The pressure is on UK car brands to deliver a better customer experience due to a continuing decline in new car volume for many of them.

This year, the total market is slipping down and fleet registrations had dropped by just more than 85,000 units (or 8%) by the end of September. The Society of Motor Manufacturers and Traders (SMMT) expects the new car market decline to continue through 2019, albeit at a slower pace. The market is likely to be 300,000 cars lower than the 2016 peak.

So, car manufacturers will continue to put franchised dealer networks and their own central fleet teams under increased pressure to retain the customers they have by being easy to work with and providing great service and incentives. This should be welcome news for fleets and other business customers.

The big news this year is Mini’s first appearance in the top 10 rated dealer networks. The brand is no longer focused on small cars and is benefiting from its relationship with BMW, whose dealers have extensive corporate sales experience and who are ploughing thousands of pounds into showroom upgrades or multi-million pound relocations.

Its arrival in the top 10 comes less than two years after it created a new role of head of corporate and used cars, with Steve Roberts taking responsibility for broadening Mini’s sales in the corporate and SME sectors.

Mini has strong residual values (RVs) which enhances its attraction for company fleets, and it has introduced models such as the Clubman City, the Countryman PHEV and the Business Countryman, offering key equipment for business users, such as sat-nav and parking sensors, with a low P11D value and WLTP CO2 ratings below 131g/km.

The brand also provides a ‘Corporate Launchpad’, an online portal which gives users the ability to view product information, fleet-related news, corporate driver information and videos.

In showrooms, the Mini Geniuses are able to advise on taxation and running costs to ensure customers get the right cars for their fleet’s needs, while an aftersales corporate charter guarantees specific levels of service such as collection and delivery within a 15 mile radius, a 20-minute response time to booking requests, and free parts and labour insurance in case a vehicle fails its first, second or third MOT test.

Yet, Mini will hope its moment of glory is not as short-lived as Land Rover’s. It made it into the top 10 for the first time last year, after a raft of improvements to its products and distribution network. However, managing director Jeremy Hicks has moved on and the brand has dropped out of the FN50’s highest rated after just 12 months.

That Land Rover disappears to be replaced by Mini is more evidence of the FN50’s clear favour of premium and near-premium brands, German-owned ones in particular, which typically have stronger RVs and attractive running costs plus dealer networks which are raising the bar in service levels.

Audi grabs top spot

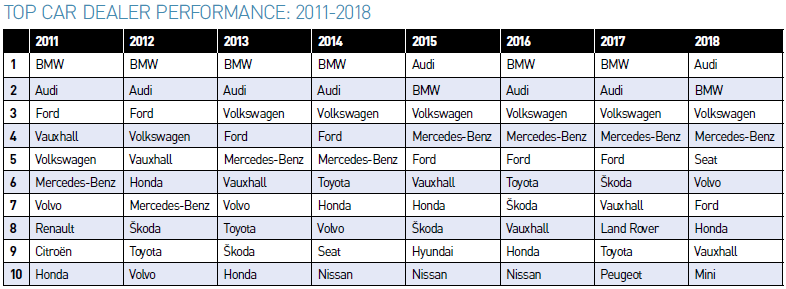

As ever, German brands dominate the FN50’s top 10. However, BMW’s crown has slipped, allowing Audi to take the top position for the second time this decade.

Tom Brennan, Audi head of fleet, says the brand is in a strong position, but the market is changing: “Corporate is under pressure; you look at the leasing company volume and volume in corporate is declining. The growth is coming from SME, retail, contract hire, brokers and personal contract hire. In the past two or three years, it has really changed.”

The A3 and A4 have performed strongly in fleet, and Audi has a new A6 now on the market. The brand’s electrification offensive is about to begin too, with the launch of the £70,000+ E-tron electric car by the end of 2018, then more electric and hybrids will follow ready for when WLTP CO2 measures replace NEDC values for company car tax. “When we get to 2020, when the changes really kick-in, we will be ready and will have the cars for our customers,” says Brennan.

This year, following a 12-month consultation with its dealer network, leasing partners and corporate customers, Audi UK adopted an agency model for its fleet sales, bringing the brand in line with many other manufacturers, including other brands within the Volkswagen Group.

It gives head office control over fleet deals and routes to market, removes the pressure for Audi dealers to compete with each other, and rewards the dealers with a handling fee for managing the customer experience.

Audi still has business sales specialists in every dealership, and Brennan wants these focused on local business opportunities. He says: “By going to an agency model, it keeps them focused on the areas of fleet we really want them to focus on and, as importantly, it allows us to give better service to our leasing company partners and our end-user fleets.”

Audi plans to launch an on-demand mobility service next year. This will enable customers to hire cars from participating franchised dealers from £70 per day. The programme is being piloted at Birmingham, Edinburgh, Glasgow, Newcastle and Oldham, and allows private customers to rent an Audi for between one hour and 28 days for a fixed fee. It plans to extend the scheme to business customers in 2019.

“The traditional model of ownership is consistently evolving and this innovative concept firmly puts Audi UK ahead when it comes to meeting consumer demand and transforming into a digital premium car company,” says Audi UK director Andrew Doyle.

BMW

At BMW, Steve Oliver left his role as general manager of corporate sales in April after 18 months. He will shortly be replaced by former Mercedes-Benz head of fleet Rob East.

Prior to Oliver’s exit, he led a review of the corporate sales strategy with the aim of simplifying the process for dealers and improving customers’ experience.

BMW has added to dealers’ training to enable them to better present the features and benefits of different powertrains – it has found that some customers are drawn to plug-in hybrid models due to the taxation benefits despite their 20,000+ annual mileage meaning they are best suited to diesel models.

Seat

Seat makes its first appearance in the top 10 since 2014, but at the expense of VW Group sister-brand Škoda, which dropped out, just as it also did in 2014. Seat has expanded its SUV range, offers four-day test drives for company car choosers, and a Driverline gives contract hire customers 24-hour assistance with easy service and repair booking through a central contact centre.

Since launching the Arona, Seat has simplified its model line-up in an ‘Easy’ initiative. Arona was launched with no options; buyers choose an engine, trim level and colour.

It makes it much easier for a customer to know exactly what they are getting and it makes it much easier for a leasing company to know exactly what they are quoting on.

Also, it will help keep things simple in 2020 when another level of complexity comes into the industry when the options will have to be taken into account under WLTP.

“The feedback we’ve received from customers and leasing companies has been positive, so our intention is to roll out Easy across all our models by the end of the year,” said Seat head of fleet Peter McDonald.

Login to comment

Comments

No comments have been made yet.