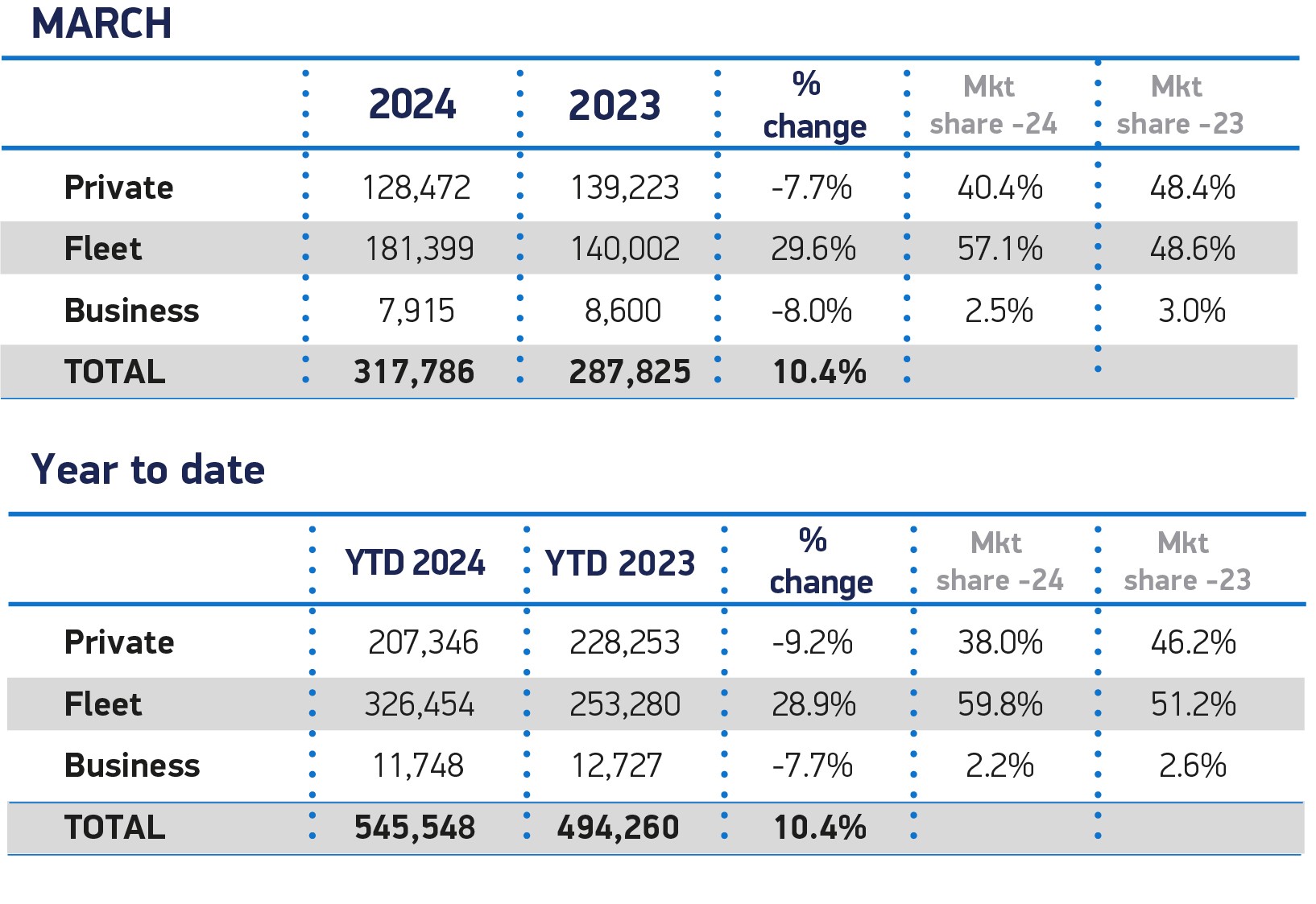

The strength of the fleet demand for new cars compared to weakening confidence in the retail market has been illustrated by new sales figures published by the Society of Motor Manufacturers and Traders (SMMT).

While the UK new car market clocked up its 20th consecutive month of growth in March, with a 10.4% rise in registrations, fleet and business registrations accounted for 60% of the market.

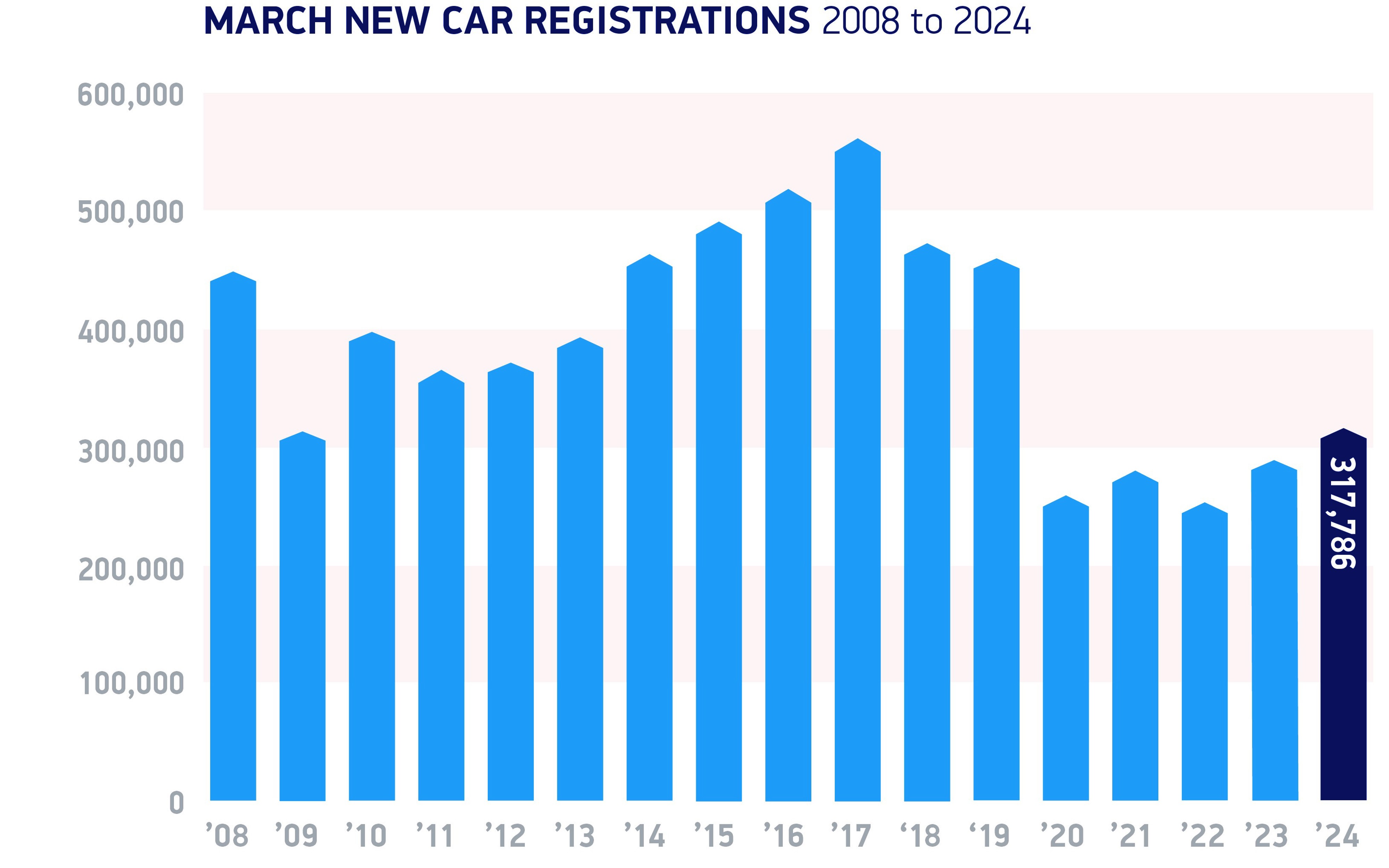

In what is typically the busiest month of the year due to the new numberplate, 317,786 new cars were registered overall – the best March performance since 2019, although still 30.6% below pre-pandemic levels.

Fleet and business registrations were up by more than 27% compared to March 2023, with 189,314 cars registered in the month, an increase of more than 40,000 units and a 60% market share.

Registrations by private buyers, meanwhile, fell by 7.7%, with a challenging economic backdrop of low growth, weak consumer confidence and high interest rates.

Year-to-date, fleet and business new car registrations now stand at 338,202 units, some 73,195 more than this time last year when it was responsible for 54% of the market.

Year-to-date, fleet and business registrations now hold a 62% market share.

Mike Hawes, SMMT chief executive, said: “Market growth continues, fuelled by fleets investing after two tough years of constrained supply.

“A sluggish private market and shrinking EV market share, however, show the challenge ahead.”

Pure electric vehicle market share falls

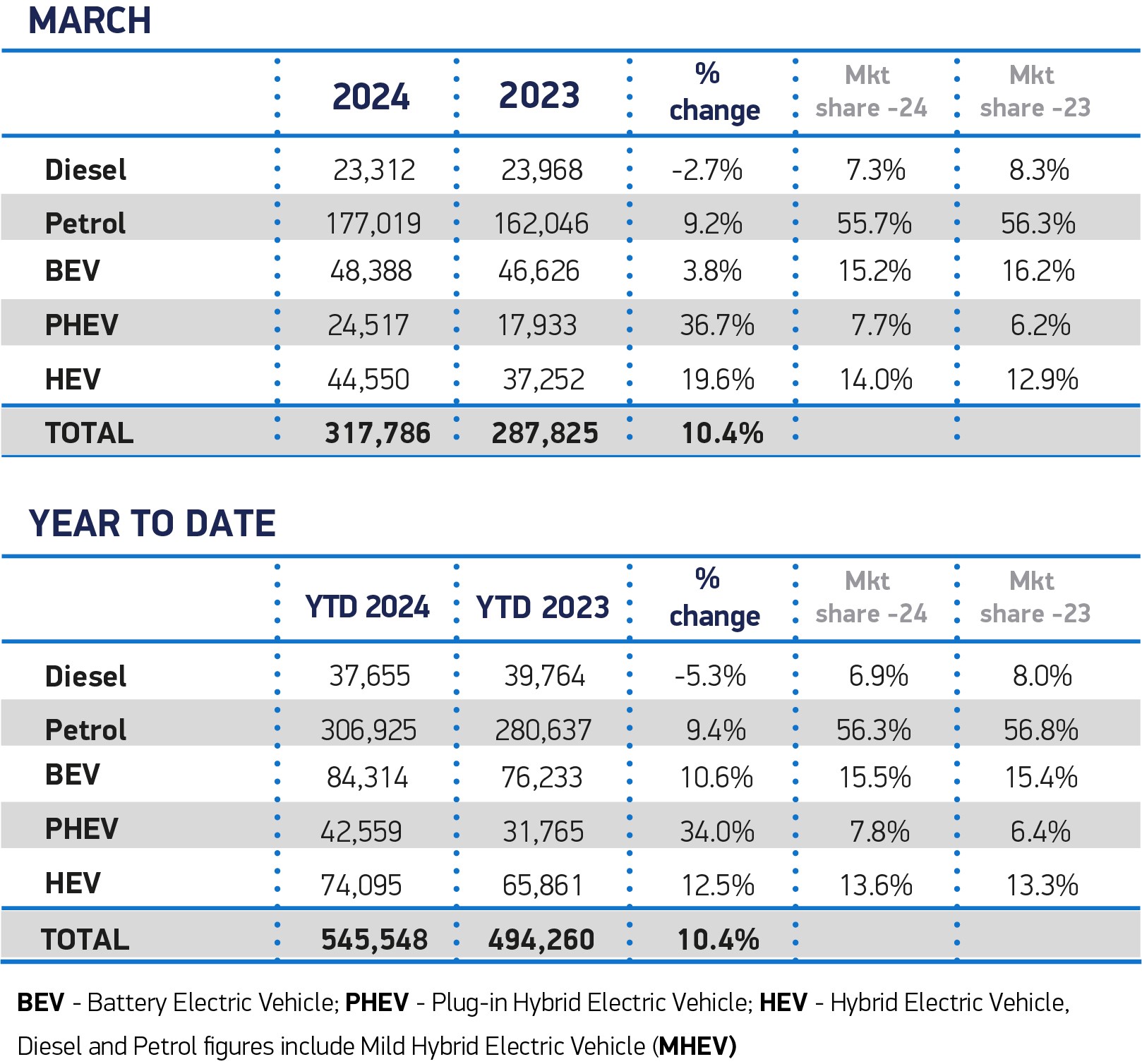

Petrol cars retained the lion’s share of the market, at 55.7%, with registrations up 9.2% year-on-year, as diesel volumes fell 2.7% to account for just 7.3% of demand.

Uptake of hybrid electric vehicles (HEVs) reached record levels, rising by 19.6% to 44,550 units and 14% of the market, while the biggest percentage growth was recorded by plug-in hybrids, up by more than a third to 24,517 units, or 7.7% of all new registrations.

Conversely, while battery electric vehicle (BEV) registration volumes were at their highest-ever recorded levels, market share fell by one percentage point from the same month last year, down to 15.2%.

Registrations rose 3.8%, with only fleets showing any volume growth.

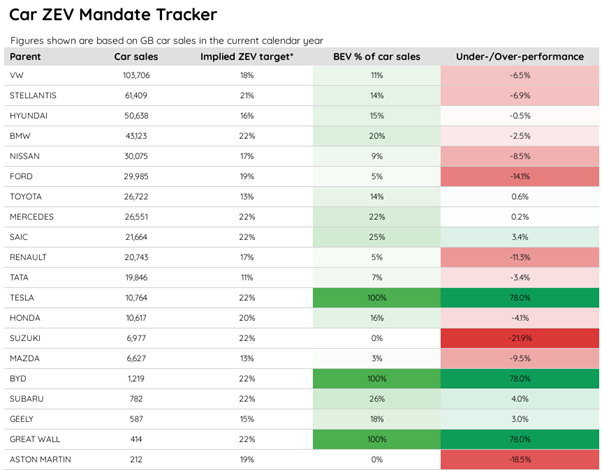

The ZEV mandate requires 22% of manufacturer car sales to be pure electric this year.

However, despite falling behind on their ZEV Mandate targets, the latest Electric Car Count from New AutoMotive suggests that the UK is still on track to reach 360,000 fully electric car sales by the end of 2024.

If sales trends continue, it expects BEV sales to achieve a 19% market share over the remaining nine months of the year.

The fall in BEV market share within a growing market underscores the need for Government to support consumers to speed up fleet renewal, says the SMMT.

Large fleets continue to drive BEV uptake, thanks to compelling tax incentives but, while registration volumes increased in March, market share declined.

“Manufacturers are providing compelling offers, but they can’t single-handedly fund the transition indefinitely,” continued Hawes.

“Government support for private consumers – not just business and fleets – would send a positive message and deliver a faster, fairer transition on time and on target.”

Jon Lawes, managing director at Novuna Vehicle Solutions, believes that the transition to electric is in danger of “stalling” without addressing the fundamental barriers to EV adoption, particularly after a “lacklustre” spring Budget.

He said: “Achieving the ZEV Mandate will prove increasingly difficult unless support measures for private buyers to make the switch are introduced, coupled with the sustained rollout of EV charging infrastructure which remains unfit for purpose,” he said.

However, Nick Williams, managing director of Lex Autolease, part of Lloyds Banking Group, added: “While market share fell in March, I still believe this will be a pivotal year for electric vehicle adoption.

“With the 2024 ZEV target and tough competition from Chinese rivals bearing down on carmakers, many are reimagining their operations and creating partnerships to cut manufacturing costs and launch more affordable models.”

Source: New AutoMotive

The SMMT suggests that temporarily halving VAT on BEVs, revising the threshold for the expensive car supplement on Vehicle Excise Duty (VED) next April, and abolishing the ‘pavement penalty’ on public EV charging by equalising VAT rates to 5% in line with home charging, would make a significant difference to consumers, helping more of them move to zero emission vehicles sooner.

Ian Plummer, commercial director at Auto Trader, also believes more needs to be done to encourage BEV sales.

He said: “While the fleet side of the market is driving the growth, more needs to be done to stimulate electric vehicle demand among private buyers where affordability remains the number one barrier.

That said, manufacturers are fighting harder than ever to tempt customers, as more than three-quarters of new EVs are now advertised on our website with discounts, with the average discount applied increasing to 11% last month.

“That trend only looks set to accelerate as manufacturers struggle to meet strict ZEV mandate targets in a much more competitive landscape.”

He added: “The arrival of new Chinese entrants is likely to continue to shake up the market and bring down prices for consumers.”

While highlighting the positive growth of new car registrations in March, Philip Nothard, insight director at Cox Automotive, also says that “subdued consumer confidence” hampered private retail sales, showing the urgent need for EV incentives.

“Although the fleet sector spearheads recovery and electrification, sustainability concerns loom large,” he added.

“High entry costs, infrastructure gaps, and a lack of Government support pose significant challenges for consumers venturing into electric vehicles.”

Login to comment

Comments

No comments have been made yet.