The amount of tax collected by the Government from fuel duty increased by 24% year-on-year, new figures suggest.

The total tax take, however, was still £1.7 billion (6%) down on the £27.6bn collected at the pumps in 2019/2020, prior to the pandemic.

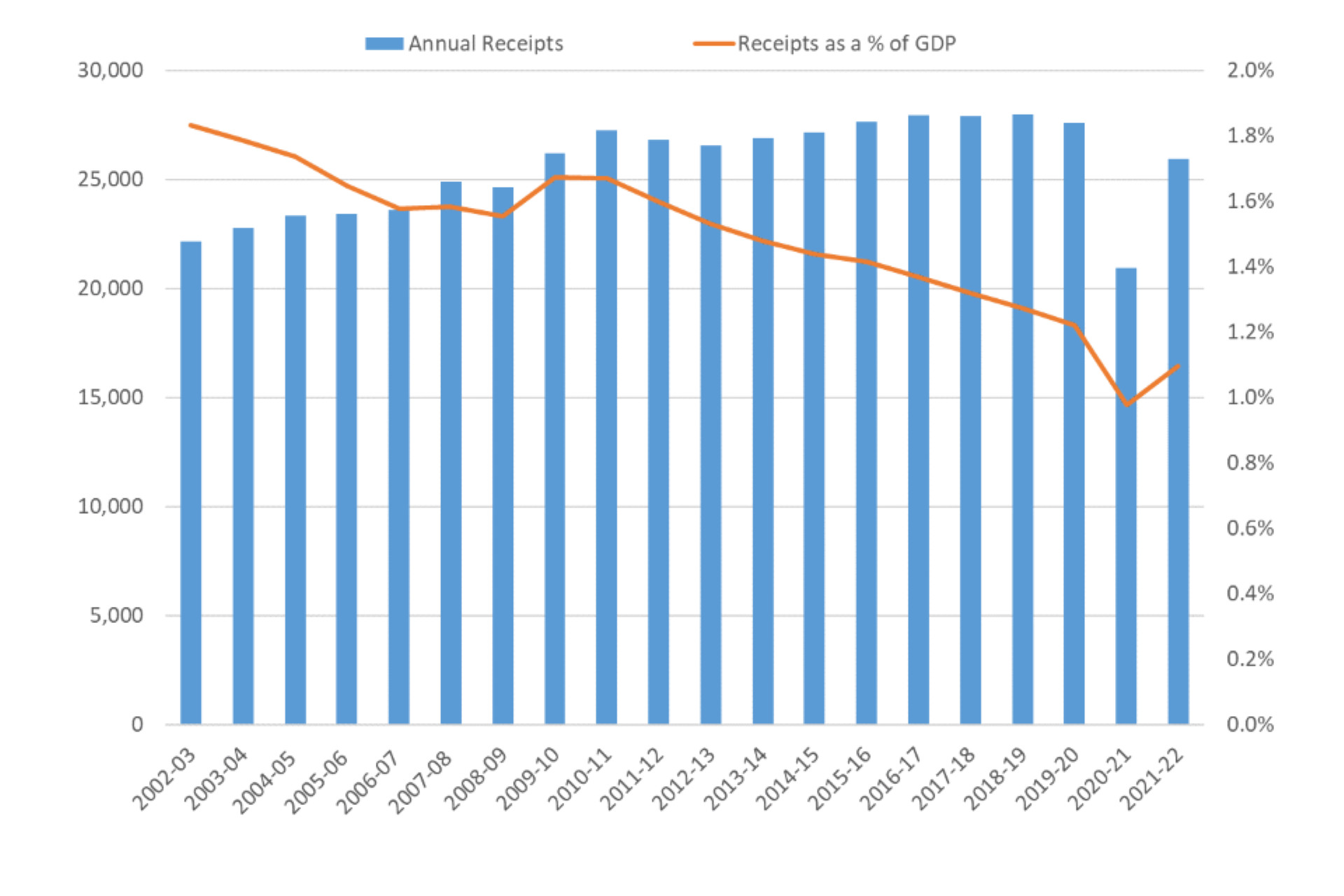

Fuel duty receipts in 2020/21 fell to £20.9bn (1% of GDP) due to the significant economic impacts of repeated lockdown and associated restrictions on travel

HMRC collected £25.9bn (1.1% of GDP) from fuel duty in the last tax year (2021/22).

In an effort to mitigate rising fuel prices, the Chancellor, Rishi Sunak, announced a 5 pence per litre (ppl) cut in fuel duty in the Spring Statement on March 23.

Fuel duty had been frozen at 57.95ppl since 2011.

Annual receipts and receipts as a proportion of GDP since the tax year 2002 to 2003 (Source HMRC).

The latest fuel duty figures were published alongside the total annual receipts for the past tax year.

HMRC collected £718.2bn in taxes in 2020/21, an increase of 22.9% from the year before.

During the tax year, receipts from Income Tax (IT), Capital Gains Tax (CGT), and National Insurance Contributions (NICs) combined accounted for 56% of the annual receipts.

Over the past decade, IT, CGT and NICs made up, on average, 55% of total annual receipts with VAT and Corporation Tax the next largest contributors, contributing an average 21% and 9% of total receipts respectively.

Helen Morrissey, senior pensions and retirement analyst at Hargreaves Lansdown, said: “HMRC’s tax take is on the rise as the UK emerges from the pandemic with an eye-watering provisional haul of £718.2bn.

“Income tax and national insurance receipts have continued to surge as the number of people in the workforce increases, while the buoyant house market has seen stamp duty reach an all-time high of £18.6bn.

“Air passenger duty, which was stuck in the doldrums as a result of Covid restrictions, has also seen some recovery with more and more people braving the airport queues and delays to book a sunshine break.”

She concluded: “As we emerge from the pandemic, we face difficult times ahead as the cost of living starts to bite.

“The property market has thrived in the past year as buyers took advantage of stamp duty holidays to bag themselves a new home.

“But with costs on the rise, it’s uncertain how long the market can sustain this momentum and we could see a quieter year ahead.

“Workers will also be bracing themselves for the 1.25 percentage point rise in national insurance which began in April – a further cost increase impacting already squeezed budgets.”

Login to comment

Comments

No comments have been made yet.