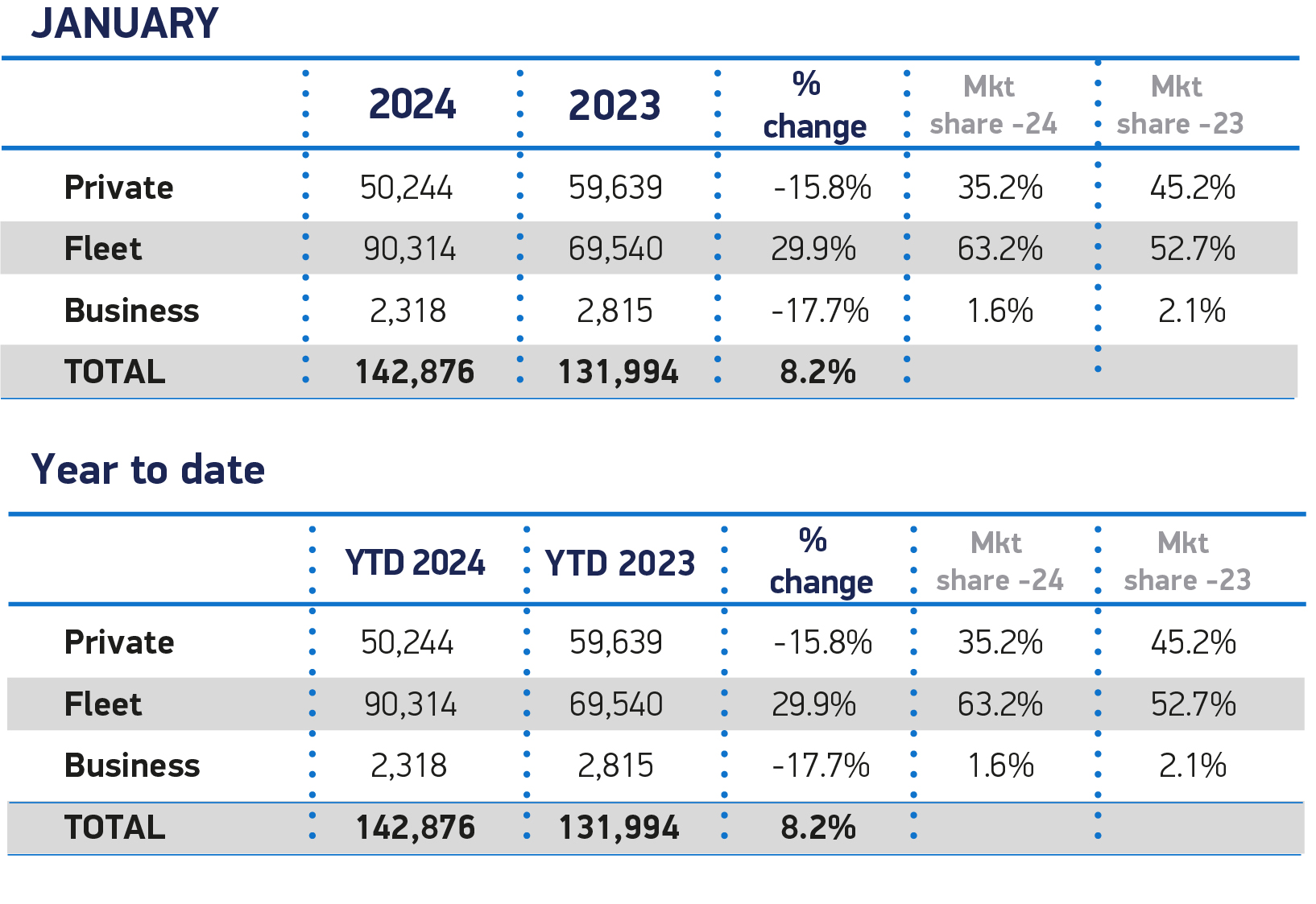

Fleet and business sales are continuing to drive the new car market, with registrations up 28% year-on-year in January.

New figures, from the Society of Motor Manufacturers and Traders (SMMT), show that there were 92,632 company cars registered to fleet and business, equating to 65% of the market.

Overall, there were 142,876 new cars registered, an uplift of 10,882 units (8.2%) on January 2023, the best performance for the month since 2020 and the 18th consecutive month of growth.

Britain’s millionth battery electric car (BEV) was also registered in January.

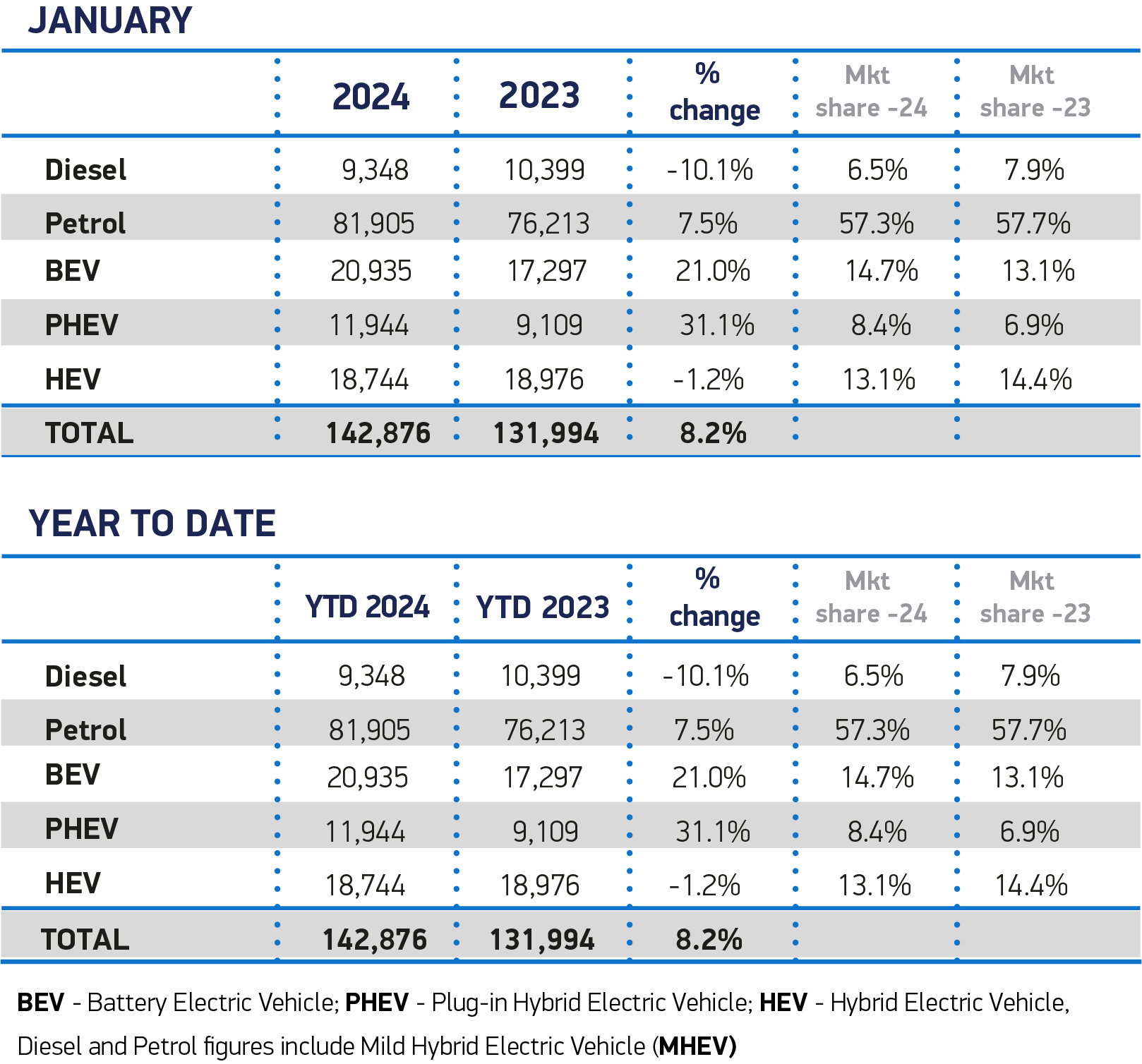

Some 20,935 BEVs were registered in January, a rise of 21% year-on-year, taking the overall total since 2002 to 1,001,677.

BEV market share for January also grew year on year to 14.7%, although this is below the full 2023 performance of 16.5%.

Plug-in hybrids (PHEVs) recorded volume growth of 31.1% to take 8.4% of the market, while hybrid (HEV) volumes fell by 1.2% with a 13.1% share.

Volatility in BEV supply

The SMMT says that the volatility in BEV supply has been expected and is likely to continue as manufacturers adjust product allocation following the last-minute resolution over UK-EU rules of origin, which had threatened to apply tariffs to EVs, restricting affordability.

However, while fleet and business demand for BEVs grew by 41.7% in January, registrations by private buyers fell by 25.1%.

The UK is now the only major market to combine a 2035 end of sale date with a mandated zero emission vehicle market share, but without any significant consumer incentives.

Ahead of next month’s Budget, industry is calling for Government to support consumers by temporarily halving VAT on new BEV purchases.

Such a step would cost the Treasury an average of just £1,125 per car, which is less than the cost of the previous plug-in car grant and would put more than a quarter of a million electric – rather than petrol or diesel – cars on the road by the end of 2026, on top of those already expected, argues the SMMT.

Temporarily reducing VAT on EVs would partly mirror the tax exemption already offered to consumers on other carbon reduction technologies such as heat pumps.

Mike Hawes, chief executive of the SMMT, said: “It’s taken just over 20 years to reach our million EV milestone – but with the right policies, we can double down on that success in just another two. Market growth is currently dependent on businesses and fleets.

“Government must therefore use the upcoming Budget to support private EV buyers, temporarily halving VAT to cut carbon, drive economic growth and help everyone make the switch.

“Manufacturers have been asked to supply the vehicles, we now ask Government to help consumers buy the vehicles on which net zero depends.”

The latest 2024 outlook for the new car market estimates a total overall volume of 1.974 million units, which is a 4,000 unit increase on the October estimate, but with the BEV forecast reduced to a market share of 21% over the year, compared with the 22.3% anticipated in October and the 23.3% expected a year ago.

Nick Williams, managing director of Lex Autolease, part of Lloyds Banking Group said: “These figures represent a positive start to the year for electric vehicle uptake.

"We expect to see this trend continue through 2024 as businesses ramp up EV adoption and models become more accessible to drivers, driven by increasing competition and a strengthening used market.

“But there is still more work to do to encourage the mass adoption the UK needs to deliver on its decarbonisation targets.

"A rapid and fair charging infrastructure roll-out, an enduring commitment to the ZEV mandate, clarity on benefit in kind rates beyond 2028, better information for would-be EV drivers and a new national battery strategy must be the focus.”

Jon Lawes, managing director at Novuna Vehicle Solutions, said: “The UK’s automotive sector recorded significant private and public investment commitments last year, which is vital to EV transition, but political uncertainty around future commitments to developing green infrastructure threatens to undermine confidence for drivers to make the switch.

“Rather than political posturing, we need collaboration at national and local level, to build a robust and accessible network of fast public chargers and ensure the UK is capable of delivering its net zero ambition.”

Kim Royds, mobility director at Centrica, also believes inequality of public charging infrastructure remains a "significant hurdle" to widespread EV adoption, but says that is only one piece of the puzzle.

"Delivering at-home and kerbside charge point solutions with affordable charging costs will go a long way to convince would-be EV drivers that an electric future can be achievable," she added.

“We need to strike a balance between home and public charging in order to create an easily accessible and cost-effective infrastructure that doesn’t exclude anybody from the transition.”

Ken McMeikan, CEO of Moto Hospitality, is concerned how the SMMT data demonstrates sales of EVs are slowing amongst private buyers.

He said: "I have called upon the Chancellor to bring back subsidies such as the plug-in car grant as well as pause the introduction of EV vehicle duty in the Spring Budget. This would tackle the number one barrier to EV adoption and encourage and incentivise more private buyers to transition to electric cars.

“We’re also in agreement with the report from the Environment and Climate Change Committee, which states that installing rapid chargers on the UK’s strategic road network is critical to consumer confidence to adopt EVs.

"It’s therefore vital that the Government pushes on with its decision to transform the planning system in favour of delivering low-carbon energy projects and prioritise EV charging hubs, so we can continue the rapid expansion of charging infrastructure on the UK’s motorways.”

Login to comment

Comments

No comments have been made yet.