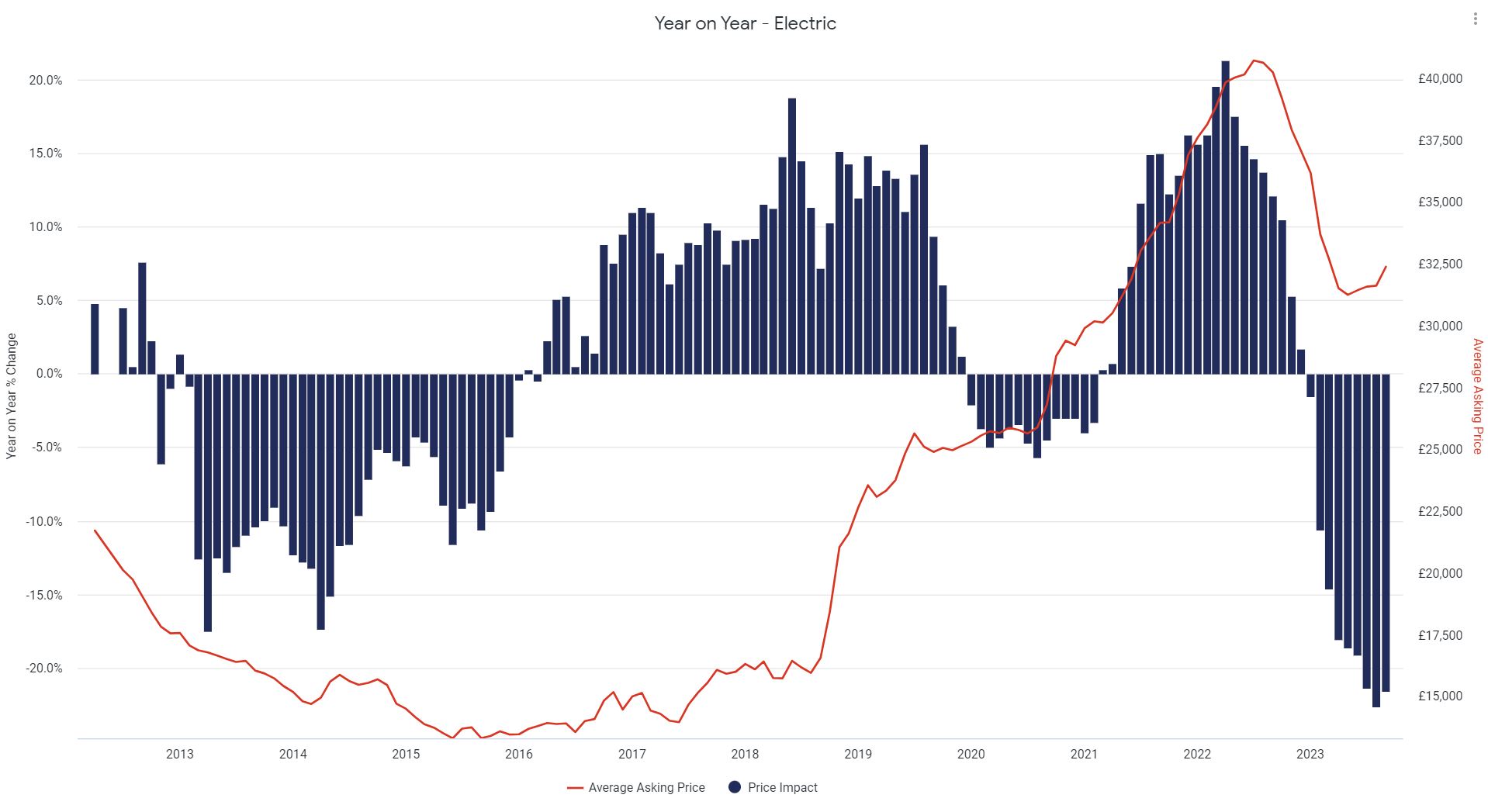

Used electric vehicles (EVs) have recorded an increase in average prices for the first time in over a year following months of declining values, new data suggests.

The average retail value of a used EV has increased 0.8% so far in September on a month-on-month and like-for-like basis, according to the latest figures from Auto Trader’s Retail Price Index.

With a current average price of £32,463, it marks the first month-on-month growth since August last year.

The increase in used EV prices is being fuelled by improving market dynamics, says Auto Trader, with levels of consumer demand outpacing supply levels for the first time since July 2022.

In fact, the rate of demand growth this month is up 87.4% year-on-year which is the highest rate of growth ever recorded. And, while the volume of used EVs entering the market is still exceptionally strong, up 77.7% year-on-year, it’s at its lowest rate of growth since September last year.

This readjustment of levels of supply and demand is not only stimulating growth, but also supporting greater profit opportunities within this segment of the market, it reports.

Auto Trader’s Market Health metric for second-hand EVs is up 5.4% year-on-year so far this month, marking the first positive uptick in 14 months.

Price gap 'rapidly' closing

The drop in average EV prices is rapidly closing the upfront price gap between many electric models and their internal combustion engine (ICE) counterparts, and in some cases, has already made them cheaper, it says.

For example, a 3-year-old petrol Renault Clio currently costs £13,163, while its electric counterpart, a 3-year-old Renault Zoe, currently costs £12,550.

There are similar examples at the other end of the market, with the all-electric 3-year-old Jaguar I-Pace (£30,757) costing almost £4,000 less than a 3-year-old fossil-fuelled Jaguar F-Pace (£34,589).

Richard Walker, Auto Trader’s data and insight director, said: “Although it’s still early days, it’s positive to see that after more than a year of contraction, the market is beginning to see green shoots emerge in used EV pricing.

“With the continued ‘de-fleeting’ of circa 750,000 electric vehicles sold over the last three years, it’ll be some time before the market reaches maturity, but with clear signs of prices beginning to stabilise, the industry using data should have more confidence in being able to source and sell profitable electric cars for their market.”

Younger cars experiencing slower overall pricing growth

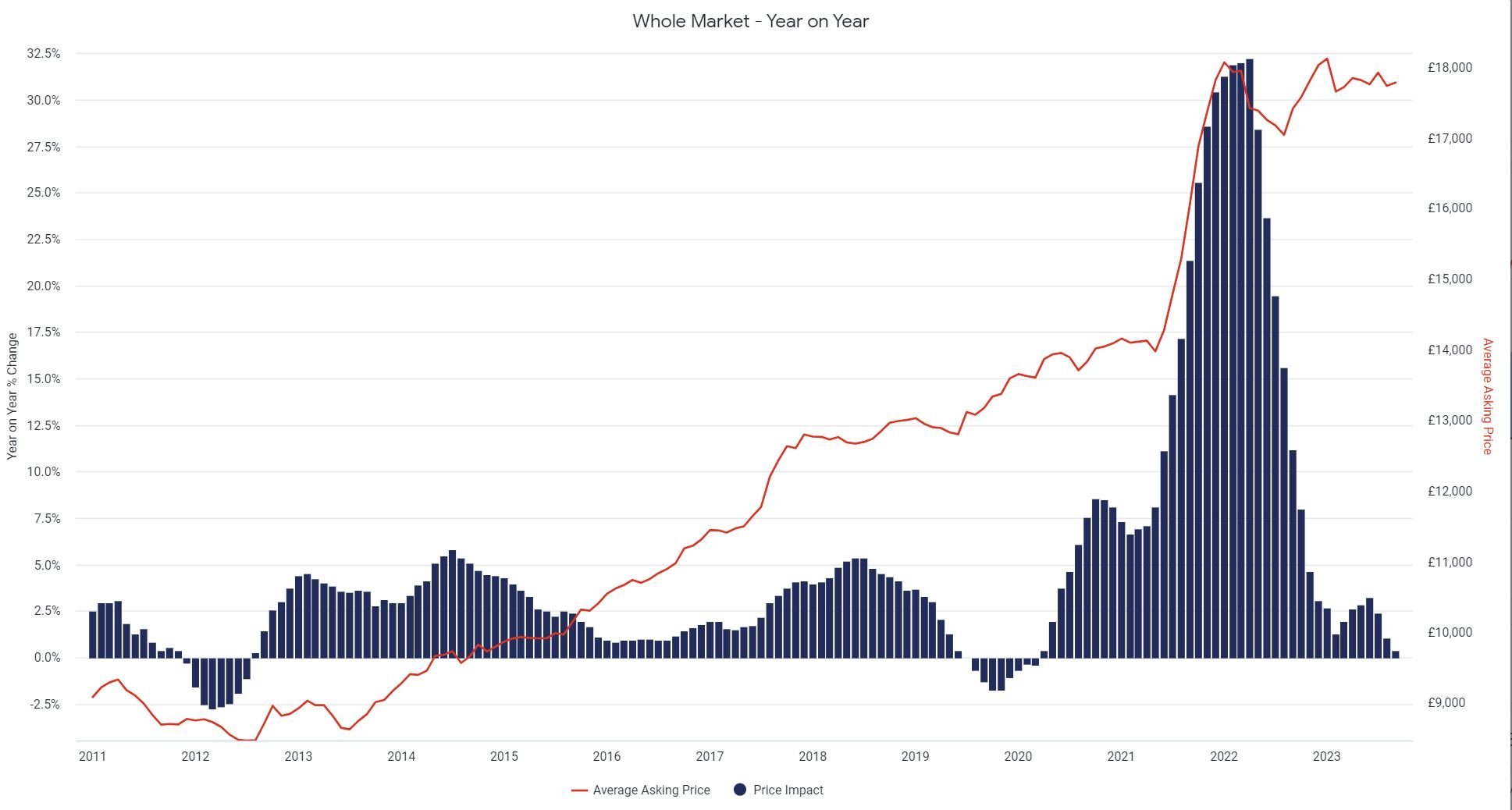

Although slowing, the volume of electric vehicles entering the second-hand market remains high, and with prices continuing to soften on a year-on-year basis, the combined effect is contributing to the overall easing of used car prices.

At an average of £17,823, retail prices are up just 0.7% year-on-year so far this month, which is down on the 1.1% recorded in August.

Prices have also contracted overall month-on-month, albeit by just 0.2%. However, it’s worth highlighting that current values remain exceptionally strong, 36% above the same period in 2021, and 45% above pre-pandemic levels in September 2019.

Contrary to some reports, this overall figure is masking what remains a buoyant used car market, with pockets of demand and therefore profit opportunities available.

In fact, Auto Trader says that looking beyond the headlines reveals a very nuanced market, with significant variances in supply and demand dynamics fuelling disparities between vehicle age cohorts and fuel types.

The prices of younger age vehicles, such as those aged below 12 months for example, are down 1.5% so far this month because of supply levels (44.3% year-on-year) outpacing the otherwise strong levels of demand growth (33.6% year-on-year), while older vehicles are outperforming the overall market.

In fact, Auto Trader says that current values for those cars aged between 10-15-years-old are up 10.9% on September last year, which is the highest rate of price growth since January and underpins the importance of utilising data to look beyond the headline figures to identify profit opportunities.

Top 10 used car price growth (all fuel types) - September month-to-date (up to Sept. 14) 2023 vs September 2022 like-for-like

|

Ranks |

Make |

Model |

Sept 23 MTD Average Asking Price |

Price Change (YoY) |

Price Change |

|

1 |

Vauxhall |

Antara |

£5,470 |

20.4% |

11.3% |

|

2 |

Renault |

Scenic |

£6,315 |

18.9% |

9.4% |

|

3 |

Alfa Romeo |

Giulietta |

£9,463 |

16.5% |

10.7% |

|

4 |

Peugeot |

Partner Tepee |

£9,781 |

11.6% |

-2.0% |

|

5 |

Dacia |

Sandero |

£8,219 |

11.2% |

0.1% |

|

6 |

Hyundai |

ix20 |

£8,990 |

11.1% |

1.8% |

|

7 |

Hyundai |

i30 |

£10,326 |

10.9% |

-1.4% |

|

8 |

Volkswagen |

up! |

£8,889 |

9.9% |

-1.2% |

|

9 |

Fiat |

Panda |

£6,295 |

9.7% |

-1.4% |

|

10 |

Mitsubishi |

ASX |

£11,779 |

9.5% |

0.5% |

Top 10 used car price contraction (all fuel types) - September month-to-date (up to Sept. 14) 2023 vs September 2022 like-for-like

|

Rank |

Make |

Model |

Sept MtD 23 Average Asking Price |

Price Change |

Price Change (MoM) |

|

10 |

Volvo |

XC40 |

£30,765 |

-9.9% |

-1.1% |

|

9 |

Hyundai |

KONA |

£19,733 |

-10.9% |

0.0% |

|

8 |

Toyota |

C-HR |

£21,404 |

-11.0% |

-1.0% |

|

7 |

Toyota |

Corolla |

£19,893 |

-11.1% |

-1.0% |

|

6 |

DS AUTOMOBILES |

DS 3 CROSSBACK |

£17,334 |

-12.1% |

-0.6% |

|

5 |

Hyundai |

IONIQ |

£16,830 |

-16.8% |

-1.3% |

|

4 |

Vauxhall |

Corsa-e |

£19,866 |

-19.7% |

1.6% |

|

3 |

Porsche |

Taycan |

£90,455 |

-22.7% |

-0.8% |

|

2 |

Peugeot |

e-208 |

£20,814 |

-23.9% |

-0.2% |

|

1 |

MINI |

Electric |

£23,154 |

-24.9% |

-2.3% |

Login to comment

Comments

No comments have been made yet.