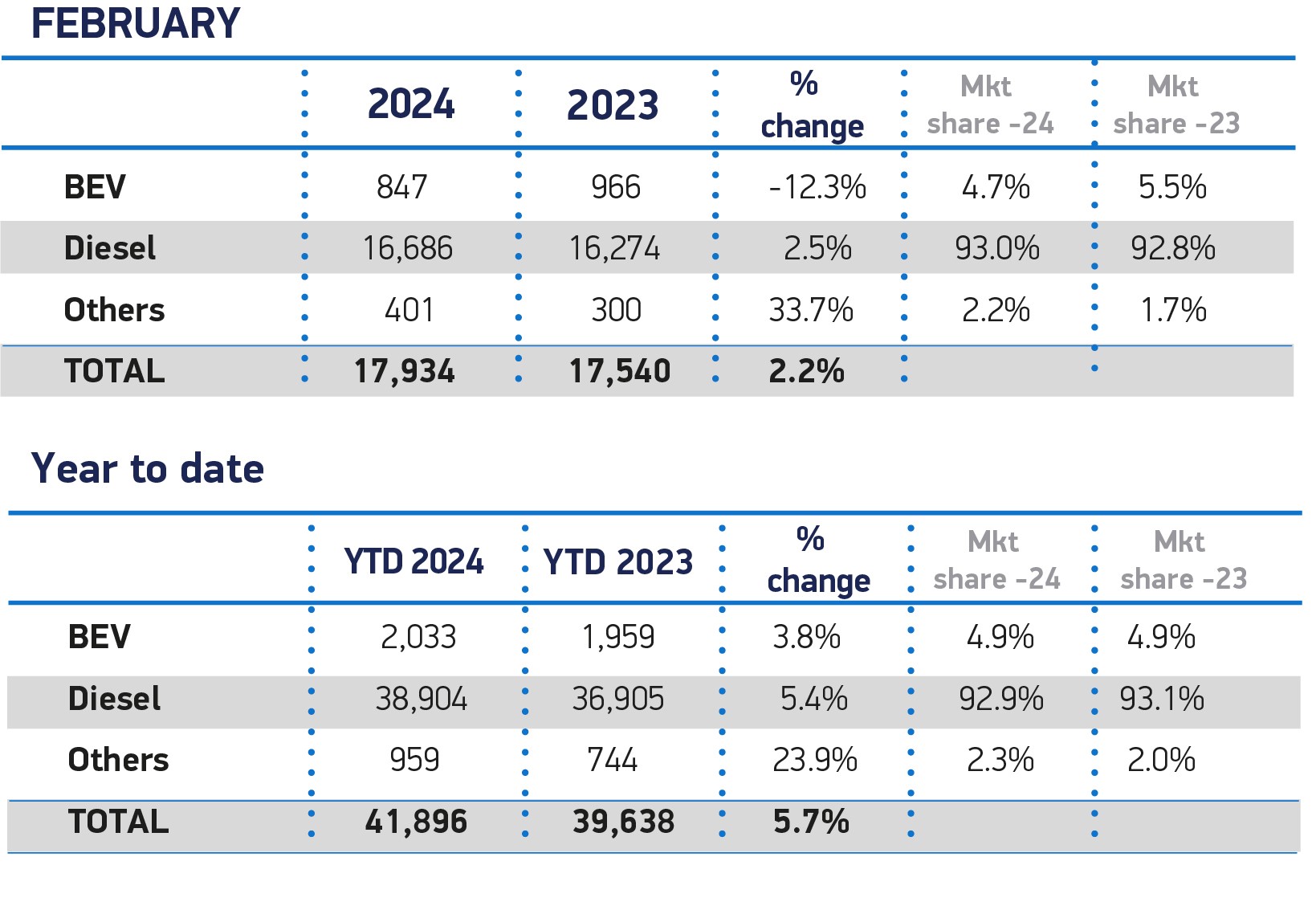

February saw a decline in registrations of battery electric vans weighing up to 3.5 tonnes, falling by 119 units to 847 units, and taking a 4.7% market share, down from 5.5% a year ago, according to new figures from the Society of Motor Manufacturers and Traders (SMMT).

With each manufacturer now mandated to achieve a minimum proportion of zero emission registrations every year, it says that maintaining existing purchase incentives and ensuring charge point rollout – including van-specific charging infrastructure – will be essential to help raise demand to the level needed to deliver net zero rapidly.

Sue Robinson, chief executive of the National Franchised Dealers Association (NFDA), which represents franchised car and commercial vehicle retailers in the UK, said: “It is concerning to see sales of electric in the light commercial market remain at 4.9%, same to the market share from this time last year.

“With the impact of the ZEV mandate requiring 10% of LCVs sold in 2024 to be electric, there needs to be more impetus from the Government to create financial incentives to encourage van buyers to make the switch.”

Separate analysis by New Automotive suggests that only Nissan met this year’s 10% Zero Emission Vehicle (ZEV) mandate sales share target for battery electric vans this month.

However, it says that, with multiple key players in the market edging closer to that 10% marker such as Vauxhall, Toyota, and Volkswagen, it is clear that the target is well within reach.

As with cars, Toyota has stepped up on vans with 9% of its sales fully electric. Meanwhile Ford, which has consistently held around one-third of the diesel van market but whose sales have rarely included more than 3% of electric volumes, and Nissan, which had more than 50% market share of battery electric vans until mid-2020, are drifting.

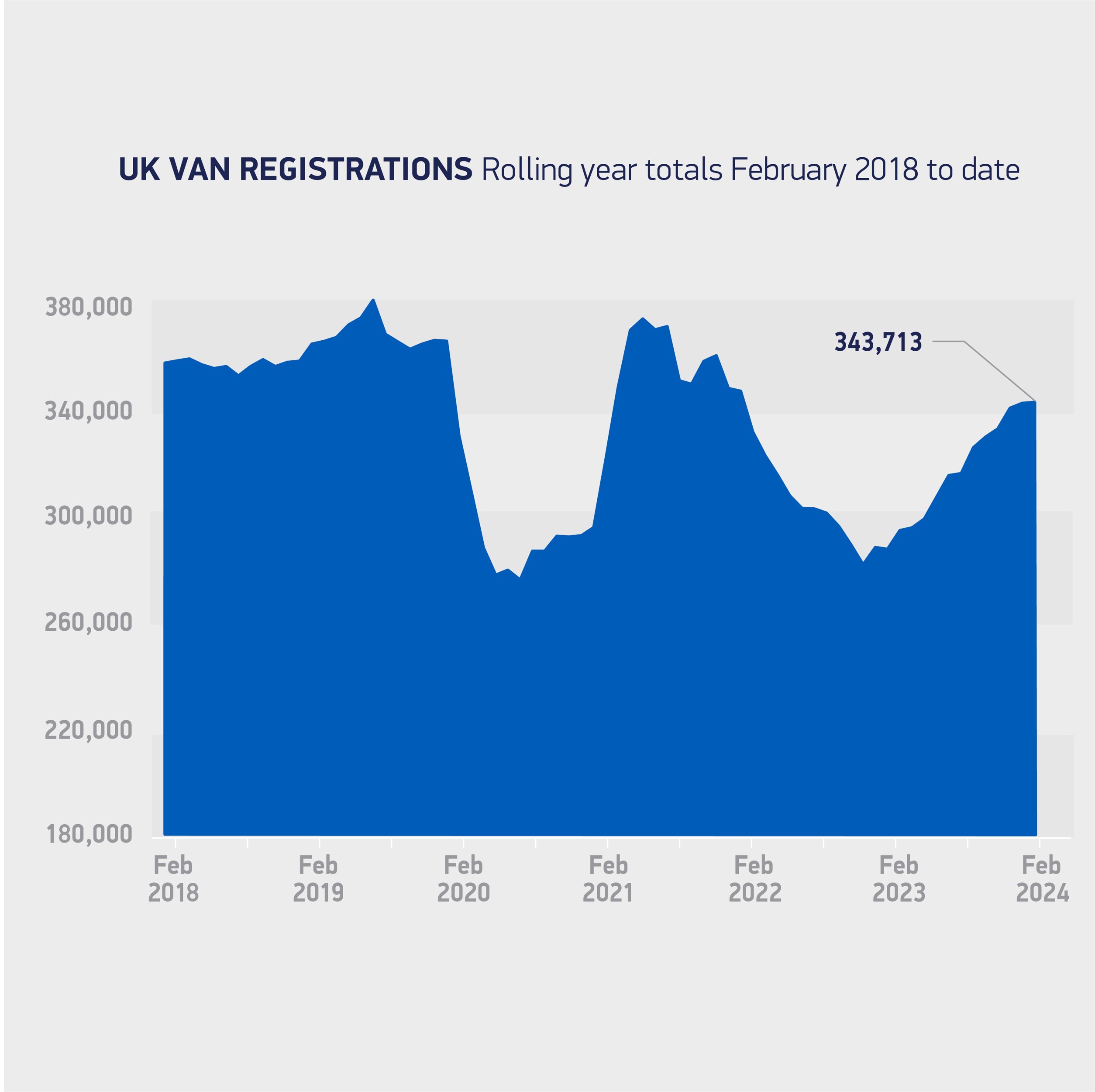

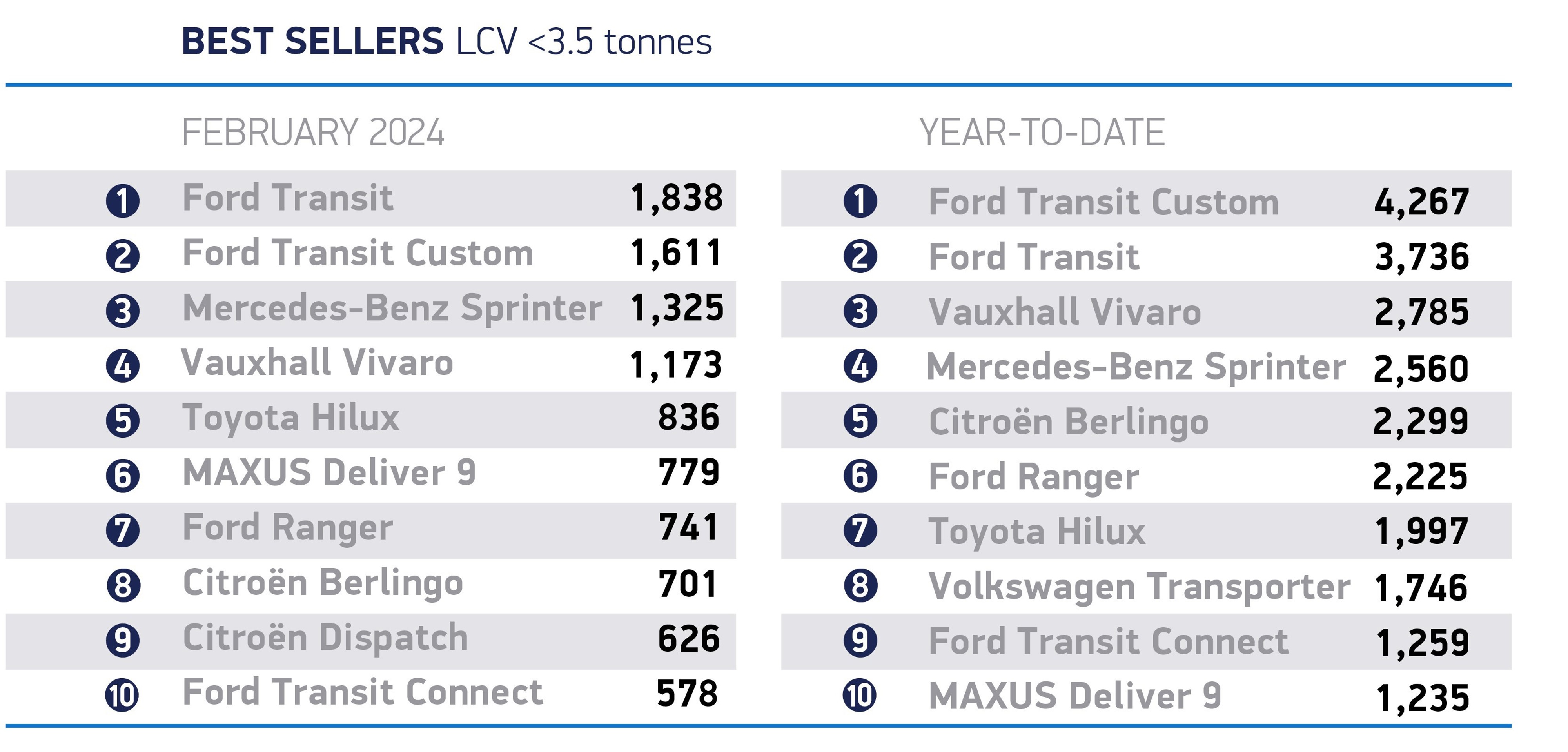

Including internal engine combustion (ICE) vans, UK demand for new light commercial vehicles (LCVs) grew by 2.2% in February to 17,934 units, marking 14 months of consecutive growth, according to the SMMT.

While February is traditionally a lower volume month, as many operators delay procurement until March for the new numberplate, the increase represents the best February performance since 1998.

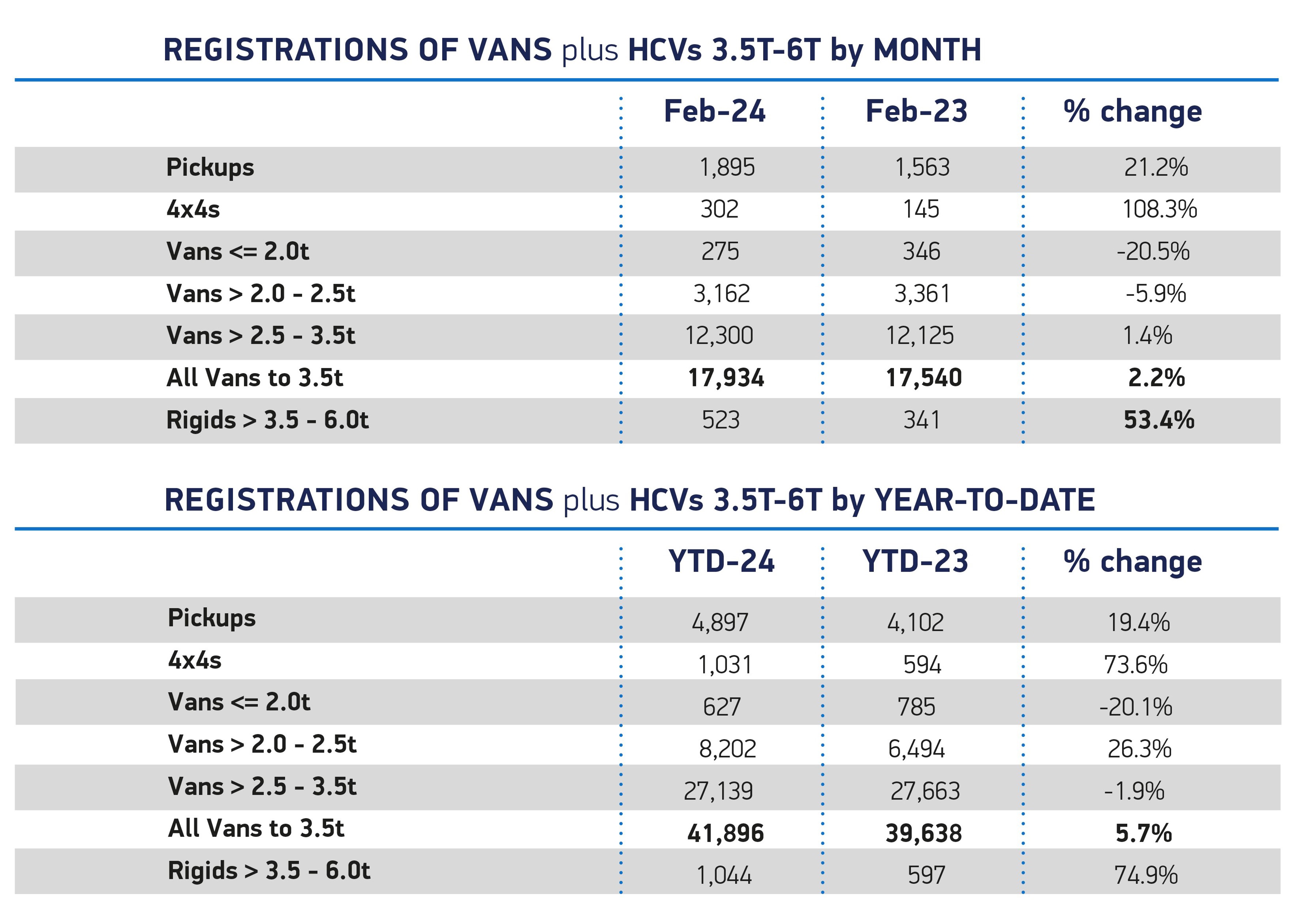

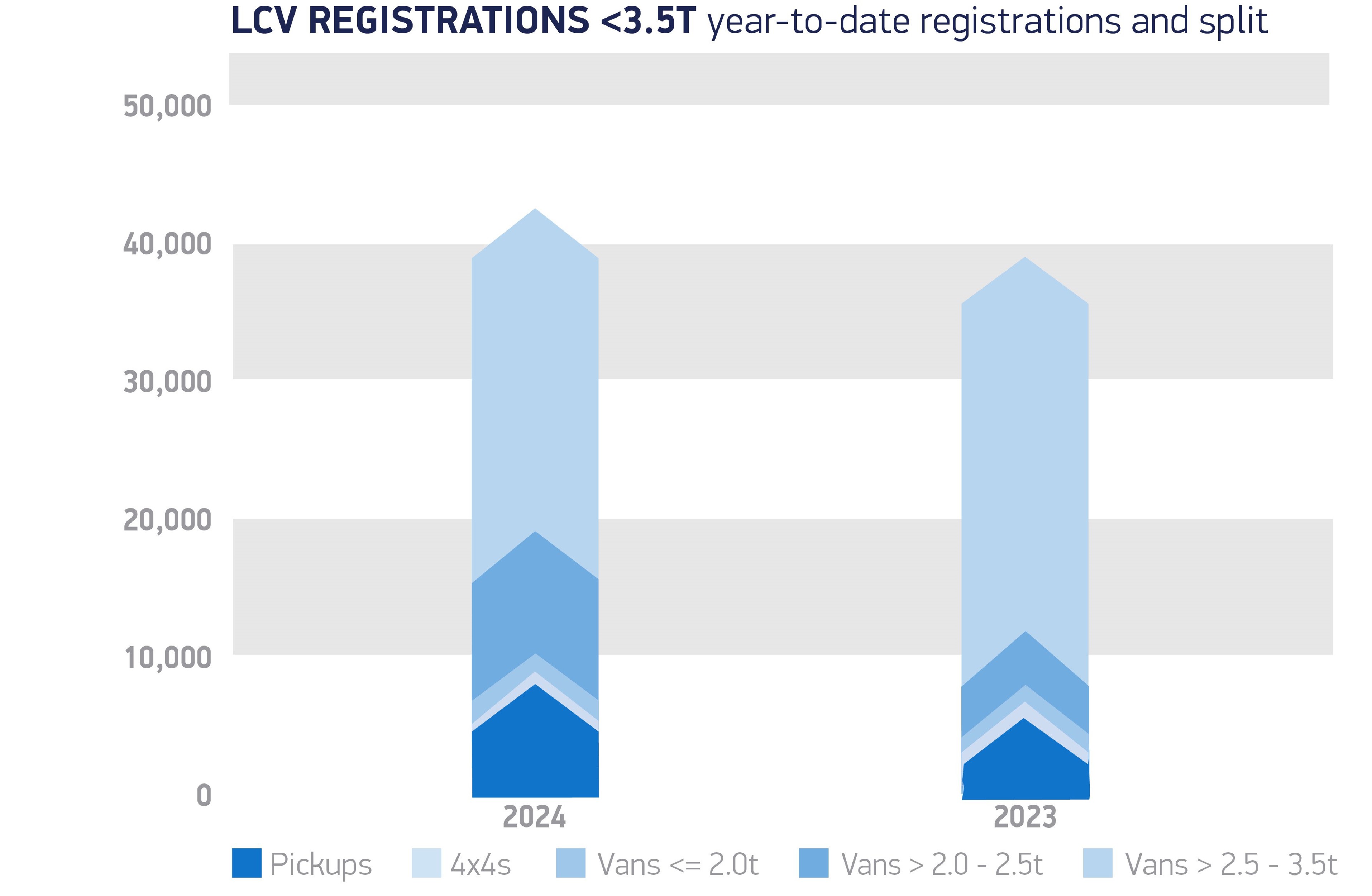

Registrations of vans weighing greater than 2.5 to 3.5 tonnes rose by 1.4% to 12,300 units, representing almost seven in 10 (68.6%) of all new vans as the trend for larger units continues.

Deliveries of small vans weighing up to and including 2.0 tonnes, and medium-sized vans weighing greater than 2.0 to 2.5 tonnes, both saw declines, falling by 20.5% to 275 units and 5.9 % to 3,162 units respectively.

The smaller volume 4x4 segment saw registrations more than double, rising by 108.3%, while pick-ups, crucial for many rural and construction business operations, were the third most popular class of commercial vehicle after heavy and medium vans, with registrations rising 21.2%.

The SMMT says that fleet renewal is crucial for decarbonisation, and the Government’s recent decision to scrap changes to double cab pick-up vehicle taxation will ensure that operators can continue to invest in newer, lower emission models.

The sector believes that it would be fairer and simpler to use a vehicle’s type approval as the basis to define it as a car or commercial vehicle for all tax purposes.

SMMT chief executive, Mike Hawes, said: “Britain’s appetite for new vans remains undiminished with 14 months of growth and, with last month’s rethink of taxation for pick-ups, expansion looks to be sustained.

“However, this growth and confidence must be translated into zero emission vehicles if we are to deliver our green goals.

“Maintenance of essential incentives and a ramp up of dedicated van-suitable charge point installation will be vital if we are to help keep long-term, net zero fleet investment moving forward at the pace needed.”

Login to comment

Comments

No comments have been made yet.