One-in-six grey fleet drivers who use their own car for business trips have failed to inform their insurance provider, new research suggests.

In a survey of 1,855 grey fleet drivers, the AA also found that one-in-15 (6%) could not remember if they had declared their visits to clients, off-site meetings and conferences.

Furthermore, while three quarters (75%) of drivers informed their insurer of the business miles they carry out, the survey discovered that one-in-six (16%) say they have underestimated the distance they travel.

The AA is advising fleets and their drivers to check policies to ensure they are adequately covered when they use their own car for work. Find out how AA fleet director Duncan Webb is managing grey fleet at Fleet & Mobility Live 2024.

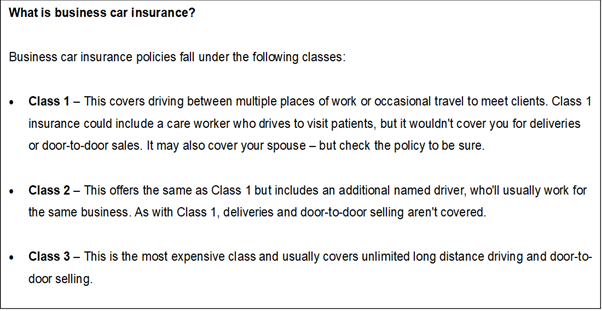

While many standard policies will protect the main policyholder commuting to one regular place of work, those carrying out visits to multiple sites or clients should upgrade their policy to include business use.

Similarly, some companies provide schemes where they have an insurance policy that will cover the business miles travelled by employees, but they need to the be registered to the scheme and may be required to take online learning or have a driving assessment.

Without the correct insurance cover, some drivers may find themselves unable to make a claim if they were using the vehicle for a business trip but had not informed their provider.

Gus Park, managing director of AA Insurance Services, said: “Some drivers who use their own cars for regular off-site business trips are running the risk of not being covered should the worst happen.

“Adding business use to your policy is a small task, but can make a big difference. If you regularly travel to see customers or attend conferences, it is really important to make sure your policy is fit for purpose.

“As well as checking your own policy, it’s also worth checking if your employer offers some form of business cover and if so, what you need to do to join the scheme.”

Separate research from the TTC Group, published earlier this week, revealed just one third (33%) of businesses monitor the status of their employees’ drivers’ licences.

adam.rollins@midas-fms.com - 19/09/2024 12:17

As well as making sure there is business cover in place and the class of insurance, it is also important to ensure the insurance covers use of the vehicle for the employer's business, not just the business of the employee; these are not necessarily the same thing. It is also important to ensure there is a process in place to regularly monitor and update grey fleet insurance, as well as the full duty-of-care issues around grey fleet; tax, service history and MOT, which is why Midas has built-in a grey fleet module, that provides reminders and reports for drivers and fleet managers to ensure each vehicle on the grey fleet is properly tracked and up-to-date with compliance.