The total number of publicly available electric vehicle (EV) charge points increased by 3,095 in the first quarter of this year, up 8% compared to the start of January, according to new data from the Department for Transport (DfT).

Charge points rated as ‘rapid’ (25-100kW) or above, increased by 760, a rise of 11% on the last quarter’s figures.

As of April 1, there were 40,150 public EV charging devices installed in the UK, with 7,647 rated ‘rapid or above – 19% of all charging devices – while 22,338 were rated as ‘fast’ chargers (7-22kW), some 56% of all charging devices

Year-on-year, the number of installed public devices has increased by 9,860, a 33% increase.

The number of rapid charging or above devices has increased by 39%, an additional 2,153 public devices installed.

Proportionately, the largest increase in installations in the last quarter was within the ultra-rapid device category (100kW-plus), which increased by 16% (albeit from a lower base than other categories), accounting for 366 charging devices.

Ultra-rapid charging devices are still the smallest overall category with 2,661 devices.

Proportionately in the last quarter, the smallest increase in charging devices installations was in the fast-charging devices categories, with an increase of 5% or 1,083 charging devices.

Fast charging devices (7-22kW) are still the most common category to be publicly installed.

Where are EV charge points are being installed?

The most common location category for charging devices is ‘destination’ with 19,044 charging devices or 47% of all publicly available charge points.

‘On street’ charging devices account for 34% of charge points or 13,571, while ‘en-route’ chargers account for 6% (2,540 charge points).

Charging device location categories are defined based on both the physical and, or type of facility they are located in and who can access them, along with the type of charging service they are designed to deliver.

On Street charging devices located on residential streets only, while en-route charging devices located for charging to continue a journey, such as motorway service areas, service stations, electric forecourts and ferry terminals. Additionally, rapid or ultra-rapid devices can be found at hotels, restaurants and attractions.

Destination charging devices are typically located at the end of an EV journey or where a driver may stop for an extended period of time.

‘Other’, which accounted for 12% of the available public charge points (4,995 devices), are semi-public with some level of access restrictions such as workplace car parks and dealership forecourts.

The DfT again reports that that there is an “uneven geographical distribution” of charging devices within the UK.

“Some UK local authorities have bid for UK Government funding for charging devices, and others have not,” it says.

Most of the provision of this infrastructure has been market-led, with individual charging networks and other businesses (such as hotels) choosing where to install devices.

London and Scotland had the highest level of charging provision per 100,000 of population, with 145 and 72 devices per 100,000 respectively. In comparison, the average provision in the UK was 60 per 100,000.

Northern Ireland had the lowest level of charging device provision in the UK, with 20 devices per 100,000, followed by the North-West and Yorkshire and the Humber with 33 and 37 devices per 100,000, respectively.

Scotland had the highest rate of rapid device provision of 18.4 rapid or quicker devices per 100,000, while the average provision in the UK was 11.4 per 100,000.

Rapid or quicker device provision was lowest for Northern Ireland with 1.9 rapid or quicker devices per 100,000. North-West and East of England were the second and third lowest regions with 9 and 9.7 rapid or quicker devices per 100,000 respectively.

An interactive map of this data is available here.

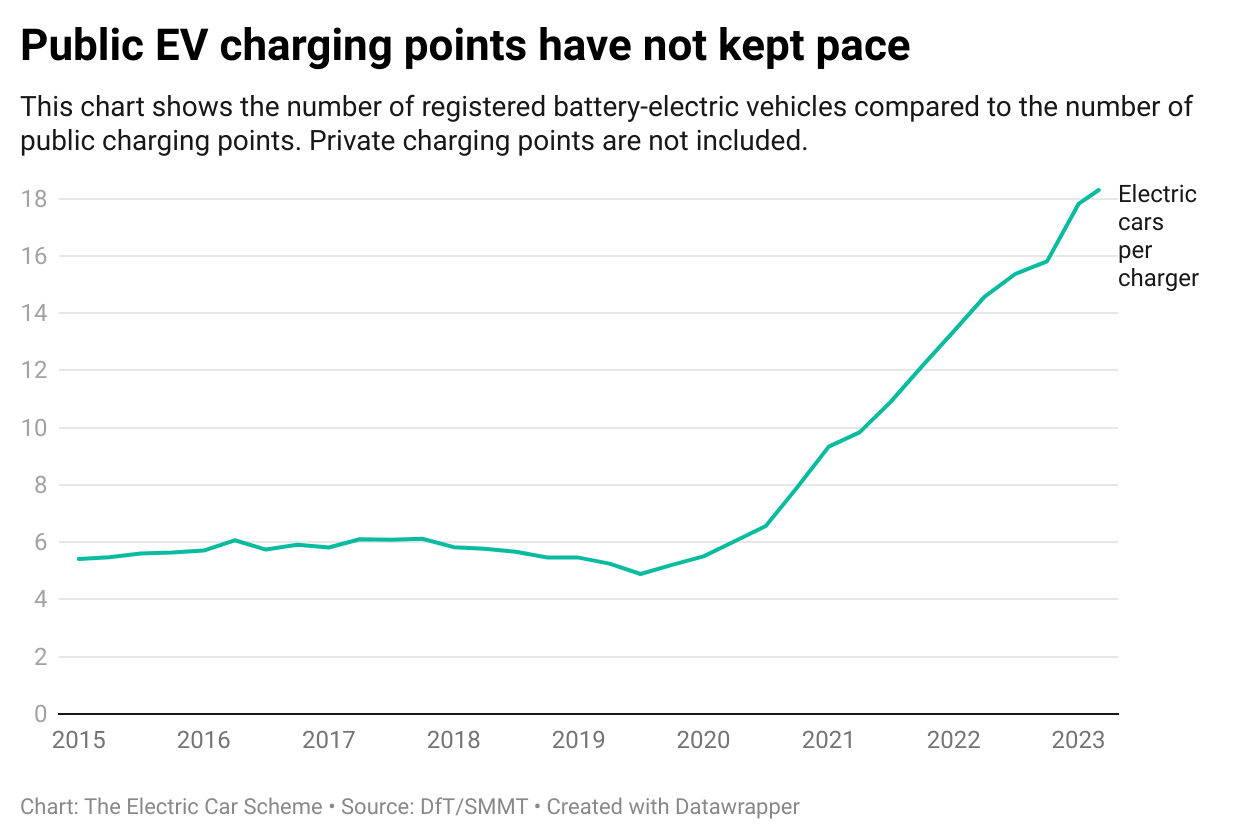

Salary sacrifice provider The Electric Car Scheme says that, while the number of charge points has grown, it has not kept pace with the growth in EV sales.

Its analysis (see graph below) shows that as of April 1 there were 18.3 cars for every charger, higher than the 17.8 on January 1 and triple the figure for April of 2020, when there were six EVs for every public charger.

Thom Groot, co-founder and CEO of salary sacrifice provider The Electric Car Scheme, said: "The Government needs to move urgently to increase the number of public charging points for electric cars.

“While it's fantastic that more people are now driving electric cars, this has led to a shortage of chargers - there are now about 18 electric cars for every charger, compared to six in 2020.

"A great way to fix this would be requiring that all new carparks over a certain size must have charging points, as Scotland is doing. Fixing the 'pavement tax' that makes public charge points far more costly than charging at home would also help.

"Most people charge their cars in the home, but for the UK to ban new fossil fuel cars at the end of the decade we will need a robust public charging network."

A new trade body for the EV charging industry, ChargeUK, launched last week, revealing investment plans up to 2030.

It brings together 18 of the country’s largest charge point operators (CPOs), which collectively have announced they will invest more than £6 billion installing and operating new EV charging infrastructure by 2030.

Tens of thousands of new chargers will be installed this year, with the aim of doubling the size of the network through 2023.

TimI - 05/05/2023 11:39

The graphs of cars per charger are distorted by the large number of slow chargers put in by mistake early on. What matters for drivers at this point is the number of ultra-rapids, and these are increasing faster than EV numbers. Once the market begins to expand for those with off street parking then slow chargers will make sense, but there is no point building vast numbers of chargers that will sit idle for years.