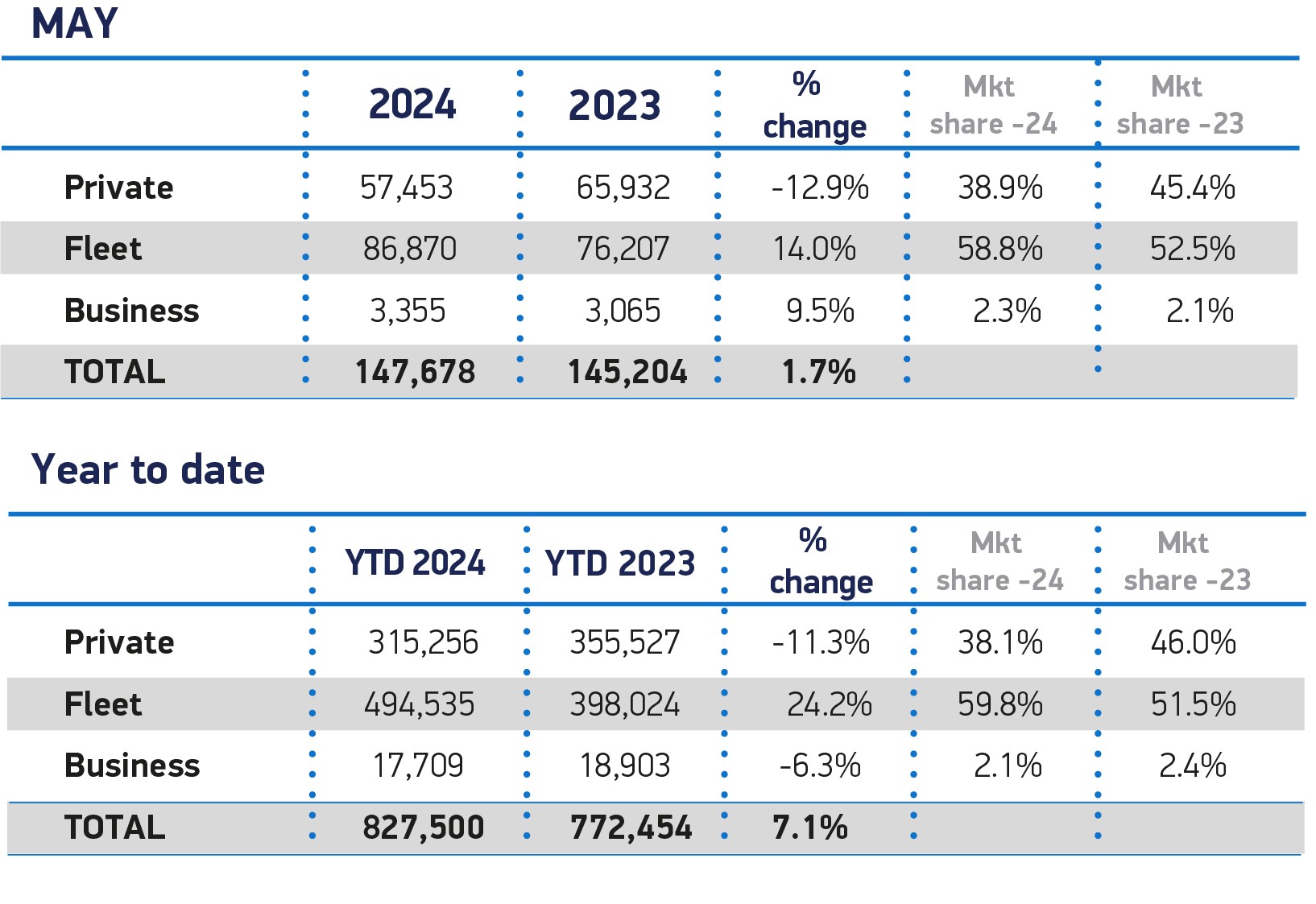

Fleet and business new car registrations have surpassed the half-million mark and are now 23% higher than at this stage last year.

New figures from the Society of Motor Manufacturers and Traders (SMMT) show 90,225 new cars were registered to fleet and business in May – a 14% uplift on May 2023 (79,272 units).

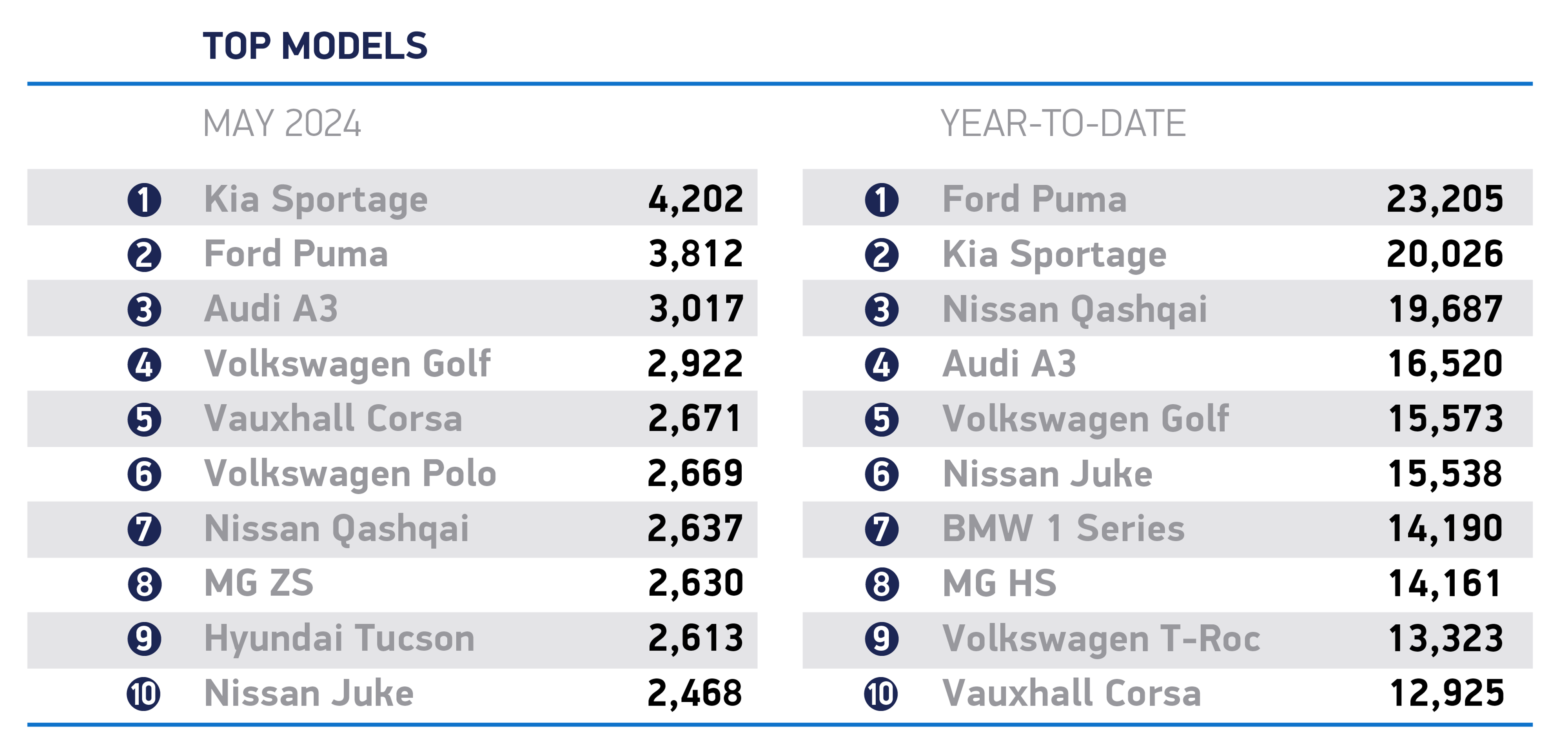

With 147,678 new cars registered during the month, fleet and business registrations continued to show their importance to an overall market, equating to a market share of 61% - a six percentage point rise on May 2023.

Year-to-date, fleet and business registrations hold 62% market share, equivalent to 512,244 new cars joining UK fleets.

That's an eight percentage point rise compared to the first five months of last year when 416,927 units were registered.

It equates to a 23% uplift in fleet and business registrations, compared to an 11% decline in private new car sales year-to-date.

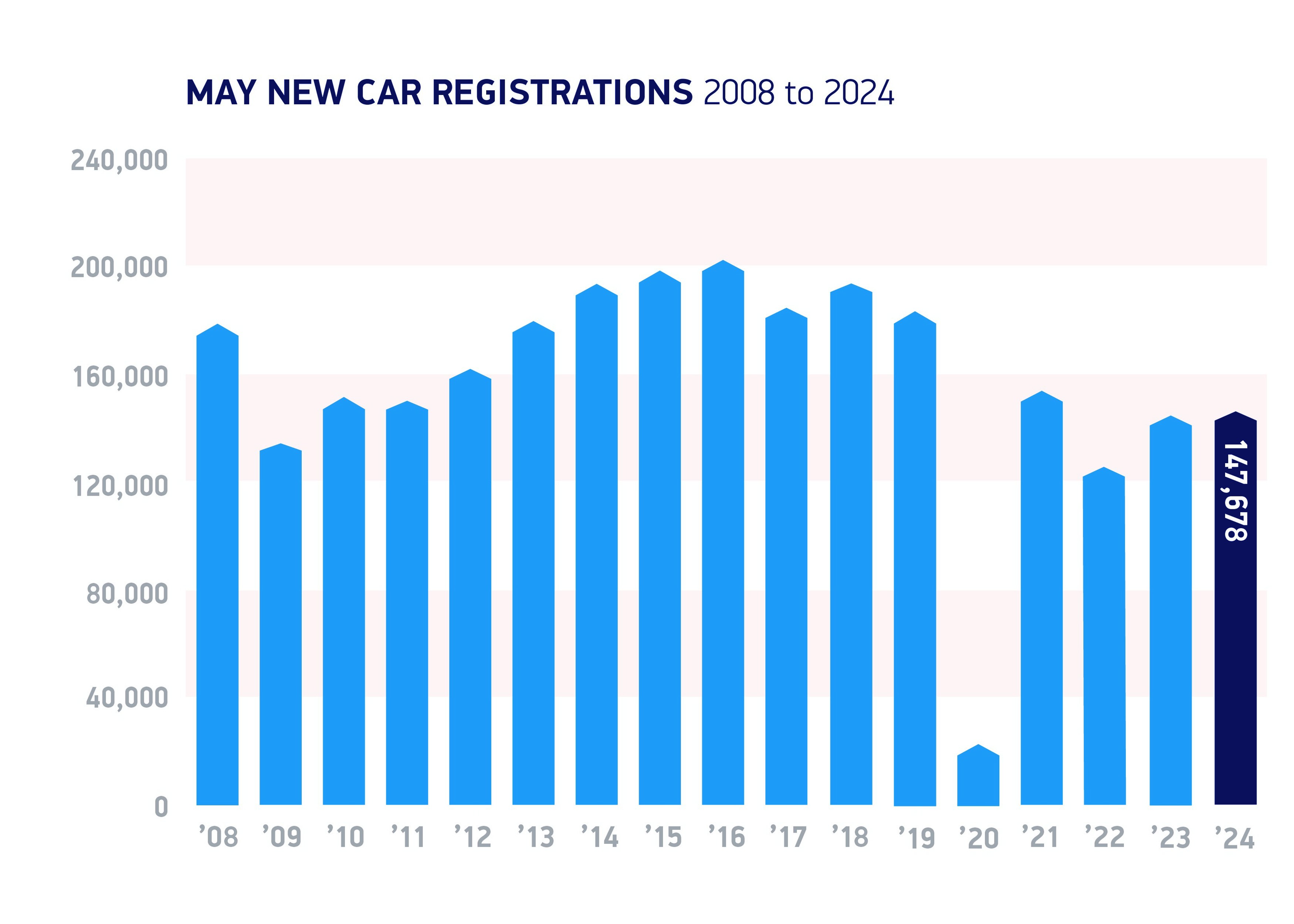

Overall, the UK new car market in May marked its 22nd consecutive month of growth as registrations rose 1.7% in what was the best May market performance since 2021, although it remained down more than 19% on 2019.

The increase in fleet and business and fleet registrations offset a 13% decline in private retail uptake during the month.

SMMT chief executive, Mike Hawes, said: “As Britain prepares for next month’s general election, the new car market continues to hold steady as large fleets sustain growth, offsetting weakened private retail demand.”

Battery electric vehicle registrations driven by fleets

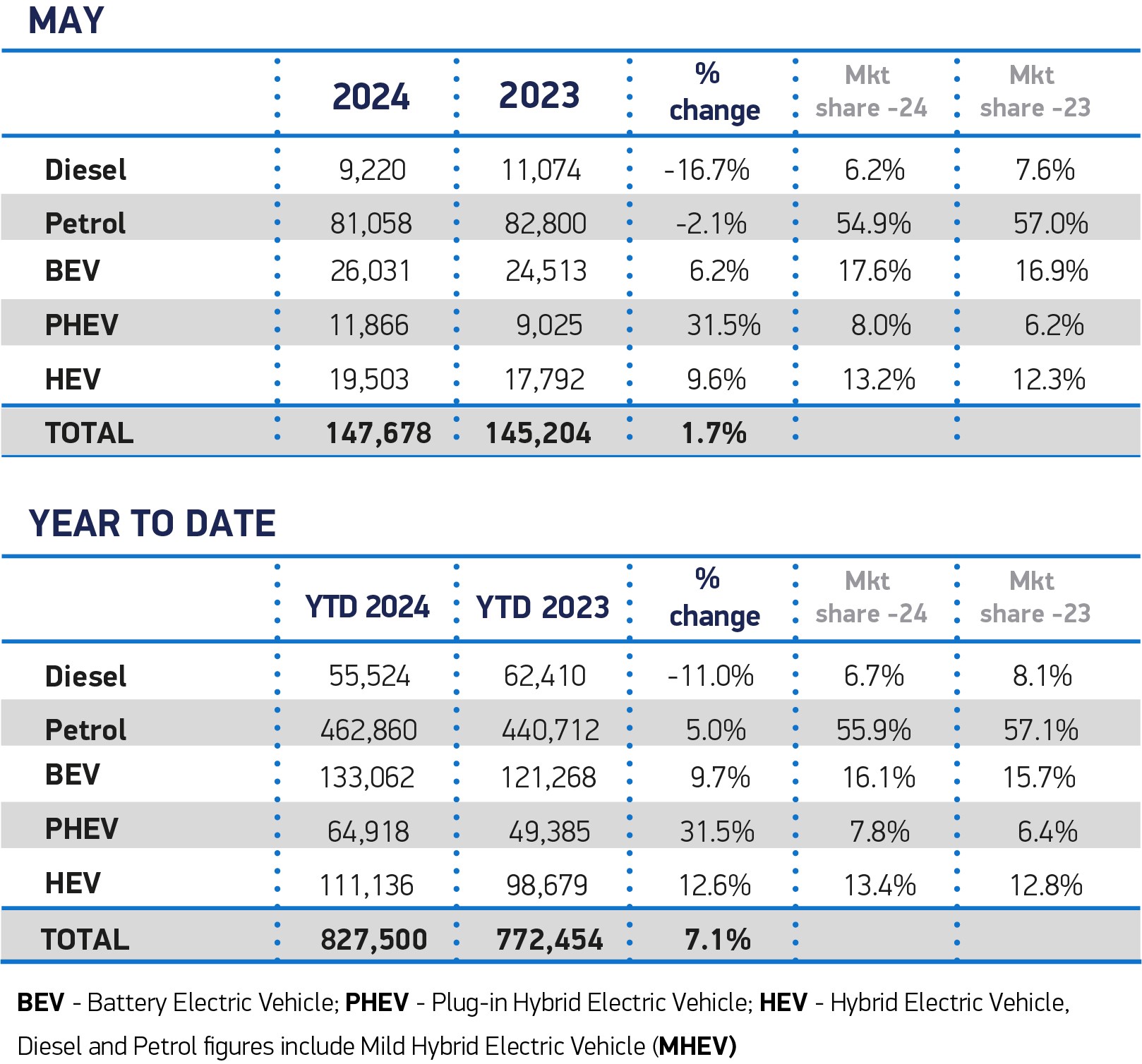

While deliveries of both petrol and diesel cars fell, demand for electrified vehicles rose, with plug-in hybrids (PHEVs) recording the highest growth of all powertrains, up 31.5% to reach an 8% market share, and hybrids (HEVs) rising 9.6%, maintaining their status as the third most popular fuel type after petrol and battery electric at 13.2% of the market.

Battery electric vehicle (BEV) registrations also outperformed the market, rising 6.2% to claim a 17.6% market share, up from 16.9% in the same month last year.

Uptake is still being driven by the fleet sector, where volumes rose 10.7%.

Private retail BEV uptake, meanwhile, fell by 2% (just 98 registrations short of May last year).

The performance, although encouraging, is still below the trajectory mandated on manufacturers by Government in its Vehicle Emissions Trading Scheme, which demands 22% of new vehicles sold this year by each brand must be zero emission.

Philip Nothard, insight director at Cox Automotive, said: “Fleet sales primarily drove BEV market share for the month, while private new car registrations remain, arguably, weak.

“That reflects a cautious buying public. The challenge of meeting the Government's 22% zero-emission vehicle mandate this year is significant and requires immediate attention."

Arguing for more support, the SMMT says that manufacturer discounting cannot be sustained indefinitely as it undermines the ability of companies to invest in next generation technologies.

Hawes explained: “Consumers enjoy a plethora of new electric models and some very attractive offers, but manufacturers can’t sustain this scale of support on their own indefinitely.

“Their success so far should be a signpost for the next government that a faster and fairer transition requires carrots, not just sticks.”

The trade body argues that temporarily halving VAT on new BEV purchases, combined with a cut in the VAT levied on public charging from 20% to 5% – in line with domestic use – would drive up demand, putting more than a quarter of a million EVs on the road instead of petrol or diesel cars over the next three years.

Jon Lawes, managing director at Novuna Vehicle Solutions, said: “With fleets facing uncertainty to move forward with their future mobility plans, it’s imperative that next month’s general election provides the catalyst to accelerate the uptake of zero emission vehicles.

“Achieving the transition to net zero must be underpinned by a bold industrial strategy and any incoming government must urgently provide firm commitments to remove barriers to greener mobility through a series of regulatory and fiscal support measures.”

Nick Williams, managing director of Lex Autolease, part of Lloyds Banking Group, added: “Consistency will be key to maintaining that long term confidence and helping the market grow. As it does, momentum will pick up and the second-hand market will entice yet more people to make the leap.

“With consumer trust and confidence low, which is affecting retail registrations, it’s time to bust the myths surrounding electric vehicles. As an industry, we need to come together to ensure drivers are informed of the cost saving of driving and charging electric vehicles.”

Jamie Hamilton, automotive partner and head of electric vehicles at Deloitte, says that consumers may have been put off by high interest rates and a squeeze on their spending power due to the cost of living.

“There needs to be more focus on removing the main barriers preventing the average consumer from contemplating a switch to electric,” he continued.

“Currently, electric vehicles don’t appear to make sense for consumers, unless they can charge their cars at home overnight. As a result, there does need to be a push on creating more publicly available charging stations.

“A raft of new low-cost options in the electric vehicle market are expected to land this year which may tempt consumers to make the transition to electric.”

In further analysis of the figures, Richard Peberdy, UK head of automotive for KPMG, said: “While some consumer new car purchases are covered under fleet data in the shape of salary sacrifice leasing, consumer new car sales are down by around 40,000 vehicles on this time last year.

“Fleets are also driving the growth in electric vehicle market share, leading industry players to continue to call for the kind of consumer incentives that have helped to boost business EV buying.”

Kim Royds, mobility director at Centrica, believes that access to charging remains one of the main barriers to mass EV adoption.

“If we’re to make electric vehicles accessible for every driver across the UK, then we must tackle the inequality that exists between at home and public charging,” she said.

“Investing more in kerbside infrastructure so those without access to driveways can still benefit from affordable charging rates must be a top priority.”

David Borland, EY UK and Ireland automotive leader, says that as we enter the summer months, we are likely to see the traditional drop off in sales in the lead up to September, with a potential further impact as consumers focus on the holiday season, the Euros and the Olympics.

He added: “The next few months will be crucial to OEMs in determining how they meet internal and external full-year targets, without negatively affecting profitability and long-term strategy.”

Login to comment

Comments

No comments have been made yet.