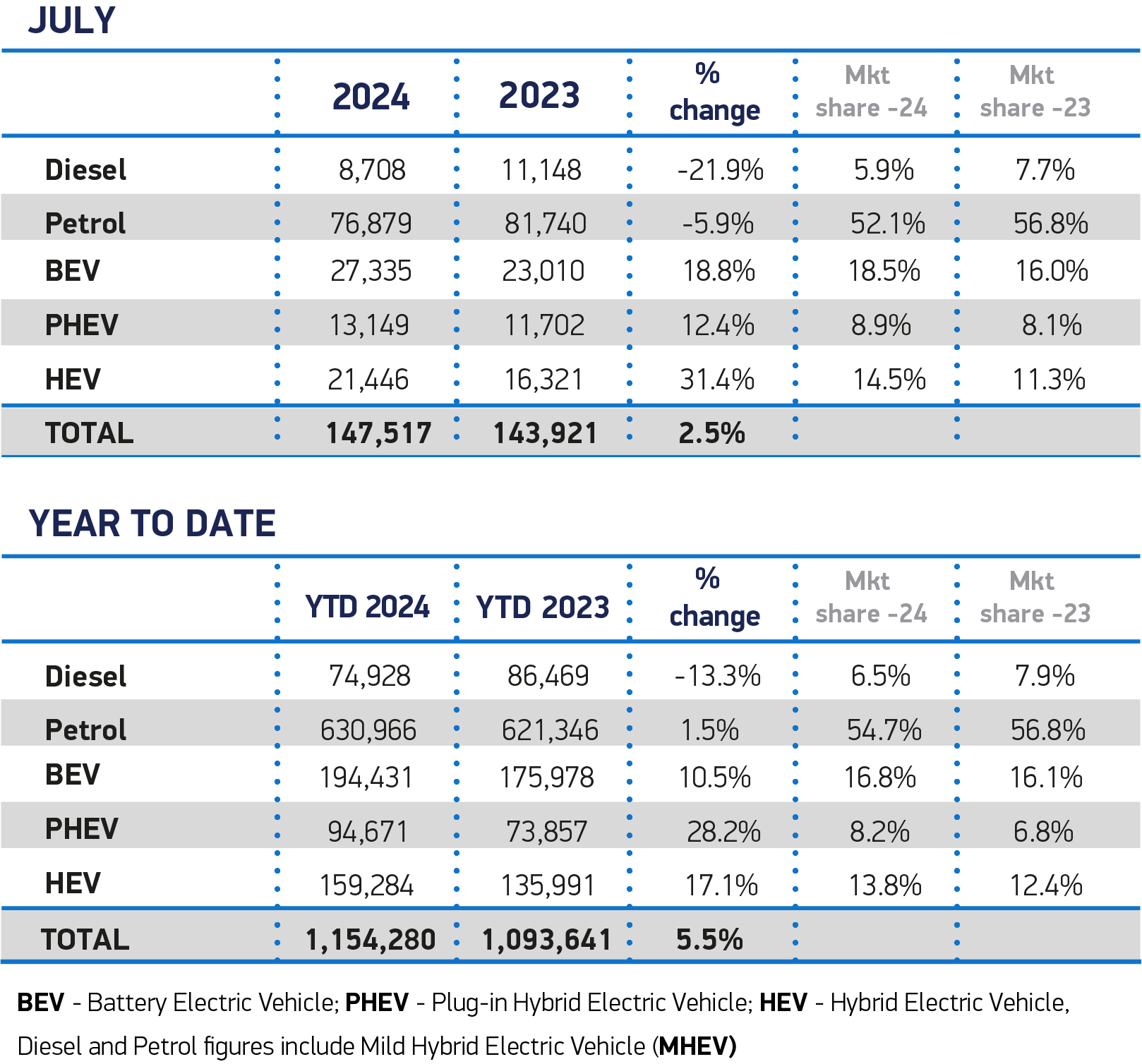

Electrified vehicle demand outpaced the overall market, accounting for four in 10 (42%) new cars registered in July, according to new data from the Society of Motor Manufacturers and Traders (SMMT).

Hybrid electric vehicle (HEV) uptake increased by 31.4% to achieve a 14.5% market share, while plug-in hybrids (PHEV) grew 12.4% to take 8.9% of registrations.

Battery electric vehicle (BEV) volumes, meanwhile, were up 18.8%, resulting in an overall market share of 18.5%.

SMMT says that, while the private share of the BEV market continues to fall – 17.2% went private buyers, compared with 20.3% last year, private BEV volumes did increase by a marginal 0.9%. Overall, BEVs account for 16.8% of the new car market, year to date.

Toby Poston, director of corporate affairs at the British Vehicle Rental and Leasing Association (BVRLA), said: “Fleet registrations, led by the huge popularity of salary sacrifice car schemes, continue to drive the uptake of EVs.

“This sends a clear message to the new Government. It needs to maintain access to these employee benefits and prolong current benefit-in-kind tax incentives in the upcoming October 30th Budget if it wants to have any chance of meeting its ZEV Mandate and phase out targets.

“Policymakers need to take this playbook and apply it to the electric van and private EV markets, where a lack of adequate incentives and shortage of cost-competitive product continues to stifle demand.”

Electric fleet registrations

Separate figures from Cap HPI show that fleet BEV registrations have risen to 41% market share year to date.

Its latest Insight Report highlights that, while BEV's market share is 10% lower than in the same period last year, PHEV's share is almost 10% higher.

The share of all alternative fuel vehicles (electric/BEV, plugin hybrid/PHEV, and hybrid/HEV) remained stable at over 70% between 2024 and the same period in 2023.

Andrew Turner, senior product specialist at Cap HPI consulting, said: “The mix for alternative vehicles has changed, with PHEV and HEV rising and BEV falling.”

|

Fuel |

Jan-Jun 24 Share |

Jan-Jun 23 Share |

|

Diesel |

4.1% |

4.9% |

|

Petrol |

25.8% |

23.9% |

|

BEV |

41.0% |

51.8% |

|

PHEV |

23.0% |

14.5% |

|

HEV |

6.1% |

4.9% |

Source: Cap HPI

He continued: “Overall, the Insight market is fairly flat compared to the same period in 2023, and this may be driven by the slowdown in electric car (BEV) registrations, given their popularity in this sector.”

Cap HPI’s June data shows the Tesla Model Y topping the table, followed by the Tesla Model 3, Audi Q4, and Audi A3. BEVs accounted for six of the top ten registered vehicles.

|

|

Jun 2024 |

|

1 |

Tesla Model Y |

|

2 |

Tesla Model 3 |

|

3 |

Audi Q4 |

|

4 |

Audi A3 |

|

5 |

Volkswagen Golf |

|

6 |

Mercedes EQA |

|

7 |

Kia Sportage |

|

8 |

Skoda Enyaq |

|

8 |

Volkswagen ID.4 |

|

10 |

Hyundai Kona |

Source: Cap HPI

Turner said: “With new market entrants targeting the fleet sector for growth, it will be interesting to see how a wider range of models and price points will impact the BEV share of the market over the coming months.”

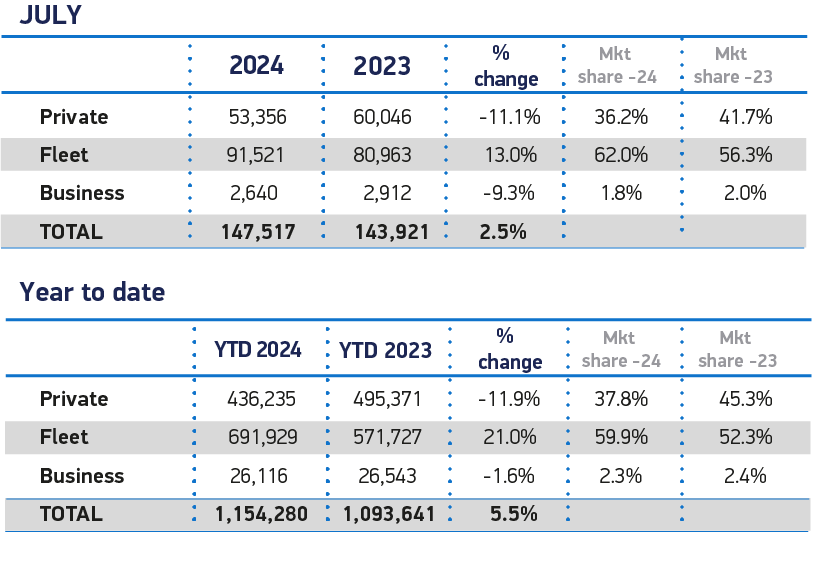

Fleet dominates new car market

Looking at SMMT new car data for July, fleet and business registrations increased more than 12% year-on-year with 94,161 cars registered, equating to 63% of the market.

Year-to-date, the fleet and business sector now holds 62% of the market, with 718,035 registrations, a 20% uplift on the 598,270 new cars registered over the same period last year.

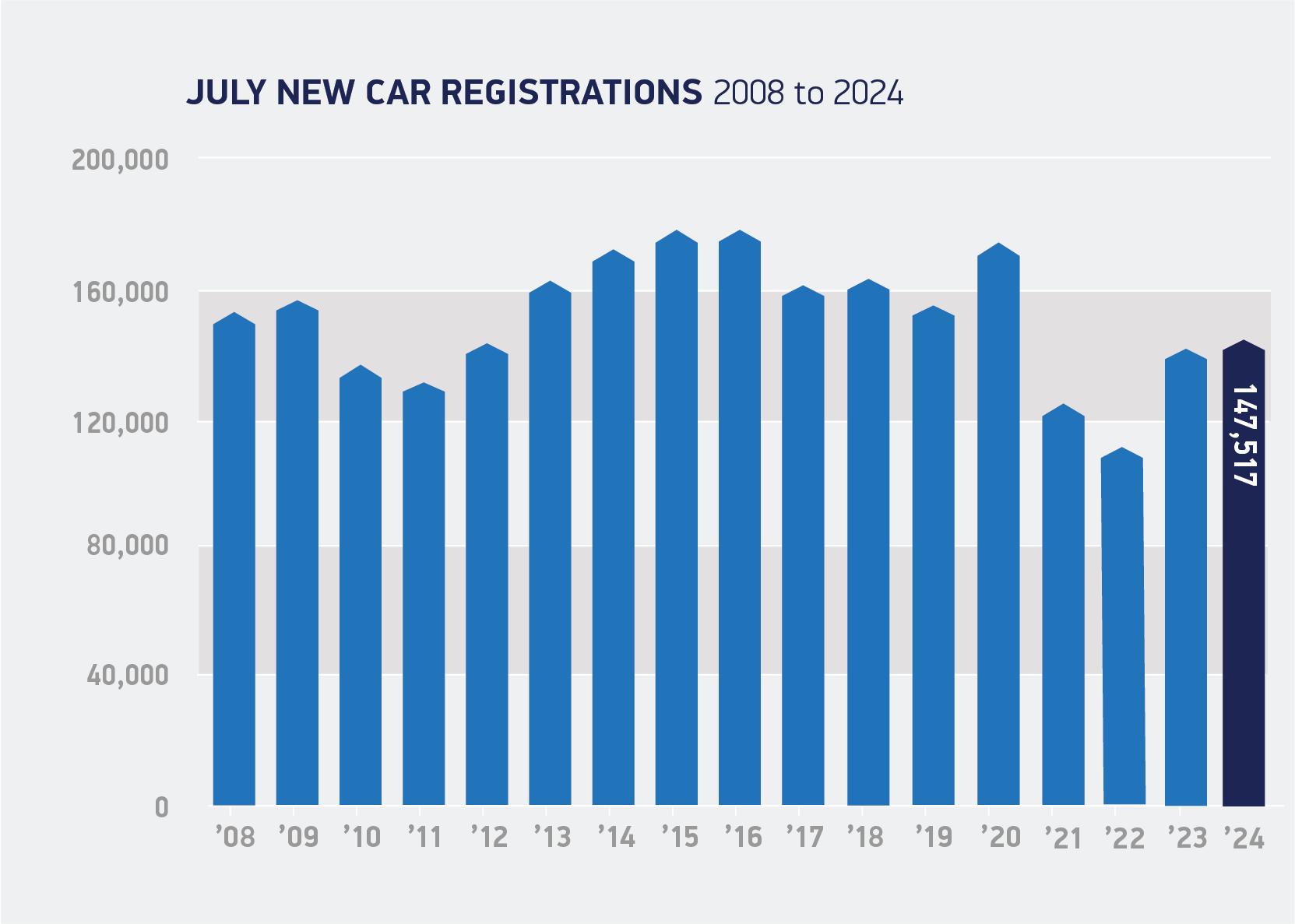

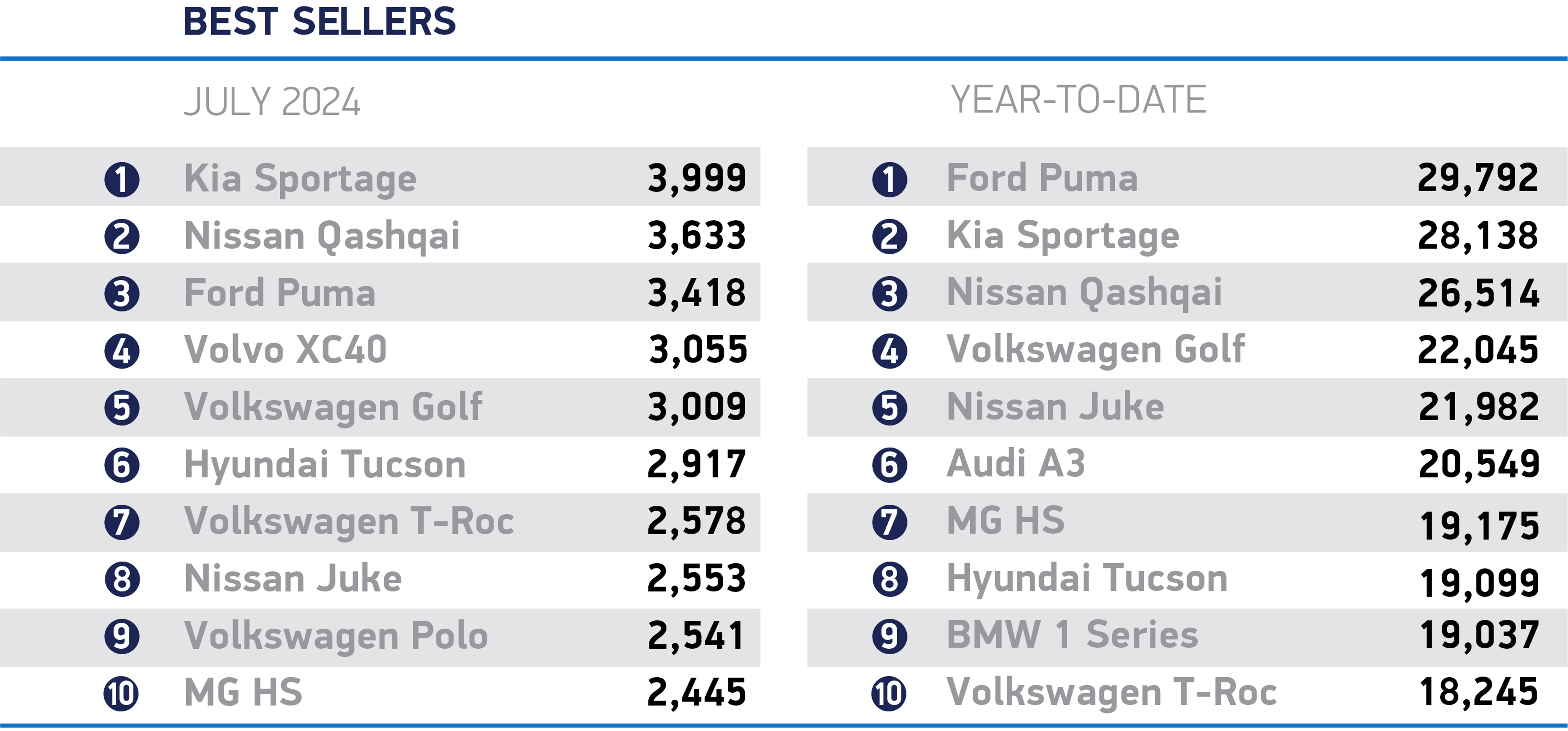

Overall, the new car market rose by 2.5% in July, delivering two years of consecutive growth, with 147,517 new cars registered – the best performance for July since 2020.

While the SMMT outlook anticipates overall market growth in 2024, expectations have been revised downwards since April, with 1.968 million new car registrations now forecast by the end of the year.

The anticipated BEV share of the market has also been revised downwards to 18.5% from the 19.8% expected in April.

Last week’s interest rate cut was already ‘priced in’ to the latest outlook but the SMMT says that further cuts would be welcome, helping reduce the costs of finance and making new car purchases more accessible to more consumers.

With zero emission vehicles mandated to comprise a minimum 22% of each brand’s new car registrations over the full year, the trade body argues the pace of transition needs to increase significantly.

However, its latest industry outlook suggests that such a surge is looking increasingly unlikely given the current market conditions.

Mike Hawes, SMMT chief executive, said: “Two years of new car market growth against a backdrop of a turbulent economy is testament to the sector’s resilience and the attractiveness of the deals on offer.

“Weakening private retail demand, however, particularly for EVs and despite generous manufacturer discounts, is the over-riding concern.

“More people than ever are buying and driving EVs but we still need the pace of change to quicken, else the UK’s climate change ambitions are threatened and manufacturers’ ability to hit regulated EV targets are at risk.

“Achieving market transition at the pace demanded requires greater support for consumers and, with the all-important new numberplate month of September beckoning, action on incentives and infrastructure is needed now.”

Philip Nothard, insight director at Cox Automotive, says that a healthy retail market is “vital” for manufacturers’ long-term profitability.

“Although BEV uptake is rising, it still falls short of mandated targets,” he explained. “However, the potential for BEVs is significant, and we expect them to play a major role in the market outlook for 2025.

“It is too soon to know what impact, if any, the new Government’s growth plans will have on consumer confidence, though the Bank of England’s base rate reduction last week was a positive and welcome sign.

“Our baseline forecast is marginally more optimistic than the SMMT’s projections, but we continue to monitor movements closely and caution that Q4 could see some dramatic movements as manufacturers manoeuvre to avoid ZEV penalties.”

Richard Peberdy, UK head of automotive for KPMG, believes that benefit-in-kind (BIK) and salary sacrifice incentives for business have been the major driver of growth in EV sales and market share for some time now.

“The evidence increasingly suggests that accelerating private EV sales may require similar incentivisation, particularly if the Government is going to reinstate the 2030 end to new petrol and diesel vehicle sales,” he said.

“While choices in the new car market are improving, EV prices and the scale and rate of price depreciation when buying from new remain major barriers to convincing consumers to buy a new EV.

“Subsequently, many consumers that are looking to transition to an EV are deciding that the used EV market is a more attractive way to do that.

“Despite used EV sales growing, the higher rate of stock that is currently coming into the used market is still pushing the price of some models down even further.

“All of this context continues to pose big questions regarding how car makers will meet their Zero Emission Mandate targets.”

Jamie Hamilton, automotive partner and head of electric vehicles at Deloitte, added: “Despite the battery electric vehicle sector outperforming the rest of the market, the industry requires continued clarity on the ban of new petrol and diesel car sales so that it can plan investments accordingly.

“If the ban on new petrol and diesel car sales is to be maintained or moved forward, we can expect further calls from within the industry for financial incentives on electric vehicles to support demand.

“In the meantime, for consumers seeking more affordable options, there are cheaper electric vehicle models becoming available, including a number of new brands entering the market.”

Kim Royds, mobility director at Centrica, believes that more work needs to be done to remove barriers to adoption and give drivers the confidence to make the switch.

“Without a doubt, tackling the inequality that exists between at home and public charging should remain a top priority,” she said.

“A large proportion of homeowners live without access to a driveway and therefore are restricted from unlocking the main benefits of going electric.

“Creating at home and kerbside charge point solutions with affordable charging costs must be high on the list for industry leaders and policymakers to ensure that nobody is left behind.”

Nick Williams, transport managing director at Lloyds Banking Group, added: “As an industry there remains real opportunity to see further growth if all parts work together and help realise the benefits offered by electric vehicles with more affordable new and used models becoming available.”

Login to comment

Comments

No comments have been made yet.