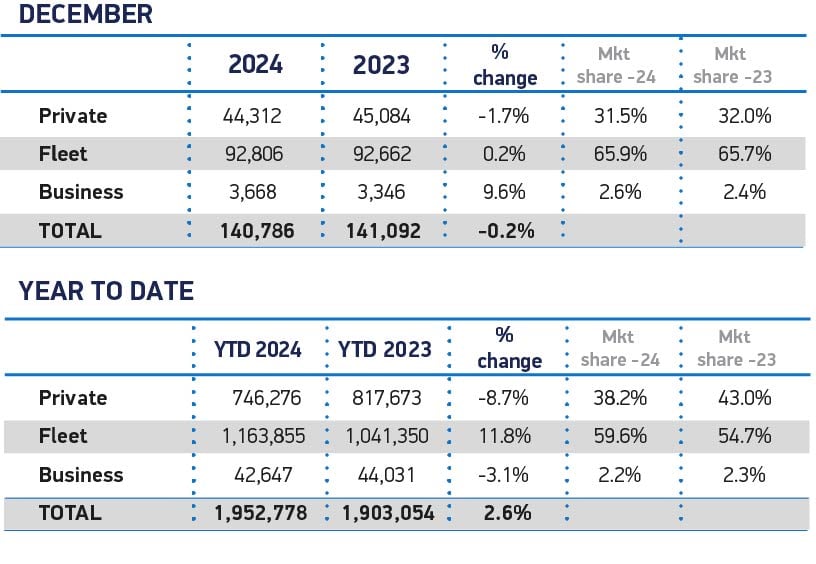

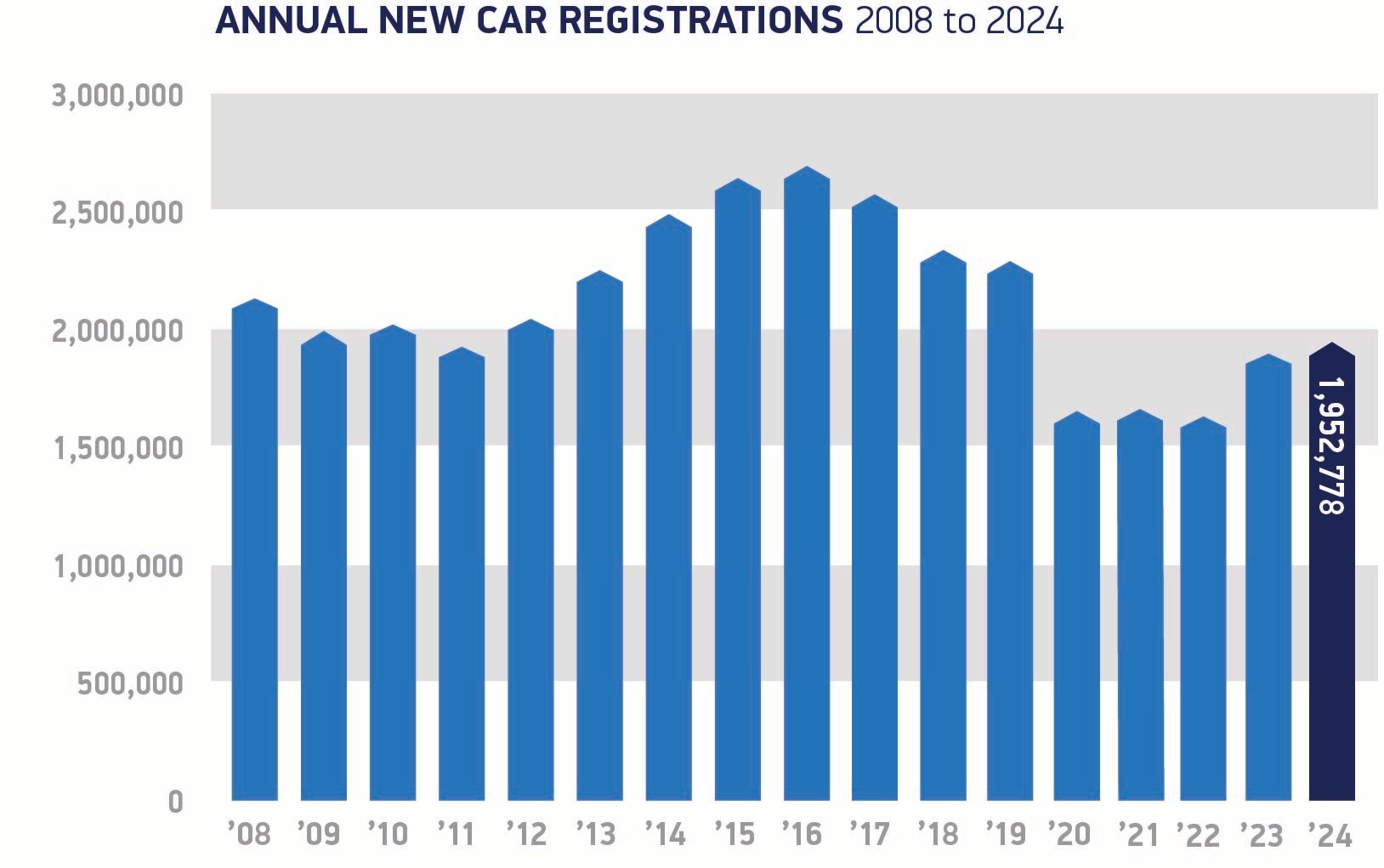

Growth in the UK new car market in 2024 was delivered entirely by fleets, according to the latest figures from the Society of Motor Manufacturers and Traders (SMMT).

In what was a second successive year of growth, some 1,952,778 new cars were registered during the year – a rise of 2.6% on 2023.

In the final month of the year, the market remained flat at 140,786 units, with a marginal 0.2% decline.

New car registrations to fleet and business were up more than 11% year-on-year to 1,206,502 units – equating to almost 62% of the market.

Registrations by private buyers, however, fell by 8.7% to 746,276 units – less than in 2020 when the pandemic effectively shut down the market for three months.

Battery electric vehicles fall short of ZEV mandate target

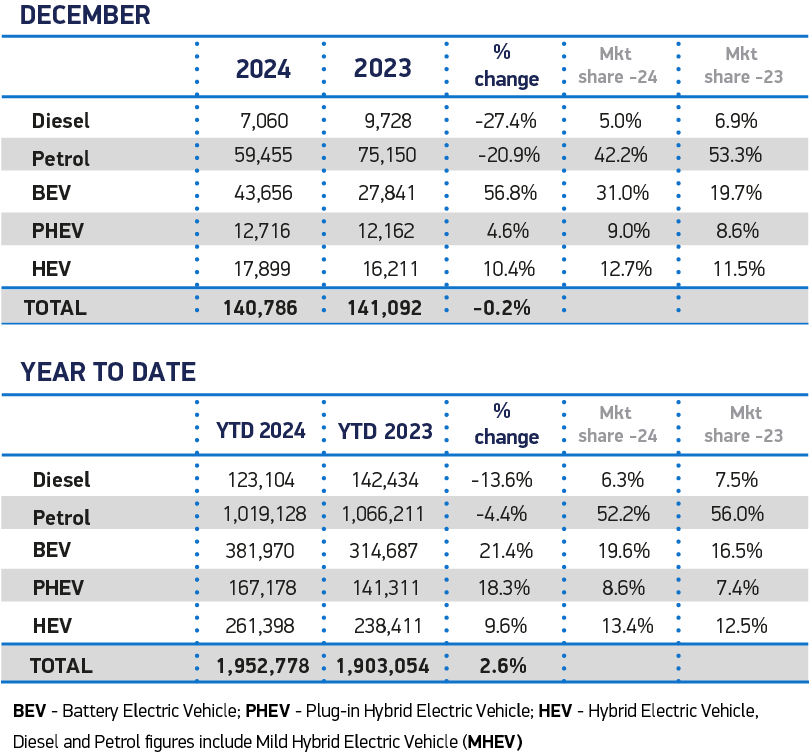

New zero emission vehicles finished with another strong December performance, with 43,656 new battery electric vehicle (BEV) registrations accounting for 31% of the market – the highest since December 2022’s record 32.9%.

However, SMMT figures suggest that it is the fleet market that is also driving the adoption of BEVs, with only one in 10 private buyers choosing an EV in 2024.

Petrol remained the most popular powertrain among these buyers, commanding 61% of demand, with hybrid electric vehicles (HEVs) in second place (16%).

Conversely, around 64,000 more BEVs were registered by businesses and fleets than a year ago, with such vehicles representing a quarter (25.4%) of those segments’ registrations and demonstrating the effectiveness of the compelling tax incentives afforded non-private buyers.

Across the total market, pure petrol and diesel car registrations fell by 4.4% and 13.6% respectively as more buyers swapped either to BEVs, or to lower emission hybrid electric vehicles (up 9.6%) and plug-in hybrids (up 18.3%).

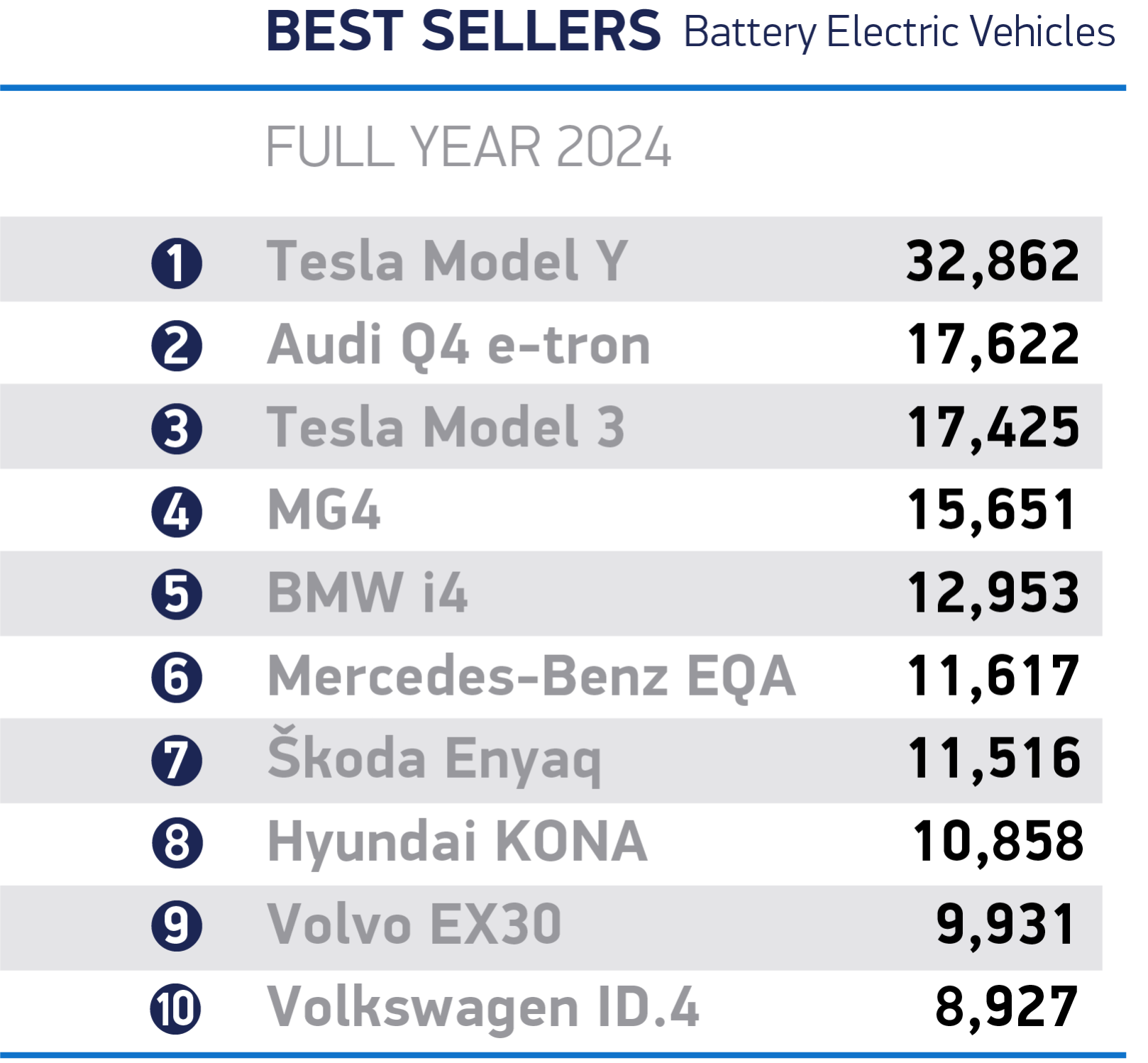

BEVs made up 19.6% of the market (381,970 units) in 2024, up by more than a fifth (67,283 units) from last year, but short of the 22% demanded by the zero emission vehicle (ZEV) mandate.

The SMMT said that industry has pulled every lever to try and achieve this target, with manufacturer discounting totalling more than £4.5 billion in 2024. However, it stressed that this level of discounting is not sustainable in the long term.

The Department for Transport (DfT) says that no car manufacturer is expected to pay fines to the Government for missing zero emission vehicle (ZEV) mandate sales targets.

The ZEV mandate required 22% of all new car sales and 10% of all new vans registered in 2024 to be zero emission. This year, that increases to 28% of all new car sales and 16% of all new vans.

Mike Hawes, chief executive of automotive trade body the SMMT, said: “A record year for EV registrations underscores vehicle manufacturers’ unswerving commitment to a decarbonised new car market, with more choice, better range and increased affordability than ever before.

“This has come at huge cost, however, with the billions invested in new models being supplemented by generous incentives which are unsustainable.

“We need rapid results from the regulatory review and urgent substantive support for consumers – else automotive investments will be at risk and the jobs, economic growth and net zero ambitions we all share in jeopardy.”

Average new car CO2 has fallen by 6.2% to 102.1g/km in 2024. While this will assist some manufacturers with mandate compliance, the SMMT says that the extent to which it will help will remain unclear until confirmed baseline CO2 figures are provided by Government.

Nick Williams, managing director at Lex Autolease, said: “Manufacturers have seen significant growth in electric vehicle sales over the course of 2024, with recovery from supply chain disruptions and more competitive pricing helping to boost purchases.

“While challenges persist, there is a quiet confidence that 2025 will see the sector successfully continue to help the country in its transition to a more sustainable future.

“Carmakers know they need to continue to invest in electric vehicles to attract consumers, which is important to the industry’s future success as the shift towards electrification continues to accelerate.

“A raft of new models coming to market and the continued growth of the second-hand market will help, but so too will investment in nascent technologies and the country’s charging infrastructure.”

Jon Lawes, managing director at Novuna Vehicle Solutions, added: “An uptick in EV growth in December reflects the significant discounting by manufacturers to reach EV vehicle quotas.

“However, it remains clear that such incentives are unsustainable with the ZEV mandate unfit for purpose, and the challenges will only get worse with rising thresholds this year.

“There’s no doubt that the industry widely maintains support for the transition, but the government must act now to relieve pressure on manufacturers that are already stretched to hit overly ambitious targets by providing bold fiscal support over and beyond measures just for company car drivers.

“Any misalignments with the 2030 ICE phase-out timeline must also be ironed out urgently with a swift conclusion to the consultation – the status quo threatens to stifle the transition to zero emissions vehicles in the year ahead.”

Login to comment

Comments

No comments have been made yet.