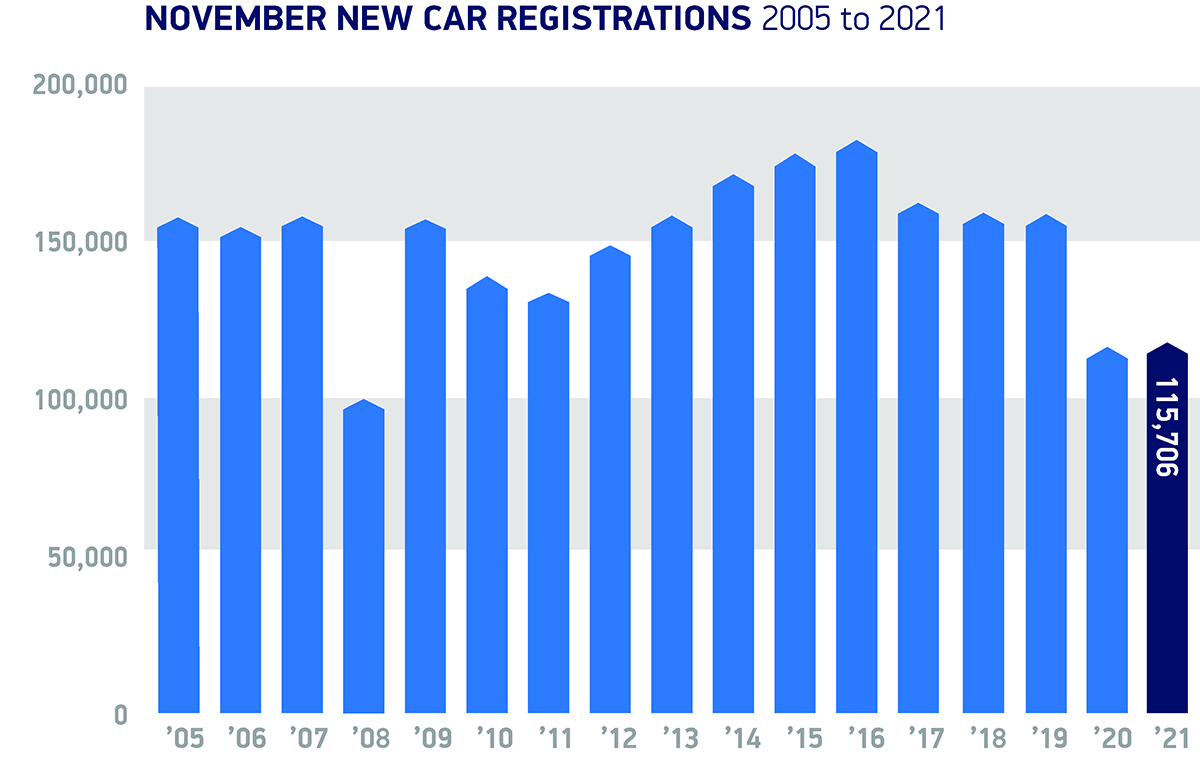

Overall, new car registrations grew 1.7% in November, bringing an end to four months of consecutive decline, with 115,706 units registered compared to the same period last year. However, compared to the pre-pandemic average, the market remains down significantly, with 31.3% fewer vehicles registered during the month.

Mike Hawes, chief executive of the SMMT, said: “What looks like a positive performance belies the underlying weakness of the market.

“Demand is there, with a slew of new, increasingly electrified, models launched but the global shortage of semiconductors continues to bedevil production and therefore new car registrations.

“The industry is working flat out to overcome these issues and fulfil orders, but disruption is likely to last into next year, compounding the need for customers to place orders early.”

Fleet operators and company car drivers are facing delays of more than one year for certain new car and van models, while others are being delivered with missing features, as the global semiconductor shortage worsens.

Jamie Hamilton, automotive director and head of EVs at Deloitte, said: “This month’s results mean that year-to-date sales are only 3% higher than last year; a time when Covid-19 restrictions closed showrooms restricted sales to online or virtual, only. At the start of 2021, there was hope that sales would return to near-previous levels but, with just a few weeks of the year left, it is evident how damaging the ongoing semiconductor shortage continues to be.

“The shortage is expected to continue well into 2022. While manufacturers are doing all they can to satisfy strong demand, consumers are still faced with a longer-than-normal wait for a new car."

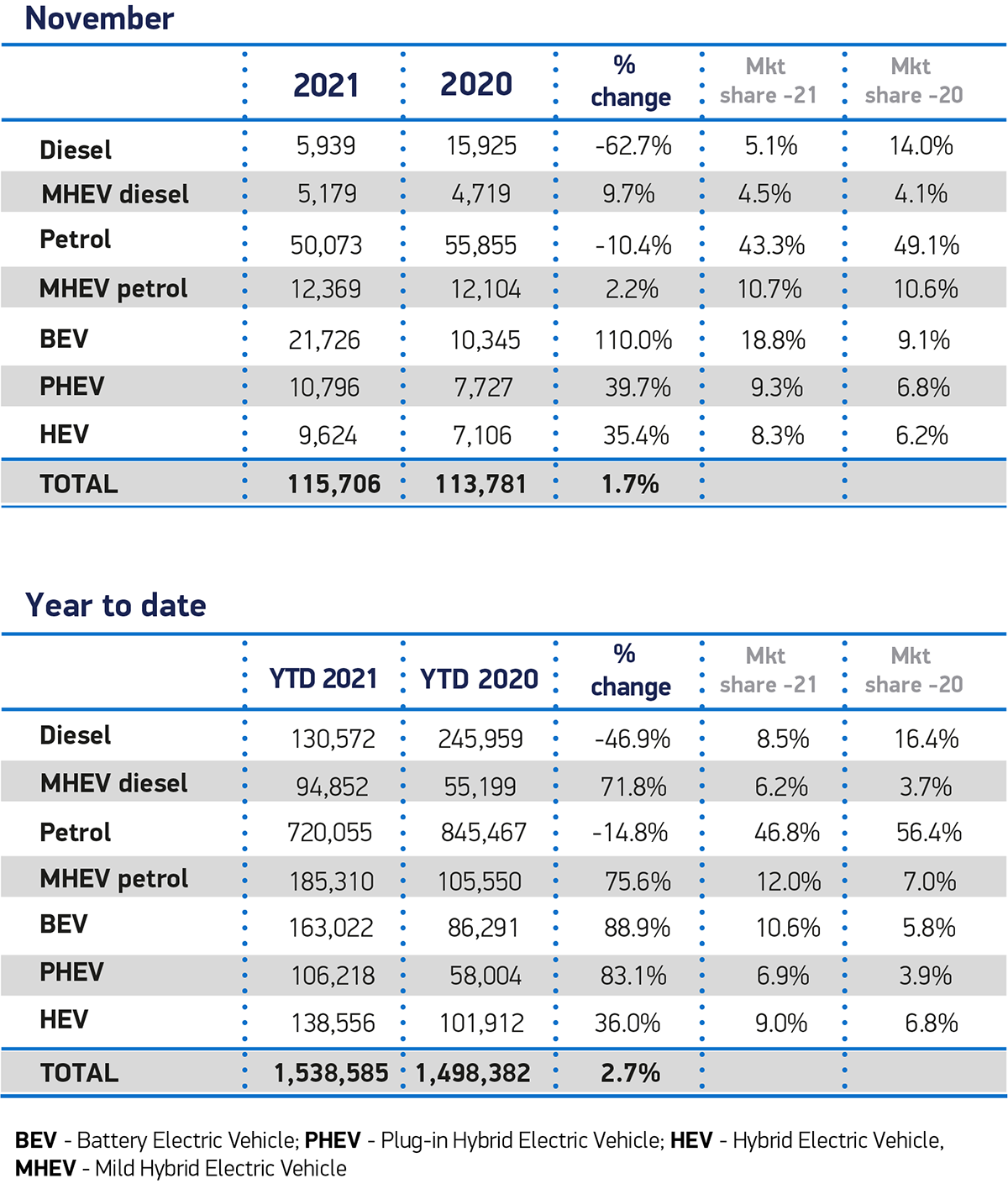

How ever he added: "“Electric vehicles continue to outperform the sector, with battery electric (+110%) and plug-in hybrid (+40%) vehicles both reporting growth. In comparison, both petrol and diesel declined compared to the same period last year by 10% and 63%, respectively."

Battery electric vehicles (BEVs) equated to 18.8% of the market, with 21,726 units - more than double compared with November 2020 – while plug-in hybrid vehicles’ (PHEVs) share grew to 9.3% or 10,796 units

Year-to-date, 1,538,585 new cars have been registered, of which 17.5% have been BEVs or PHEVs, meaning one in six new cars is capable of being plugged in. When combined with hybrid electric vehicles (9.0% share), more than a quarter (26.5%) of the new car market during 2021 has been electrified.

Hawes continued: “The continued acceleration of electrified vehicle registrations is good for the industry, the consumer and the environment but, with the pace of public charging infrastructure struggling to keep up, we need swift action and binding public charger targets so that everyone can be part of the electric vehicle revolution, irrespective of where they live.”

Despite this uptake in demand for plug-in vehicles, new SMMT analysis this month revealed that the pace of on-street public charging infrastructure rollout is lagging, with the number of plug-in cars potentially sharing a public on-street charger deteriorating from 11 to 16 between 2019 and 2020 and just one standard on-street public charger installed for every 52 new plug-in cars registered over the course of this year.

Britain’s ratio of plug-in vehicles on the road to standard public chargers (16:1) was one of the worst among the top 10 global electric vehicle markets at the end of 2020.

With plug-in vehicle uptake having grown by 86.6% in 2021, SMMT is calling on the Government to take action to avoid the ratio deteriorating further, by boosting the provision of public charging points through the imposition of binding targets.

Jon Lawes, managing director of Hitachi Capital Vehicle Solutions, said: “The rise in popularity of electric vehicles continues to be welcome news for the industry as drivers are increasingly convinced by the compelling benefits of EVs.

“However, with a deteriorating ratio of public charge points to cars, there are concerns momentum towards zero emission motoring will be hampered in 2022 by insufficient public charging provision which is failing to keep pace with new EV registrations.

“Despite recent welcome Government pledges to invest in charging infrastructure, the current shortfall and significant geographical disparities threaten to dampen driver confidence.”

Lucy Simpson, head of EV propositions at Centrica, agreed. She said: “As sales of electric vehicles continue to rise, charging infrastructure and energy systems will need to be upgraded to cope with increased demand from drivers.

“The Government’s recent mandate to install charging points in new homes and buildings from next year is another positive step along the Road to Zero. However, we must continue to see further investment in the UK’s charging infrastructure to avoid large swathes of the population being left behind on the journey towards an electric future.”

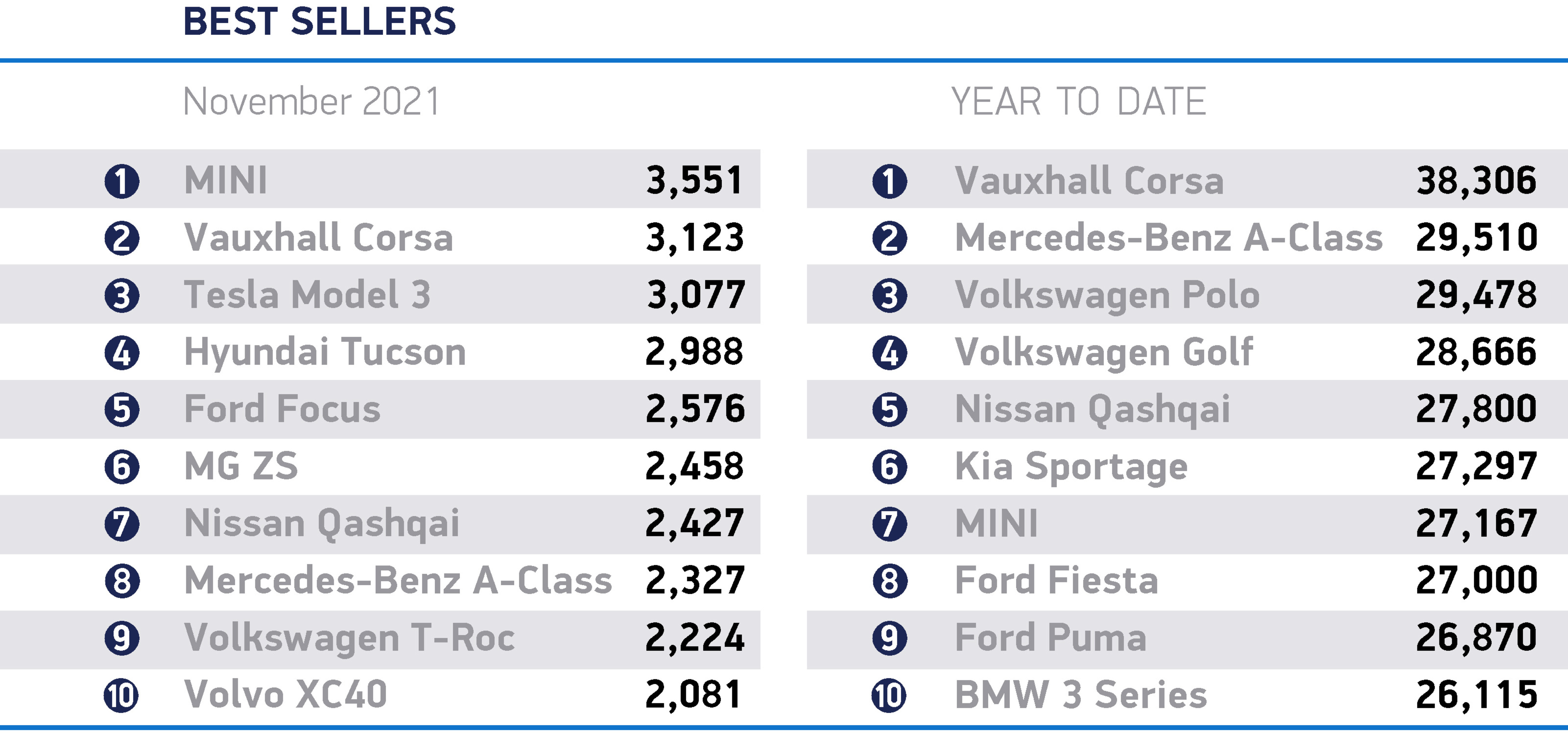

Meryem Brassington, electrification propositions lead at Lex Autolease, highlighted how the total number of EVs registered – more than 163,000 – has already surpassed the 108,000 EVs registered in 2020.

While the continued growth is encouraging, Brassington also highlighted shortcomings in the charging infrastructure. She said: “There’s still a long way to go to achieve the UK’s ambitious electrification plans, with charging infrastructure investment firmly at the top of the agenda.

“The Government’s latest requirement to install charge points in new homes and buildings from next year is another welcome step in the right direction. By ensuring the product supply and supporting charge network is in place, we can continue to accelerate the transition towards a zero-emission future.”

Private demand over the course of the month saw an increase of 41.7%, taking the private market share to an unusual high of 54.1%, although the growth reflects the impact that the November 2020 lockdown had on consumer purchases, as well as the supply-constrained nature of the current market as the shortage of semi-conductors undermines both production and registrations of new vehicles.

Mini and specialist sports vehicle segments both saw significant increases of 139.9% and 66.8% respectively, despite representing relatively low volume segments and therefore subject to volatility.

The most popular categories remain the lower medium (28.8%), supermini (28.6%) and dual purpose (27.5%) segments.

Richard Peberdy, UK head of automotive at KPMG, said: “Supply shortages continue to limit the amount of cars produced, and as a consequence it’s no surprise to still see lower numbers of car registrations when compared to pre pandemic.

Demand for what’s available, both new and old, continues to outpace car supply however. That’s reassuring for the industry, despite the frustration and financial challenge of not being able to increase supply in order to meet demand.

“Electric vehicle adoption is also a huge reassurance during these times. It’s a key reason why our recently published annual survey of global automotive executives shows that the majority are optimistic about the coming years.”

Login to comment

Comments

No comments have been made yet.