Repair cost inflation is set to increase above previous year averages, as well as the price of components, parts and labour, QBE Insurance says.

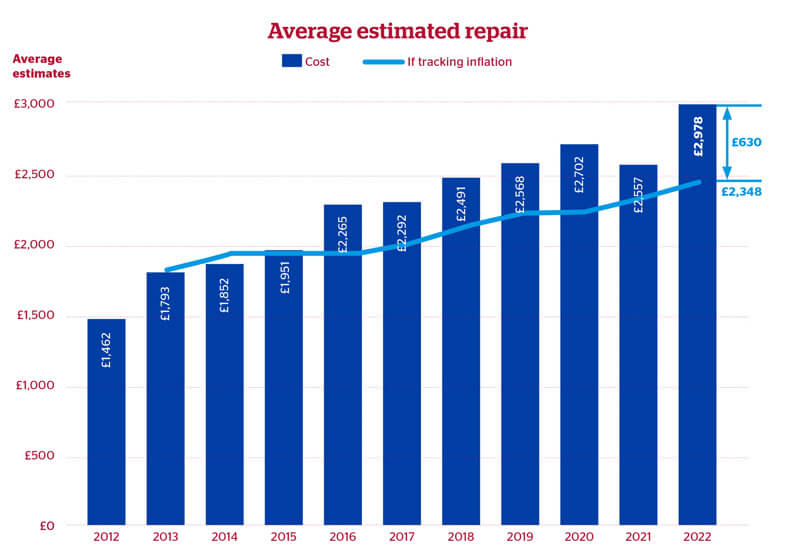

David Round, regional underwriter manager at QBE, said if the average estimated repair cost had tracked along with consumer price index inflation, the average cost would be £2,348, £630 less than it was in 2021.

A typical fleet vehicle with medium front-end above-average damage saw a £505 overall increase from 2021 to 2022 (a £305 increase in parts, £154 increase in paint and £46 increase in labour), according to the insurance company.

The original estimate on the example repair provided by QBE is £6,818, resulting in an 7.5% increase, using the same repair method and same parts basket.

Private cars have seen a 9.3% increase (from £2,843.06 to £3,030.00) in estimates in 2022 vs 2021, LCVs - 6.9% increase (£2,191.50 to £2,341.01) and HGVs - 6.7% increase (£2,191.50 to £2,424.82).

New vehicle technology, engineering techniques and the advancement of the vehicle parc have brought about a need for skilled people and improved frameworks and hardware, says QBE.

New vehicle technology, engineering techniques and the advancement of the vehicle parc have brought about a need for skilled people and improved frameworks and hardware, says QBE.

The transformations have been deepened by financial factors including the coronavirus pandemic, Brexit and the cost-of-living crisis. These difficulties are upsetting the production network, have limited the recruitment market and are impacting the interest and supply of volumes and available capacity, said QBE.

The global shortage of microchips has also impacted new vehicle production which has resulted in a rise in second-hand car sales. The parts delay, impacting all manufacturers, has affected hire car duration periods and the shortage of hire vehicles has increased hire rates.

However, there are ways that fleets can help reduce insurance spend in the current climate, including carrying a higher excess.

Offering to carry a higher excess on a policy could help lower the premiums as you would be agreeing to contribute towards the cost of any claim, for example, by offering to pay the first £250 or £500, says QBE.

Jim Billings, practice leader risk solutions at QBE, said: “It’s worth considering your programme structure, your deductibles, your excesses etc.

“Essentially a lot of the larger fleets that we work with, if they have a bigger deductible in place, that means they are carrying more of the risk on their own balance sheet. Therefore, it can often lead to smaller reduced premiums.

"From a non-risk side, that is a key area to think about. Even before you start thinking about risk management initiatives, driver training etc. think about that structure.

“It’s something that be discussed internally with your brokers and then through to the insurance and underwriting side – definitely something to consider.”

Risk management

QBE also said that fleets demonstrating that they are managing risk in the business may lead to the insurer looking favourably on their commitment to risk and road safety.

Fleets can help reduce vehicle spend in the long run by providing driver training that focuses on driver profiling and targeted driver training based on post-collision interviews, where the direct cause of a collision has been identified, which can be used to determined the necessary interventions to offer drivers.

Billings added: “The more fleets can do around behaviour-based training, the better. There is a lot of research around the human factors in crash involvement including stressed and time-pressured drivers - anything we can do to chip away at that will definitely have a positive effect of the claims experience.”

QBE said that driving style is also key to help generate savings as aggressive driving, over-revving and late braking use up more fuel, whereas smooth acceleration and braking can help save money.

"Simple stuff like educating drivers to lift the chin up to look further ahead down the road and read the road ahead properly - basic fundamental, but advanced driver techniques," said Billings.

"Encouraging drivers to look further ahead into the far distance, bring it back to middle distance and near-distance, can help drivers massively when it comes to anticipating hazards. It also helps them make the driver smoothera and more progressive."

Adopting in-vehicle cameras can also help with determining liability following an incident and defending fraudulent claims, as well as helping to improve driver behaviour, said QBE.

QBE's other ways to reduce spend:

- Vehicle checks - conduct regular vehicle checks to help identify defects that could potentially lead to an incident

- Reading the road - encourage drivers to plan ahead, anticipate hazards and use acceleration sense to help reduce fuel usage, tyre wear and carbon emissions

- Refuelling - prices at the pump can vary dramatically between providers and will be more expensive at motorway service stations. Use apps/websites which list the cheapest places local to drivers to refuel

Login to comment

Comments

No comments have been made yet.